Preview text:

Group assignment presentation 7

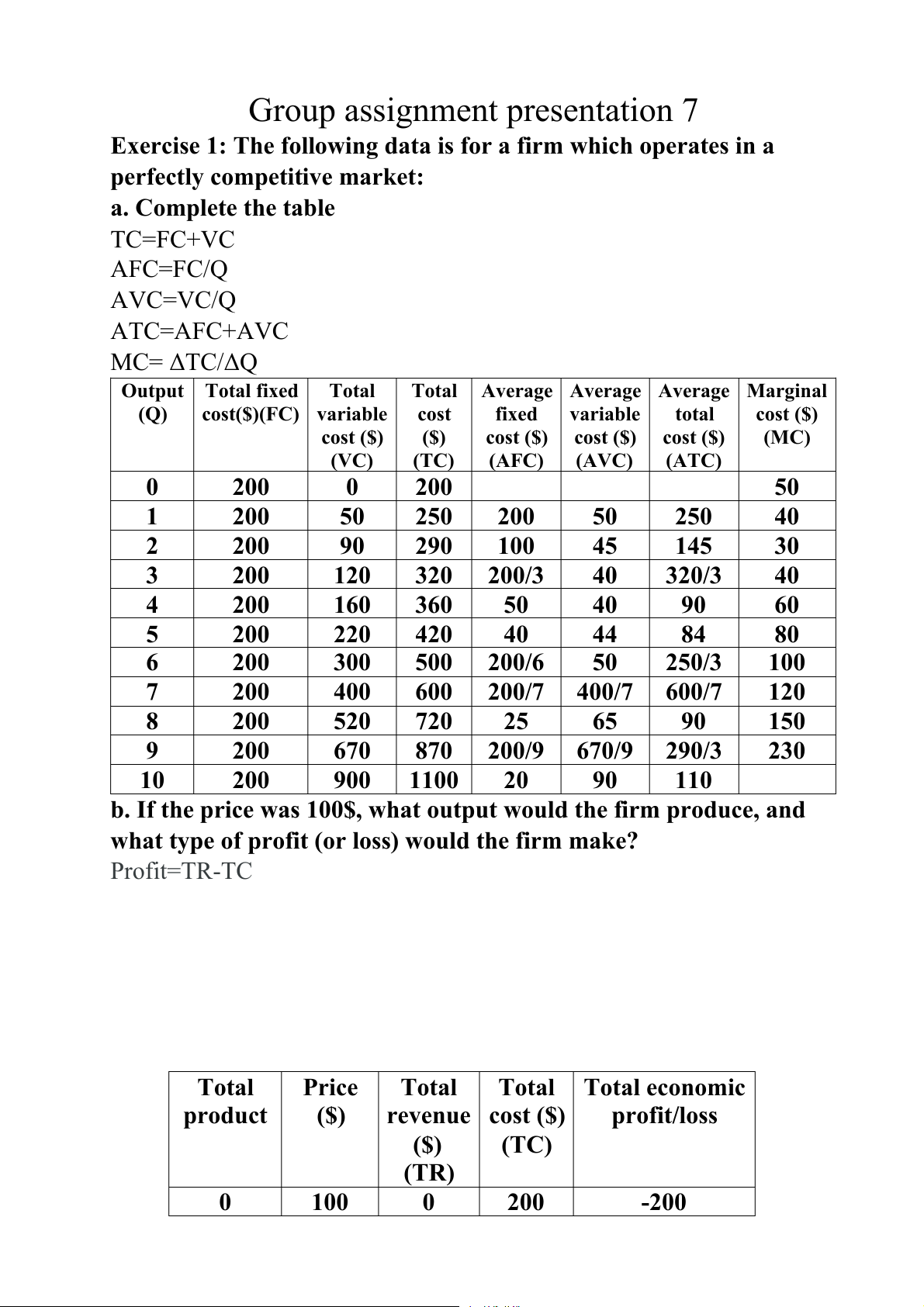

Exercise 1: The following data is for a firm which operates in a perfectly competitive market: a. Complete the table TC=FC+VC AFC=FC/Q AVC=VC/Q ATC=AFC+AVC MC= ΔTC/ΔQ Output Total fixed Total Total

Average Average Average Marginal (Q) cost($)(FC) variable cost fixed variable total cost ($) cost ($) ($) cost ($) cost ($) cost ($) (MC) (VC) (TC) (AFC) (AVC) (ATC) 0 200 0 200 50 1 200 50 250 200 50 250 40 2 200 90 290 100 45 145 30 3 200 120 320 200/3 40 320/3 40 4 200 160 360 50 40 90 60 5 200 220 420 40 44 84 80 6 200 300 500 200/6 50 250/3 100 7 200 400 600 200/7 400/7 600/7 120 8 200 520 720 25 65 90 150 9 200 670 870 200/9 670/9 290/3 230 10 200 900 1100 20 90 110

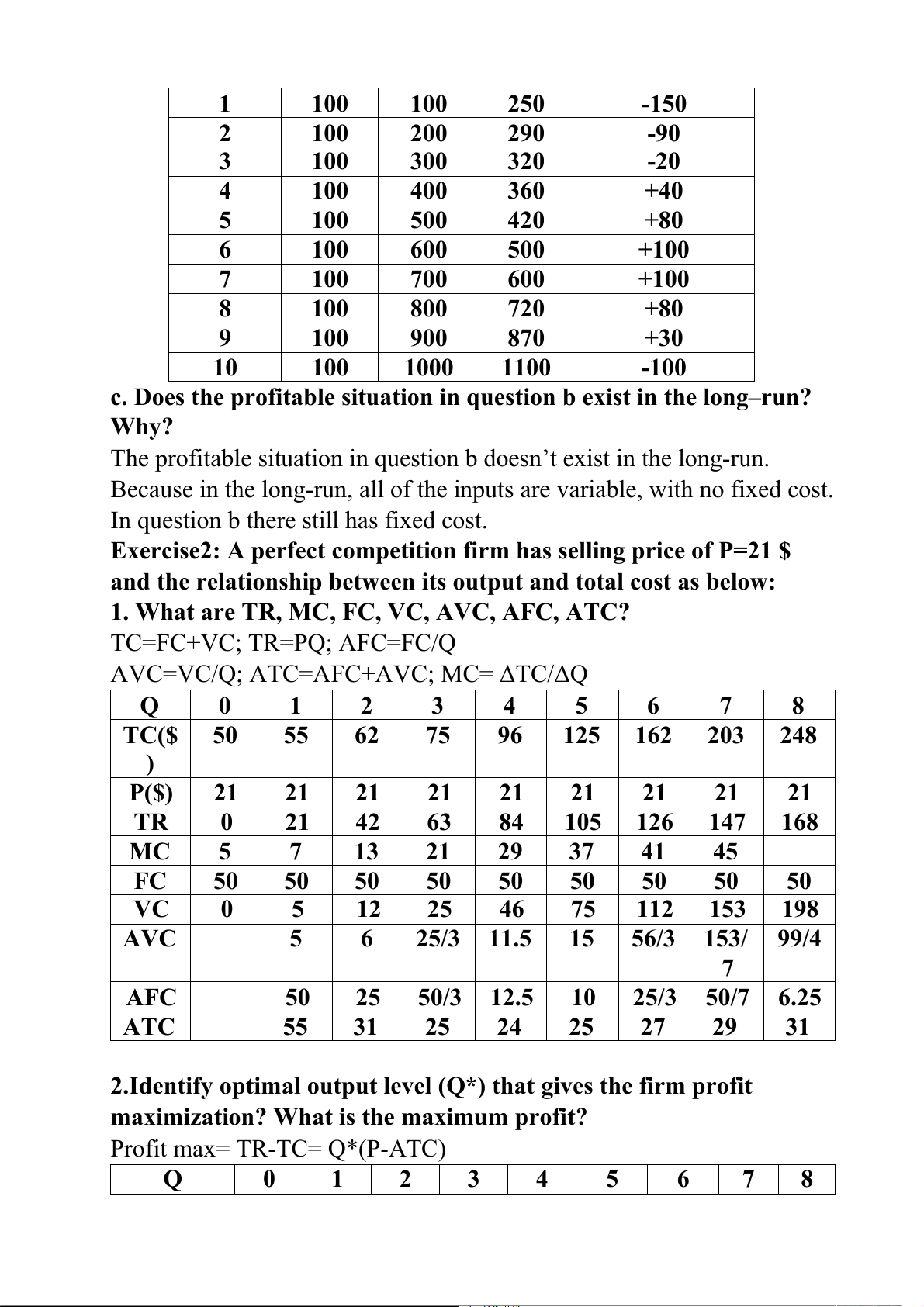

b. If the price was 100$, what output would the firm produce, and

what type of profit (or loss) would the firm make? Profit=TR-TC Total Price Total Total Total economic product ($) revenue cost ($) profit/loss ($) (TC) (TR) 0 100 0 200 -200 1 100 100 250 -150 2 100 200 290 -90 3 100 300 320 -20 4 100 400 360 +40 5 100 500 420 +80 6 100 600 500 +100 7 100 700 600 +100 8 100 800 720 +80 9 100 900 870 +30 10 100 1000 1100 -100

c. Does the profitable situation in question b exist in the long–run? Why?

The profitable situation in question b doesn’t exist in the long-run.

Because in the long-run, all of the inputs are variable, with no fixed cost.

In question b there still has fixed cost.

Exercise2: A perfect competition firm has selling price of P=21 $

and the relationship between its output and total cost as below:

1. What are TR, MC, FC, VC, AVC, AFC, ATC? TC=FC+VC; TR=PQ; AFC=FC/Q

AVC=VC/Q; ATC=AFC+AVC; MC= ΔTC/ΔQ Q 0 1 2 3 4 5 6 7 8 TC($ 50 55 62 75 96 125 162 203 248 ) P($) 21 21 21 21 21 21 21 21 21 TR 0 21 42 63 84 105 126 147 168 MC 5 7 13 21 29 37 41 45 FC 50 50 50 50 50 50 50 50 50 VC 0 5 12 25 46 75 112 153 198 AVC 5 6 25/3 11.5 15 56/3 153/ 99/4 7 AFC 50 25 50/3 12.5 10 25/3 50/7 6.25 ATC 55 31 25 24 25 27 29 31

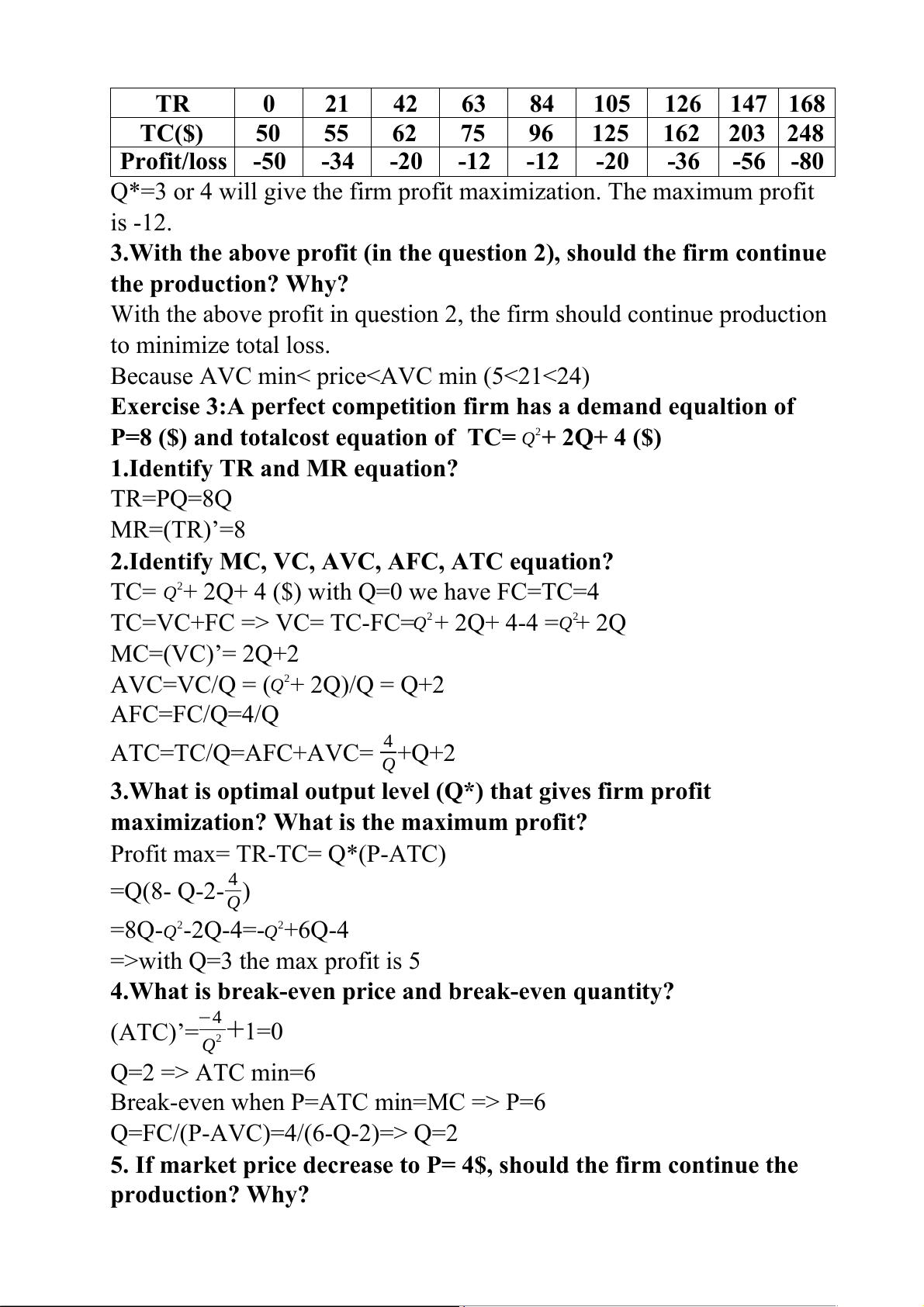

2.Identify optimal output level (Q*) that gives the firm profit

maximization? What is the maximum profit?

Profit max= TR-TC= Q*(P-ATC) Q 0 1 2 3 4 5 6 7 8 TR 0 21 42 63 84 105 126 147 168 TC($) 50 55 62 75 96 125 162 203 248 Profit/loss -50 -34 -20 -12 -12 -20 -36 -56 -80

Q*=3 or 4 will give the firm profit maximization. The maximum profit is -12.

3.With the above profit (in the question 2), should the firm continue the production? Why?

With the above profit in question 2, the firm should continue production to minimize total loss.

Because AVC min< priceExercise 3:A perfect competition firm has a demand equaltion of

P=8 ($) and totalcost equation of TC= Q2+ 2Q+ 4 ($) 1.Identify TR and MR equation? TR=PQ=8Q MR=(TR)’=8

2.Identify MC, VC, AVC, AFC, ATC equation?

TC= Q2+ 2Q+ 4 ($) with Q=0 we have FC=TC=4

TC=VC+FC => VC= TC-FC=Q2+ 2Q+ 4-4 =Q2+ 2Q MC=(VC)’= 2Q+2

AVC=VC/Q = (Q2+ 2Q)/Q = Q+2 AFC=FC/Q=4/Q ATC=TC/Q=AFC+AVC= 4 +Q+2 Q

3.What is optimal output level (Q*) that gives firm profit

maximization? What is the maximum profit?

Profit max= TR-TC= Q*(P-ATC) =Q(8- Q-2- 4 ) Q

=8Q-Q2-2Q-4=-Q2+6Q-4

=>with Q=3 the max profit is 5

4.What is break-even price and break-even quantity? −4 (ATC)’= +1=0 Q2 Q=2 => ATC min=6

Break-even when P=ATC min=MC => P=6

Q=FC/(P-AVC)=4/(6-Q-2)=> Q=2

5. If market price decrease to P= 4$, should the firm continue the production? Why?

Because AVC min

continue to production to minimize total loss.