Preview text:

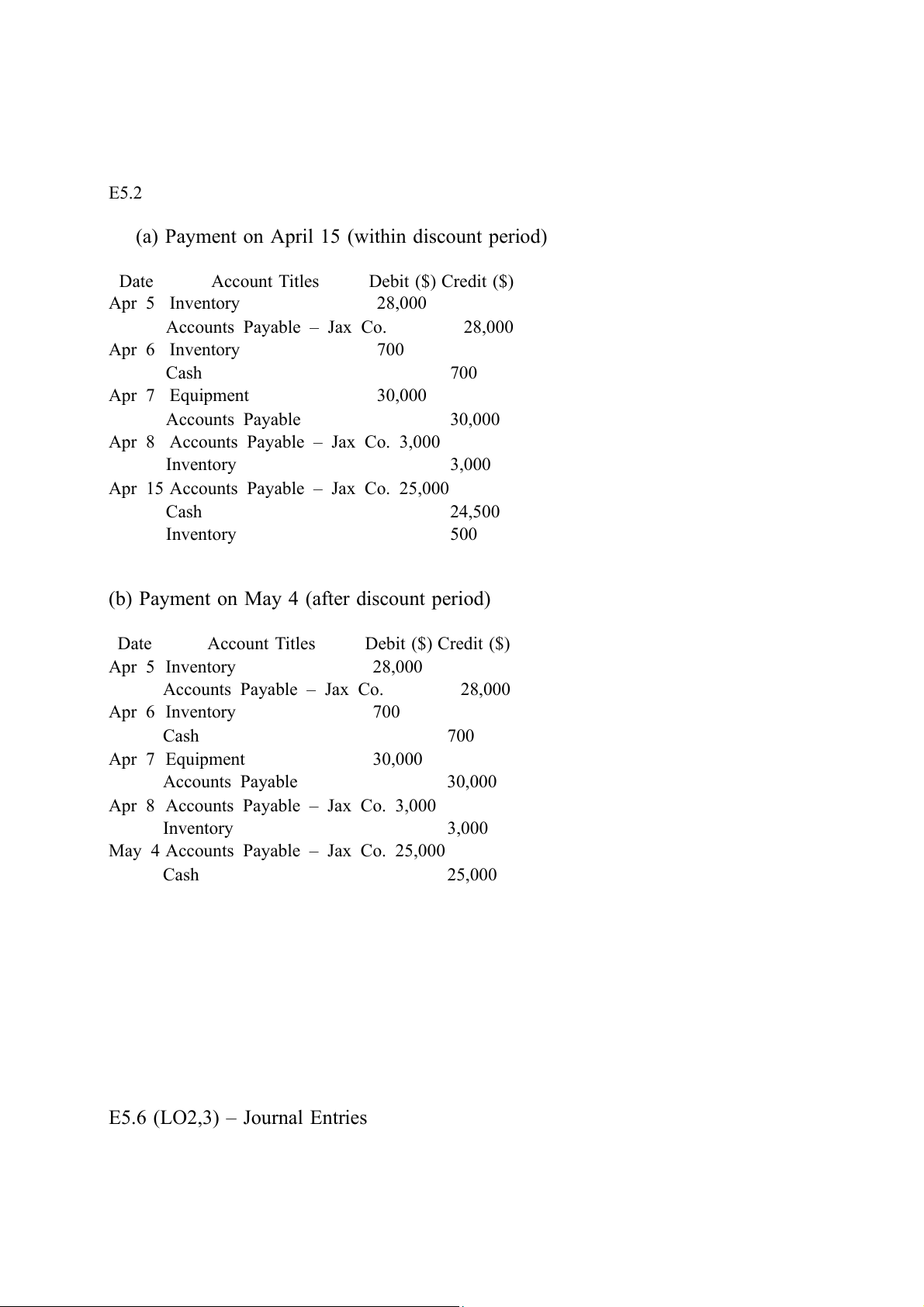

E5.2

(a) Payment on April 15 (within discount period) Date Account Titles

Debit ($) Credit ($) Apr 5 Inventory 28,000 Accounts Payable – Jax Co. 28,000 Apr 6 Inventory 700 Cash 700 Apr 7 Equipment 30,000 Accounts Payable 30,000

Apr 8 Accounts Payable – Jax Co. 3,000 Inventory 3,000

Apr 15 Accounts Payable – Jax Co. 25,000 Cash 24,500 Inventory 500

(b) Payment on May 4 (after discount period) Date Account Titles

Debit ($) Credit ($) Apr 5 Inventory 28,000 Accounts Payable – Jax Co. 28,000 Apr 6 Inventory 700 Cash 700 Apr 7 Equipment 30,000 Accounts Payable 30,000

Apr 8 Accounts Payable – Jax Co. 3,000 Inventory 3,000

May 4 Accounts Payable – Jax Co. 25,000 Cash 25,000

E5.6 (LO2,3) – Journal Entries

Date Account Titles and Explanation Debit ($) Credit ($) Sept. 1 Inventory 5,650 Accounts Payable 5,650 Sept. 3 Accounts Payable 600 Inventory 600 Sept. 12 Accounts Payable 5,050 Cash 5,050

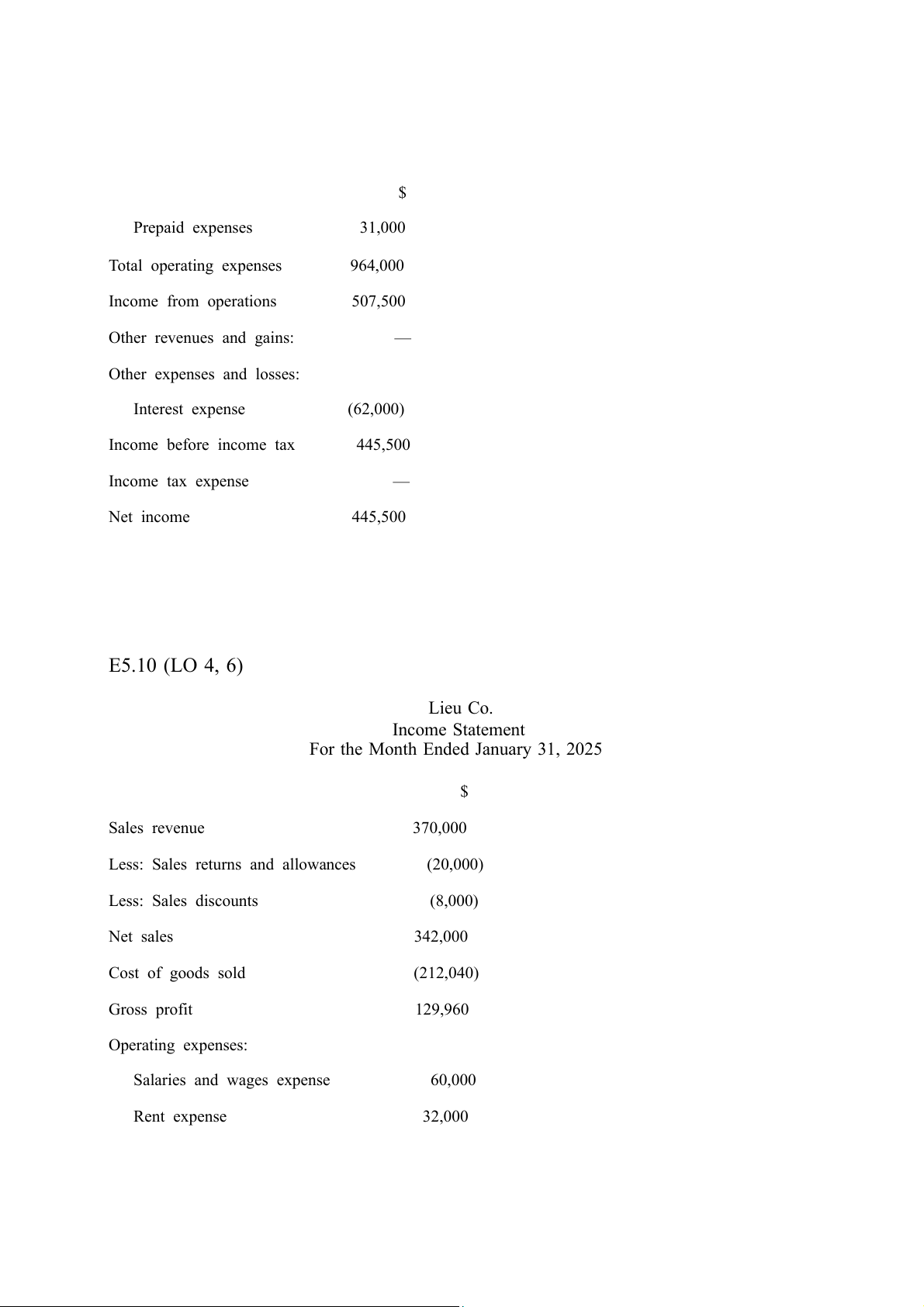

E5.9 (LO 4, 6), AP Orlando Corporation Income Statement

For the Year Ended December 31, 2027 $ Revenues: Sales revenue 2,589,500 Rent revenue 24,000 Interest revenue 30,000 Total revenues 2,643,500

Cost of goods sold (1,172,000) Gross profit 1,471,500 Operating expenses: Advertising expense 55,000 Depreciation expense 125,000 Freight-out 25,000 Insurance expense 23,000 Salaries and wages expense 705,000 $ Prepaid expenses 31,000

Total operating expenses 964,000

Income from operations 507,500

Other revenues and gains: —

Other expenses and losses: Interest expense (62,000)

Income before income tax 445,500

Income tax expense — Net income 445,500

E5.10 (LO 4, 6) Lieu Co. Income Statement

For the Month Ended January 31, 2025 $ Sales revenue 370,000

Less: Sales returns and allowances (20,000) Less: Sales discounts (8,000) Net sales 342,000

Cost of goods sold (212,040) Gross profit 129,960 Operating expenses: Salaries and wages expense 60,000 Rent expense 32,000 $ Insurance expense 12,000 Freight-out 7,000

Total operating expenses 111,000

Income from operations 18,960

Income tax expense (5,280) Net income 13,680

Other comprehensive income (net of tax) 2,000 Comprehensive income 15,680 b. Ratios Formula Result Profit margin Net income ÷ Net sales 13,680 ÷ 342,000 = 4.0%

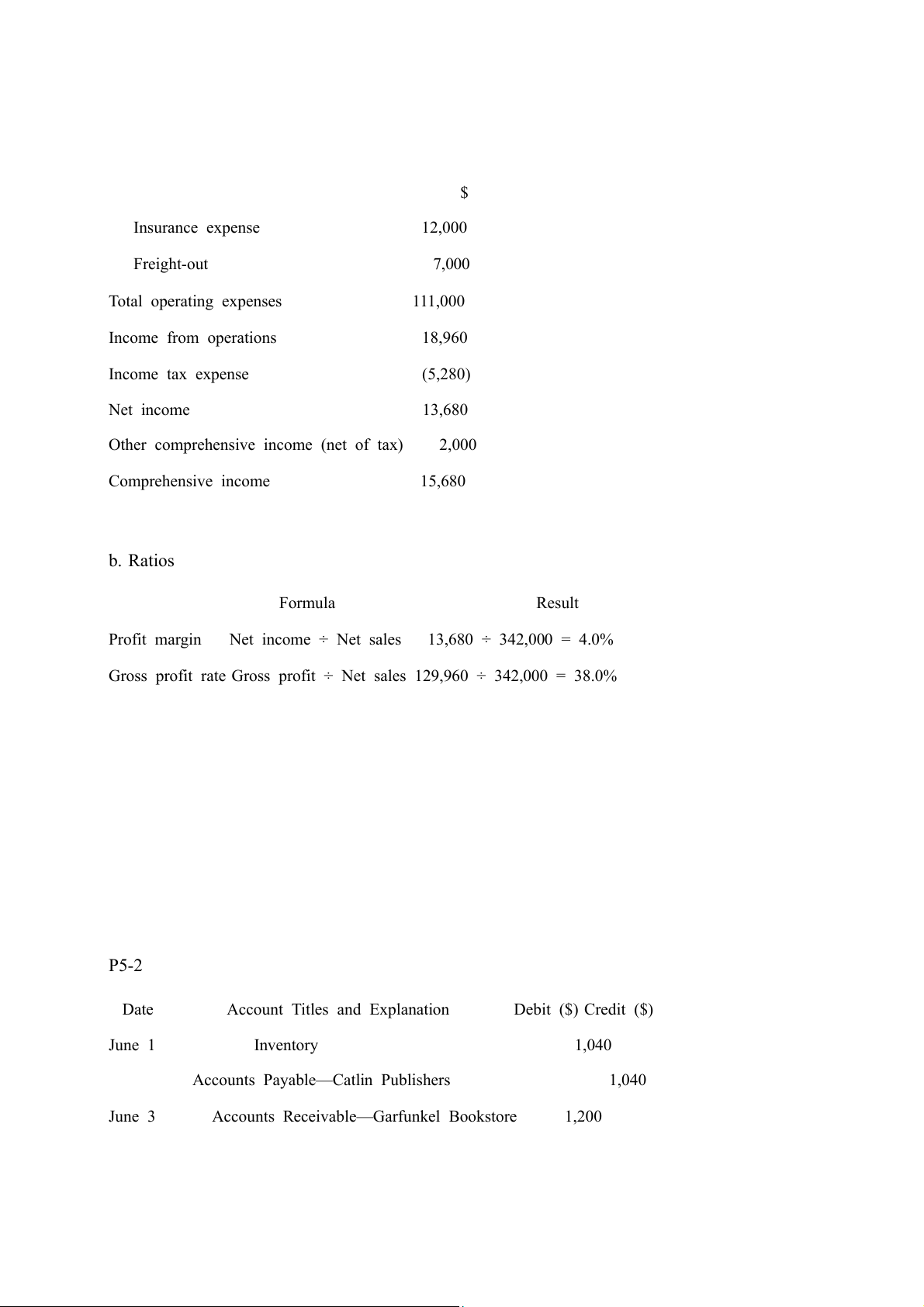

Gross profit rate Gross profit ÷ Net sales 129,960 ÷ 342,000 = 38.0% P5-2 Date

Account Titles and Explanation

Debit ($) Credit ($) June 1 Inventory 1,040

Accounts Payable—Catlin Publishers 1,040

June 3 Accounts Receivable—Garfunkel Bookstore 1,200 Date

Account Titles and Explanation

Debit ($) Credit ($) Sales Revenue 1,200 Cost of Goods Sold 720 Inventory 720

June 6 Accounts Payable—Catlin Publishers 40 Inventory 40

June 9 Accounts Payable—Catlin Publishers 1,000 Inventory (discount) 20 Cash 980 June 15 Cash 1,176 Sales Discounts 24

Accounts Receivable—Garfunkel Bookstore 1,200

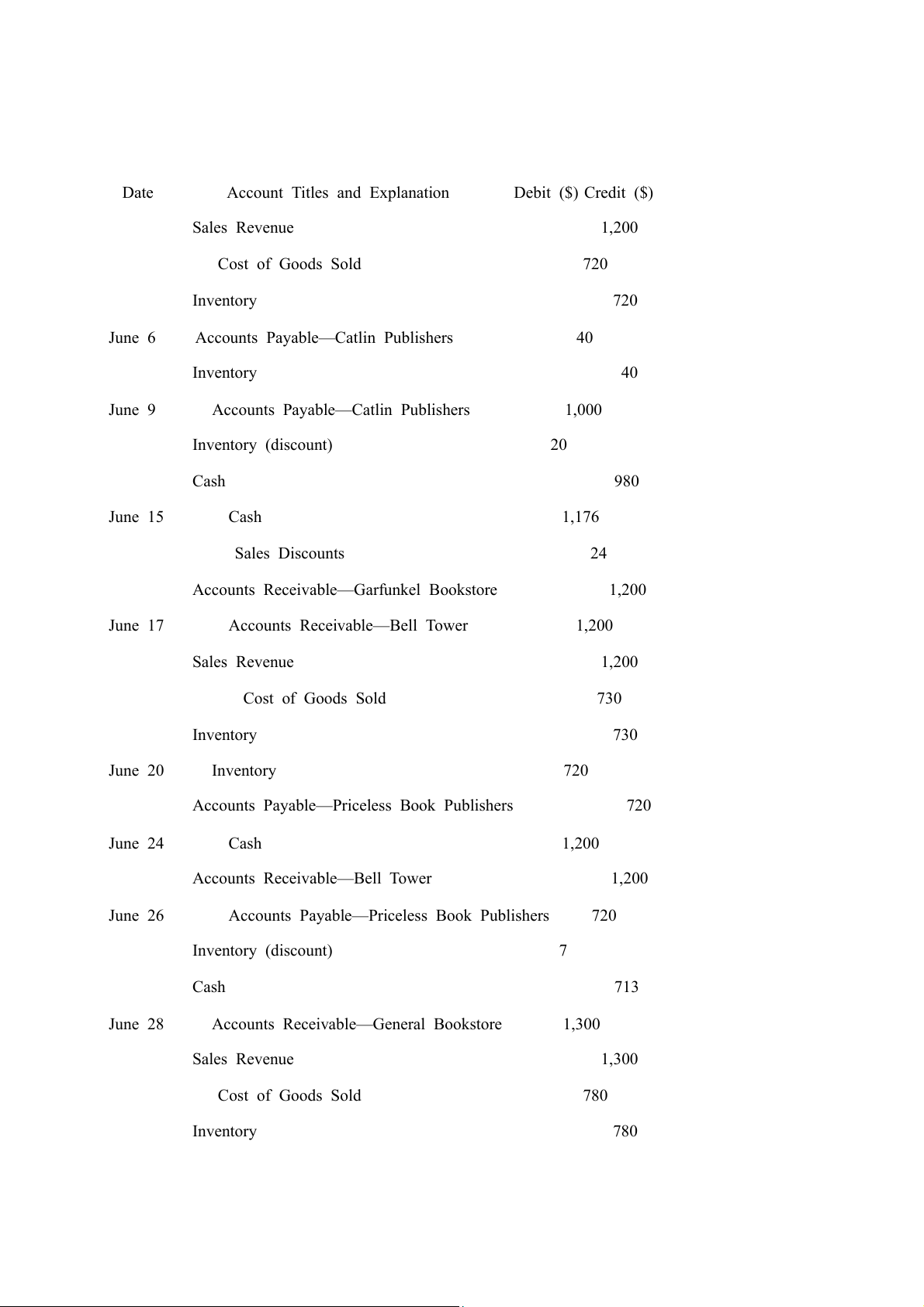

June 17 Accounts Receivable—Bell Tower 1,200 Sales Revenue 1,200 Cost of Goods Sold 730 Inventory 730 June 20 Inventory 720

Accounts Payable—Priceless Book Publishers 720 June 24 Cash 1,200

Accounts Receivable—Bell Tower 1,200

June 26 Accounts Payable—Priceless Book Publishers 720 Inventory (discount) 7 Cash 713

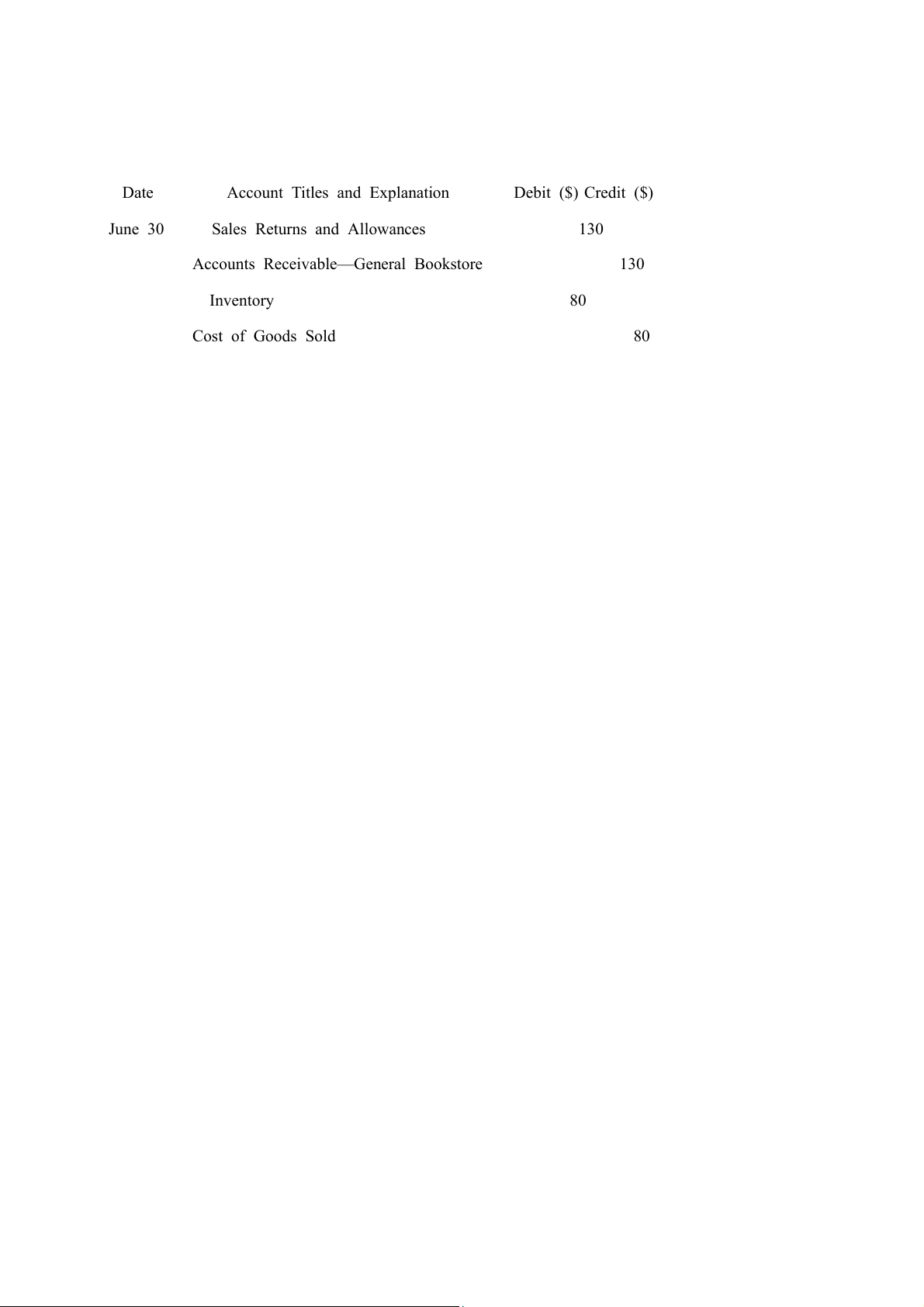

June 28 Accounts Receivable—General Bookstore 1,300 Sales Revenue 1,300 Cost of Goods Sold 780 Inventory 780 Date

Account Titles and Explanation

Debit ($) Credit ($)

June 30 Sales Returns and Allowances 130

Accounts Receivable—General Bookstore 130 Inventory 80 Cost of Goods Sold 80