Preview text:

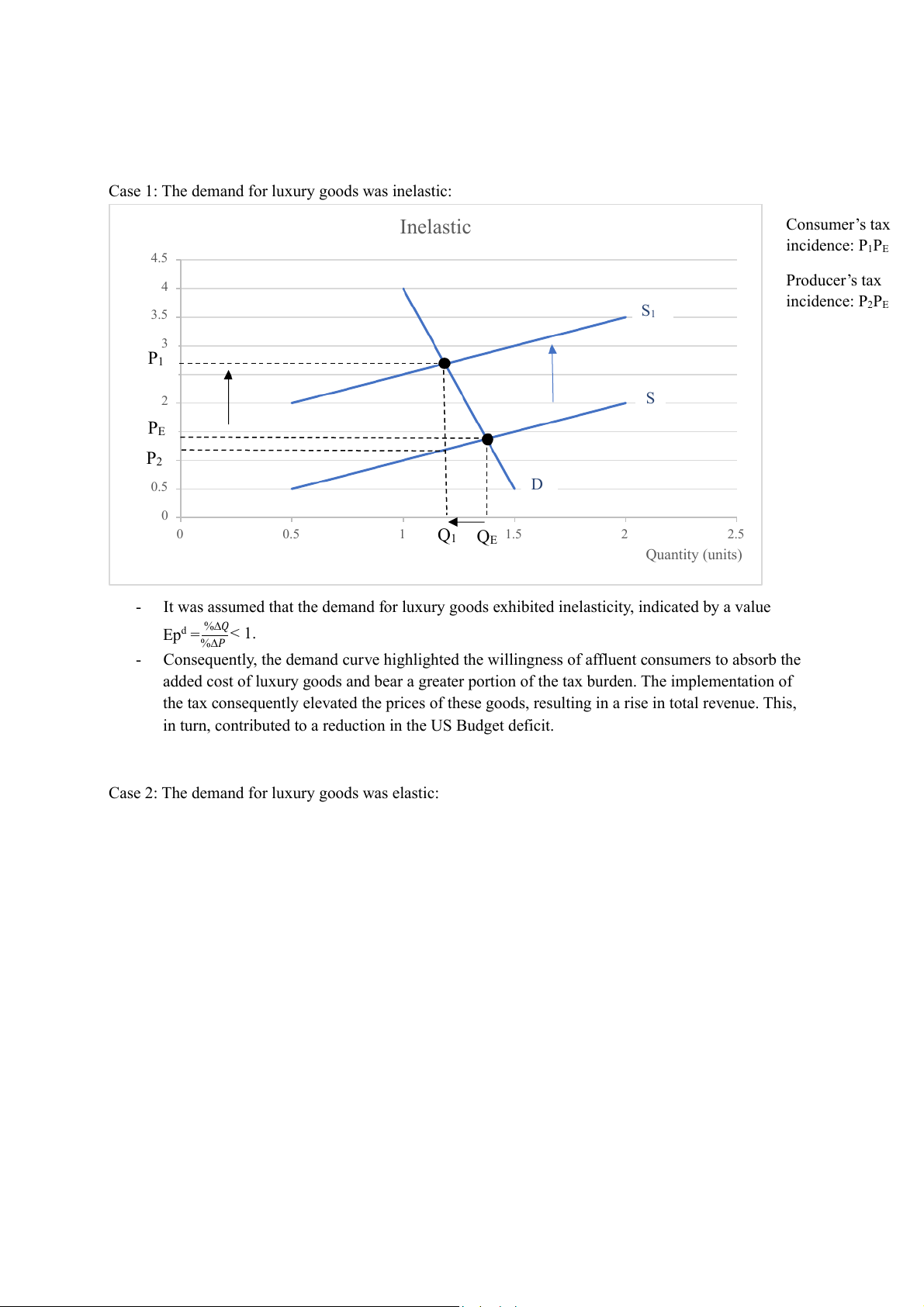

Case 1: The demand for luxury goods was inelastic: Inelastic Consumer’s tax incidence: P1PE 4.5 4 Producer’s tax rice ($) P incidence: P2PE 3.5 S1 3 P1 2 S PE P2 0.5 D 0 0 0.5 1 Q 1.5 2 2.5 1 QE Quantity (units) -

It was assumed that the demand for luxury goods exhibited inelasticity, indicated by a value Epd = %∆𝑄 < 1. %∆𝑃 -

Consequently, the demand curve highlighted the willingness of affluent consumers to absorb the

added cost of luxury goods and bear a greater portion of the tax burden. The implementation of

the tax consequently elevated the prices of these goods, resulting in a rise in total revenue. This,

in turn, contributed to a reduction in the US Budget deficit.

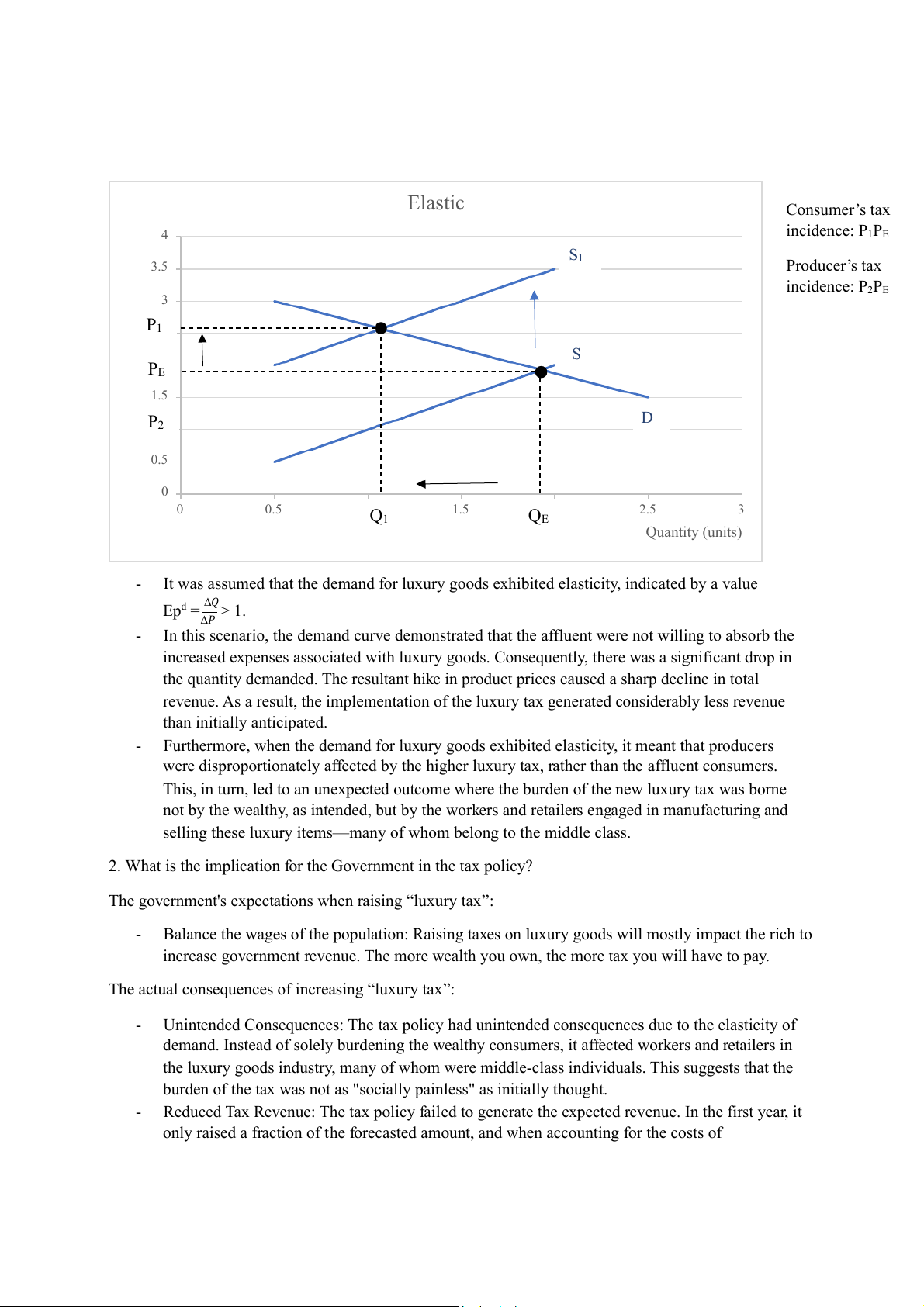

Case 2: The demand for luxury goods was elastic: Elastic Consumer’s tax 4 incidence: P1PE S1 3.5 rice ($) Producer’s tax P incidence: P2PE 3 P1 S PE 1.5 D P2 0.5 0 0 0.5 1.5 2.5 3 Q1 QE Quantity (units) -

It was assumed that the demand for luxury goods exhibited elasticity, indicated by a value Epd = ∆𝑄 > 1. ∆𝑃 -

In this scenario, the demand curve demonstrated that the affluent were not willing to absorb the

increased expenses associated with luxury goods. Consequently, there was a significant drop in

the quantity demanded. The resultant hike in product prices caused a sharp decline in total

revenue. As a result, the implementation of the luxury tax generated considerably less revenue than initially anticipated. -

Furthermore, when the demand for luxury goods exhibited elasticity, it meant that producers

were disproportionately affected by the higher luxury tax, rather than the affluent consumers.

This, in turn, led to an unexpected outcome where the burden of the new luxury tax was borne

not by the wealthy, as intended, but by the workers and retailers engaged in manufacturing and

selling these luxury items—many of whom belong to the middle class.

2. What is the implication for the Government in the tax policy?

The government's expectations when raising “luxury tax”: -

Balance the wages of the population: Raising taxes on luxury goods will mostly impact the rich to

increase government revenue. The more wealth you own, the more tax you will have to pay.

The actual consequences of increasing “luxury tax”: -

Unintended Consequences: The tax policy had unintended consequences due to the elasticity of

demand. Instead of solely burdening the wealthy consumers, it affected workers and retailers in

the luxury goods industry, many of whom were middle-class individuals. This suggests that the

burden of the tax was not as "socially painless" as initially thought. -

Reduced Tax Revenue: The tax policy failed to generate the expected revenue. In the first year, it

only raised a fraction of the forecasted amount, and when accounting for the costs of

enforcement and administration, it likely resulted in a net loss for the government. This is due to

the significant decrease in sales, which was driven by the elasticity of demand for luxury goods. -

Market Substitution: Consumers reacted to the tax by seeking substitutes or purchasing the

taxed items in other locations (e.g., buying pleasure boats in the Bahamas). This kind of

substitution behavior can further reduce the effectiveness of luxury taxes.

What should the government do? -

Taxation exerts influence on both supply and demand factors by altering incentives within the

market. To address this, the government can consider reducing taxes as a potential solution.

Lowering tax rates, for instance, can facilitate increased employment as businesses find it more

feasible to hire additional workers, thereby enhancing productivity. This not only boosts

production but also draws in more customers. Furthermore, a reduction in taxes creates an

opportunity for the government to attain its targeted tax rate. This is because consumers might

focus on purchasing luxury items within the existing market, avoiding the need to seek

alternative markets due to high taxation.