Preview text:

Chapter 24

Measuring the Cost of Living TRUE/FALSE 1.

The consumer price index is used to monitor changes in an economy’s production of goods and services over time. ANS: F DIF: 2 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive 2.

When the consumer price index falls, the typical family has to spend fewer dollars to maintain the same standard of living. ANS: T DIF: 2 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive 3.

Economists use the term inflation to describe a situation in which the economy’s overall price level is rising. ANS: T DIF: 1 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation MSC: Definitional 4.

The inflation rate is the absolute change in the price level from the previous period. ANS: F DIF: 1 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Definitional 5.

Inflation can be measured using either the GDP deflator or the consumer price index. ANS: T DIF: 2 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation | CPI | GDP deflator MSC: Interpretive 6.

The inflation rate reported in the news is usually calculated from the GDP deflator rather than the consumer price index. ANS: F DIF: 2 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP:

Inflation rate | CPI | GDP deflator MSC: Interpretive 7.

Because the consumer price index reflects the goods and services bought by consumers better than the GDP

deflator does, it is the more common gauge of inflation. ANS: T DIF: 1 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation | CPI | GDP deflator MSC: Definitional 8.

The CPI is a measure of the overall cost of the goods and services bought by a typical consumer. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional 9.

Each week, the Bureau of Labor Statistics computes and reports the consumer price index. ANS: F DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional 10.

The Bureau of Labor Statistics is part of the U.S. Department of Labor. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Bureau of Labor Statistics MSC: Definitional 1619

1620 Chapter 24/Measuring the Cost of Living 11.

The Bureau of Labor Statistics determines which prices are most important to the typical consumer by surveying consumers. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Bureau of Labor Statistics MSC: Definitional 12.

The content of the basket of goods and services used to compute the CPI changes every month. ANS: F DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive 13.

By keeping the basket of goods and services the same when computing the CPI, the Bureau of Labor Statistics

isolates the effects of price changes from the effect of any quantity changes that might be occurring at the same time. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional 14.

When the consumer price index is computed, the base year is always the first year among the years being considered. ANS: F DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive 15.

The CPI for 2008 is computed by dividing the price of the basket of goods and services in 2008 by the price of

the basket of goods and services in the base year, then multiplying by 100. ANS: T DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive 16.

The CPI is always 1 in the base year. ANS: F DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional 17.

If the current year CPI is 140, then the price level has increased 40 percent since the base year. ANS: T DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative 18.

If the current year CPI is 90, then the price level has decreased 10 percent since the base year. ANS: T DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative 19.

The inflation rate for 2007 is computed by dividing (the CPI in 2007 minus the CPI in 2006) by the CPI in 2006, then multiplying by 100. ANS: T DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Interpretive 20.

If the value of the consumer price index is 110 in 2005 and 121 in 2006, then the inflation rate is 11 percent for 2006. ANS: F DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

Chapter 24/Measuring the Cost of Living 1621 21.

The producer price index measures the cost of a basket of goods and services bought by firms rather than consumers. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: PPI MSC: Definitional 22.

Changes in the consumer price index are useful in predicting changes in the producer price index. ANS: F DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | PPI MSC: Interpretive 23.

Data from the Bureau of Labor Statistics show that the largest category of consumer spending is housing. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

Categories of consumer spending MSC: Definitional 24.

Data from the Bureau of Labor Statistics show that consumer spending on transportation is only slightly

higher than consumer spending on food and beverages. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

Categories of consumer spending MSC: Definitional 25.

Data from the Bureau of Labor Statistics show that consumer spending on medical care is about equal to

consumer spending on recreation and consumer spending on education and communication. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

Categories of consumer spending MSC: Definitional 26.

Data from the Bureau of Labor Statistics show that apparel makes up 14 percent of the typical consumer’s budget. ANS: F DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

Categories of consumer spending MSC: Definitional 27.

The goal of the consumer price index is to gauge how much incomes must rise to maintain a constant standard of living. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional 28.

Substitution bias occurs because the CPI ignores the possibility of consumer substitution toward goods that

have become relatively less expensive. ANS: T DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Substitution bias MSC: Interpretive 29.

Substitution bias causes the CPI to understate the increase in the cost of living from one year to the next. ANS: F DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Substitution bias MSC: Definitional 30.

When a new good is introduced, consumers have more variety from which to choose, and this in turn increases

the cost of maintaining the same level of economic well-being. ANS: F DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

CPI | Introduction of new goods MSC: Definitional 31.

The CPI does not reflect the increase in the value of the dollar that arises from the introduction of new goods. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

CPI | Introduction of new goods MSC: Definitional

1622 Chapter 24/Measuring the Cost of Living 32.

If the quality of a good deteriorates from one year to the next while its price remains the same, then the value of a dollar falls. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Quality change MSC: Definitional 33.

The Bureau of Labor Statistics does not try to account for quality changes in the goods and services in the

basket used to compute the CPI. ANS: F DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Quality change MSC: Interpretive 34.

There is no longer much debate among economists concerning the severity of and the solution to the problems

in using the CPI to measure the cost of living. ANS: F DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive 35.

Many economists believe the bias in the CPI is now only about half as large as it once was. ANS: T DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional 36.

The CPI and GDP deflator usually tell two different stories about how quickly prices are rising. ANS: F DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | GDP deflator MSC: Interpretive 37.

When the price of Italian wine rises, this change is reflected in the U.S. CPI but not in the U.S. GDP deflator. ANS: T DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | GDP deflator MSC: Applicative 38.

When the price of nuclear missiles rises, this change is reflected in the CPI but not in the GDP deflator. ANS: F DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | GDP deflator MSC: Applicative 39.

In the U.S., when the price of oil rises, the CPI rises by much more than does the GDP deflator. ANS: T DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | GDP deflator MSC: Applicative 40.

The group of goods and services used to compute the GDP deflator changes automatically over time, but the

group of goods and services used to compute the CPI does not. ANS: T DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | GDP deflator MSC: Applicative 41.

The purpose of measuring the overall level of prices in the economy is to permit comparison between dollar figures from different times. ANS: T DIF: 1 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Comparing dollar figures MSC: Definitional 42.

A dollar figure from 1908 is converted into 2008 dollars by dividing the 2008 price level by the 1908 price

level, then multiplying by the 1908 dollar figure. ANS: T DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Comparing dollar figures MSC: Interpretive

Chapter 24/Measuring the Cost of Living 1623 43.

If the CPI today is 120 and the CPI five years ago was 80, then something that cost $1 five years ago would cost $1.50 in today's prices. ANS: T DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Comparing dollar figures MSC: Applicative 44.

Henry Ford paid his workers $5 a day in 1914, when the CPI was 10. Today, with the price index at 177, the $5 a day is worth $88.50. ANS: T DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Comparing dollar figures MSC: Applicative 45.

If you currently make $25,000 a year and the CPI rises from 110 today to 150 in five years, then you need to

be making $43,333.33 in five years to have kept pace with consumer price inflation. ANS: F DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Comparing dollar figures MSC: Applicative 46.

When some dollar amount is automatically corrected for inflation by law or contract, the amount is said to be indexed for inflation. ANS: T DIF: 1 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Indexation MSC: Definitional 47.

A COLA automatically raises the wage when the CPI rises. ANS: T DIF: 1 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: COLA MSC: Definitional 48.

The U.S. income tax system is completely indexed for inflation. ANS: F DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Indexation MSC: Interpretive 49.

Bob deposits $100 in a bank account that pays an annual interest rate of 5 percent. A year later, Bob

withdraws his $105. If inflation was 2 percent during the year the money was deposited, then Bob’s

purchasing power has increased by 3 percent. ANS: T DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Real interest rate MSC: Applicative 50.

Bob deposits $100 in a bank account that pays an annual interest rate of 5 percent. A year later, Bob

withdraws his $105. If inflation was 5 percent during the year the money was deposited, then Bob’s

purchasing power has not changed. ANS: T DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Real interest rate MSC: Applicative 51.

Bob deposits $100 in a bank account that pays an annual interest rate of 5 percent. A year later, Bob

withdraws his $105. If inflation was 7 percent during the year the money was deposited, then Bob’s

purchasing power has increased by 2 percent. ANS: F DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Real interest rate MSC: Applicative

1624 Chapter 24/Measuring the Cost of Living 52.

Bob deposits $100 in a bank account that pays an annual interest rate of 5 percent. A year later, Bob

withdraws his $105. If deflation was 5 percent during the year the money was deposited, then Bob’s

purchasing power has not changed. ANS: F DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Real interest rate MSC: Applicative 53.

Bob deposits $100 in a bank account that pays an annual interest rate of 5 percent. A year later, Bob

withdraws his $105. If deflation was 7 percent during the year the money was deposited, then Bob’s

purchasing power has increased by 12 percent. ANS: T DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Real interest rate MSC: Applicative 54.

The real interest rate measures the change in dollar amounts. ANS: F DIF: 1 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Nominal interest rate MSC: Definitional 55.

The real interest rate is the interest rate corrected for inflation. ANS: T DIF: 1 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Real interest rate MSC: Definitional 56.

The nominal interest rate tells you how fast the number of dollars in your bank account rises over time. ANS: T DIF: 1 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Nominal interest rate MSC: Definitional 57.

The real interest rate tells you how fast the purchasing power of your bank account rises over time. ANS: T DIF: 1 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Real interest rate MSC: Definitional 58.

If the nominal interest rates rises, then the inflation rate must have increased. ANS: F DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

Nominal interest rate | Inflation rate MSC: Interpretive 59.

If the nominal interest rate is 5 percent and the inflation rate is 2 percent, then the real interest rate is 7 percent. ANS: F DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Real interest rate MSC: Applicative 60.

If the nominal interest rate is 5 percent and the real interest rate is 2 percent, then the inflation rate is 3 percent. ANS: T DIF: 2 REF: 24-2 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative 61.

If the real interest rate is 5 percent and the inflation rate is 2 percent, then the nominal interest rate is 7 percent. ANS: T DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Nominal interest rate MSC: Applicative 62.

The value of the consumer price index increased from 140 to 147 during 2006. Nathan opened a bank account

at the beginning of 2006, and at the end of 2006 his account balance was $12,840. The purchasing power of

Nathan’s account increased by 2 percent during the year. We can conclude that Nathan opened his account

with a deposit of $11,500 at the beginning of 2006. ANS: F DIF: 3 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

Nominal interest rate | Real interest rate MSC: Analytical

Chapter 24/Measuring the Cost of Living 1625 63.

The U.S. economy has experienced rising consumer prices in every year since 1965. ANS: T DIF: 1 REF: 24-2 NAT: Analytic

LOC: Unemployment and inflation TOP: U.S. inflation MSC: Definitional 64.

The U.S. economy has never experienced deflation. ANS: F DIF: 2 REF: 24-2 NAT: Analytic

LOC: Unemployment and inflation TOP: U.S. inflation MSC: Interpretive 65.

In the late 1970s, U.S. nominal interest rates were high and real interest rates were low, but in the late 1990s,

U.S. nominal interest rates were low and real interest rates were high. ANS: T DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: U.S. interest rates MSC: Interpretive SHORT ANSWER 1.

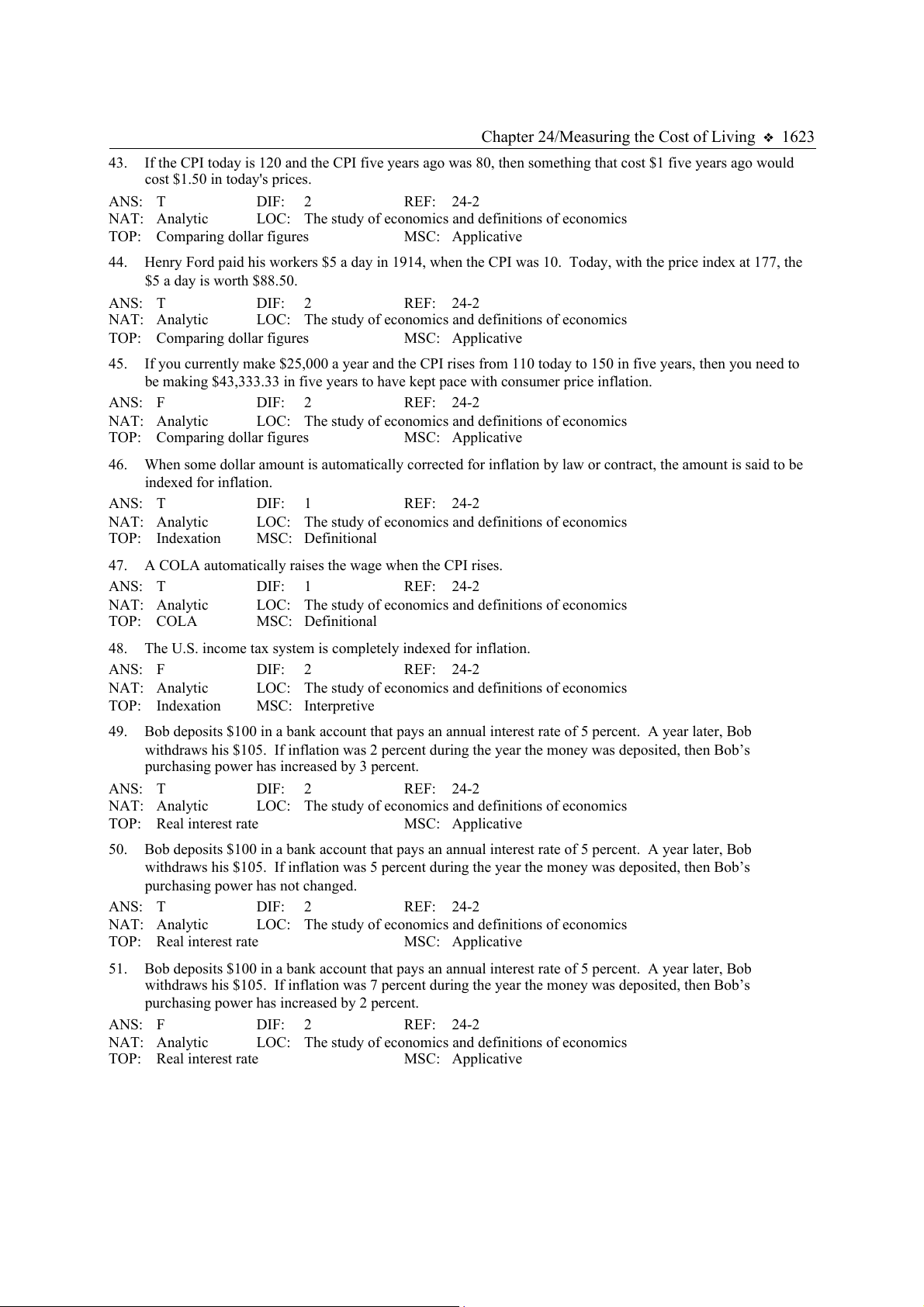

In a simple economy, people consume only 2 goods, food and clothing. The market basket of goods used to

compute the CPI consists of 50 units of food and 10 units of clothing. Food Clothing 2002 price per unit $4 $10 2003 price per unit $6 $20 a.

What are the percentage increases in the price of food and in the price of clothing? b.

What is the percentage increase in the CPI? c.

Do these price changes affect all consumers to the same extent? Explain. ANS: a.

The price of food increased by 50 percent ([6-4]/4 x 100). The price of clothing increased by 100 percent ([20-10]/10 x 100). b.

In 2002, the market basket cost $300 (4x50 + 10x10); in 2003, it cost $500 (6x50 + 20x10). The

percentage increase in the CPI is 66.7 percent ([500-300]/300 x 100). c.

Because the price of clothing increased relatively more than the price of food, people who purchase a lot

of clothing and little food became worse off relative to people who purchase a lot of food and little clothing. DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative 2.

Which is likely to have the larger effect on the CPI, a 2 percent increase in the price of food or a 3 percent

increase in the price of diamond rings? Explain. ANS:

The 2 percent increase in the price of food will increase the CPI by more because the portion of the market basket

consisting of food is much larger than the portion consisting of diamond rings. DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive

1626 Chapter 24/Measuring the Cost of Living 3.

List the three major problems in using the CPI as a measure of the cost of living. ANS:

(1) Substitution bias. The CPI ignores the fact that consumers substitute toward goods that have become relatively

less expensive. (2) Introduction of new goods. Because the CPI uses a fixed basket of goods, it does not take into

account the increased well-being of consumers created when new goods are introduced. (3) Unmeasured quality

change. Not all quality changes can be measured. DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive 4.

Why does the GDP deflator give a different rate of inflation than the CPI? ANS:

The GDP deflator and the CPI differ in two important ways. The GDP deflator uses as a basket all final goods and

services produced in the domestic economy, while the CPI basket includes goods and services purchased by typical

consumers. Therefore, changes in the price of imported goods affect the CPI, but not the GDP deflator. Also,

changes in the price of domestically produced capital goods affect the GDP deflator, but not the CPI. Changes in

the price of domestically produced consumer goods are likely to affect the CPI more than the GDP deflator because

it is likely that those goods make up a larger part of consumer budgets than of GDP. DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | GDP deflator MSC: Interpretive 5.

Compute how much each of the following items is worth in terms of today's dollars using 177 as the price index for today. a.

In 1926, the CPI was 17.7 and the price of a movie ticket was $0.25. b.

In 1932, the CPI was 13.1 and a cook earned $15.00 a week. c.

In 1943, the CPI was 17.4 and a gallon of gas cost $0.19. ANS: a.

The movie ticket is worth $.25 177/17.7 = $2.50 in today's dollars. b.

The cook’s weekly wage is worth $15.00 177/13.1 = $202.67 in today's dollars. c.

The gallon of gas is worth $.19 177/17.4 = $1.93 in today's dollars. DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Comparing dollar figures MSC: Applicative 6.

Jay and Joyce meet George, the banker, to work out the details of a mortgage. They all expect that

inflation will be 2 percent over the term of the loan, and they agree on a nominal interest rate of 6

percent. As it turns out, the inflation rate is 5 percent over the term of the loan. a.

What was the expected real interest rate? b.

What was the actual real interest rate? c.

Who benefited and who lost because of the unexpected inflation? ANS: a.

The expected real interest rate was 4 percent (6-2). b.

The actual real interest rate was 1 percent (6-5). c.

George, the banker, lost because he received less real interest income than he expected. Jay and Joyce

gained because they paid less real interest income than they expected. DIF: 2 REF: 24-2 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Real interest rate MSC: Applicative

Chapter 24/Measuring the Cost of Living 1627

Sec00 - Measuring the Cost of Living MULTIPLE CHOICE 1.

Babe Ruth, the famous baseball player, earned $80,000 in 1931. Today, the best baseball players

can earn more than 300 times as much as Babe Ruth earned in 1931. However, prices have also

risen since 1931. We can conclude that a.

the best baseball players today are about 300 times better off than Babe Ruth was in 1931. b.

because prices have also risen, the standard of living of baseball stars hasn't changed since 1931. c.

one cannot make judgments about changes in the standard of living based on changes in prices and changes in incomes. d.

one cannot determine whether baseball stars today enjoy a higher standard of living than Babe Ruth

did in 1931 without additional information regarding increases in prices since 1931. ANS: D DIF: 2 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: Prices | Standard of living MSC: Interpretive 2.

The consumer price index is used to a.

monitor changes in the level of wholesale prices in the economy. b.

monitor changes in the cost of living over time. c.

monitor changes in the level of real GDP over time. d.

monitor changes in the stock market. ANS: B DIF: 1 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional 3.

The consumer price index is used to a.

convert nominal GDP into real GDP. b.

turn dollar figures into meaningful measures of purchasing power. c.

characterize the types of goods and services that consumers purchase. d.

measure the quantity of goods and services that the economy produces. ANS: B DIF: 1 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional 4.

Which of the following is not correct? a.

The consumer price index gives economists a way of turning dollar figures into meaningful measures of purchasing power. b.

The consumer price index is used to monitor changes in the cost of living over time. c.

The consumer price index is used by economists to measure the inflation rate. d.

The consumer price index is used to measure the quantity of goods and services that the economy is producing. ANS: D DIF: 2 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive 5.

When the consumer price index rises, the typical family a.

has to spend more dollars to maintain the same standard of living. b.

can spend fewer dollars to maintain the same standard of living. c.

finds that its standard of living is not affected. d.

can offset the effects of rising prices by saving more. ANS: A DIF: 1 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Standard of living MSC: Definitional

1628 Chapter 24/Measuring the Cost of Living 6.

When the consumer price index falls, the typical family a.

has to spend more dollars to maintain the same standard of living. b.

can spend fewer dollars to maintain the same standard of living. c.

finds that its standard of living is not affected. d.

can save less because they do not need to offset the effects of rising prices. ANS: B DIF: 2 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Standard of living MSC: Interpretive 7.

Economists use the term inflation to describe a situation in which a.

some prices are rising faster than others. b.

the economy's overall price level is rising. c.

the economy's overall price level is high, but not necessarily rising. d.

the economy's overall output of goods and services is rising faster than the economy's overall price level. ANS: B DIF: 1 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation MSC: Definitional 8.

The term inflation is used to describe a situation in which a.

the overall level of prices in the economy is increasing. b.

incomes in the economy are increasing. c.

stock-market prices are rising. d.

the economy is growing rapidly. ANS: A DIF: 1 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation MSC: Definitional 9.

When the overall level of prices in the economy is increasing, economists say that the economy is experiencing a. economic growth. b. stagflation. c. inflation. d. deflation. ANS: C DIF: 1 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation MSC: Definitional

10. The inflation rate is defined as the a. price level in an economy. b.

change in the price level from one period to the next. c.

percentage change in the price level from the previous period. d.

price level minus the price level from the previous period. ANS: C DIF: 1 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Definitional

11. The economy's inflation rate is the a.

price level in the current period. b.

change in the price level from the previous period. c.

change in the gross domestic product from the previous period. d.

percentage change in the price level from the previous period. ANS: D DIF: 1 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Definitional

Chapter 24/Measuring the Cost of Living 1629

12. The inflation rate you are likely to hear on the nightly news is calculated from a. the GDP deflator. b. the CPI. c.

the Dow Jones Industrial Average. d. the unemployment rate. ANS: B DIF: 2 REF: 24-0 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Interpretive

13. Which of the following is correct? a.

The GDP deflator is better than the CPI at reflecting the goods and services bought by consumers. b.

The CPI is better than the GDP deflator at reflecting the goods and services bought by consumers. c.

The GDP deflator and the CPI are equally good at reflecting the goods and services bought by consumers. d.

The GDP deflator is more commonly used as a gauge of inflation than the CPI is. ANS: B DIF: 2 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | GDP deflator MSC: Interpretive

14. The CPI is more commonly used as a gauge of inflation than the GDP deflator is because a. the CPI is easier to measure. b.

the CPI is calculated more often than the GDP deflator is. c.

the CPI better reflects the goods and services bought by consumers. d.

the GDP deflator cannot be used to gauge inflation. ANS: C DIF: 2 REF: 24-0 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | GDP deflator MSC: Interpretive

Sec01 - Measuring the Cost of Living - The Consumer Price Index MULTIPLE CHOICE 1.

The CPI is a measure of the overall cost of a.

the inputs purchased by a typical producer. b.

the goods and services purchased by a typical consumer. c.

the goods and services produced in the economy. d.

the stocks on the New York Stock Exchange. ANS: B DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional 2.

The CPI is a measure of the overall cost of the goods and services bought by a. a typical firm. b. the government. c. a typical consumer. d. All of the above are correct. ANS: C DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional

1630 Chapter 24/Measuring the Cost of Living 3.

The CPI is a measure of the overall cost of the goods and services bought by a.

a typical consumer, and the CPI is computed and reported by the Department of the Treasury. b.

typical consumers and typical business firms, and the CPI is computed and reported by the Department of the Treasury. c.

a typical consumer, and the CPI is computed and reported by the Bureau of Labor Statistics. d.

typical consumers and typical business firms, and the CPI is computed and reported by the Bureau of Labor Statistics. ANS: C DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive 4.

Which of the following agencies calculates the CPI? a. the National Price Board b.

the Department Of Weight and Measurements c. the Bureau of Labor Statistics d.

the Congressional Budget Office ANS: C DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

CPI | Bureau of Labor Statistics MSC: Definitional 5.

Which entity within the U.S. government is responsible for computing and reporting the CPI? a. the Department of Commerce b. the Department of Labor c. the General Accounting Office d.

the Council of Economic Advisers ANS: B DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Department of Labor MSC: Definitional 6. The CPI is calculated a.

monthly by the Department of Commerce. b.

monthly by the Bureau of Labor Statistics. c.

quarterly by the Department of Commerce. d.

quarterly by the Bureau of Labor Statistics. ANS: B DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

CPI | Bureau of Labor Statistics MSC: Definitional 7. The CPI is calculated a. weekly. b. monthly. c. quarterly. d. yearly. ANS: B DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional

Chapter 24/Measuring the Cost of Living 1631 8.

The steps involved in calculating the consumer price index and the inflation rate, in order, are as follows: a.

Choose a base year, fix the basket, find the prices, compute the basket’s cost, compute the index,

and compute the inflation rate. b.

Choose a base year, fix the basket, find the prices, compute the inflation rate, compute the basket's cost, and compute the index. c.

Fix the basket, find the prices, compute the basket's cost, choose a base year and compute the index,

and compute the inflation rate. d.

Fix the basket, find the prices, compute the inflation rate, compute the basket’s cost, and choose a

base year and compute the index. ANS: C DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Inflation rate MSC: Definitional 9.

In the CPI, goods and services are weighted according to a.

how long a market has existed for each good or service. b.

the extent to which each good or service is regarded by the government as a necessity. c.

how much consumers buy of each good or service. d.

the number of firms that produce and sell each good or service. ANS: C DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive

10. In the calculation of the CPI, coffee is given greater weight than tea if a.

consumers buy more coffee than tea. b.

the price of coffee is higher than the price of tea. c.

it costs more to produce coffee than it costs to produce tea. d.

coffee is more readily available than tea is to the typical consumer. ANS: A DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative

11. In the calculation of the CPI, sweaters are given greater weight than jeans if a.

the price of sweaters is higher than the price of jeans. b.

it costs more to produce sweaters than it costs to produce jeans. c.

sweaters are more readily available than jeans are to the typical consumer. d.

consumers buy more sweaters than jeans. ANS: D DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative

12. In calculating the CPI, a fixed basket of goods and services is used. The quantities of the goods and

services in the fixed basket are determined by a. surveying consumers. b.

surveying sellers of the goods and services. c.

working backward from the rate of inflation to arrive at imputed values for those quantities. d.

arbitrary choices made by federal government employees. ANS: A DIF: 1 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Definitional

1632 Chapter 24/Measuring the Cost of Living

13. What basket of goods and services is used to construct the CPI? a.

a random sample of all goods and services produced in the economy b.

the goods and services that are typically bought by consumers as determined by government surveys c.

only food, clothing, transportation, entertainment, and education d.

the least expensive and the most expensive goods and services in each major category of consumer expenditures ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive

14. Consider a small economy in which consumers buy only two goods: apples and pears. In order to

compute the consumer price index for this economy for two or more consecutive years, we assume that a.

the number of apples bought by the typical consumer is equal to the number of pears bought by the typical consumer in each year. b.

neither the number of apples nor the number of pears bought by the typical consumer changes from year to year. c.

the percentage change in the price of apples is equal to the percentage change in the price of pears from year to year. d.

neither the price of apples nor the price of pears changes from year to year. ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive

15. Consider a small economy in which consumers buy only two goods: pies and tarts. In order to

compute the consumer price index for this economy for two or more consecutive years, we assume that a.

the percentage change in the price of pies is equal to the percentage change in the price of tarts from year to year. b.

the number of pies bought by the typical consumer is equal to the number of tarts bought by the typical consumer in each year. c.

neither the number of pies nor the number of tarts bought by the typical consumer changes from year to year. d.

neither the price of pies nor the price of tarts changes from year to year. ANS: C DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive

16. To calculate the CPI, the Bureau of Labor Statistics uses a.

the prices of all goods and services produced domestically. b.

the prices of all final goods and services. c.

the prices of all consumer goods. d.

the prices of some consumer goods. ANS: D DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive

17. When computing the cost of the basket of goods and services purchased by a typical consumer,

which of the following changes from year to year? a.

the quantities of the goods and services purchased b.

the prices of the goods and services c.

the goods and services making up the basket d. All of the above are correct. ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive

Chapter 24/Measuring the Cost of Living 1633

18. In computing the consumer price index, a base year is chosen. Which of the following statements

about the base year is correct? a.

The base year is always the first year among the years for which computations are being made. b.

It is necessary to designate a base year only in the simplest case of two goods; in more realistic

cases, it is not necessary to designate a base year. c.

The value of the consumer price index is always 100 in the base year. d.

The base year is always the year in which the cost of the basket was highest among the years for

which computations are being made. ANS: C DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive

19. For any given year, the CPI is the price of the basket of goods and services in the a.

given year divided by the price of the basket in the base year, then multiplied by 100. b.

given year divided by the price of the basket in the previous year, then multiplied by 100. c.

base year divided by the price of the basket in the given year, then multiplied by 100. d.

previous year divided by the price of the basket in the given year, then multiplied by 100. ANS: A DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Interpretive

20. The inflation rate is calculated a.

by determining the change in the price index from the preceding period. b.

by adding up the price increases of all goods and services. c.

by computing a simple average of the price increases for all goods and services. d.

by determining the percentage increase in the price index from the preceding period. ANS: D DIF: 1 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Definitional

21. The inflation rate is calculated a.

by determining the change in the price index from the preceding period. b.

by determining the change in the price index from the base year. c.

by determining the percentage change in the price index from the preceding period. d.

by determining the percentage change in the price index from the base year. ANS: C DIF: 1 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Definitional

22. If 2004 is the base year, then the inflation rate for 2005 equals a. b. c. d. ANS: A DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Interpretive

1634 Chapter 24/Measuring the Cost of Living

23. If 2002 is the base year, then the inflation rate in 2005 equals a. b. c. d. ANS: D DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Interpretive

24. If the consumer price index was 80 in 2004, 100 in 2005, and 110 in 2006, then the base year must be a. 2004. b. 2005. c. 2006. d.

The base year cannot be determined from the given information. ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative

25. Suppose a basket of goods and services has been selected to calculate the CPI and 2002 has been

chosen as the base year. In 2002, the basket’s cost was $75.00; in 2004, the basket’s cost was

$79.50; and in 2006, the basket’s cost was $85.86. The value of the CPI was a. 100 in 2002. b. 106 in 2004. c. 114.48 in 2006. d. All of the above are correct. ANS: D DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative

26. Suppose a basket of goods and services has been selected to calculate the CPI and 2002 has been

selected as the base year. In 2002, the basket’s cost was $50; in 2004, the basket’s cost was $52;

and in 2006, the basket’s cost was $54.60. The value of the CPI in 2004 was a. 96.2. b. 102.0. c. 104.0. d. 152.0. ANS: C DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative

27. Suppose a basket of goods and services has been selected to calculate the CPI and 2002 has been

selected as the base year. In 2002, the basket’s cost was $50; in 2004, the basket’s cost was $52;

and in 2006, the basket’s cost was $54.60. The value of the CPI in 2006 was a. 91.6. b. 104.6. c. 109.2. d. 154.6. ANS: C DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative

Chapter 24/Measuring the Cost of Living 1635

28. Suppose a basket of goods and services has been selected to calculate the CPI and 2004 has been

selected as the base year. In 2002, the basket’s cost was $50; in 2004, the basket’s cost was $52;

and in 2006, the basket’s cost was $54.60. The value of the CPI in 2006 was a. 91.6. b. 95.2. c. 105.0. d. 109.2. ANS: C DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI MSC: Applicative

29. If the consumer price index was 100 in the base year and 107 in the following year, then the inflation rate was a. 1.07 percent. b. 7 percent. c. 10.7 percent. d. 107 percent. ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

30. The price index was 320 in one year and 360 in the next year. What was the inflation rate? a. 9 percent b. 11.1 percent c. 12.5 percent d. 40 percent ANS: C DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

31. The price index was 120 in 2006 and 127.2 in 2007. What was the inflation rate? a. 5.7 percent b. 6.0 percent c. 7.2 percent d. 27.2 percent ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

32. For an imaginary economy, the value of the consumer price index was 140 in 2006 and 149.10 in

2007. The economy’s inflation rate for 2007 was a. 6.1 percent. b. 6.5 percent. c. 9.1 percent. d. 49.1 percent. ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

33. From 2004 to 2005, the CPI for medical care increased from 260.8 to 272.8. What was the inflation rate for medical care? a. 4.4 percent b. 4.6 percent c. 12.0 percent d. 172.8 percent ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

1636 Chapter 24/Measuring the Cost of Living

34. The market basket used to calculate the CPI in Aquilonia is 4 loaves of bread, 6 gallons of milk, 2

shirts, and 2 pairs of pants. In 2005, bread cost $1.00 per loaf, milk cost $1.50 per gallon, shirts cost

$6.00 each, and pants cost $10.00 per pair. In 2006, bread cost $1.50 per loaf, milk cost $2.00 per

gallon, shirts cost $7.00 each, and pants cost $12.00 per pair. Using 2005 as the base year, what was

Aquilonia’s inflation rate in 2006? a. 4 percent b. 11 percent c. 19.6 percent d. 24.4 percent ANS: D DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

35. Between October 2001 and October 2002, the CPI in Canada rose from 116.5 to 119.8 and the CPI

in Mexico rose from 93.2 to 102.3. What were the inflation rates for Canada and Mexico over this one-year period? a.

2.8 percent for Canada and 9.1 percent for Mexico b.

2.8 percent for Canada and 9.8 percent for Mexico c.

3.3 percent for Canada and 9.1 percent for Mexico d.

3.3 percent for Canada and 9.8 percent for Mexico ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

36. Suppose the price index was 110 in 2004, 120 in 2005, and 125 in 2006. Which of the following statements is correct? a.

The economy experienced inflation between 2004 and 2005 and between 2005 and 2006. b.

The inflation rate was positive between 2004 and 2005, and it was negative between 2005 and 2006. c.

The inflation rate was higher between 2005 and 2006 than it was between 2004 and 2005. d. All of the above are correct. ANS: A DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

37. The price index was 150 in the first year, 160 in the second year, and 175 in the third year. The inflation rate was about a.

6.25 percent between the first and second years, and 8.6 percent between the second and third years. b.

6.7 percent between the first and second years, and 9.4 percent between the second and third years. c.

10 percent between the first and second years, and 15 percent between the second and third years. d.

60 percent between the first and second years, and 75 percent between the second and third years. ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

Chapter 24/Measuring the Cost of Living 1637

38. The price index was 110 in the first year, 100 in the second year, and 96 in the third year. The economy experienced a.

9.1 percent deflation between the first and second years, and 4 percent deflation between the second and third years. b.

9.1 percent deflation between the first and second years, and 4.2 percent deflation between the second and third years. c.

10 percent deflation between the first and second years, and 4 percent deflation between the second and third years. d.

10 percent deflation between the first and second years, and 4.2 percent deflation between the second and third years. ANS: A DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

39. If the price index was 90 in year 1, 100 in year 2, and 95 in year 3, then the economy experienced a.

10 percent inflation between years 1 and 2 ,and 5 percent inflation between years 2 and 3. b.

10 percent inflation between years 1 and 2, and 5 percent deflation between years 2 and 3. c.

11.1 percent inflation between years 1 and 2, and 5 percent inflation between years 2 and 3. d.

11.1 percent inflation between years 1 and 2, and 5 percent deflation between years 2 and 3. ANS: D DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

40. The price index was 150 in the first year, 160 in the second year, and 165 in the third year. Which

of the following statements is correct? a.

The price level was higher in the second year than in the first year, and it was higher in the third year than in the second year. b.

The inflation rate was positive between the first and second years, and it was positive between the second and third years. c.

The inflation rate was lower between the second and third years than it was between the first and second years. d. All of the above are correct. ANS: D DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Price level | Inflation rate MSC: Applicative

41. In a particular economy, the price index was 270 in 2005 and 300 in 2006. Which of the following statements is correct? a.

The economy experienced a rising price level between 2005 and 2006. b.

The economy experienced a higher inflation rate between 2005 and 2006 than it had experienced between 2004 and 2005. c.

The inflation rate between 2005 and 2006 was 30 percent. d. All of the above are correct. ANS: A DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Price level | Inflation rate MSC: Applicative

42. Which of the following changes in the price index produces the greatest rate of inflation: 80 to 100, 100 to 120, or 150 to 170? a. 80 to 100 b. 100 to 120 c. 150 to 170 d.

All of these changes produce the same rate of inflation. ANS: A DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

1638 Chapter 24/Measuring the Cost of Living

43. Which of the following changes in the price index produces the greatest rate of inflation: 106 to 112, 112 to 118, or 118 to 124? a. 106 to 112 b. 112 to 118 c. 118 to 124 d.

All of these changes produce the same rate of inflation. ANS: A DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

44. Which of the following changes in the price index produces the greatest rate of inflation: 100 to 110, 150 to 165, or 180 to 198? a. 100 to 110 b. 150 to 165 c. 180 to 198 d.

All of these changes produce the same rate of inflation. ANS: D DIF: 2 REF: 24-1 NAT: Analytic

LOC: Unemployment and inflation TOP: Inflation rate MSC: Applicative

45. If the CPI was 110 this year and 100 last year, then a.

the cost of the CPI basket of goods and services increased by 110 percent this year. b.

the price level increased by 10 percent this year. c.

the inflation rate for this year was 10 percent higher than the inflation rate for last year. d. All of the above are correct. ANS: B DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Price level MSC: Applicative

46. If the CPI was 125 this year and 120 last year, then a.

the cost of the CPI basket of goods and services increased by 4.2 percent this year. b.

the price level increased by 4.2 percent this year. c.

the inflation rate for this year was 4.2 percent. d. All of the above are correct. ANS: D DIF: 2 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP:

CPI | Price level | Inflation rate MSC: Applicative

47. In an imaginary economy, consumers buy only hot dogs and hamburgers. The fixed basket consists

of 10 hot dogs and 6 hamburgers. A hot dog cost $3 in 2006 and $5.40 in 2007. A hamburger cost

$5 in 2006 and $6 in 2007. Which of the following statements is correct? a.

When 2006 is chosen as the base year, the consumer price index is 90 in 2007. b.

When 2006 is chosen as the base year, the inflation rate is 150 percent in 2007. c.

When 2007 is chosen as the base year, the consumer price index is 100 in 2006. d.

When 2007 is chosen as the base year, the inflation rate is 50 percent in 2007. ANS: D DIF: 3 REF: 24-1 NAT: Analytic

LOC: The study of economics and definitions of economics TOP: CPI | Inflation rate MSC: Analytical