Preview text:

Name: Tran Thi Thanh Hang ID: 11222129 Class: EBDB 4

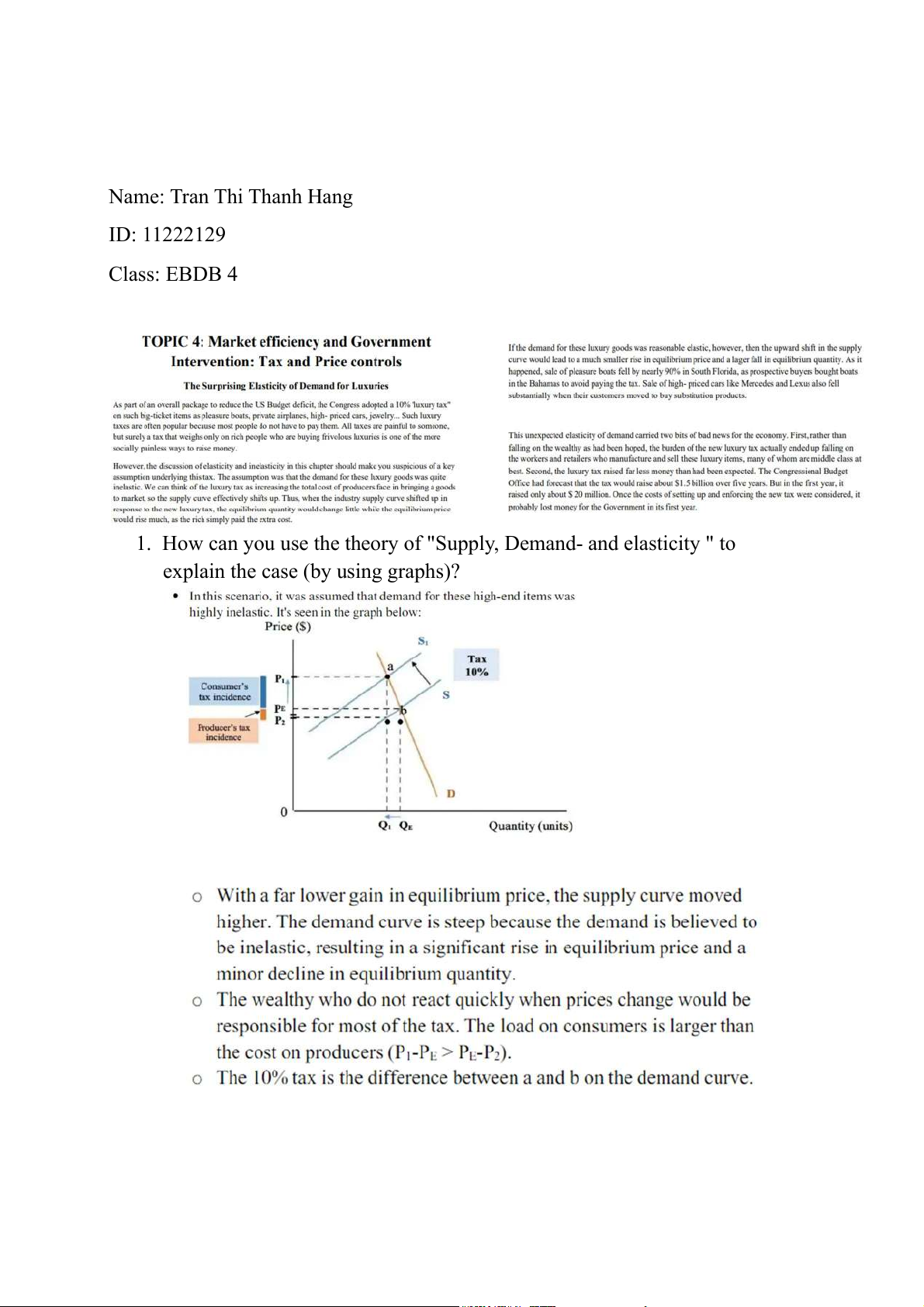

1. How can you use the theory of "Supply, Demand- and elasticity " to

explain the case (by using graphs)?

2. What is implication for the Government in the tax policy?

- Luxury taxes are an effective technique to collect money from the

wealthy. The reality, however, shows that the demand elasticity

assumption for these luxuries goods is incorrect. It also serves as

evidence that the government's tax policy is flawed in several ways.

- First, the Congress imposed a 10% “luxury tax” which is an inappropriate

tax. This resulted in the government losing money and the quantity of

supplies declining, harming the economy as a whole.

The fact that the employees and retailers who produce and market these

luxury items ended up bearing the brunt of this tax indicates that the

levy's intended outcome was not achieved.

- The Congress should have implemented lower taxes, such as 4-5% or

10%, in some states as a test, and then evaluated the results to determine

the best course of action. The employees and retailers who produce and

market these luxury items ended up bearing the brunt of this tax indicates

that the levy's intended outcome was not achieved.