Preview text:

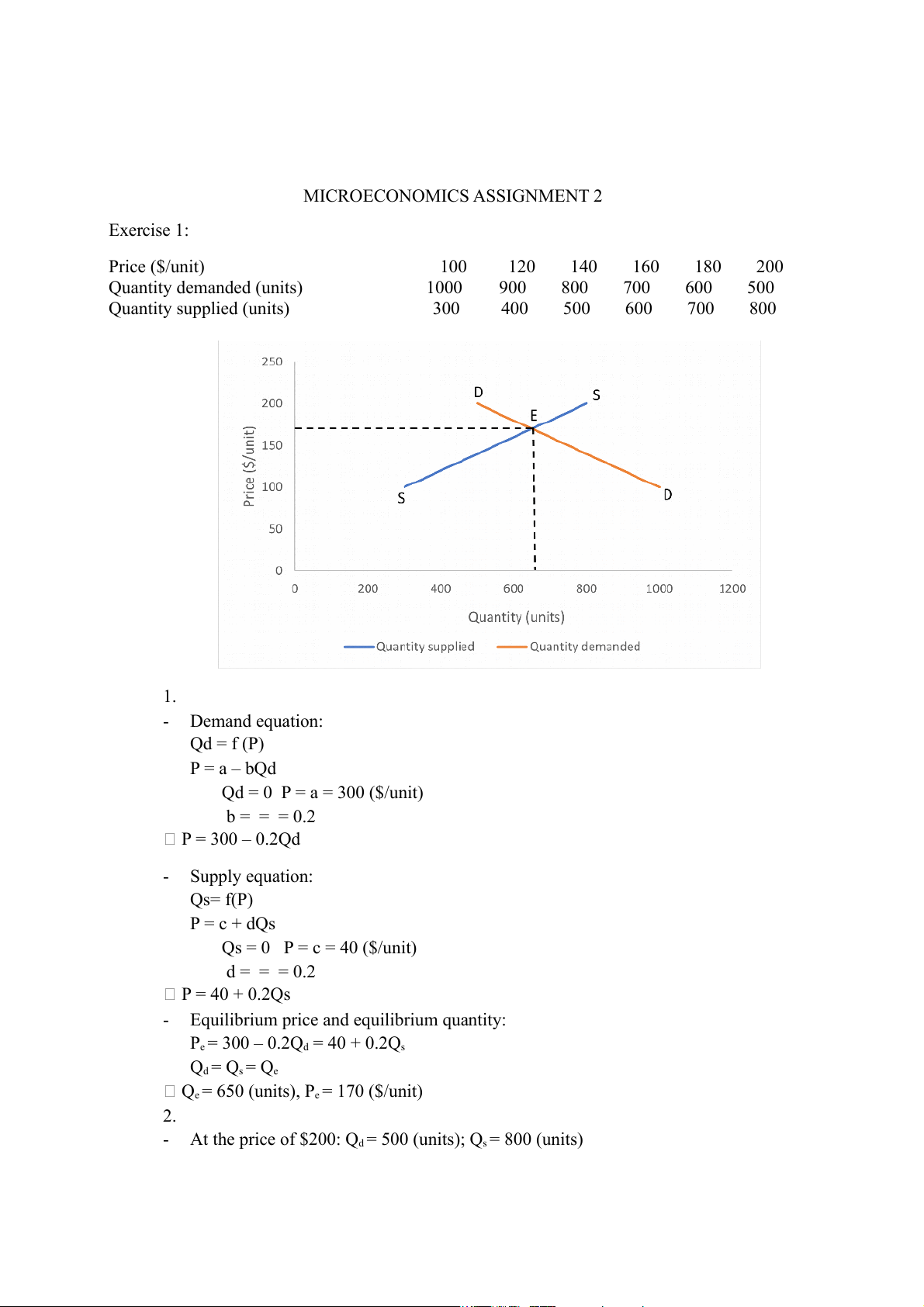

MICROECONOMICS ASSIGNMENT 2 Exercise 1: Price ($/unit) 100 120 140 160 180 200 Quantity demanded (units) 1000 900 800 700 600 500 Quantity supplied (units) 300 400 500 600 700 800 1. - Demand equation: Qd = f (P) P = a – bQd Qd = 0 P = a = 300 ($/unit) b = = = 0.2 P = 300 – 0.2Qd - Supply equation: Qs= f(P) P = c + dQs Qs = 0 P = c = 40 ($/unit) d = = = 0.2 P = 40 + 0.2Qs -

Equilibrium price and equilibrium quantity: Pe = 300 – 0.2Q = 40 + 0.2Q d s Qd = Qs = Qe

Qe = 650 (units), Pe = 170 ($/unit) 2. -

At the price of $200: Qd = 500 (units); Qs = 800 (units)

® The surplus of fridge at price of $200 is 800 – 500 = 300 (units) -

At the price of $110: Q = 950 (units); Q d s = 350 (units)

® The shortage of fridge at the price of $110 is 950 – 350 = 600 (units) 3. -

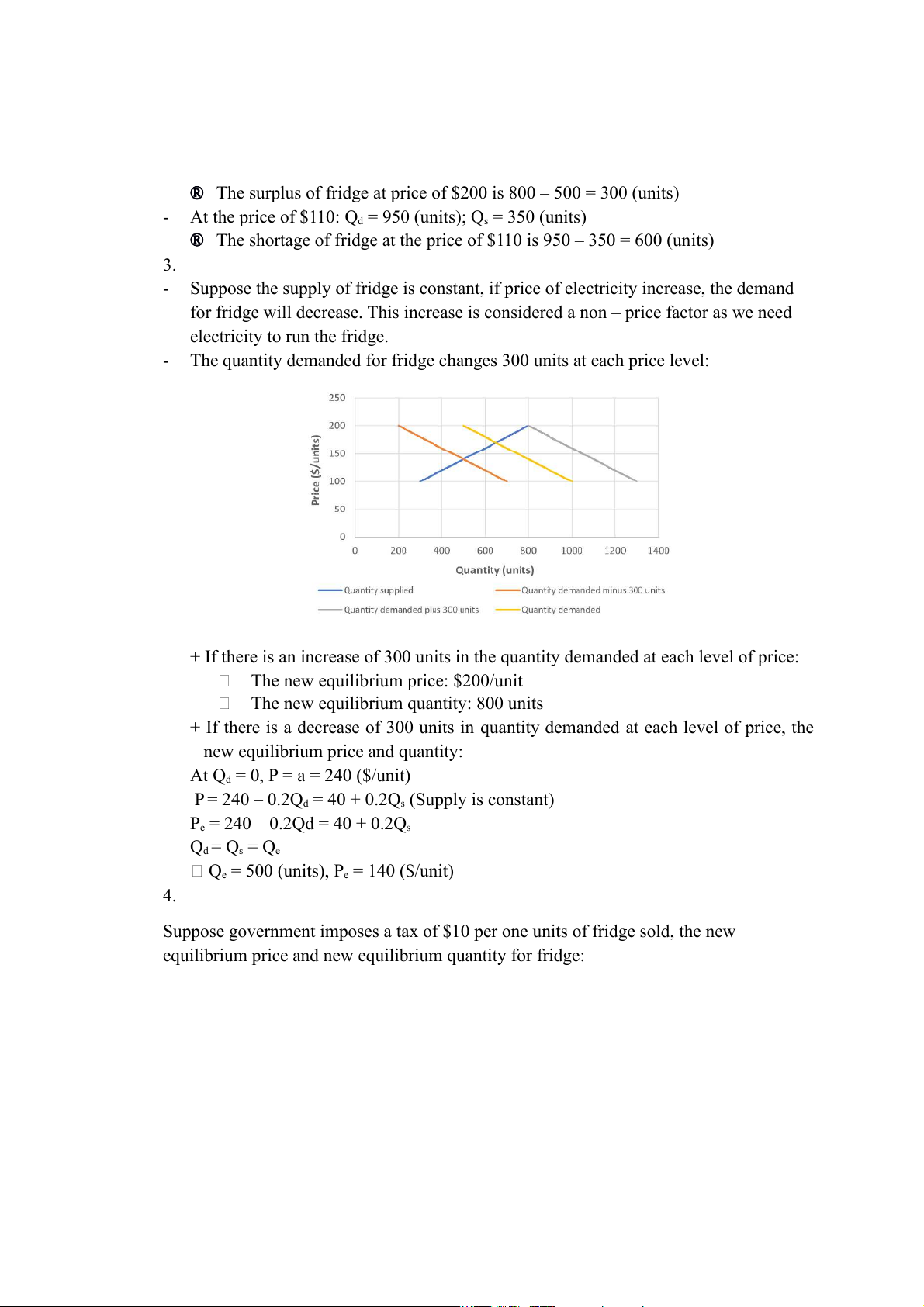

Suppose the supply of fridge is constant, if price of electricity increase, the demand

for fridge will decrease. This increase is considered a non – price factor as we need electricity to run the fridge. -

The quantity demanded for fridge changes 300 units at each price level:

+ If there is an increase of 300 units in the quantity demanded at each level of price:

The new equilibrium price: $200/unit

The new equilibrium quantity: 800 units

+ If there is a decrease of 300 units in quantity demanded at each level of price, the

new equilibrium price and quantity: At Q = 0, P d = a = 240 ($/unit) P = 240 – 0.2Q = 40 + 0.2Q d s (Supply is constant)

Pe = 240 – 0.2Qd = 40 + 0.2Qs Qd = Qs = Qe

Qe = 500 (units), Pe = 140 ($/unit) 4.

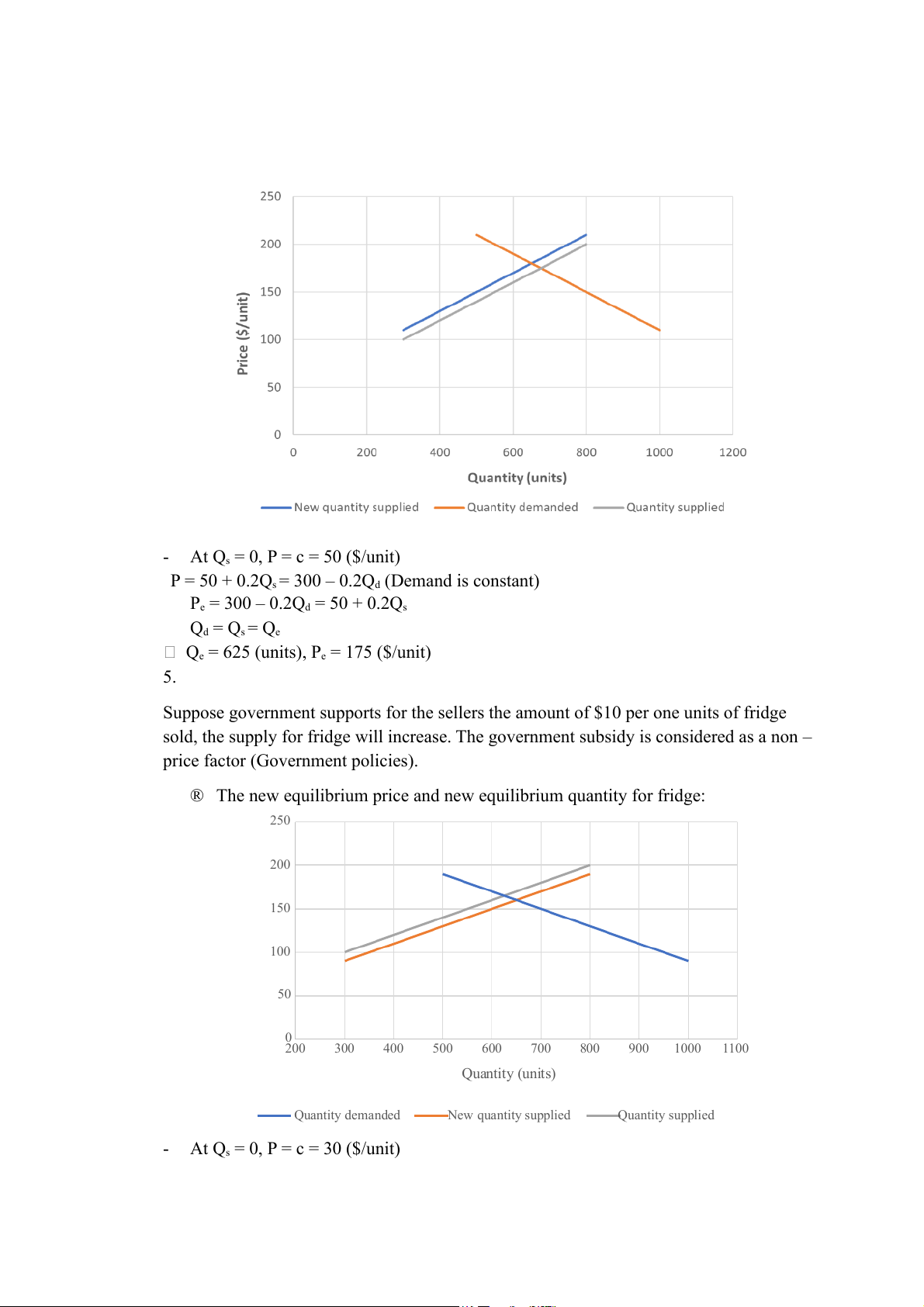

Suppose government imposes a tax of $10 per one units of fridge sold, the new

equilibrium price and new equilibrium quantity for fridge: -

At Qs = 0, P = c = 50 ($/unit)

P = 50 + 0.2Qs = 300 – 0.2Q (Demand is constant) d Pe = 300 – 0.2Q = 50 + 0.2Q d s Qd = Qs = Qe

Qe = 625 (units), Pe = 175 ($/unit) 5.

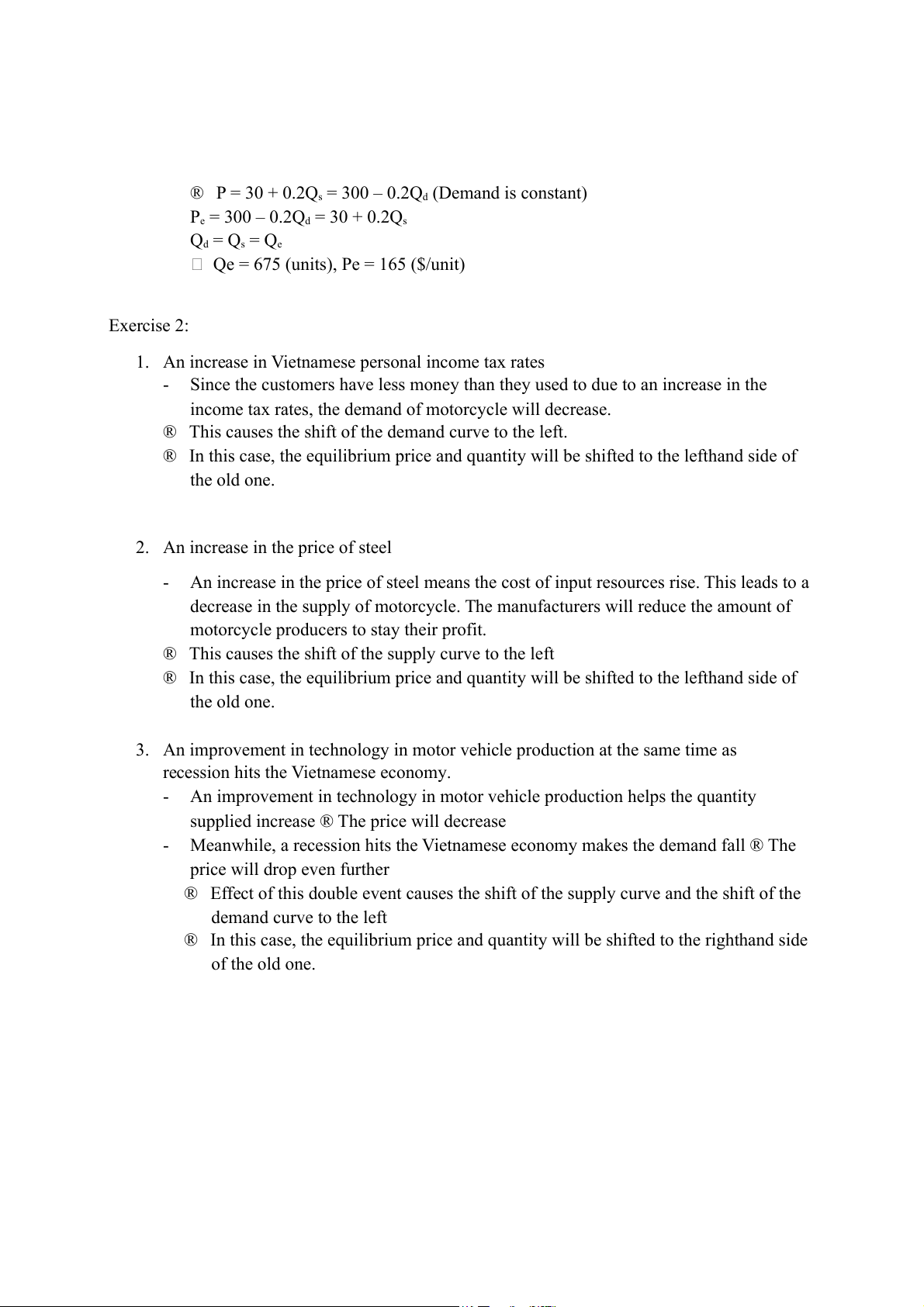

Suppose government supports for the sellers the amount of $10 per one units of fridge

sold, the supply for fridge will increase. The government subsidy is considered as a non –

price factor (Government policies).

® The new equilibrium price and new equilibrium quantity for fridge: 250 200 t) 150 uni e ($/ 100 Pric 50 0 200 300 400 500 600 700 800 900 1000 1100 Quantity (units) Quantity demanded New quantity supplied Quantity supplied - At Qs = 0, P = c = 30 ($/unit)

® P = 30 + 0.2Qs = 300 – 0.2Q (Demand is constant) d Pe = 300 – 0.2Q = 30 + 0.2Q d s Qd = Qs = Qe

Qe = 675 (units), Pe = 165 ($/unit) Exercise 2:

1. An increase in Vietnamese personal income tax rates -

Since the customers have less money than they used to due to an increase in the

income tax rates, the demand of motorcycle will decrease.

® This causes the shift of the demand curve to the left.

® In this case, the equilibrium price and quantity will be shifted to the lefthand side of the old one.

2. An increase in the price of steel -

An increase in the price of steel means the cost of input resources rise. This leads to a

decrease in the supply of motorcycle. The manufacturers will reduce the amount of

motorcycle producers to stay their profit.

® This causes the shift of the supply curve to the left

® In this case, the equilibrium price and quantity will be shifted to the lefthand side of the old one.

3. An improvement in technology in motor vehicle production at the same time as

recession hits the Vietnamese economy. -

An improvement in technology in motor vehicle production helps the quantity supplied increase ® The price will decrease -

Meanwhile, a recession hits the Vietnamese economy makes the demand fall ® The price will drop even further

® Effect of this double event causes the shift of the supply curve and the shift of the demand curve to the left

® In this case, the equilibrium price and quantity will be shifted to the righthand side of the old one.