Preview text:

The Vietnamese government is drafting a new law to impose a 10% special

consumption tax on sugary beverages. The goal is to reduce the consumption of

sugary drinks due to their potential negative health impacts. However, there has

been limited analysis of the economic implications of this policy.

(reference: https://tuoitre.vn/ap-thue-tieu-thu-dac-biet-nuoc-giai-khat-co-duong-

tranh-gay-hai-suc-khoe-nhung-thiet-kinh-te-20241017134706063.htm)

As a microeconomics student, you will use theoretical tools learned in class to

examine how this tax might affect the sugary beverage market and its

participants. Your analysis will focus on market dynamics, consumer and

producer behavior, and societal welfare.

1/ Explain how the proposed tax affects the demand, supply, and equilibrium

price and quantity in the sugary beverage market. Evaluate whether the tax is

likely to effectively reduce sugary beverage consumption. -

Demand curve: The 10% tax increases the price of sugary beverages.

According to the law of demand, this will reduce quantity demanded ->

the demand curve will shift to the left as higher prices lead consumers to reduce consumption -

Supply curve: The tax increases production costs for suppliers -> a

decrease in supply -> the supply curve shifts to the left as producers will

supply fewer units at any given price due to the higher tax burden -

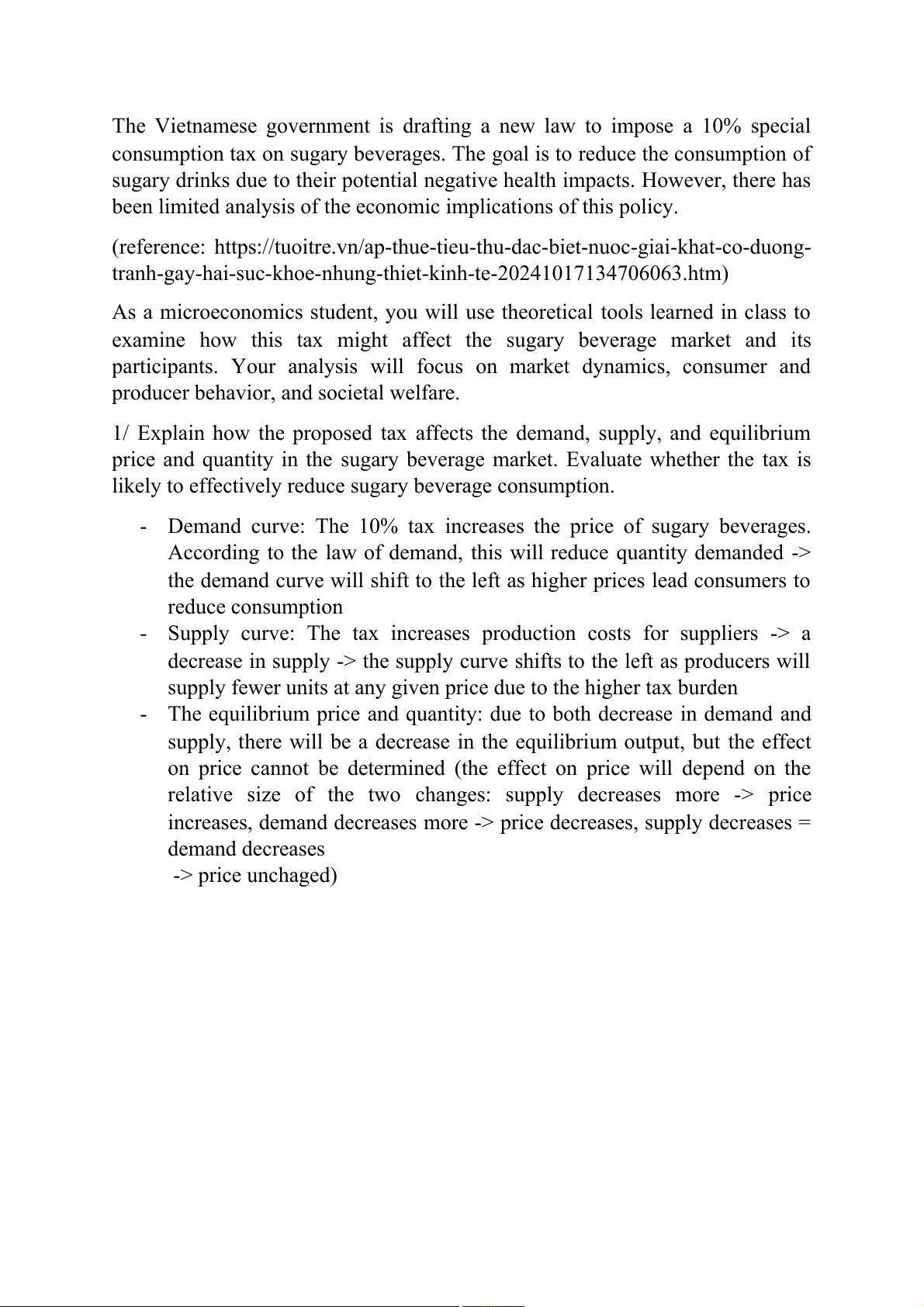

The equilibrium price and quantity: due to both decrease in demand and

supply, there will be a decrease in the equilibrium output, but the effect

on price cannot be determined (the effect on price will depend on the

relative size of the two changes: supply decreases more -> price

increases, demand decreases more -> price decreases, supply decreases = demand decreases -> price unchaged) -

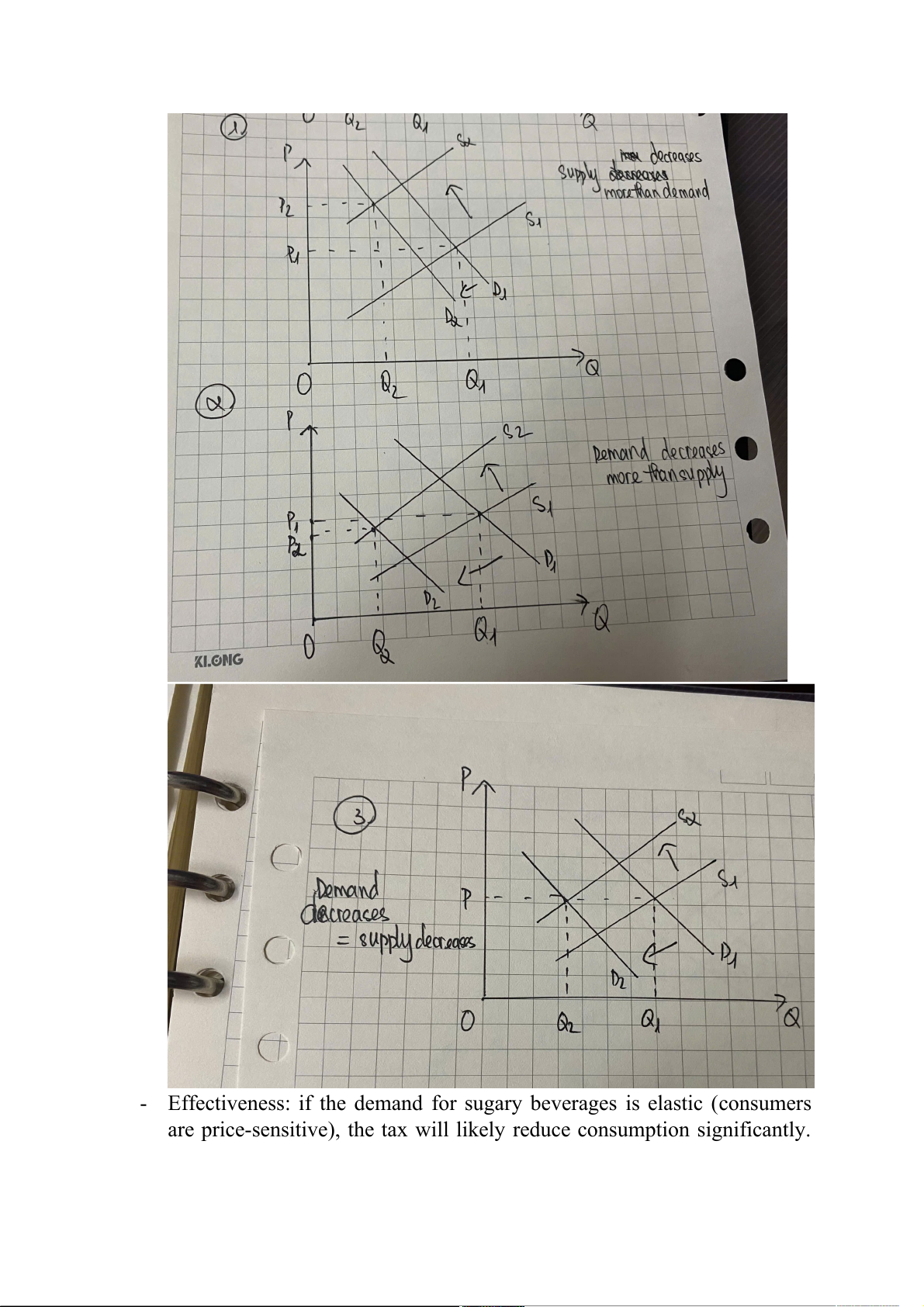

Effectiveness: if the demand for sugary beverages is elastic (consumers

are price-sensitive), the tax will likely reduce consumption significantly.

If the demand is inelastic (consumers are not very responsive to price

increases), the reduction in consumption will be smaller

2/ Discuss how the burden of the tax is likely to be distributed between consumers and producers -

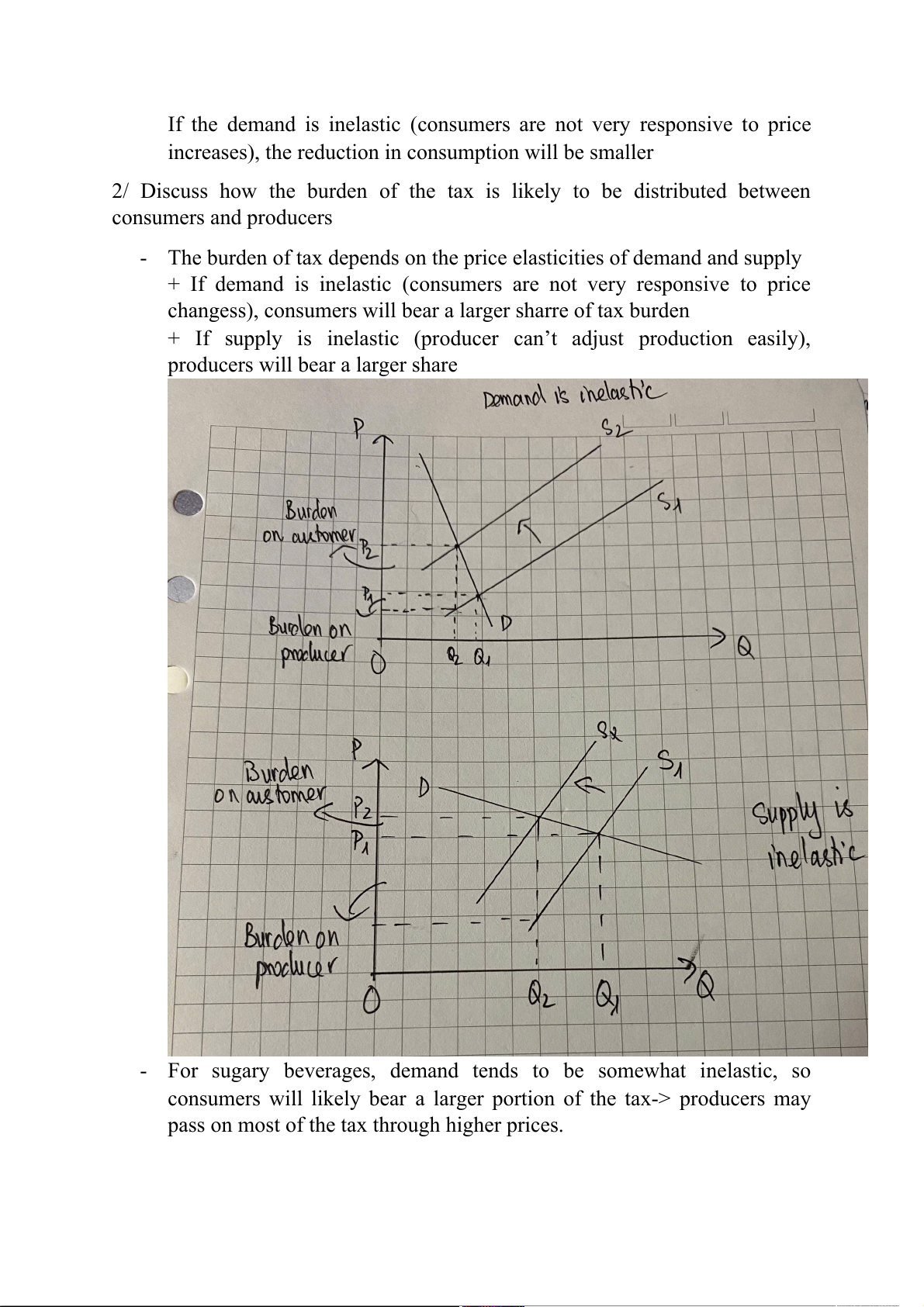

The burden of tax depends on the price elasticities of demand and supply

+ If demand is inelastic (consumers are not very responsive to price

changess), consumers will bear a larger sharre of tax burden

+ If supply is inelastic (producer can’t adjust production easily),

producers will bear a larger share -

For sugary beverages, demand tends to be somewhat inelastic, so

consumers will likely bear a larger portion of the tax-> producers may

pass on most of the tax through higher prices.

3/ Analyze how the tax impacts consumer, and producer well-being, as well as overall social welfare. - Consumer well-being

Consumers will face higher prices, reducing their welfare or consumer

surplus. For those who continue consuming sugary drinks, the price

increase reduces their overall pleasure. However, for those who reduce

consumption, health benefits including lower risks of obesity or diabetes

could offset some welfare loss. - Producer well-being

Producers face higher costs due to the tax -> they may reduce supply ->

lower revenues and profits. The reduction in the quantity sold + the

increased price -> reduce producer surplus. Moreover, smaller producers

maybe more affected than larger producers - Social Welfare

If the tax leads to a significant reduction in consumption, it could

improve social welfare by lowering healthcare costs (obesity, diabetes) in

the long run. However, there maybe some deadweight loss if the tax

causes inefficiencies in the market, including reduced consumer and

producer surplus without sufficient health benefits.