Preview text:

VŨ LAN HƯƠNG- TMDT CLC 66C Background

The Vietnamese government is drafting a new law to impose a 10% special consumption tax

on sugary beverages. The goal is to reduce the consumption of sugary drinks due to their

potential negative health impacts. However, there has been limited analysis of the economic

implications of this policy. (reference:

https://tuoitre.vn/ap-thue-tieu-thu-dac-biet-nuoc-giai-khat-co-duong-tranh-gay-hai-suc-khoe-

nhung-thiet-kinh-te-20241017134706063.htm)

As a microeconomics student, you will use theoretical tools learned in class to examine how

this tax might affect the sugary beverage market and its participants. Your analysis will focus

on market dynamics, consumer and producer behavior, and societal welfare.

1. Explain how the proposed tax affects the demand, supply, and equilibrium price and

quantity in the sugary beverage market. Evaluate whether the tax is likely to effectively

reduce sugary beverage consumption.

2. Discuss how the burden of the tax is likely to be distributed between consumers and producers.

3. Analyze how the tax impacts consumer, and producer well-being, as well as overall social welfare. ANSWERS

1. Because the Vietnamese government is drafting a new law to impose a 10%

special consumption tax on sugary beverages. Therefore, the cost of production

increase and lead to the rise in the price of supply. Facing this changes in price,

the producer will manufacture less because with the same quantity, they will

have to pay more than the price before tax. This can force the supply curve shift to the left.

While the supply curve shift to the left, the demand curve still stay the same.

However, there will be a movement along the demand curve due to the increase

in price. The tax impose on sugary beverages make the cost of production

increase, as well as the price of product in the market. Thus, the quantity

demand will decrease because when the price of sugary beverages increase,

people tend to choose others substitute goods such as: water, fresh juice or ice tea…

Because of the tax, the equilibrium price increase and the equilibrium quantity decrease.

In my point of view, the effectiveness of this tax policy depends on the price

elasticity of demand. If the demand is elastic, consumer will be more sensitive

to the changes in price and reduce their consumption. However, if the demand

is inelastic, the tax may not lead to the decrease of consumption because the

buyers will continue to consume sugar beverages in spite of the high price.

2. The distribution of the burden of tax between consumers and producers is

based on the price elasticity of demand and supply. The more elastic of the

curve is, the less burden of tax it have to pay. For example, if the demand for

sugary beverages is elastic, the consumer will react in a more sensitive way and

the demand for this good is reduce. In order not to loose too many customer,

producer will have to pay a higher amount of tax. At the same time, if the

supply is inelastic, the producers are unable to reduce the production, they have

to share a larger part of the tax incident to maintain sales.

In conclusion, if demand is elastic and supply is inelastic, producers will have

to share a larger part of tax. If demand is inelastic and supply is elastic, buyers will have to pay more tax.

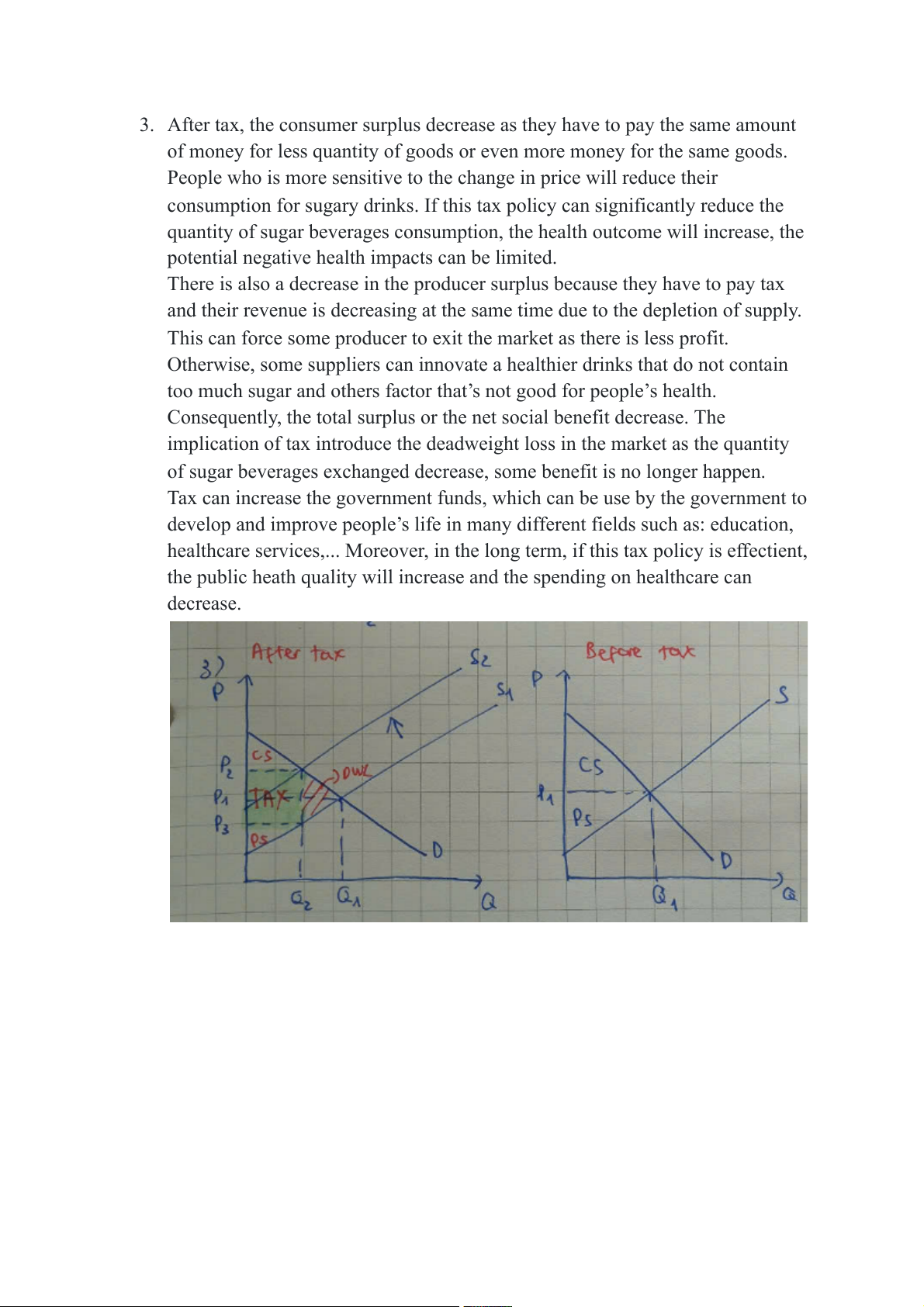

3. After tax, the consumer surplus decrease as they have to pay the same amount

of money for less quantity of goods or even more money for the same goods.

People who is more sensitive to the change in price will reduce their

consumption for sugary drinks. If this tax policy can significantly reduce the

quantity of sugar beverages consumption, the health outcome will increase, the

potential negative health impacts can be limited.

There is also a decrease in the producer surplus because they have to pay tax

and their revenue is decreasing at the same time due to the depletion of supply.

This can force some producer to exit the market as there is less profit.

Otherwise, some suppliers can innovate a healthier drinks that do not contain

too much sugar and others factor that’s not good for people’s health.

Consequently, the total surplus or the net social benefit decrease. The

implication of tax introduce the deadweight loss in the market as the quantity

of sugar beverages exchanged decrease, some benefit is no longer happen.

Tax can increase the government funds, which can be use by the government to

develop and improve people’s life in many different fields such as: education,

healthcare services,... Moreover, in the long term, if this tax policy is effectient,

the public heath quality will increase and the spending on healthcare can decrease.