Preview text:

Assignment 8:Te T am1 Trần Ngọc Ánh Chu Văn Tiến Đạt Giáp Huy Hoàng Hồng Anh Hồ Hải Anh

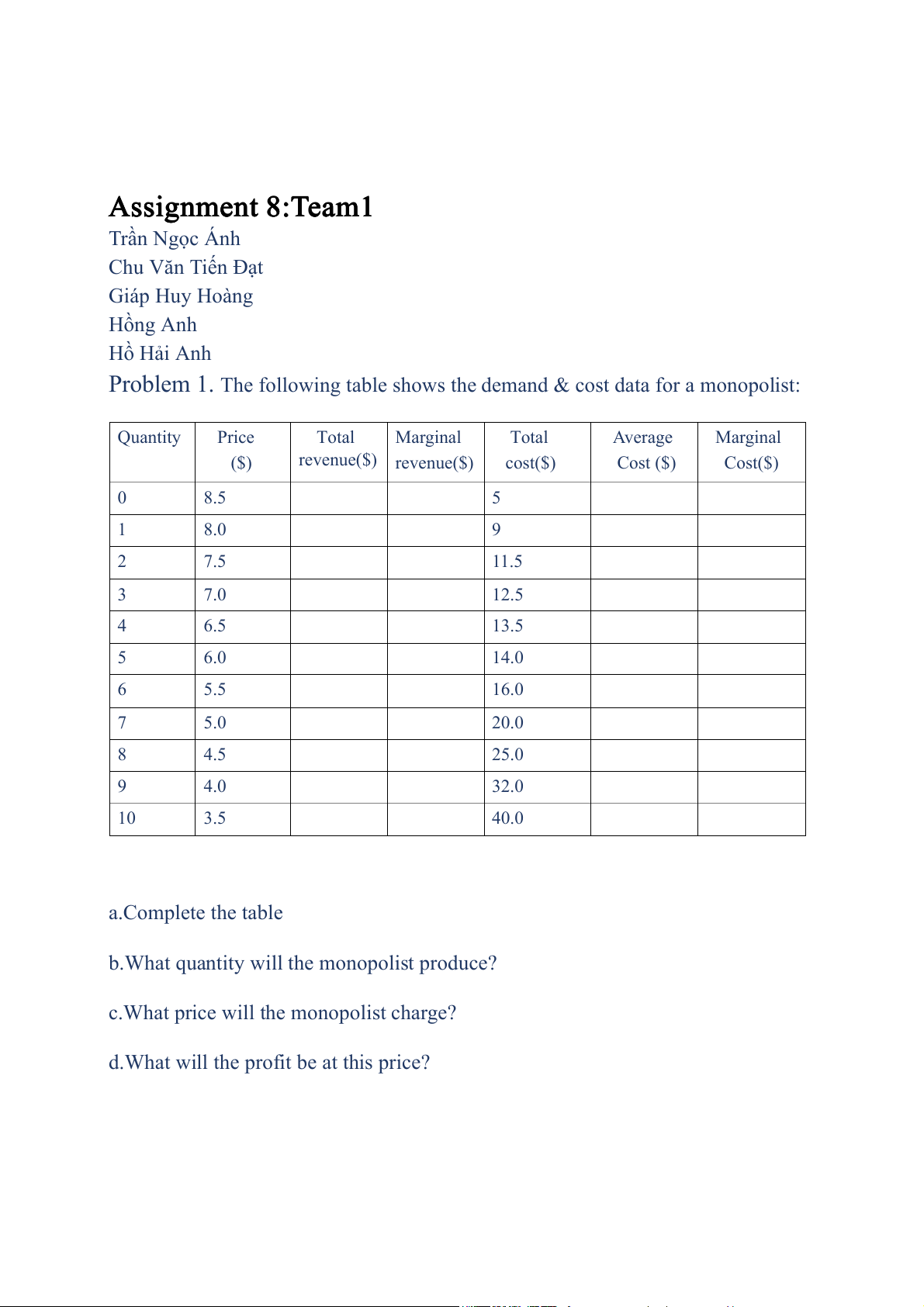

Problem 1. The following table shows the demand & cost data for a monopolist: Quantity Pric e Total Marginal Total Average Marginal ($) revenue($) revenue($) cost($ ) Cost ($) Cost($) 0 8.5 5 1 8.0 9 2 7.5 11.5 3 7.0 12.5 4 6.5 13.5 5 6.0 14.0 6 5.5 16.0 7 5.0 20.0 8 4.5 25.0 9 4.0 32.0 10 3.5 40.0 a.Complete the table

b.What quantity will the monopolist produce?

c.What price will the monopolist charge?

d.What will the profit be at this price? a.Complete the table Quantity Pric e Total Marginal Total Average Marginal ($) revenue($) revenue($) cost($ ) Cost ($) Cost($) 0 8.5 0 _ 5 _ _ 1 8.0 8 8 9 9 9 2 7.5 15 7 11.5 5.75 2.5 3 7.0 21 6 12.5 25/6 1 4 6.5 26 5 13.5 3.375 1 5 6.0 30 4 14.0 2.8 0.5 6 5.5 33 3 16.0 8/3 2 7 5.0 35 2 20.0 20/7 4 8 4.5 36 1 25.0 3.125 5 9 4.0 36 0 32.0 32/9 7 10 3.5 35 -1 40.0 4 8

b.What quantity will the monopolist produce?

-The monopolist will produce 6 products. Because at the quantity the MR will be closest to MC

c.What price will the monopolist charge?

The monopolist will charge 5.5$ per unit => P=5.5$ at Q=6

d.What will the profit be at this price?

At this price, the profit will be : TR-TC=33-16=17$ Problem 2.

A firm has demand function of P=100-Q ($) and total cost function of TC=500+ 4Q+Q2 ($).

a. Is this firm a perfect competitive firm? Why?

b. What is price and quantity to maximize total revenue ? What is that maximum total revenue ?

c. What is price and optimal quantity to maximize profit? What is that maximum total profit ?

d. Asume government imposes a tax of 8 $ per unit of good sold, what is price and

optimal quantity that gives the firm maximum profit? What is this maximum profit?

e. Assume the government imposes a fixed tax of 100 $, what is the price and

optimal quantity that gives the firm maximum profit?

a. This firm is not a perfectly competitive firm because if this firm is a perfectly

competitive firm, D will be perfectly elastic but this demand equation: P=100-Q => slope down D

b. When maximum revenue: MR=0 =>(TR)’=0 =>100-2Q=0. =>Q=50 =>P=50$/unit

Maximum total revenue: TR=PQ=50.50=2500$

c. When maximum profit: MR=MC1 =>(TR)’=(TC=)’ =>100-2Q=4+2Q =>Q=24 =>P=76$/unit

Maximum total profit: TR-TC=PQ-TC=76.24-(500+4.24+24.24)=652$

d.When government imposes a tax of 8 $ per unit of good sold MC2=MC1+t. =>MC2=2Q+12

So when the firm maximum profit: MR=MC2 =>100-2Q=2Q+12 =>Q=22 =>P=78$/unit

=>maximum profit: TR-TC=PQ-(TC1+t.Q)=78.22-(500+4.22+22.22+22.8)=468$

e. When the government imposes a fixed tax of 100 $, MC doesn’t change so: TR-TC-T=525-100=425$