Preview text:

SECTION 2 : MONOPOLY I. Definition

Monopolies are on the other end of the continuum from pure competition. A

monopoly consists of one firm that produces a unique product or service with no

close substitutes. Entry into the market is blocked, which gives the firm market

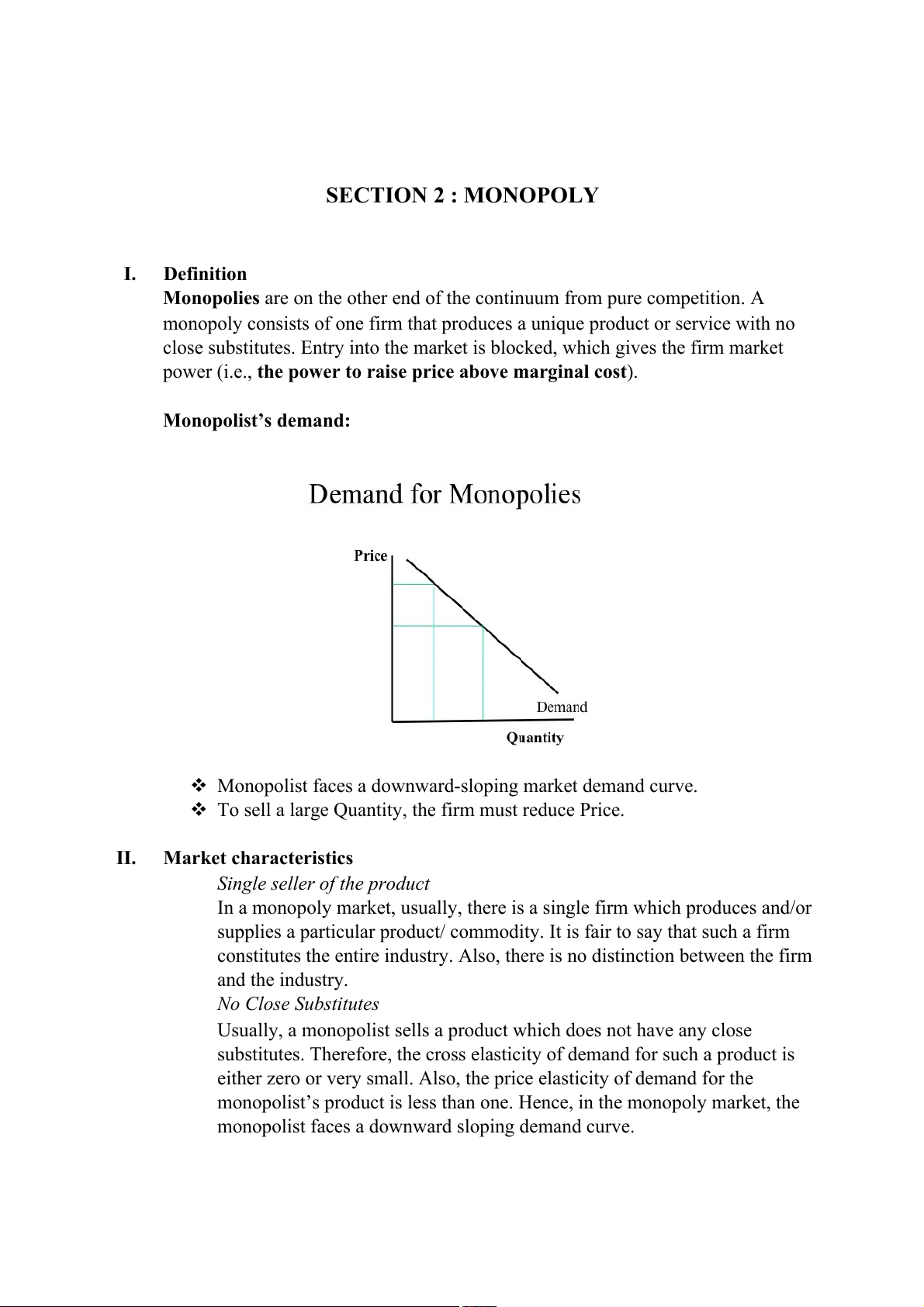

power (i.e., the power to raise price above marginal cost). Monopolist’s demand:

Monopolist faces a downward-sloping market demand curve.

To sell a large Quantity, the firm must reduce Price. II. Market characteristics

Single seller of the product

In a monopoly market, usually, there is a single firm which produces and/or

supplies a particular product/ commodity. It is fair to say that such a firm

constitutes the entire industry. Also, there is no distinction between the firm and the industry.

No Close Substitutes

Usually, a monopolist sells a product which does not have any close

substitutes. Therefore, the cross elasticity of demand for such a product is

either zero or very small. Also, the price elasticity of demand for the

monopolist’s product is less than one. Hence, in the monopoly market, the

monopolist faces a downward sloping demand curve.

( Exy = 0 : X and Y are independent )

Price Maker (Market Power)

Since there is only one firm selling the product, it becomes the price maker

for the whole industry. The consumers have to accept the price set by the

firm as there are no other sellers or close substitutes.

Create a barrier to entry

Another feature of a monopoly market is restrictions of entry. These

restrictions can be of any form like economical, legal, institutional, artificial, etc. Pros:

Without competition, monopolies can set prices and keep pricing consistent and reliable for consumers.

Monopolies enjoy economies of scale and often are able to produce mass

quantities at lower costs per unit.

Standing alone as a monopoly allows a company to securely invest in

innovation without fear of competition. Cons:

A company that dominates a sector or industry can use its advantage to

create artificial scarcities, fix prices, and provide low-quality products.

Due to limited or unavailable substitutes in the market, consumers have no

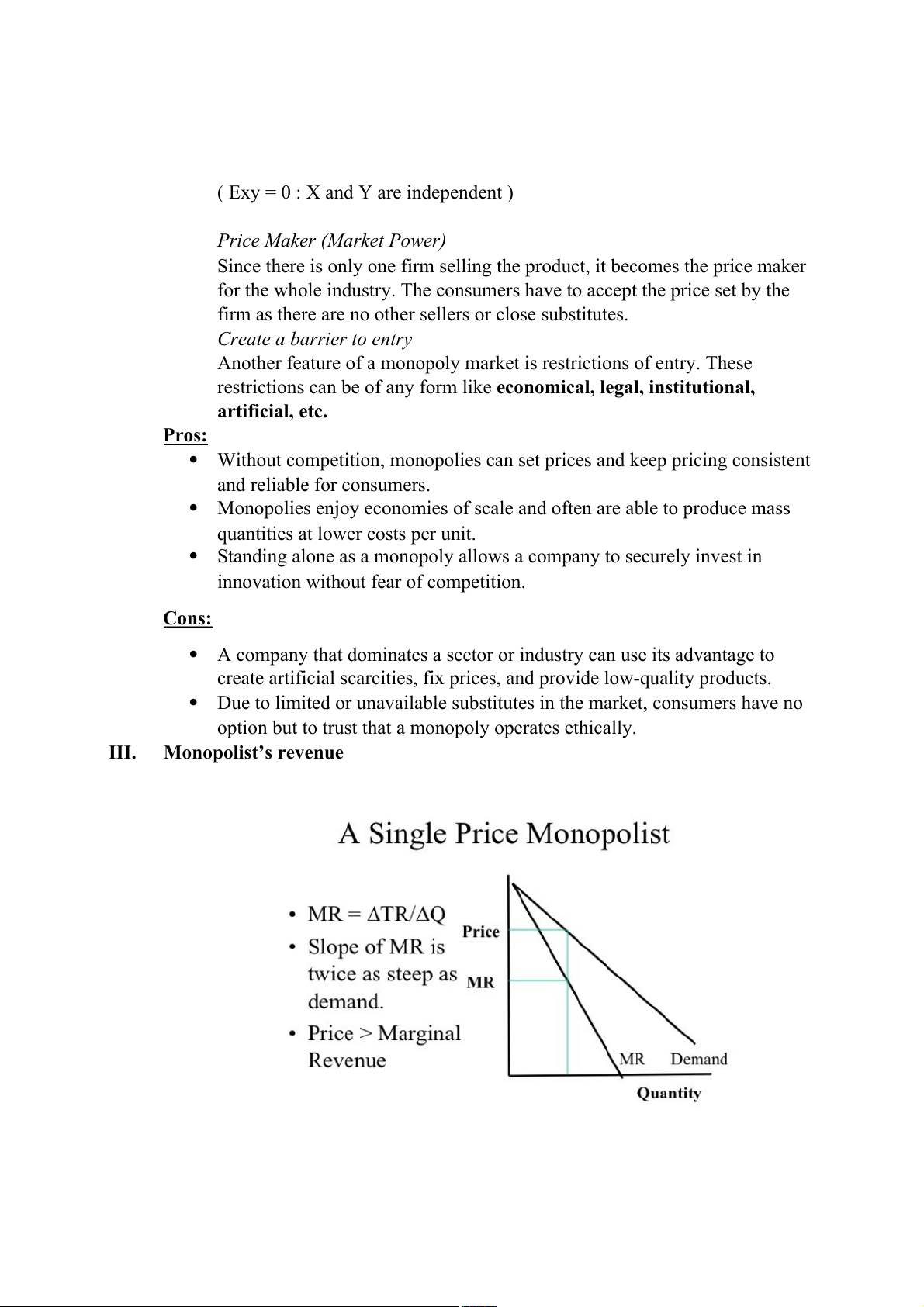

option but to trust that a monopoly operates ethically. III. Monopolist’s revenue -

A monopolist’s marginal revenue is less than the price of its good. (MR

-

The MR curve has the same vertical intercept and TWICE the slope as the demand curve. AR=P = aQ + b (a<0) MR = 2aQ + b IV. Profit Maximization -

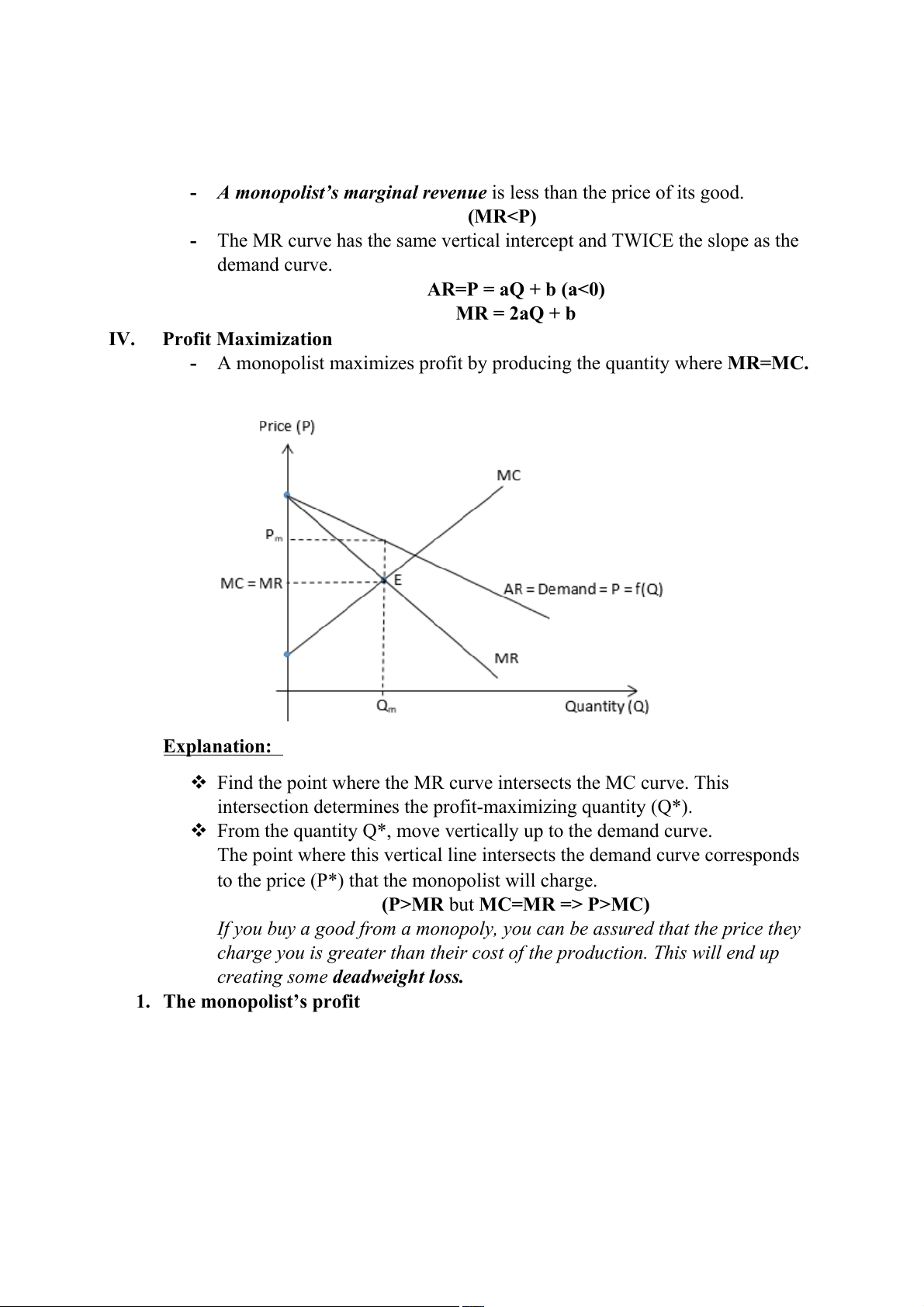

A monopolist maximizes profit by producing the quantity where MR=MC. Explanation:

Find the point where the MR curve intersects the MC curve. This

intersection determines the profit-maximizing quantity (Q*).

From the quantity Q*, move vertically up to the demand curve.

The point where this vertical line intersects the demand curve corresponds

to the price (P*) that the monopolist will charge.

(P>MR but MC=MR => P>MC)

If you buy a good from a monopoly, you can be assured that the price they

charge you is greater than their cost of the production. This will end up

creating some deadweight loss.

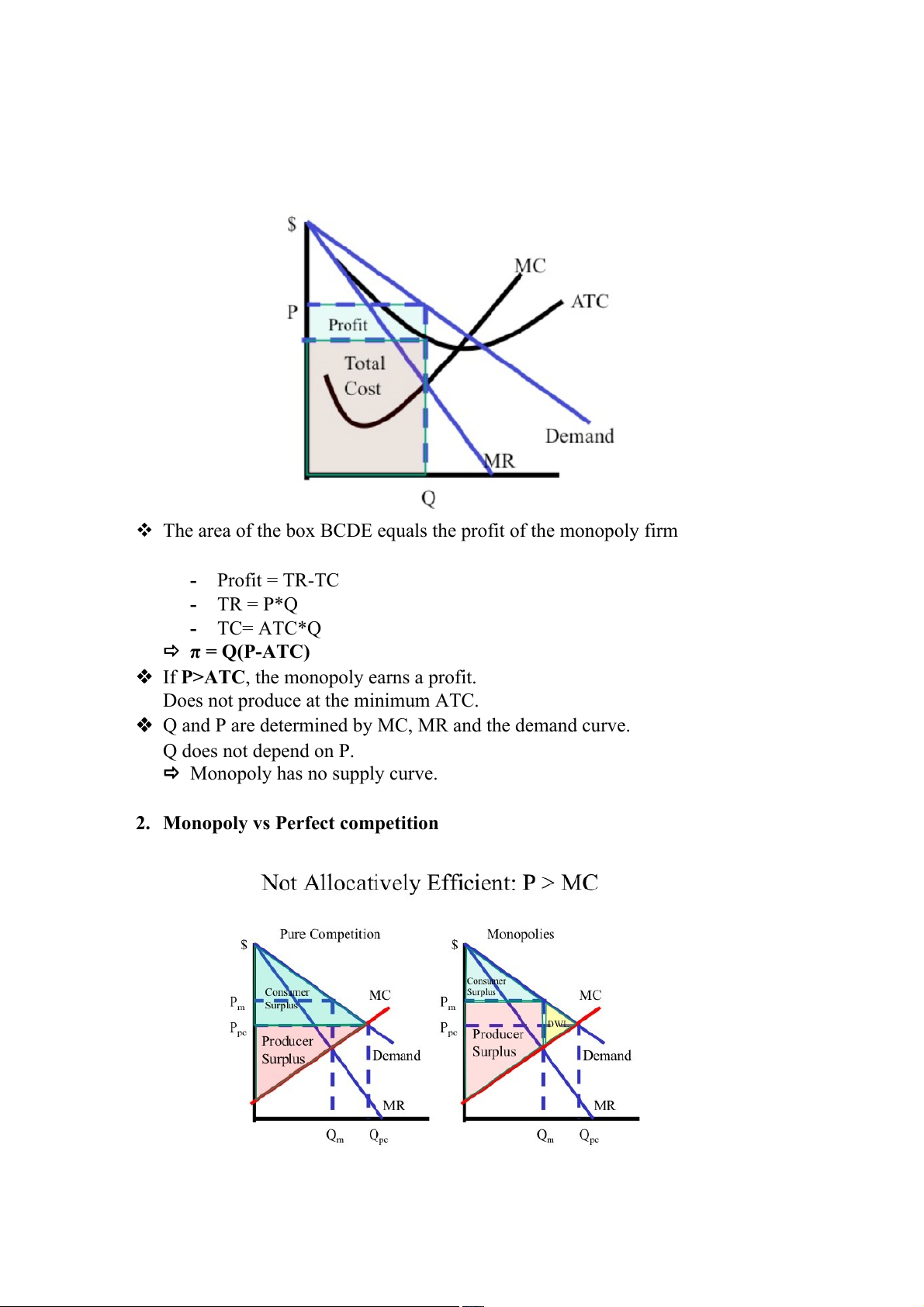

1. The monopolist’s profit

The area of the box BCDE equals the profit of the monopoly firm - Profit = TR-TC - TR = P*Q - TC= ATC*Q π = Q(P-ATC) If

, the monopoly earns a profit. P>ATC

Does not produce at the minimum ATC.

Q and P are determined by MC, MR and the demand curve. Q does not depend on P.

Monopoly has no supply curve.

2. Monopoly vs Perfect competition Explanation:

In pure competition, economic surplus which is consumer plus producer surplus, is

maximized. The industry is allocatively efficient producing where the price is

equal to the marginal cost. By restricting output and raising price, the single price

monopolist captures a portion of the consumer surplus. Since output is restricted, a

portion of both the consumer and producer surplus is lost. This loss of economic

surplus is known as deadweight loss, that neither the consumer nor the producer enjoy. Monopolies: - Higher Price - Lower Quantity -

The goal of monopoly is not to maximize the total surplus

The goal of monopoly is to maximize its profit.

3. Lerner Index and market power