Preview text:

National Economics University …...0O0…...

MICROECONOMICS ASSIGNMENT FINAL GROUP PROJECT COCA-COLA Class: EBBA 14.1 TEAM 3 Phan Thi Mai Anh Nguyen Khanh Linh Tran Huyen Nga Ho Thu Nga Nguyen Ha Phuong Ha Noi - 12/2022 INDEX

INTRODUCTION..............................................................................................3

CONTENT...........................................................................................................4

I. The soft drink indusstry is oligopoly..........................................................4

1. A few large firms dominate the market.....................................................4

2. Firms are interdependent/interrelation.......................................................4

3. Products differentiation.............................................................................5

4. Substantial barriers to entry.......................................................................6

5. Imperfect information................................................................................7

II. Factor that affect demand and suppy over last year................................7

1. Demand......................................................................................................7

1.1. Price....................................................................................................7

1.2. Prices of related goods (complementary/ subtitutes)..........................8

1.3. Hobby, tastes, and preferences...........................................................9

1.4. New slogan.......................................................................................10

1.5. Marketing strategy............................................................................10

1.6. New products....................................................................................11

1.7. The recovery after Covid 19.............................................................11

2. Supply......................................................................................................11

2.1. Technology.......................................................................................11

2.2. Costs of production (Input prices)....................................................12

2.3. Government policies.........................................................................12

2.4. Number of producers........................................................................13

CONCLUSION.................................................................................................14

REFERENCES.................................................................................................15 1 INTRODUCTION

Soft drinks are defined as water-based flavored drinks usually with added

carbon dioxide and with nutritive, nonnutritive, and/or intense sweeteners with

other permitted food additives. They first appeared in 1884. It was believed that

a drugstore owner in Lisbon Falls, America, produced the product under the

brand name Moxie. Soon after, comparable products like Pepsi-Cola and Coco-

Cola debuted. Soft drinks have advanced significantly over the previous

century, going from being a product available only at neighborhood pharmacies

to a $60 billion industry that produces 10 billion ounces annually. This

development is the result of breakthroughs in marketing and manufacturing

technology. In this post-industrial period, soft drinks are one of the important

beverage goods, and in recent decades their sales have been rapidly increasing.

The market for soft drinks is growing day by day due to the focus on health and wellbeing.

The global soft drinks market size was valued at USD 416.19 Billion in

2021 and is expected to expand at a CAGR of 5.2% from 2022 to 2028. Rising

disposal incomes, changing lifestyle, and a growing population is expected to

promote market growth over the next few years. The growing demand for clean-

label, gluten-free, low-calorie, and low-carb products drives the global soft

drinks market. Additionally, rising popularity among the millennials and

increasing investments in R&D in the food and beverage sector are expected to drive the industry demand [2].

Coca-Cola is the most famous and best-selling soft drink in history.

Coca-Cola, or Coke, is a carbonated soft drink manufactured by the Coca-Cola

Company. It was created by John Stith Pemberton in Atlanta, Georgia, in the

late 19th century with the intention of being a patent medicine. In 1888,

Pemberton sold Coca-Cola's ownership rights to Asa Griggs Candler. Coca-

Cola was registered as a trademark in 1893 and began selling in every state of

United States by 1895. in 1906, the business started to spread internationally.

Through Candler's innovative marketing strategies, Coca-Cola went on to

dominate the world market for soft drinks in the 20th and 21st centuries. On the

50th anniversary of Coke, it became the national symbol of America. In 2020,

Coca-Cola ranked as the sixth most valuable brand in the world according to

Interbrand's "best global brand" research. Coca-Cola ranked No. 87 in the 2018

Fortune 500 list of the largest United States corporations by total revenue. 2 CONTENT

I. The soft drink indusstry is oligopoly

1. A few large firms dominate the market

The soda market is a large sector of the economy. There are many

carbonated beverages available in real life, which means that there is

competition. However, in the practice, Pepsi Co. and Coca-Cola Co. domained

the carbonated beverage market for decades. Coca-Cola Company is one of the

most influential beverages and soft drinks corporations with global influence

and the largest market share. So, the soft drink industry becomes oligopoly.

Therefore, a smaller company like F&N in the beverage business has a small

share of sales and cannot be compared to the sales of Coca-Cola and Pepsi.

Due to the factor of economies of scale, the market can be categorized

into six main groups. These are Coca-Cola, PepsiCo, Dr. Pepper, National

Beverage, Cheerwine and others. The respective market shares for 2021 are

46.3%, 25.6%, 21.7%, 0.5%, 0.2%, and 5.6% (M. Ridder 2022). It can be seen

that Coca-Cola takes up almost half of the market share and its main

competitor’s share twice as little.

The carbonated beverage business is an oligopoly market rather than a

monopolistic competition market due to the number of firms in the market, the

tendency for firms to enter the market, and the branding and advertisement effort.

2. Firms are interdependent/interrelation

Definition: Firms always consider rival’s response when they make decisions. 3

The firms in the soft drink industry are mutually interdependent and each

firm is affected by the actions of the competitors. The sales of Coca Cola

Company may end up being affected in case Pepsi changes its product

specification or even the price of the product. The competitors often act by

changing their advertising, specification, and price.

In 2003 Coke-Cola introduced it`s affordable pricing strategy, sharply

lowered its prices to 0.06$. A change in price can result in a significantly larger

change in quantity demanded. An increase in demand can help Coke achieve

large-scale production and consequently reduce average total costs in the long

run due to benefits of economies of scale. Consumers would prefer Coca-Cola

rather than Pepsi because it’s cheaper than Pepsi in this segment. Pepsi - the

main rival of Coca-Cola was obliged to reduce its price to a minimum of 0.097$

to maintain its market share. The longer Pepsi allows Coke to retain a price

advantage over it, the more customers it would lose in the long run. However,

these two businesses found it difficult to run operation at such low prices,

therefore they both abandoned their reduced pricing strategy.

3. Products differentiation

Definition: Product differentiation is the characteristic or characteristics

that make your product or service stand out to your target audience. It’s how

you distinguish what you sell from what your competitors do, and it increases

brand loyalty, sales, and growth.

Coca-Cola Company is in an oligopoly type of market structure because

the firms in this industry produce products that are differentiated. The

competition depends on the way the brand of the firm markets its products

because they have similar taste. How then does Coca-Cola differentiate itself from the Pepsi drinks?

- Coca-Cola Company uses diverse competitive strategies to sustain their

leading position in the industry of soft drink. It is vital for the company to

sustain a brand image that mainly looks more diverse than Pepsi.

- Coke has a raisin-vanilla flavor and high salt nutritional value. The

corporation has been able to distinguish its offers to the various customer

segments through its several brands, such as Lemon Coke, Diet Coca-Cola, Cherry, and Vanilla Coke.

- The special of Coke that makes strong impression is different packaging

used for its different brands. Coca-Cola sets itself apart from Pepsi through its

packaging: the classic Coke with the red color, Diet Coke is black. Coca-Cola

frequently releases new looks for its products of each line.

- In addition to the packaging, Coca-Cola ensures that consumers can get

these different brands in different quantities. The plastic bottles come in sizes of 4

0.5, 1, 1.5, and 2 liters, the cans in 0.25 or 0.33 liters, and the glass bottles in

0.25, 0.5, and 1 liter. It guarantees the recyclable and environmentally friendly

nature of the packing materials. In 2021, Coca-Cola reveiled PlantBottle - the

world’s first fully recyclable PET plastic bottle made from 30% plant-based

material. In this way, Coca-Cola has differentiated its drinks from that of Pepsi

to make sure it better meets the needs of its consumers.

- Most of Coca-Cola’s adverts are keen on emphasizing family,

friendship, happiness. The global brand platform of Coca-Cola is “Real Magic”

which invites everyone to celebrate the real magic of humanity and coveys the

message: Magic exists in unexpected moments of connection that transform the ordinary into the exceptional.

- The two competitors produce products that are almost similar, yet their

practices of marketing have largely managed to generate a high brand loyalty

level for every product. Coca Cola maintains its discrepancy from other soft

drinks by spending more than 20% of its advertisement budget to only differentiate its products.

4. Substantial barriers to entry

It is difficult to enter an oligopoly industry and compete as a small start-

up company. Oligopoly firms are large and benefit from economies of scale. It

takes considerable know-how and capital to compete in this industry

Coca-Cola Company operates in an oligopoly market structure. Its only

real competitor is PepsiCo. Together Coca-Cola and Pepsi’s dominate the

industry and their size in the market create barriers that deter new companies

from trying to compete on the international level. High barriers to entry prevent

smaller firms from making a large impact. This allows the two firms to compete

on areas other than price in an attempt to maximize profit.

Producing soft drinks for a wide market would require a significant

investment in production equipment, brand material, and advertising. The high

cost and captital of operating in this industry prevent many companies from

entering the competitive arena. According to O’Sullivan et al (2008), the

government has intervention in this market, making sure there is no bunch of

firms operating in the oligopoly industry by issuing controllers such as patent and business licenses.

There aren’t many barriers to entry in the soft drink industry, it can be

easy for any firm to begin their company and sell soft drinks to their customers.

However, mostly it can be very hard to be noticeable since there are already

numerous diverse products and brands of soft drinks out there for consumers to

select from. According to Doyle (1990), the per capita beverage rate of

consumption is the highest for Coca-Cola Company consolidated in the world.

Additionally, Coca-Cola Company has the highest number of consumers in the

world and has created a high barrier to entry in soft drink market through its 5

increasing advertising. To be precise, building a brand is the biggest barrier to

entry in the soft drink industry.

Economies of scale is a important element that should be took into account:

- Focusing on economies of scale, which basically refers to the manner an

organization can focus on the reduction of the average per unit cost of its

services or goods by basically increasing the production scale for a single type

of product. For Coca-Cola, economics of scale are mostly at work when the

corporation lowers the manufacturing or production cost by increasing its level of output.

- Coca-Cola is considered a billion-dollar brand in 19 countries. It also

owns 16 other billion-dollar brands and 20 more sparkling and still brands,

which each produce around $500 million-$1 billion in revenue annually. The

company has the leadership position in the American soda industry, with a

46.3% market share. PepsiCo ranks second, accounting for 25.6% of the soda market.

- Furthermore, Coca-Cola has a strong global distribution system in 200

countries, possessing more vehicles than both UPS and FedEx combined. Thus,

Coca-Cola has a huge moat with great economies of scale that no competitors

could easily copy or beat. That provides an extremely strong foundation for the business future growth.

5. Imperfect information

Definition: Imperfect information occurs when the economic agents lack

information about a good or any other information relevant to the transaction. In

this case, for example, the consumers may have partial information about the

product quality, which would make it difficult to make a rational choice upon purchase.

Until 2019, Coca-Cola did not mention its sugar content publicly.

Because the consumers were unaware of the high sugar content and the possible

risks associated with the product, they consumed it disproportionately. This

over-consumption has made the public overweight, which puts a significant

strain on the healthcare system and the Government brought in the Sugar

Sweetened Drinks Tax (SSDT) in 2018 6

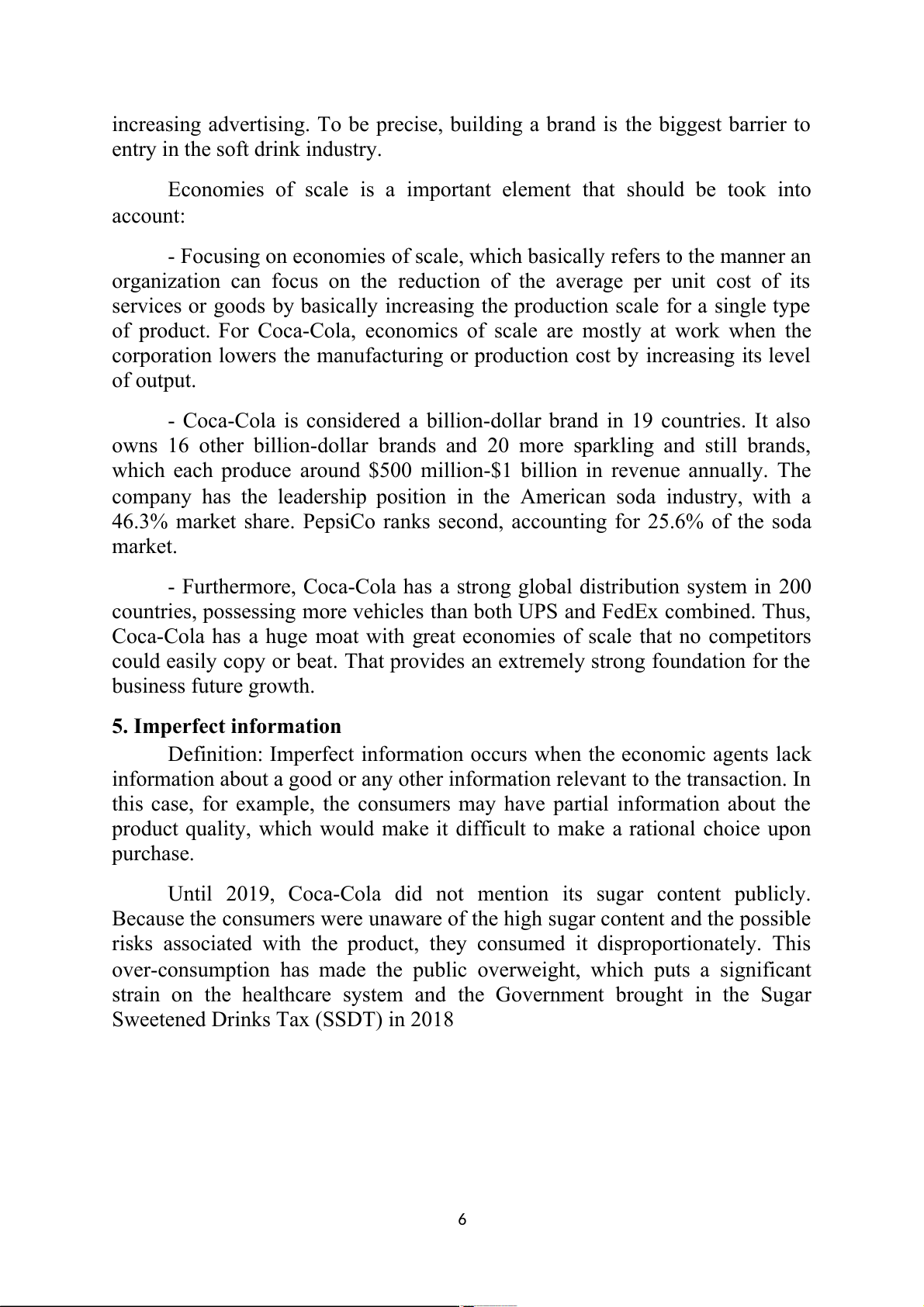

II. Factor that affect demand and suppy over last year 1. Demand 1.1. Price

The price of Coca-Cola in USA is 0.76$ (while in VietNam is 0.38$). The

average price for 92 countries is 0.94$. Recently, Coca-Cola has raised its price

by 12% mainly due to food inflation. Despite the increase in price of Coke and

global recession, the demand for Coca-Cola doesn’t change much. The

company's second quarter data showed that net revenue increased 12% to reach

$11.3 billion, exceeding analyst estimates. However, Coca-Cola executives

warned that there are already signs of inflation and an economic recesssion

having a bad impact on consumer buying power, particularly Europe.

A consumer is more likely to buy larger quantities of Coca-Cola if the

price is lower. Thus, that price plays a significant role in determining demand.

1.2. Prices of related goods (complementary/ subtitutes)

- Subtitutes: The biggest substitute good is Pepsi. Coca cola’s price is

higher than Pepsi ($0.04). However, thanks to good quality and special flavor,

Coca is still trusted by a large number of consumers. Coke knows people are

willing to pay a little more to get its products. However, during the Covid 19,

Coca-Cola’s price has rised, consumers want to put aside as much as possible,

so they tend to choose cheaper products from small or private brands instead of Coca-Cola.

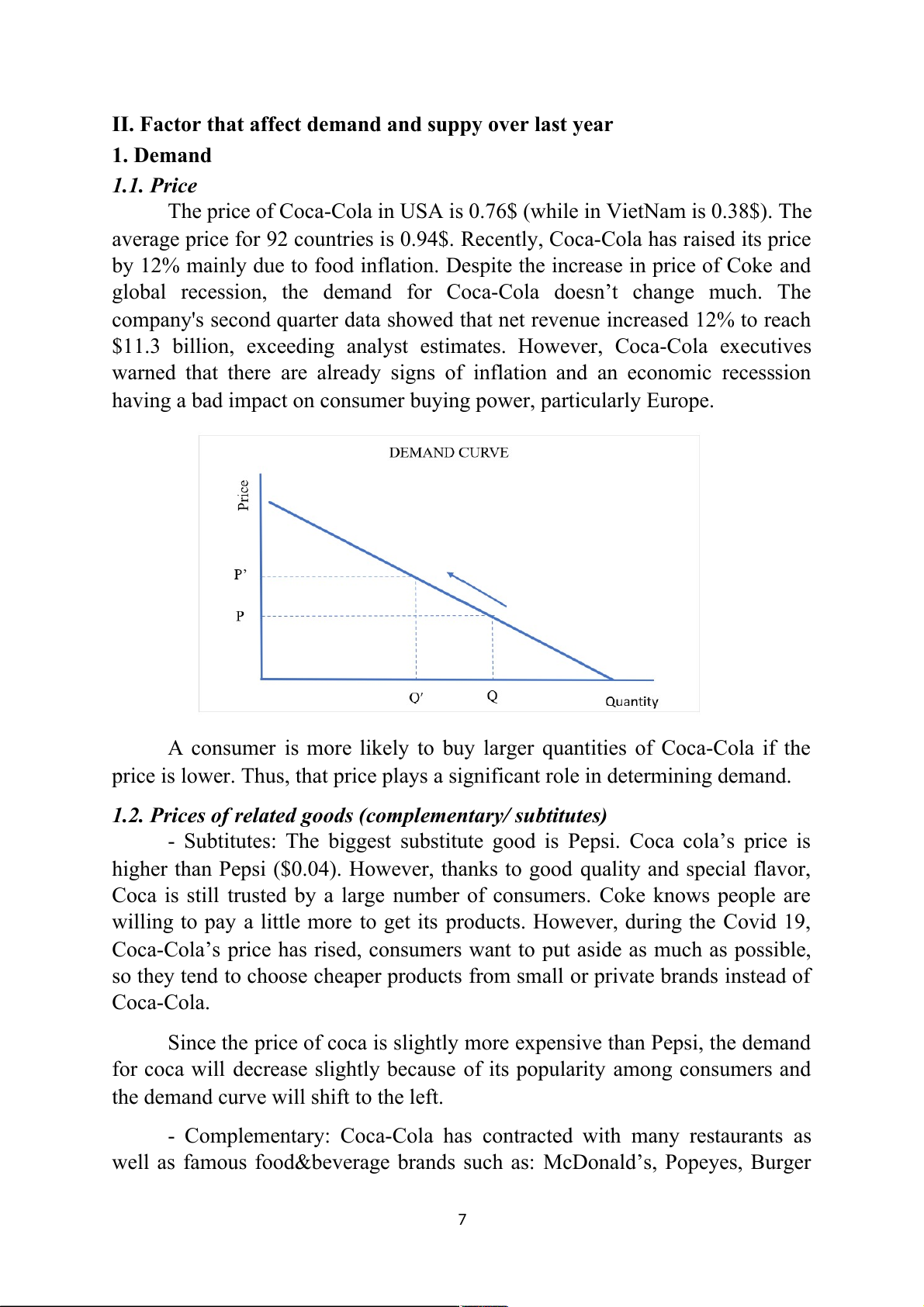

Since the price of coca is slightly more expensive than Pepsi, the demand

for coca will decrease slightly because of its popularity among consumers and

the demand curve will shift to the left.

- Complementary: Coca-Cola has contracted with many restaurants as

well as famous food&beverage brands such as: McDonald’s, Popeyes, Burger 7

King, Domino's Pizza, Dunkin’s Donut... So, the demand for coco cola would

decline if the cost of complementary products (Mc Donald’s, Burger King,

KFC...) rises. This shifts the demand curve to the left.

- The number of consumers: 1.9 billion Coca-Cola products will be sold around

the world each day. Coca-Cola operates in more than 200 countries around the

world and has traditionally—like many global corporations—operated with a

complex network of marketing and advertising partners throughout its

worldwide business (J. Beer 2022). Due to the impact of the covid epidemic in

recent years, the number of consumers is also lower than before the epidemic,

causing the demand curve to shift to the left.

Demand curve when shifting to the left (demand decreases) The Coca-Cola Company’s operational structure is composed of four geographic operating segments: Europe,

Middle East & Africa; Latin America; North America; and Asia Pacific

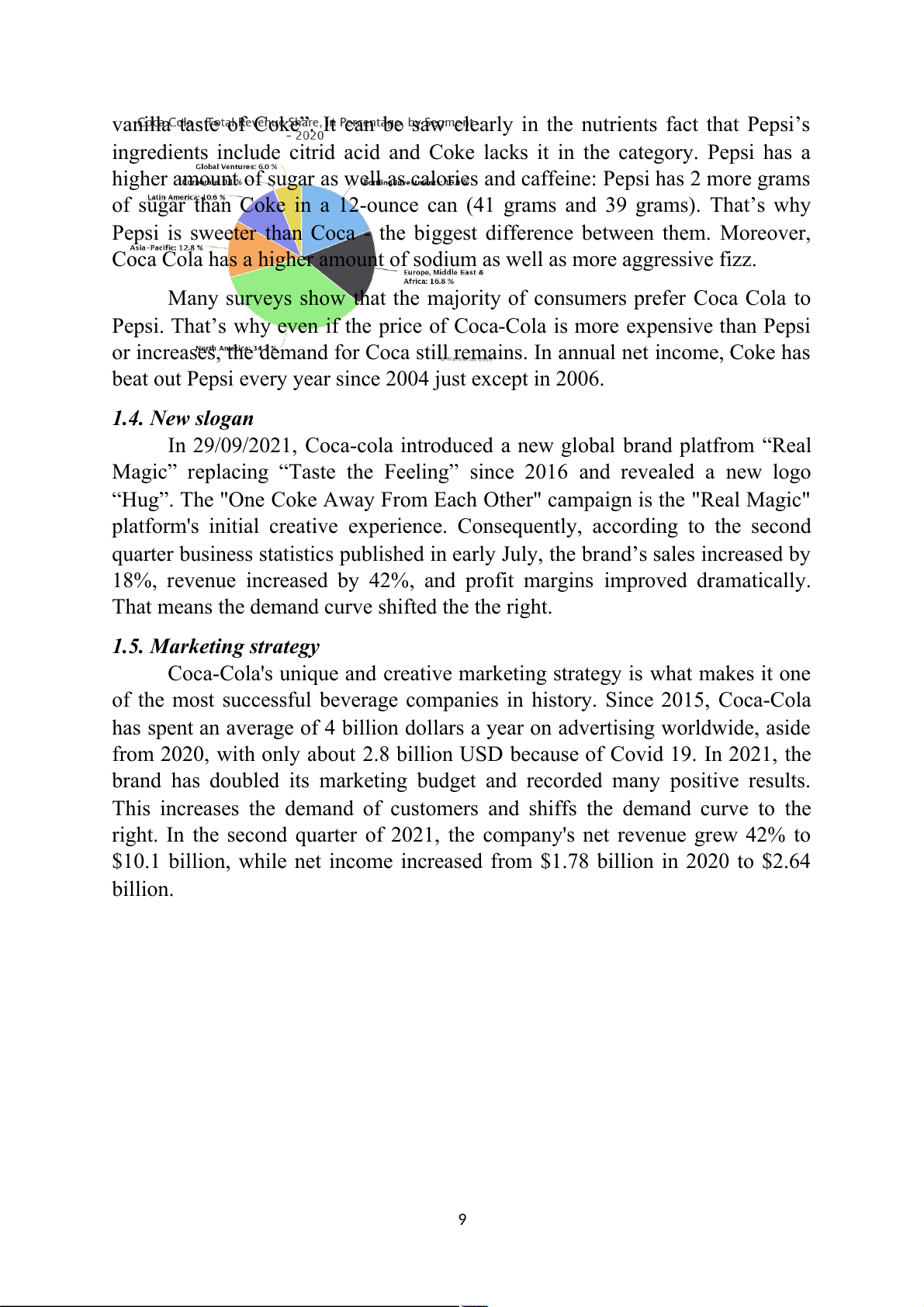

1.3. Hobby, tastes, and preferences

The most longlasting and biggest rival of Coca-Cola is Pepsi.They have

some difference of flavor if sipping slowly. According to Business Insider,

author Malcolm Gladwell notably summarized the differentiations in his book

"Blink," stating that Pepsi has a "citrusy flavor burst, unlike the more raisiny- 8

vanilla taste of Coke”. It can be saw clearly in the nutrients fact that Pepsi’s

ingredients include citrid acid and Coke lacks it in the category. Pepsi has a

higher amount of sugar as well as calories and caffeine: Pepsi has 2 more grams

of sugar than Coke in a 12-ounce can (41 grams and 39 grams). That’s why

Pepsi is sweeter than Coca - the biggest difference between them. Moreover,

Coca Cola has a higher amount of sodium as well as more aggressive fizz.

Many surveys show that the majority of consumers prefer Coca Cola to

Pepsi. That’s why even if the price of Coca-Cola is more expensive than Pepsi

or increases, the demand for Coca still remains. In annual net income, Coke has

beat out Pepsi every year since 2004 just except in 2006. 1.4. New slogan

In 29/09/2021, Coca-cola introduced a new global brand platfrom “Real

Magic” replacing “Taste the Feeling” since 2016 and revealed a new logo

“Hug”. The "One Coke Away From Each Other" campaign is the "Real Magic"

platform's initial creative experience. Consequently, according to the second

quarter business statistics published in early July, the brand’s sales increased by

18%, revenue increased by 42%, and profit margins improved dramatically.

That means the demand curve shifted the the right.

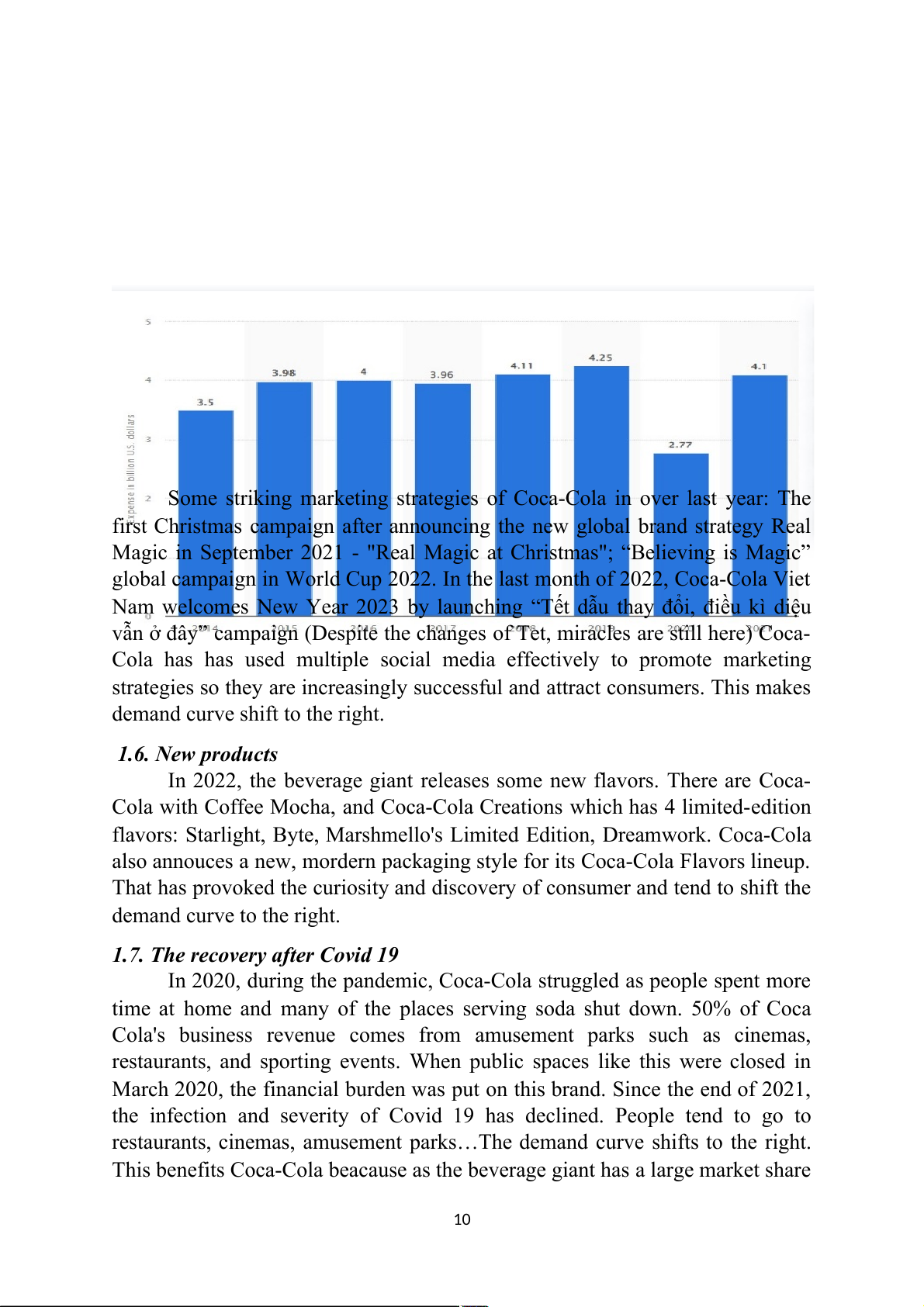

1.5. Marketing strategy

Coca-Cola's unique and creative marketing strategy is what makes it one

of the most successful beverage companies in history. Since 2015, Coca-Cola

has spent an average of 4 billion dollars a year on advertising worldwide, aside

from 2020, with only about 2.8 billion USD because of Covid 19. In 2021, the

brand has doubled its marketing budget and recorded many positive results.

This increases the demand of customers and shiffs the demand curve to the

right. In the second quarter of 2021, the company's net revenue grew 42% to

$10.1 billion, while net income increased from $1.78 billion in 2020 to $2.64 billion. 9

Some striking marketing strategies of Coca-Cola in over last year: The

first Christmas campaign after announcing the new global brand strategy Real

Magic in September 2021 - "Real Magic at Christmas"; “Believing is Magic”

global campaign in World Cup 2022. In the last month of 2022, Coca-Cola Viet

Nam welcomes New Year 2023 by launching “Tết dẫu thay đổi, điều kì diệu

vẫn ở đây” campaign (Despite the changes of Tet, miracles are still here) Coca-

Cola has has used multiple social media effectively to promote marketing

strategies so they are increasingly successful and attract consumers. This makes

demand curve shift to the right.

1.6. New products

In 2022, the beverage giant releases some new flavors. There are Coca-

Cola with Coffee Mocha, and Coca-Cola Creations which has 4 limited-edition

flavors: Starlight, Byte, Marshmello's Limited Edition, Dreamwork. Coca-Cola

also annouces a new, mordern packaging style for its Coca-Cola Flavors lineup.

That has provoked the curiosity and discovery of consumer and tend to shift the demand curve to the right.

1.7. The recovery after Covid 19

In 2020, during the pandemic, Coca-Cola struggled as people spent more

time at home and many of the places serving soda shut down. 50% of Coca

Cola's business revenue comes from amusement parks such as cinemas,

restaurants, and sporting events. When public spaces like this were closed in

March 2020, the financial burden was put on this brand. Since the end of 2021,

the infection and severity of Covid 19 has declined. People tend to go to

restaurants, cinemas, amusement parks…The demand curve shifts to the right.

This benefits Coca-Cola beacause as the beverage giant has a large market share 10

in external consumption channels and Coca-Cola’s price at outside locations is

higher than at grocery stores where sell Coke for home consumption. For the

full year of 2021, the company's revenue grew 17% to $38.7 billion while EPS grew 26% to $2.25. 2. Supply 2.1. Technology

Coca-Cola is making investments in advanced technology, modernizing

and digitizing many of its supply chain procedures. Coca-Cola utilizes new and

different technologies and processes that will optimize its infrastructure and turn

its current facilities into productive mega-plants that can efficiently supply an

entire nation or area. To promote product innovation, Coca-Cola also updated

its production lines. For instance, Coca-Cola invested in a new premium glass

packaging line for FUZETEA in the Czech Republic and Romania and for

Coca-Cola Energy in Hungary. Coca-Cola recently made investments in

additional production capabilities for various package sizes in Italy. At our

Nogara facility, we provided an aseptic PET line and new TriBlock technology

to a PET line at Marcianise plant. Moreover, Coca-Cola proceeded to invest in

automation for its high-capacity warehouses. There will be a rightward shift in supply curve. 11

Supply curve shifts to the right (supply increases)

2.2. Costs of production (Input prices)

For Coca-Cola, the costs of production include raw materials,

transportation and delivery and packaging. Because of the economic recession

and inflation, the input prices have increased. This led to the increase in price of

Coca-cola and a slightly decrease in supply. Coca-Cola has moved to produce

big size products which makes it receive less profit.

2.3. Government policies

Government policies, such as taxes, restrictions, and subsidies, can have

an impact on the cost of manufacturing. For example, in May 2018, the

Government introduced the Sugar Sweetened Drinks Tax (SSDT). Since the tax

rate on Coca-Cola Original Taste was so high, they passed the whole tax on to

retailers, as the government had expected producers to do. This was

accomplished on certain packs by combining decreased pack sizes and higher

costs. As a result of the tax, Coca-Cola had to exchange 1.75L bottle with a

1.5L one and they have decided to raise the capacity of the 1.75L Coca-Cola

Zero Sugar and Diet Coke bottles to 2L, making zero sugar alternatives even

more affordable [13]. For the year ended September 30, 2022, Coca-Cola paid

$2.181 billion in income taxes, a 27.25% decrease from the previous year. The 12

company must deal with harsh taxation policies in some countries to set up its

branches. The government policies in many countries have significantly come

up with policies for price control. The companies must control their prices

according to the country’s policies [14]. It seems that policies of

government have minimal impact on the supply of Coca. The supply curve may shift to the left.

Supply curve shifts to the left (Supply decreases)

2.4. Number of producers

There are thousands of soft drink brands all over the world (There are 376

soda production businesses in the USA in 2022) but Coca-Cola is one of two

powerhouses controlling the soft drink industry. Since 2004, Coca-Cola

Company has been the market leader. Despite a 13% drop in brand value in

2021, Coca-Cola maintained its position as the most valuable soft drink brand in

the world with $33.2 billion, according to Brand Finance. Nearly 60% of all

non-alcoholic beverage production in the world is under the control of Coca-

Cola and Pepsi (Maverick, 2022). In 2021, about 46% of the market is dominated by Coca-Cola [3]. 13 CONCLUSION

The soft drink industry is oligopoly which is closer to monopoly than

pure comeptition. It has features of oligopoly market: a few big bussiness

control the market, interdependent firms, the difference of products, quite high

barriers to enter or exit, imperfect information. Coca-Cola is the top brand in this market.

With all these factors above, in 2022 Coca-Cola’s financial report has

gone beyond expectations and raised growth forecast despite global recession.

Coca-Cola's revenue for the year ended September 30, 2022, was $42.343

billion, up 12.01% from the previous year [15]. According to the report of

Coca-Cola’s third-quarter 2022 results: Net revenues increased by 10% to $11.1

billion, and organic revenues (non-GAAP) increased by 16%; Operating Income

increased by 7%, Comparable Currency Neutral Operating Income (Non-

GAAP) grew 18%; Operating Margin was 27.9% compared to 28.9% the year

before, while comparable operating margin (non-GAAP) was 29.5% compared

to 30.0%; EPS rised by 14% to $0.65 while comparable EPS (non-GAAP)

increased by 7% to $0.69. Reuters reports that Coca-third-quarter Cola's

revenue and earnings above expectations, which led to a 2.3% increase in the

company's stock price. The company expects net sales to increase 14–15% in

2022, which is 2% more than its earlier prediction of 12–13%. Coca-Cola

increased its prior prediction for full-year earnings per share growth from 5-6%

to 6-7%. In 2022, Coca-Cola’s brand is valued at 97.9 billion U.S. dollars.

Moreover, following the Brand Finance Food & Drink 2022, Coca-Cola

dominates the non-alcoholic beverage industry with a global market value of

US$35.4 billion; Coca-Cola also has an outstanding AAA+ rating, making it the

most powerful non-alcoholic beverage brand. In general, Coca-Cola is the top

brand in the soft drink industry with 46.3% market shares. 14 REFERENCES

1. L.J. Mohan Rao, K. Ramalakshmi (2011), Recent Trends in Soft Beverages

[2]. Soft Drinks Market Size, Share & Trends Analysis Report By Product,

https://www.grandviewresearch.com/industry-analysis/soft-drinks-market- report

3. M. Ridder (2022), Leading carbonated soft drink (CSD) companies in the

United States in 2021, based on volume share

4. Coca Cola market structure Analytical Essay (2021)

5. D. Saxena (2018), Product Differentiation is the Secret Ingredient (Pepsi vs.

Coca-Cola), https://www.superheuristics.com/product-differentiation-pepsi-vs- coca-cola/

6. Level Strategic Pricing Between Coca Cola Company and PepsiCo. Journal

of Economics & Management Strategy, 905-931

7. Doyle, P. (1990), Building successful brands: the strategic options. Journal of consumer Marketing, 5-20

8. UKEssays (2018), The Competitive Strategies Of Coca Cola Economics

Essay, https://www.ukessays.com/essays/economics/the-competitive-strategies-

of-coca-cola-economics-essay.php?vref=1

9. K. Martin (2022), Why Coca-Cola Is Planning To Keep Raising Its Prices,

https://www.tastingtable.com/943054/why-coca-cola-is-planning-to-keep- raising-its-prices/

10. J. Beer (2022), Coca-Cola has an ambitious plan to double its number of

customers in the next few years

11. M. Ridder (2022), Coca-Cola Company's advertising expense from 2014 to 2021,

12. Supply Chain Overview, https://www.coca-colahellenic.com/en/about-us/ what-we-do/supply-chain [13]. The Sugar Tax,

https://www.coca-cola.co.uk/ingredients/reducing-sugar/lets-talk-about-soft- drinks-tax

[14]. Flood P. (2000), Managing Strategy Implementation, an Organizational Behavior Perspective 15

14. J. Gelski (2021), Food Business News, State of the Beverage Industry

15. CocaCola Revenue 2010-2022, Macrotrends

16. J.B. Maverick, Coke vs. Pepsi: Who Controls the Market Share?

https://www.investopedia.com/ask/answers/060415/how-much-global-beverage

-industry-controlled-coca-cola-and-pepsi.asp#citation-1

17. Coca-Cola Reports Third Quarter 2022 Results and Raises Full-Year

Guidance, https://investors.coca-colacompany.com/news-events/press-releases/

detail/1071/coca-cola-reports-third-quarter-2022-results-and-raises 18. Brand Finance Food & Drink 2022,

https://brandirectory.com/rankings/food/ 16