Preview text:

lOMoAR cPSD| 46831624 CHAPTER 9

1. Link ôn tập câu trắc nghiệm + câu hỏi úng sai:

http://highered.mheducation.com/sites/0072396881/student_view0/chapter9/tootsie_roll_ exercises.html

MỘT SỐ KHÁI NIỆM CẦN NHỚ:

- Tangible plant assets: Tài sản hữu hình (có hình thái vật lý), ví dụ: land ( ất ai), building

(nhà cửa), machine (máy móc). Trong ó:

o Land ko tính khấu hao (depreciation) do ko có thời gian sử dụng hữu ích

(useful life) o Các tài sản còn lại -> tính khấu hao (phân bổ chi phí mua tài sản

vào quá trình sử dụng tài sản)

- Intangible assets: Tài sản vô hình (ko có hình thái vật lý), ví dụ: patents (bằng sáng

chế), copyrights (bản quyền), trademarks (thương hiệu), franchises (nhượng quyền),

goodwill (lợi thế thương mại)

- Natural resources: ví dụ: oil (dầu mỏ), timber (gỗ), minerals (khoáng sản)

DẠNG BÀI 1: Xác ịnh nguyên giá khi mua TS (Acquisitions of Plant Assets) Ví dụ: Problem 9.1A

Nguyên giá (Cost) = Mọi khoản phù hợp và cần thiết ể ưa TS về vị trí mong muốn và trạng

thái sẵn sàng sử dụng.

Ví dụ: Mua 1 machine -> Chi phí cần tính vào cost gồm: giá mua + thuế (sale tax)+ phí

vận chuyển + Phí lắp ặt

CHÚ Ý: Chi phí sửa chữa và bảo dưỡng ịnh kì (repair and maintenance), chi phí ào tạo

nhân viên (training fee), chi phí sữa chữa 1 số sp hỏng trong quá trình lắp ặt … -> ko tính

vào COST mà tính vào chi phí trong kì ó

LAND -> khi tính COST cho land thì phân biệt : LAND (khi mua) và LAND IMPROVEMENTS

COST of LAND = giá mua + 1 số chi phí : commissions to real estate brokers, escrow fees,

legal fees for examining and insuring the title, delinquent taxes paid by the purchaser, and

fees for surveying, draining, clearing, and grading the property

LAND thì ko cần tính khấu hao

LAND IMPROVEMENTS = driveways, fences, parking lots, landscaping, and sprinkler systems lOMoAR cPSD| 46831624

-> Phần improvement này có thời gian sử dụng hữu ích -> cần tính khấu hao

Buildings, equipments: chi phí phát sinh sau khi tài sản ã i vào sử dụng -> ko tính vào

COST mà tính vào chi phí trong kì

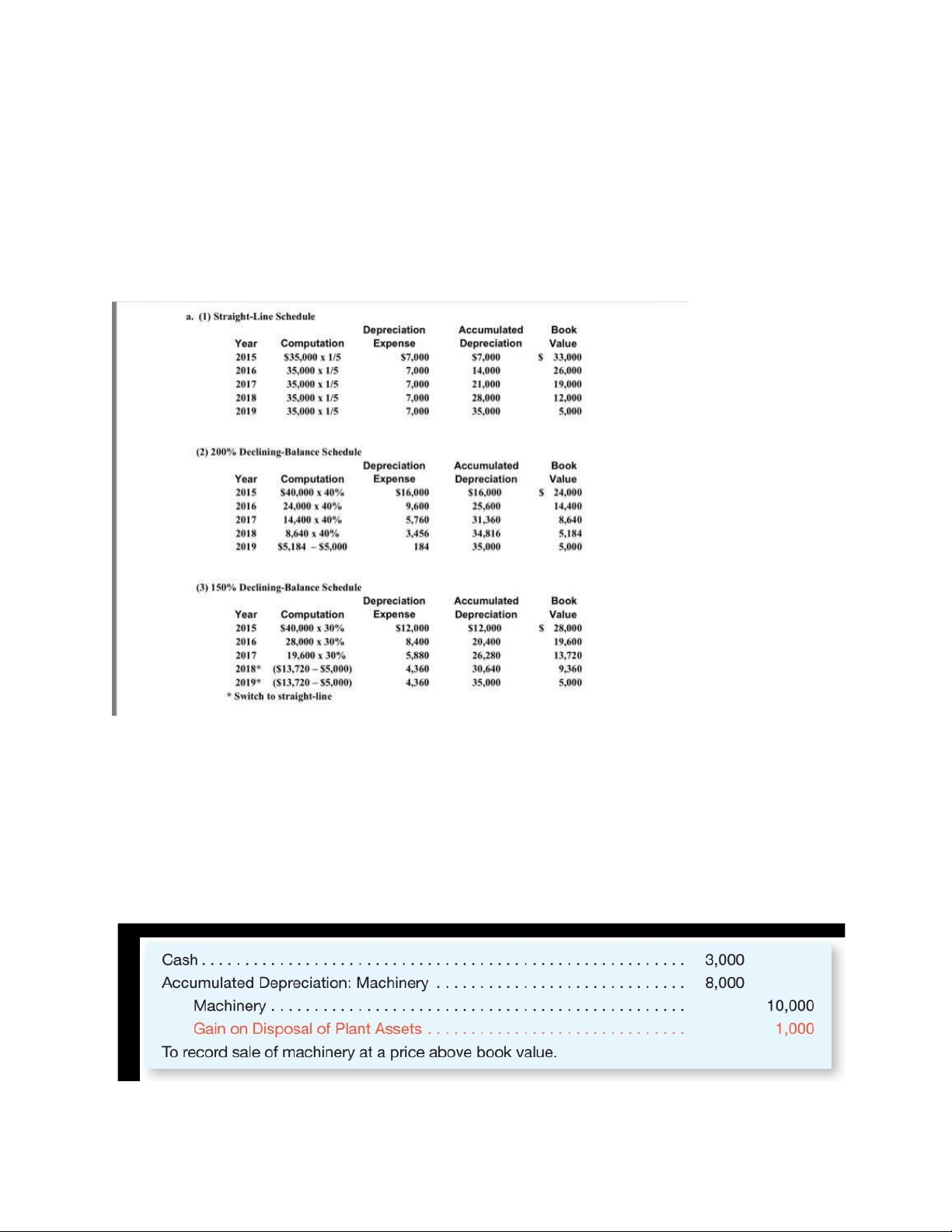

DẠNG BÀI 2: Tính khấu hao Ví dụ bài E.9.4

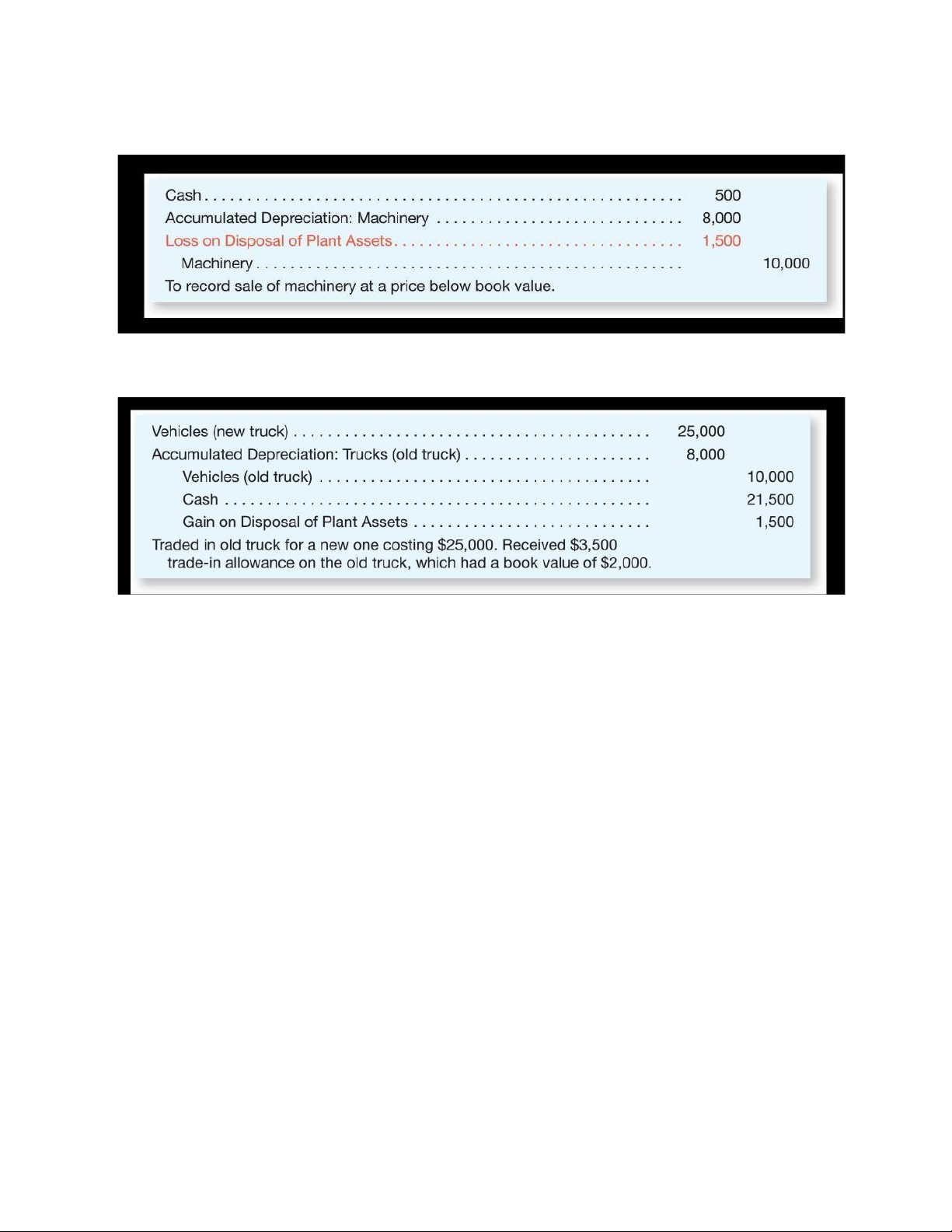

DẠNG BÀI 3: BÁN THANH LÝ TÀI SẢN Ví

dụ bài Problem 9.4A, Problem 9.8A

Sau 1 thời gian sử dụng, doanh nghiệp có thể thanh lý tài sản vì nhiều lý do khác nhau, có thể

ngay khi chưa hết thời gian sử dụng (useful life). Khi muốn ánh giá, 1 giao dịch thanh lý tài sản

cố ịnh là lãi hay lỗ (Gain or loss on Disposal), chúng ta sẽ so sánh giá bán với giá trị còn lại của

tài sản cố ịnh. Ngoài ra còn phải xóa số nguyên giá và khấu hao lũy kế của tài sản cố ịnh.

Đối với lãi do thanh lý, ta ịnh khoản như sau: lOMoAR cPSD| 46831624

Đối với lỗ do thanh lý, ta có ịnh khoản sau:

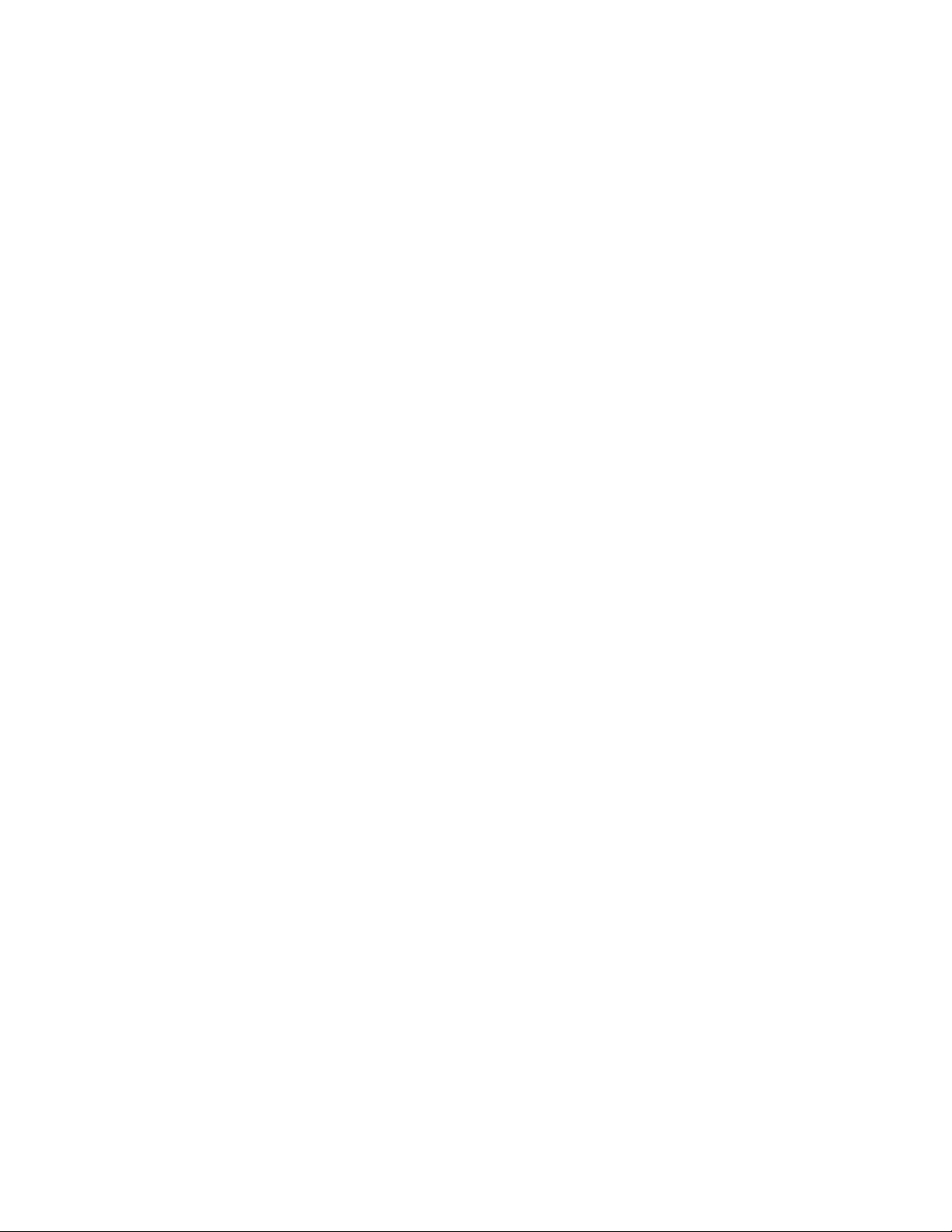

Đổi TS cũ lấy mới: MCQS

1. Each of the following should be classified as plant and equipment in the balance sheet of Chin's Nursery except: A. The office building

B. Patents held on specific varieties of roses

C. Land on which the nursery is located

D. Plants held for resale to customers

2. An example of an error in distinguishing between revenue expenditures and capital expenditures is:

A. Failure to consider residual salvage value in estimating depreciation

B. Inclusion in the Building account of payments for property taxes

C. Inclusion in the Delivery Truck account of state sales taxes paid on the purchase of a truck

D. Inclusion in Utilities Expense of the cost of electrical repairs made on the air- conditioning lOMoAR cPSD| 46831624

3. Carter Co. and Greer Corp. purchased identical plant assets, and both companies

estimated the useful life at 10 years with no salvage value. Carter uses straight-line

depreciation in its financial statements, whereas Greer uses an accelerated method. A. Over

the life of the asset, Greer will recognize more depreciation expense than Carter B. In the

tenth year of ownership, Carter will recognize more depreciation expense on this asset than Greer

C. If the asset is sold after 4 years, Carter is more likely to report a gain than is Greer

D. In its income tax return, only Greer may depreciate this asset by the MACRS method

4. The journal entry to record the sale or disposition of a depreciable plant asset always includes: A. Recognition of a gain

B. A debit to the Accumulated Depreciation account for the related accumulated depreciation C. Recognition of a loss

D. A debit to the asset account for the book value of the asset

5. For financial statement purposes, Adel Corporation was depreciating a truck by the

straight-line method over five years. For income tax purposes, the truck was being

depreciated by an accelerated method over a life of only three years. After two years, the

truck was sold at a price above its book value for financial statement purposes. Adel

Corporation should report this sale as:

A. A gain in its income statement and an even larger gain in its income tax return

B. A gain in its income statement, but as a smaller gain in its income tax return

C. A gain in its income statement, but as a loss in its income tax return

D. A gain of the same dollar amount in both its income statement and its income tax return

6. Which item among the following is not an intangible asset? A. A trademark B. An account receivable C. A patent D. Goodwill

7. Land with a price of $60,000 is acquired for future use. Accrued taxes of $1,500 on the

parcel were paid to clear the title. Legal fees to complete the purchase total $2,500. A small

building on the parcel will not be used and is demolished at a net cost of $4,000. What will be the cost of the land? A. $64,000 B. $68,000 C. $65,000 lOMoAR cPSD| 46831624 D. $67,000

Total cost of the land would include the purchase price, accrued taxes, legal fees, and the

net cost of removing the building that will not be used. $60,000 + $1,500 + $2,500 + $4,000 = $68,000.

8. A one-time fee paid to the water company to bring water across adjoining land to the

corner of a parcel owned by the business should be charged to which account? A. Building account B. Land account C. Utility Expense account D. Land Improvements account

This one-time fee increases the value of the land to the owner as well as to any future buyer.

The improvements are not on the property, are not owned by the business and will not be maintained by the business.

9. A machine is purchased for $5,000 plus additional freight costs of $500. Major

modifications and installation costs will be $1,200. What is the amount of the cost basis for this asset? A. $5,000 B. $6,700 C. $6,200 D. $5,500

The cost of the machine includes the purchase price, freight costs to have the machine

delivered, and all costs of modification and installation. $5,000 + $500 + $1,200 = $6,700.

10. Small repairs made to keep a truck running over its useful life have been debited to the

Vehicles account. As a result of this, which of the following occurred?

A. The balance in the Vehicles account was correctly stated

B. The balance in the Vehicles account was overstated

C. The expenses for the period were overstated

D. The net income for the period was understated

Normal repairs that do not change the useful life of the asset, but are needed to maintain its

running condition, should be charged to an expense account. This error would cause the

Vehicles account to be overstated, expenses understated, and net income overstated.

11. A business acquired land and two buildings for a single, lump-sum purchase price of

$240,000. The land was assessed for tax purposes at $50,000 and the buildings at $30,000 lOMoAR cPSD| 46831624

and $20,000, respectively, for a total assessed value of $100,000. Which of the following

is the recorded cost of the land? A. $50,000 B. $120,000 C. $60,000 D. $190,000

Since the land is 1/2 of the total assessed value, it is allocated 1/2 of the purchase price ($240,000 X 1/2).

12. A material expenditure that will benefit only the current period is called which of the following? A. Capital expenditure B. Liability C. Revenue expenditure D. Tax expenditure

A material expenditure that will benefit several accounting periods is called a capital

expenditure. An expenditure that will benefit only the current period is called a revenue

expenditure and should be debited to an appropriate expense account.

13. An asset having a four-year service life and a salvage value of $5,000 was acquired for

$45,000 cash on January 2. What will be the depreciation expense for the second year ending December 31?

A. $5,000, using the straight-line method

B. $11,250, using the double-declining-balance method

C. $14,000, using the units-of-output method

D. $11,250, using the straight-line method

Under declining-balance, salvage value is ignored in the calculation. Depreciation for year

one would be $22,500 (45,000 X 50%) and $11,250 (($45,000 - $22,500) X 50%) for year two.

14. An asset having a four-year service life and a salvage value of $5,000 was acquired for

$45,000 cash on June 28. What will be the depreciation expense at the end of the first year, December 31?

A. $10,000, under the straight-line method

B. $22,500, under the double-declining-balance method

C. $7,000, under the straight-line method

D. $11,250, under the double-declining-balance method lOMoAR cPSD| 46831624

A fractional adjustment must be made for the six months of asset use (July through

December). Under the double-declining-balance method the depreciation will be $11,250 ($45,000 X 50% X 1/2).

15. Production equipment that cost $20,000, with a salvage value of $5,000 and an

estimated service life of five years, was purchased on the 10th day of the first month of the

fiscal year. What will be the depreciation expense for the second year using the double- declining-balance method? A. $8,000 B. $3,600 C. $4,400 D. $4,800

At the end of the second year, prior to depreciation, the book value of the asset is $12,000

($20,000 - ($20,000 X 40%)). The depreciation for the second year would be $4,800 ($12,000 X 40%).

16. An asset being depreciated on a straight-line basis has a current book value of $10,000,

a remaining useful life of two years, and no salvage value. New information indicates a

useful life of four years and no change in salvage value. What should be the amount of

depreciation expense for each of the next four years? A. $5,000 B. $7,500 C. $2,000 D. $2,500

The change in the estimated useful life requires that the carrying value (book value) of the

asset be allocated over the remaining useful life (4 years) of the asset ($10,000 / 4 = $2,500).

17. On June 28, 2001, a business sold for $1,500 a plant asset that cost $5,000. The asset

had a 5-year service life, no salvage value, and had been used by the business since January

1, 1998. Straight-line depreciation was used. The fiscal year ends on December 31. What

will be the result of selling the plant asset?

A. A $500 gain on the disposal of a plant asset.

B. A $1,000 gain on the disposal of a plant asset.

C. A $500 loss on the disposal of a plant asset.

D. No gain or loss on the disposal of the plant asset.

The annual depreciation was $1,000 ($5,000 / 5). The book value on June 28 was $1,500

($5,000 - ($1,000 X 3) - ($1,000 X 1/2)). The sales price was equal to the book value; there was no gain or loss. lOMoAR cPSD| 46831624

18. On January 1, a business exchanged a plant asset with a book value of $1,500 for a

similar asset that had a price of $23,000. The business received a trade-in allowance of

$2,100 on the old plant asset. What was the result of the exchange?

A. A $600 gain on the disposal of a plant asset.

B. A $1,000 unrecognized gain on the exchange of a plant asset.

C. A cost basis of $22,400 for the new plant asset.

D. A cost basis of $23,600 for the new plant asset.

The trade-in is $600 more than the book value of the asset. A trade-in transaction is simply a sale

of the old asset and the acquisition of a similar or like-kind asset. The $600 gain is a recognized gain.

19. Your company currently is generating a 12% return on total assets of $450,000. Comparable

companies are earning 10% on total assets. What is the estimated goodwill of your company? A. $90,000 B. $45,000 C. $9,000 D. $15,000

A 12% return on assets of $450,000 is $54,000. In order for the other firms to generate a return

of $54,000 on total assets, their total assets would have to be valued at $540,000. Your goodwill

is $90,000 ($540,000 - $450,000).

20. Which of the following items is an intangible asset? A. Patents B.Franchises C. Trademarks D. All of the above lOMoAR cPSD| 46831624

TRUE/FALSE QUIZ + Short Explaination

1. Different depreciation methods may be used for different assets. ➔ True

2. A company may use different methods of depreciation in its financial statements than

are used for determining taxable income. ➔ True

3. Double-declining-balance, 150%-declining balance, and MACRS are all examples of

accelerated depreciation methods ➔ True

4. When a business acquires land as a site to construct a new store, the cost of removing

unwanted buildings, grading, clearing, and delinquent real estate taxes should be

recorded as part of the cost of the new store.

➔ False (include in the cost of land)

5. When a business buys and then immediately repairs an old building, the cost of the

building repairs should be charged to the Building account. ➔ True

Repairs that prepare an asset for its intended use are capitalized and then depreciated over

the intended useful life of the asset.

6.The cost to have a second-hand machine assembled would be charged to an expense

account, since the machine is not new. ➔ False

Whether the machine is second-hand or new, it is new to the business and any cost to

prepare the machine for its intended use should be charged to the asset account established for the machine.

7. Interest costs related to the construction of an asset should be charged directly to the Interest Expense account. ➔ False

Interest costs related to the construction of an asset should be accounted for as a part of the

cost of the asset and directly debited to the appropriate asset account.

8. The cost of land and the cost of installing parking lot surfaces, fences, and lighting

systems should be debited to the Land account. ➔ False

The land cost should be maintained in a Land account. Land is not subject to depreciation.

The other items are land improvements, which are subject to depreciation. They are

recorded in separate accounts. lOMoAR cPSD| 46831624

9. Land, vehicles, buildings, parking lots, and business equipment, are examples of plant

and equipment assets. Each will be depreciated over its estimated useful life. ➔ False

All of the items listed except land will be depreciated. Land is not depreciated. Land has

an infinite life and is listed at cost on the balance sheet of the business. Land held for

investment purposes is listed in the 'Investments' section of the balance sheet.

10. Outlays of cash for the addition, improvement, or replacement of plant assets are

referred to as revenue expenditures. ➔ False

Such outlays of cash are referred to as capital expenditures--they benefit current and future

time periods. Revenue expenditures, such as repair expenses, benefit the current time period.

11. Miscellaneous shop tools purchased periodically should be charged directly to an

appropriate operating expense account. ➔ True

Small, normal expenditures that are not material in amount are commonly expensed rather

than capitalized. It is not cost effective to attempt to depreciate these small items.

12. The basic purpose of depreciation is to achieve the matching principle--to match the

cost of using the asset against the revenues that the asset helps to generate during any particular accounting period. ➔ True

Depreciation of an asset is an attempt to spread the cost of the asset over the accounting

periods in which the asset participates in the production of revenues.

13. The normal balance of a contra-asset account is debit. ➔ False

A contra-asset account's normal balance is a credit balance. Contra means to subtract from

or deducted from--such as accumulated depreciation being deducted from the cost of an

asset to determine its book value.

14. Book value is the asset cost less the salvage value of the asset. ➔ False

Book value or carrying value is the unexpired cost of the asset. It is a measure of the cost

of the asset less its accumulated depreciation.

15. An asset purchased for $40,000, with an accumulated depreciation balance at the end

of the year totaling $30,000, has a book value $70,000. ➔ False

The historical cost of the asset less its accumulated depreciation determined the current

undepreciated value or book value of the asset.

16. Depreciation is a process of placing a value on an asset. ➔ False lOMoAR cPSD| 46831624

Depreciation is a process of cost allocation and is not an attempt to reflect the market value of an asset.

17. Accumulated Depletion is a contra-liability account. ➔ False

Accumulated Depletion is a contra-asset account.

18. Accumulated depreciation represents a cash fund that will be available to replace the

asset when its useful life has been exhausted. ➔ False

Accumulated depreciation represents the total amount of an asset's cost that has been

expensed. It has nothing to do with cash. The initial cost of the asset less its total

accumulated depreciation is its total undepreciated value or book value.

19. A decline in the usefulness of a plant asset because of its obsolescence is considered to be physical depreciation. ➔ False

The loss or reduction of the usefulness of an asset because newer or more efficient assets

are available is called obsolescence.

20. The term residual value (salvage value) refers to the estimated value of an asset on its disposal date. ➔ True

The term refers to the value of the asset at its disposal. An asset may be discarded, sold, or

exchanged (traded in) during or at the end of its useful life.

21. The straight-line method of depreciation allocates the cost of an asset (minus any

residual value) equally to each year of its life. ➔ True

Annual depreciation expense is calculated as (Cost - Residual value)/Years of useful life,

under the straight-line method of depreciation.

22. The half-year convention approach cannot be used with the straight-line depreciation method. ➔ False

The half-year convention is the recording of a half-year's depreciation for the first year of

an asset's life regardless of what point in the year it was purchased. It is allowable under straight-line depreciation.

23. The straight-line rate for an asset with a 10-year life is 10%. lOMoAR cPSD| 46831624 ➔ True

The straight-line rate can be computed by dividing the number 1 by the assets' life in years.

For example, a 20-year life is a 5% straight-line rate (1/20 = 0.05 = 5%).

24. The depreciation method that applies a constant rate to a declining base is the declining- balance method. ➔ True

The declining-balance method of depreciation requires multiplying a rate (for example:

twice the straight-line rate) times the book value, which will decline each time that depreciation is recorded.

25. It is not permissible to use depreciation methods for income-tax reporting purposes

other than those used in financial statements that are distributed to other external users. ➔ False

Most businesses use straight-line methods for financial reporting; they tend to report higher

net income. Most business use accelerated methods for income tax returns; they tend to

lower net income and the income tax burden. In all cases, the firm should disclose in notes

to its financial statement the method(s) of depreciation used.

26. While the consistency principle applies to the method of inventory valuation used, it

does not apply to methods of depreciation used. ➔ False

A company should not change from year to year the method used in computing depreciation

expense for a given plant asset. However, it is permissible to revise the estimated useful

life, and therefore recompute the amount of the annual depreciation expense. 27.

At the time a plant asset is being discarded or sold, it is necessary to update the accumulated

depreciation and book value of the plant asset at the date of sale. ➔ True

Depreciation is the allocation of the cost of an asset over its service life to the business.

Failure to update the depreciation will result in an understatement of gain or an

overstatement of loss on the sale of the asset.

28. The periodic allocation of the cost of a patent is called amortization. lOMoAR cPSD| 46831624 ➔ True

The allocation of the cost of long-lived, intangible assets is called amortization. The

allocation of the cost of long-lived, physical assets is called depreciation.

29. Amortization of intangible assets can be longer than 40 years, under special circumstances. ➔ False

Generally accepted accounting principles (GAAP) require that the amortization of

intangible assets never be longer than 40 years.

30. Goodwill can be estimated and can be reported on the business records any time

management feels the business has increased in value. ➔ False

Goodwill should be reported only when established by an arms length sale and purchase.

31. Research and development costs for a product or process should be capitalized and

amortized over the life of the product or process as it is sold or used. ➔ False

Research and development costs should be expensed as they occur. There is no guarantee

that the research and development costs will ever be recovered through revenues from the product or use of the process lOMoAR cPSD| 46831624