Preview text:

2023 Jul 04 Hoai-Son Nguyen

Preparation for Peregrine test Outline - Admins stuff - Peregrine topics - Some core topics Admin stuff - MCQs - 3 mins for each question - Non back track questions. Peregrine topics Sub-Topic: Macroeconomics -

Business Cycle (Questions related to what the business cycle depicts) -

Consumption and Saving (Questions related to investment vs. consumption, disposable income, and savings) -

Economic Analysis (Questions related to short-run vs. long-run, investment spending,

increasing investment, and inventory levels) -

Economic Investment (Questions related to defining economic investment and investing in capital) -

Employment Analysis (Questions related to unemployment and employment rates) -

Gross Domestic Product (Questions related to economic growth rates, real GDP, and moderate economic growth) -

Inflation and Deflation (Questions related to the rate of inflation or deflation) -

Interest Rates (Questions related to real interest rates, level of investment, and defining real interest rates) -

Recession and Depression (Questions related to the definitions of recession and depression) -

Supply and Demand (Questions related to investment demand curve and demand shocks) Example Questions:

Which of the following is not part of the real business cycle explanation of business cycles?

A. Wage flexibility keeps output close to its potential level.

B. Output fluctuates because of fluctuations in aggregate supply.

C. Aggregate supply fluctuates because of fluctuations in the demand for labour.

D. Labour demand might fall if technology increases faster than expected. Correct Response: D

There are many reasons why a poor country may fail to catch up with a rich neighbour. Which one of

the following is not one of these reasons?

A. The poor country may have more rapid population growth.

B. The rich country may have more human capital. hoaisonkt@gmail.com Economics Faculty - NEU 1

C. The poor country may have a higher savings ratio.

D. The rich country may be more open to the world economy. Correct Response: C Exam Summary:

Global Business Administration Undergraduate Level Sub-Topic: Microeconomics -

Economic Analysis (Questions related to methods and tools used for economic analysis) -

Employment Analysis (Questions related to minimum wage and price elasticity) -

Pricing (Questions related to increases and decreases in pricing based on demand and the

relationship between supply and demand on pricing) -

Supply and Demand (Questions related to supply curves, producer surplus, consumer surplus,

demand curves, and price elasticity) Example Questions:

A firm charges $14 for a product. If the mark-up is 40%, then the fully allocated average cost is . A. $19.60 B. $10.00 C. $8.40 D. $9.00 Correct Response: B

An increase in price, with all other things being unchanged, leads to A. an outward shift in demand B. an inward shift in demand C. a contraction of demand D. an extension of demand Correct Response: C Some core topics

Please make sure that you have time to review topics covered in microeconomics and

macroeconomics courses. The below parts cover some main issues only, they DO NOT cover all topics in exam. Microeconomics -

Economics analysis (methods and tools) o Methods

Observation -> Research question: relationship

Models -> Theory – assumption

Ceteris paribus: keep other things being equal Testing o Tools

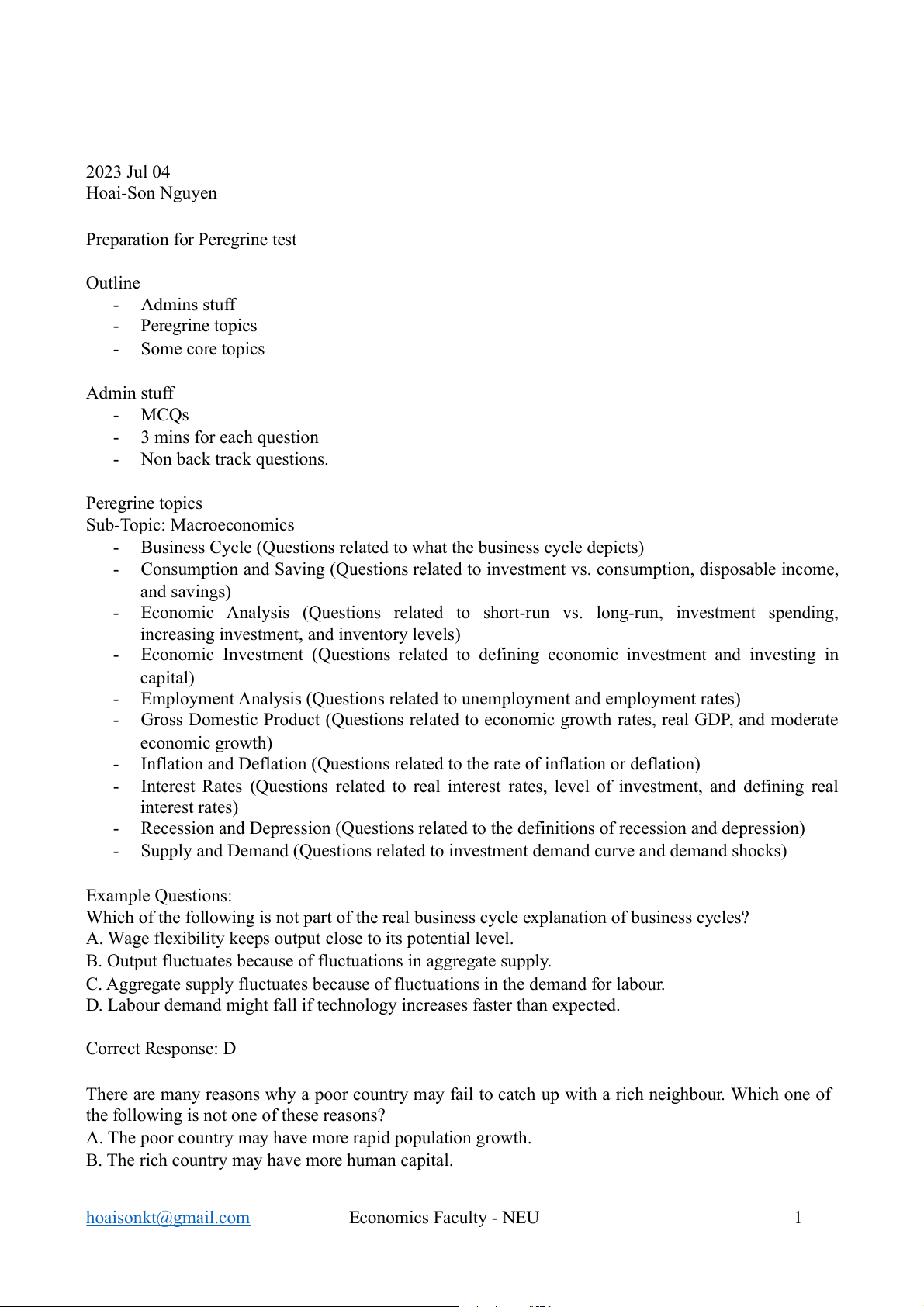

Tables, charts to present relationship hoaisonkt@gmail.com Economics Faculty - NEU 2 Single variable o

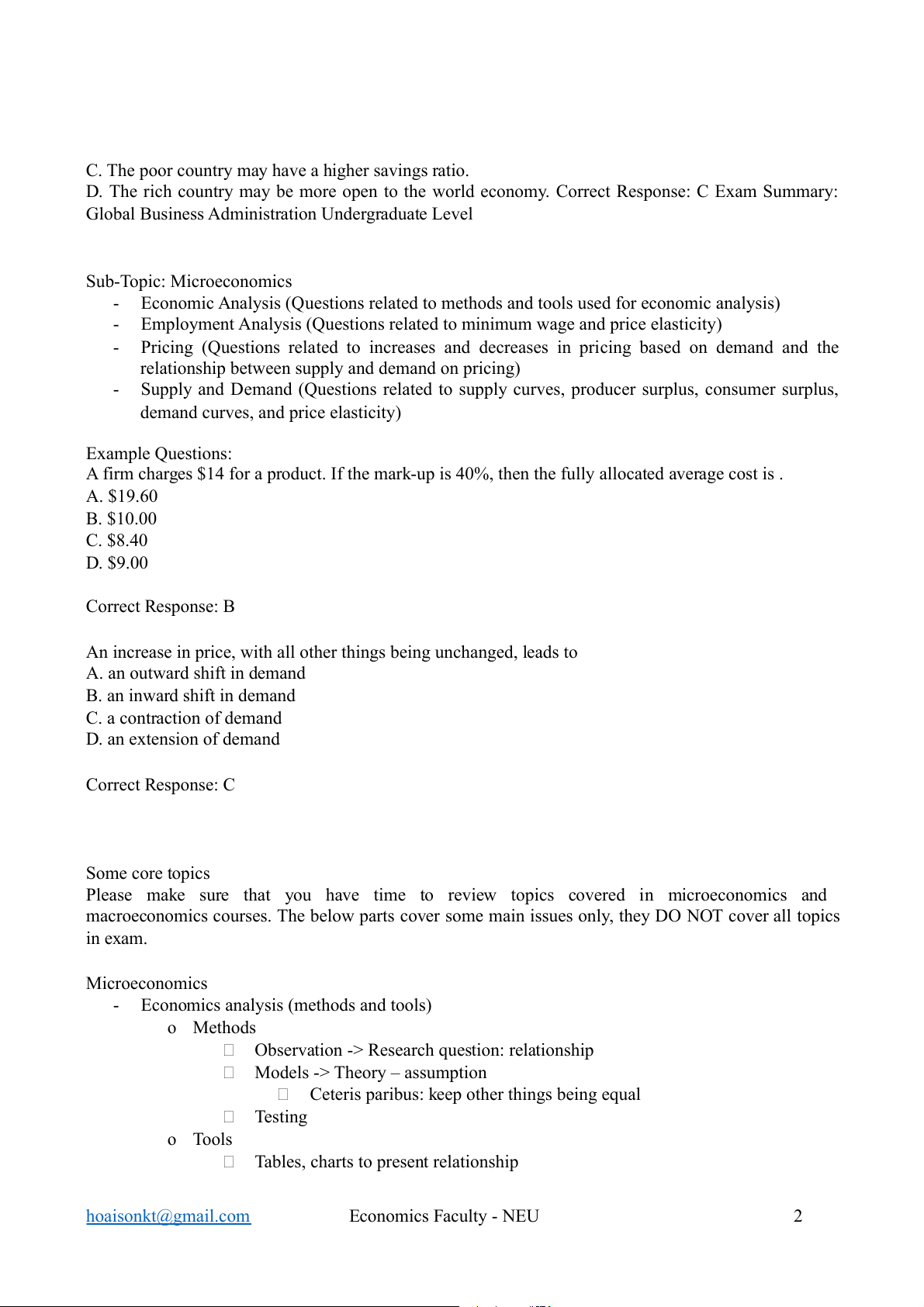

Two variables: correlation – coordinate system o o Curve

Slope: how much one variabe responds to changes in another variable

Positive (upward sloping) vs negative (downward sloping) Movement along vs shift hoaisonkt@gmail.com Economics Faculty - NEU 3 Causal-effect Omitted variable Reverse causality - Employment analysis:

o Minimum wage: Gov set a minimum wage that employer can pay employees. To protect employees

Binding: should be smaller than market equilibrium wage Cause unemployment o Price elasticity

In addition, unemployment is higher when the supply/ demand of labor is more

elastic and unemployment is lower when the supply/ demand of labor is more inelastic. w Unemployment w1 wE E Ld1 LE Ls1 L - Pricing o Pricing based on demand

Imperfect markets: monopoly, monopolistic competition

Max profit: MR = MC (MR: marginal revenue; MC: marginal cost)

P = MC + Markup (Markup = P – MC) (Note. Sometimes, Markup = P – AC) MC = S P* MC(Q*) hoaisonkt@gmail.com Economics F D aculty - NEU 4 MR Q*

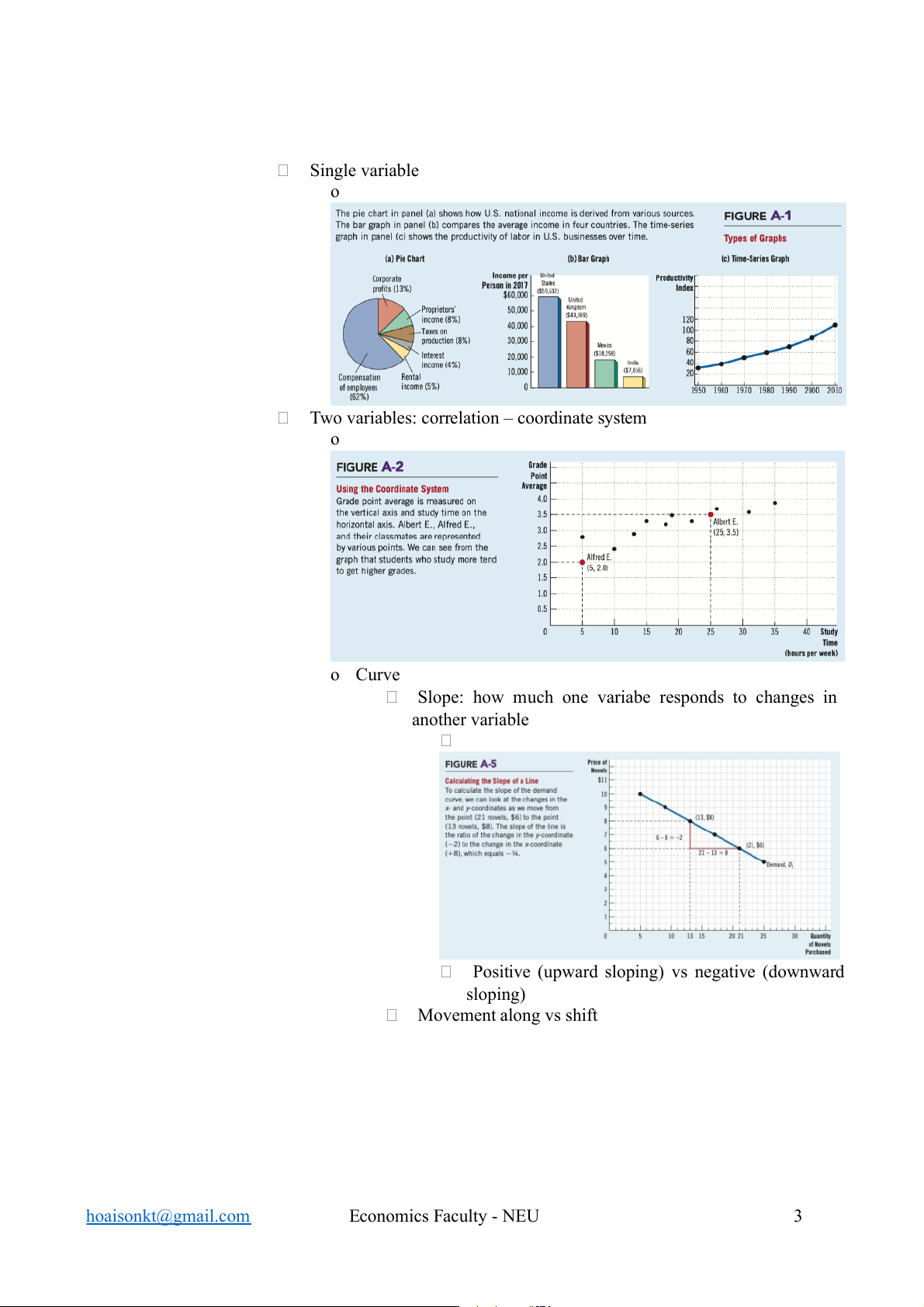

The more elastic a demand is the lower price a firm can set. o Supply and demand on pricing

Perfectly competitive market – perfect competition Price-takers Market price = S X D P P Market A firm S MC PE PE E MR=P=PE D QE Q Q1 Q* Q2 Q Market price change S↑ S stays the same S↓ D↑ PE ambiguous; QE↑ PE↑; QE↑ PE↑, QE ambiguous D stays the same PE↓; QE↑ PE, QE unchanged PE↑; QE↓ D↓ PE↓; QE ambiguous PE↓; QE↓ PE ambiguous; QE↓ o Output decision P = MC

Break even: P = min ATC (Average total cost)

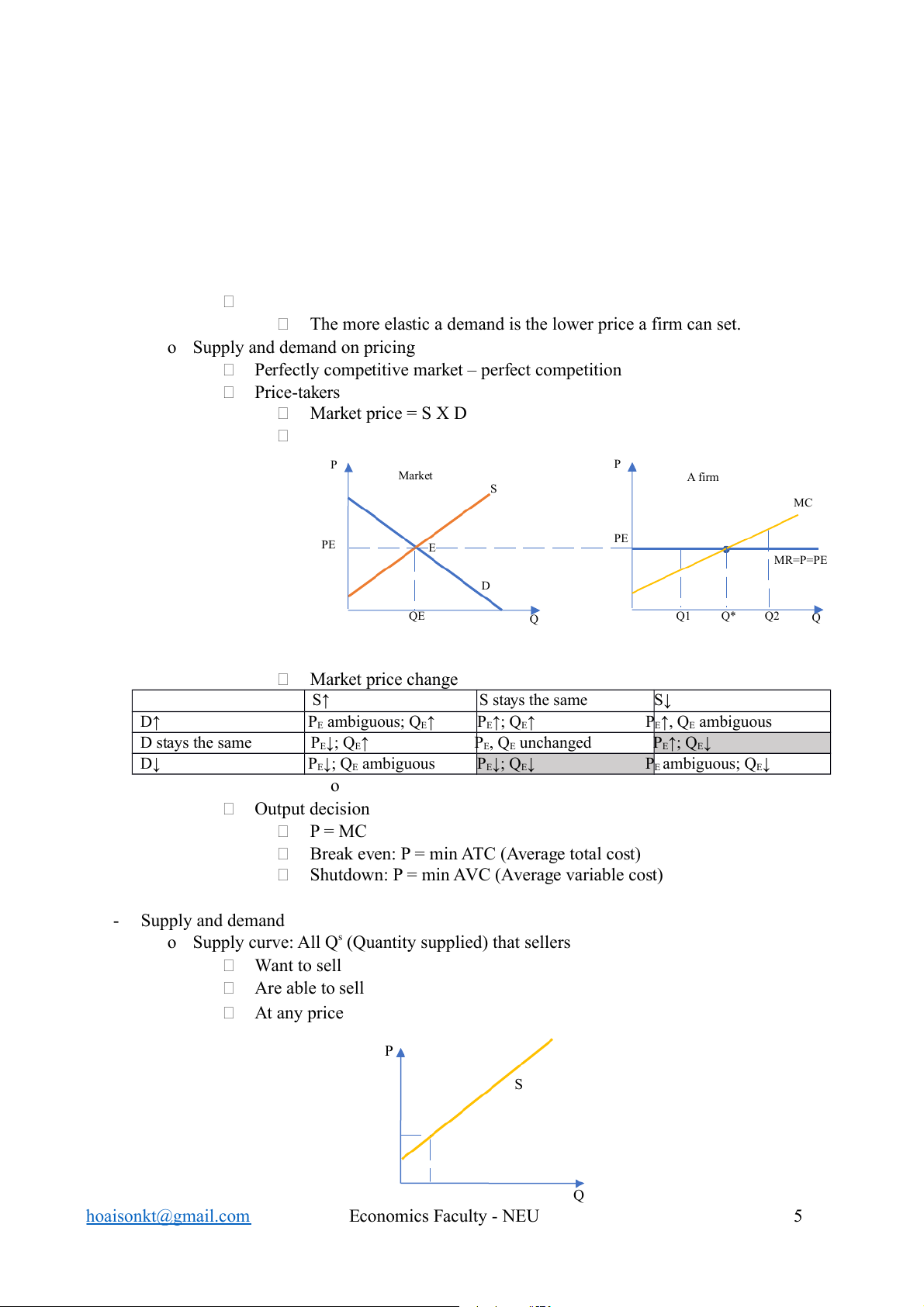

Shutdown: P = min AVC (Average variable cost) - Supply and demand

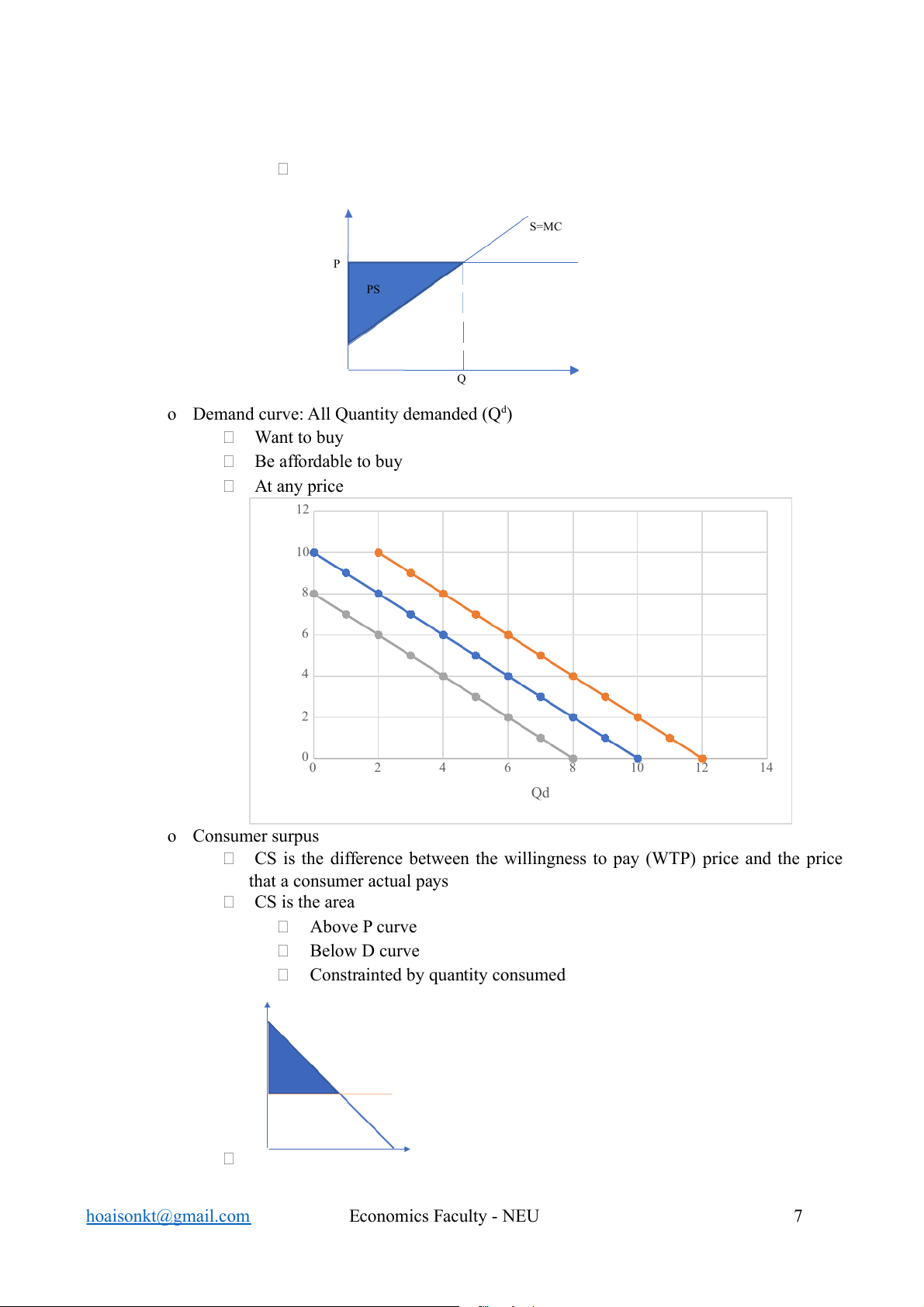

o Supply curve: All Qs (Quantity supplied) that sellers Want to sell Are able to sell At any price P S Q hoaisonkt@gmail.com Economics Faculty - NEU 5 o Producer surplus (PS)

The differences between the willingness to sell price and the actual sold price. The area Above S Below price curve Constrainted by quantity sold hoaisonkt@gmail.com Economics Faculty - NEU 6 S=MC P PS Q

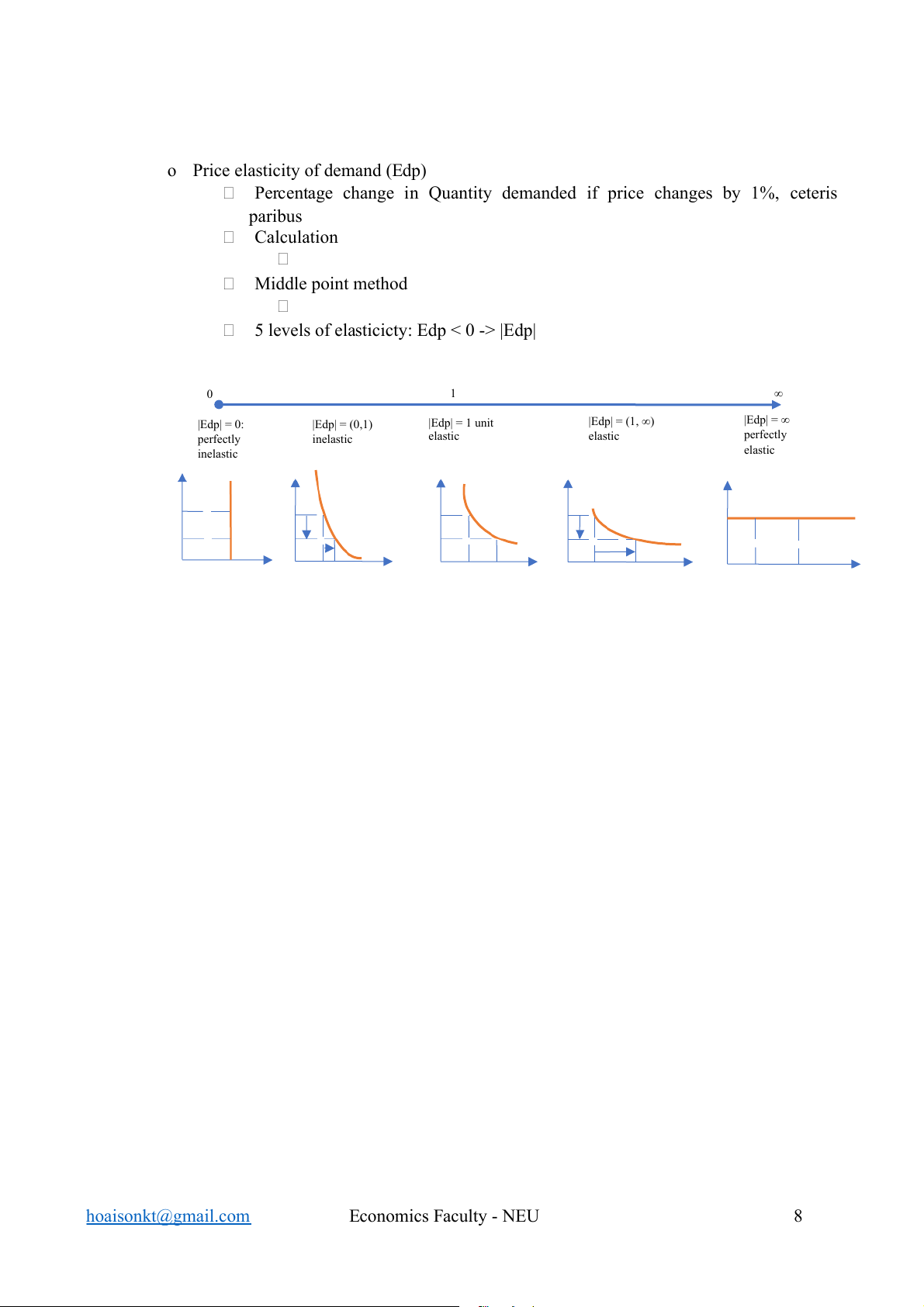

o Demand curve: All Quantity demanded (Q ) d Want to buy Be affordable to buy At any price 12 10 8 6 P 4 2 00 2 4 6 8 10 12 14 Qd o Consumer surpus

CS is the difference between the willingness to pay (WTP) price and the price that a consumer actual pays CS is the area Above P curve Below D curve

Constrainted by quantity consumed hoaisonkt@gmail.com Economics Faculty - NEU 7

o Price elasticity of demand (Edp)

Percentage change in Quantity demanded if price changes by 1%, ceteris paribus Calculation Middle point method

5 levels of elasticicty: Edp < 0 -> |Edp| 0 1 ∞ |Edp| = 0: |Edp| = (0,1) |Edp| = 1 unit |Edp| = (1, ∞) |Edp| = ∞ perfectly inelastic elastic elastic perfectly inelastic elastic hoaisonkt@gmail.com Economics Faculty - NEU 8 Macroeconomics - Gross Domestic Product o GDP = C + I + G + NX

Investment vs consumption (C vs. I)

C: comsumption: spending by households on goods and services, with

the exception of purchases of new housing.

o Disposal income – saving = consumption

o Disposable income = Income - tax I: investment

o The purchase of goods (called capital goods) that will be used in

the future to produce more goods and services.

o Investment is the sum of purchases of business capital,

inventories and residential capital Business capital Factory, Office building Equipment Itellectual property products Inventories

Firms “purchased” their own products Residential capital Households purchase new houses

o Economic Investment vs Financial Investment

Economic investment: purchases of capital goods

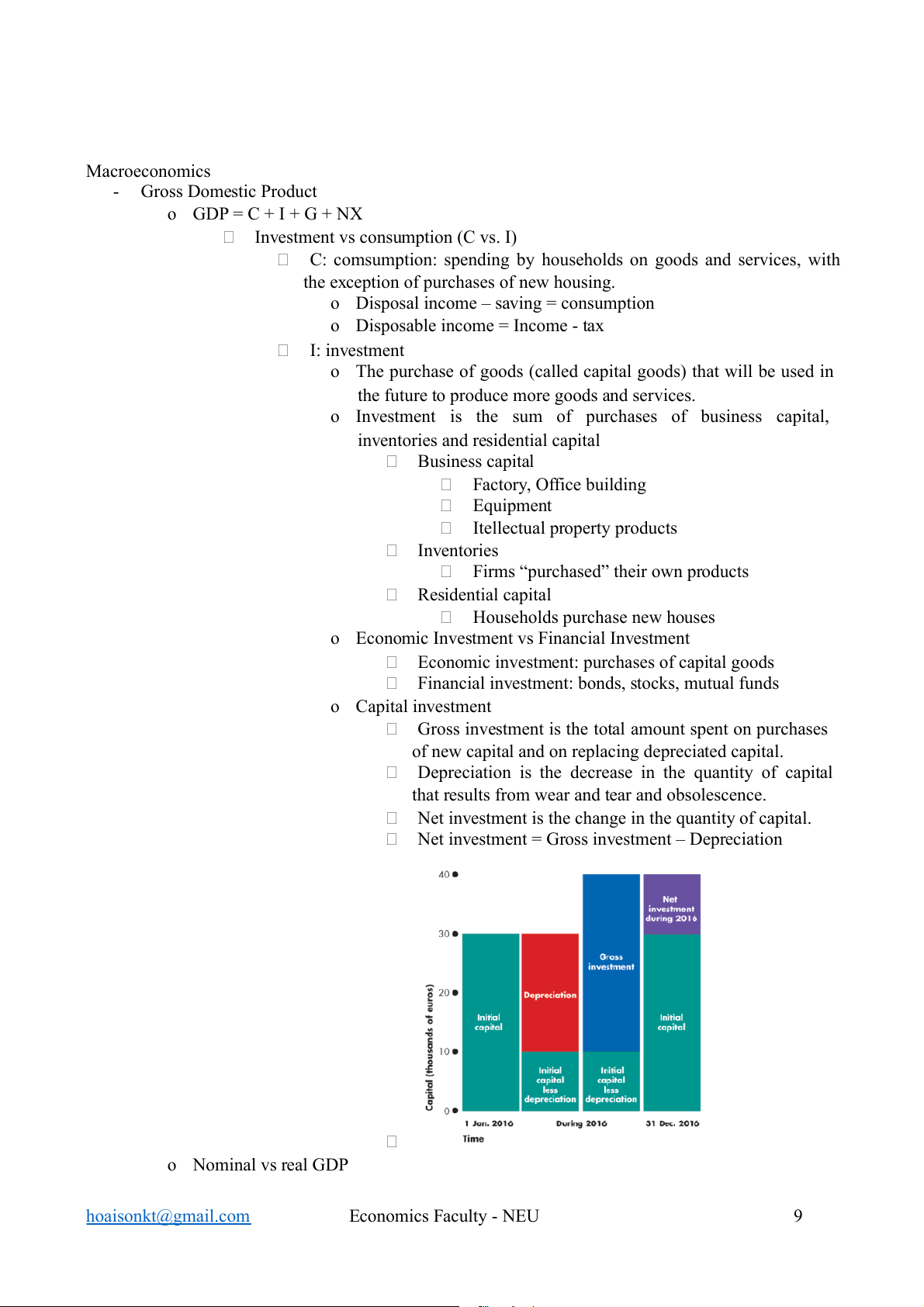

Financial investment: bonds, stocks, mutual funds o Capital investment

Gross investment is the total amount spent on purchases

of new capital and on replacing depreciated capital.

Depreciation is the decrease in the quantity of capital

that results from wear and tear and obsolescence.

Net investment is the change in the quantity of capital.

Net investment = Gross investment – Depreciation o Nominal vs real GDP hoaisonkt@gmail.com Economics Faculty - NEU 9

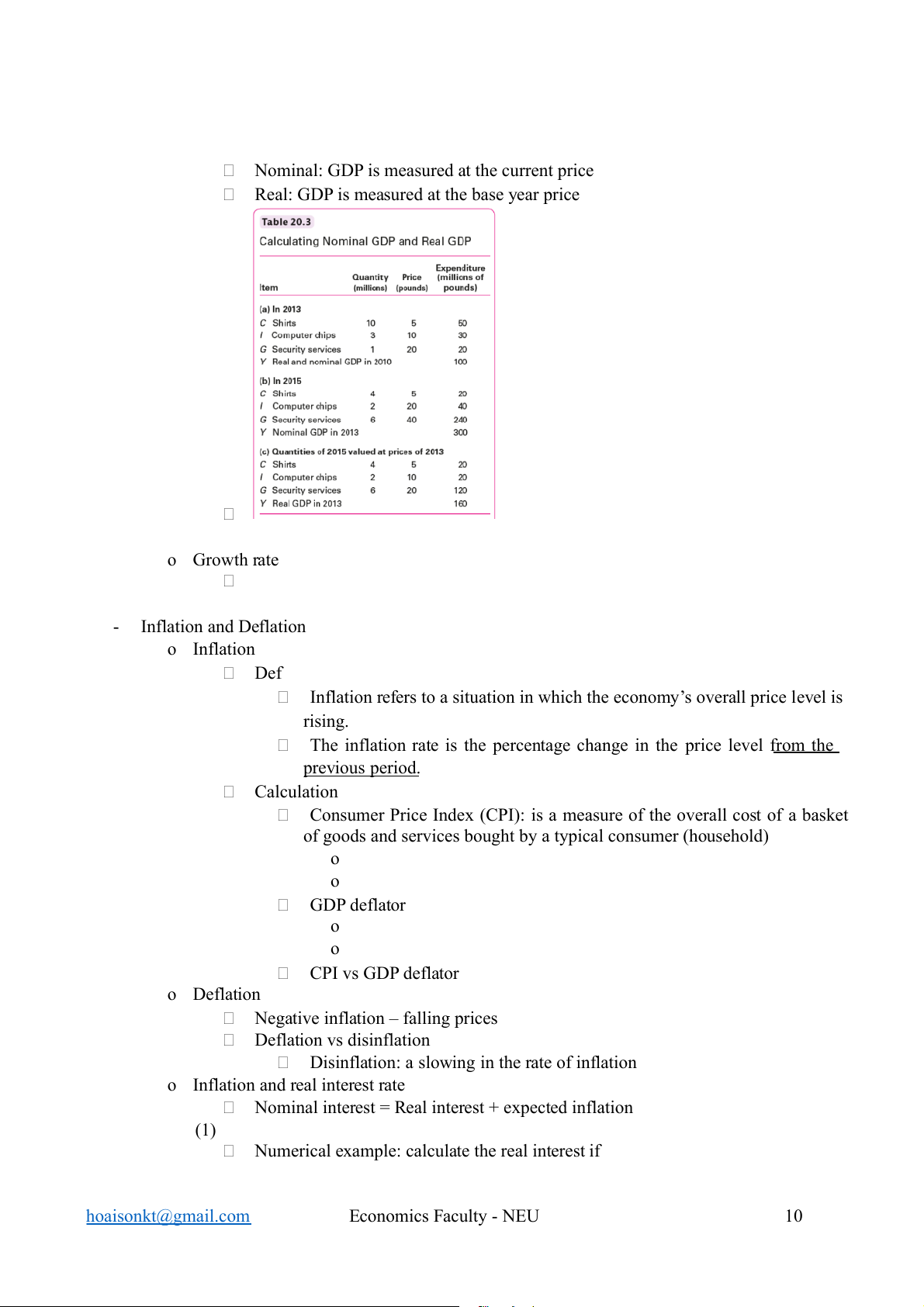

Nominal: GDP is measured at the current price

Real: GDP is measured at the base year price o Growth rate - Inflation and Deflation o Inflation Def

Inflation refers to a situation in which the economy’s overall price level is rising.

The inflation rate is the percentage change in the price level from the previous period. Calculation

Consumer Price Index (CPI): is a measure of the overall cost of a basket

of goods and services bought by a typical consumer (household) o o GDP deflator o o CPI vs GDP deflator o Deflation

Negative inflation – falling prices Deflation vs disinflation

Disinflation: a slowing in the rate of inflation

o Inflation and real interest rate

Nominal interest = Real interest + expected inflation (1)

Numerical example: calculate the real interest if hoaisonkt@gmail.com Economics Faculty - NEU 10 Deposit amount is 200$ Nominal interest is 10%

Overall price of a basket is 2$ Inflation = 7%

Before depositing, the amount of goods that you can consume = 200/2 = 100 unit

After deposit a certain period (1 year)

Money account = 200*(1+0.1) = 220$

New price level = 2(1+0.07) = 2.14$

The amount of goods that you can consume = 220/2,14=103 unit

Real interest = (103-100)/100 = 3%

Verifying with (1): r = 10% -7% = 3%

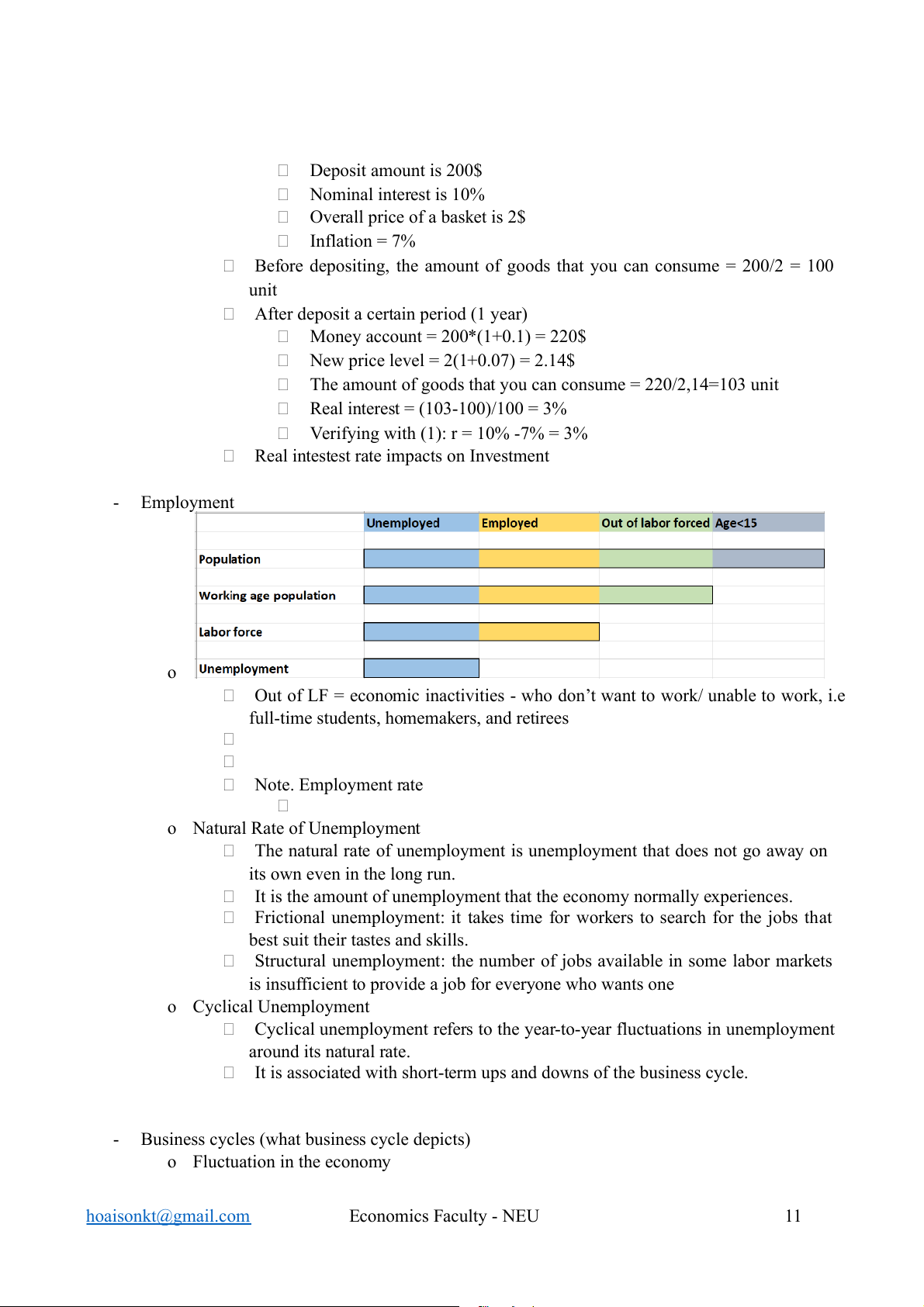

Real intestest rate impacts on Investment - Employment o

Out of LF = economic inactivities - who don’t want to work/ unable to work, i.e

full-time students, homemakers, and retirees Note. Employment rate o Natural Rate of Unemployment

The natural rate of unemployment is unemployment that does not go away on its own even in the long run.

It is the amount of unemployment that the economy normally experiences.

Frictional unemployment: it takes time for workers to search for the jobs that

best suit their tastes and skills.

Structural unemployment: the number of jobs available in some labor markets

is insufficient to provide a job for everyone who wants one o Cyclical Unemployment

Cyclical unemployment refers to the year-to-year fluctuations in unemployment around its natural rate.

It is associated with short-term ups and downs of the business cycle. -

Business cycles (what business cycle depicts) o Fluctuation in the economy hoaisonkt@gmail.com Economics Faculty - NEU 11 o irregular and unpredictable

o Alternating periods of positive and negative GDP growth rates. Expansion = real GDP grows Recession

a period of declining real incomes and rising unemployment Depression: a severe recession o Short run vs Long run Short run: Wage and price are sticky

nominal variables can have impacts on real variables Long run:

Wage and price are fully flexibility

nominal variables do not have impacts on real variables

o Shock = an unexpected event (such as a drought, or a pandemic) which causes GDP to fluctuate

Investment is more volatile than consumption

Households tent to smooth their consumption

Firms make Investment decisions depend on firms’ expectations about future demand

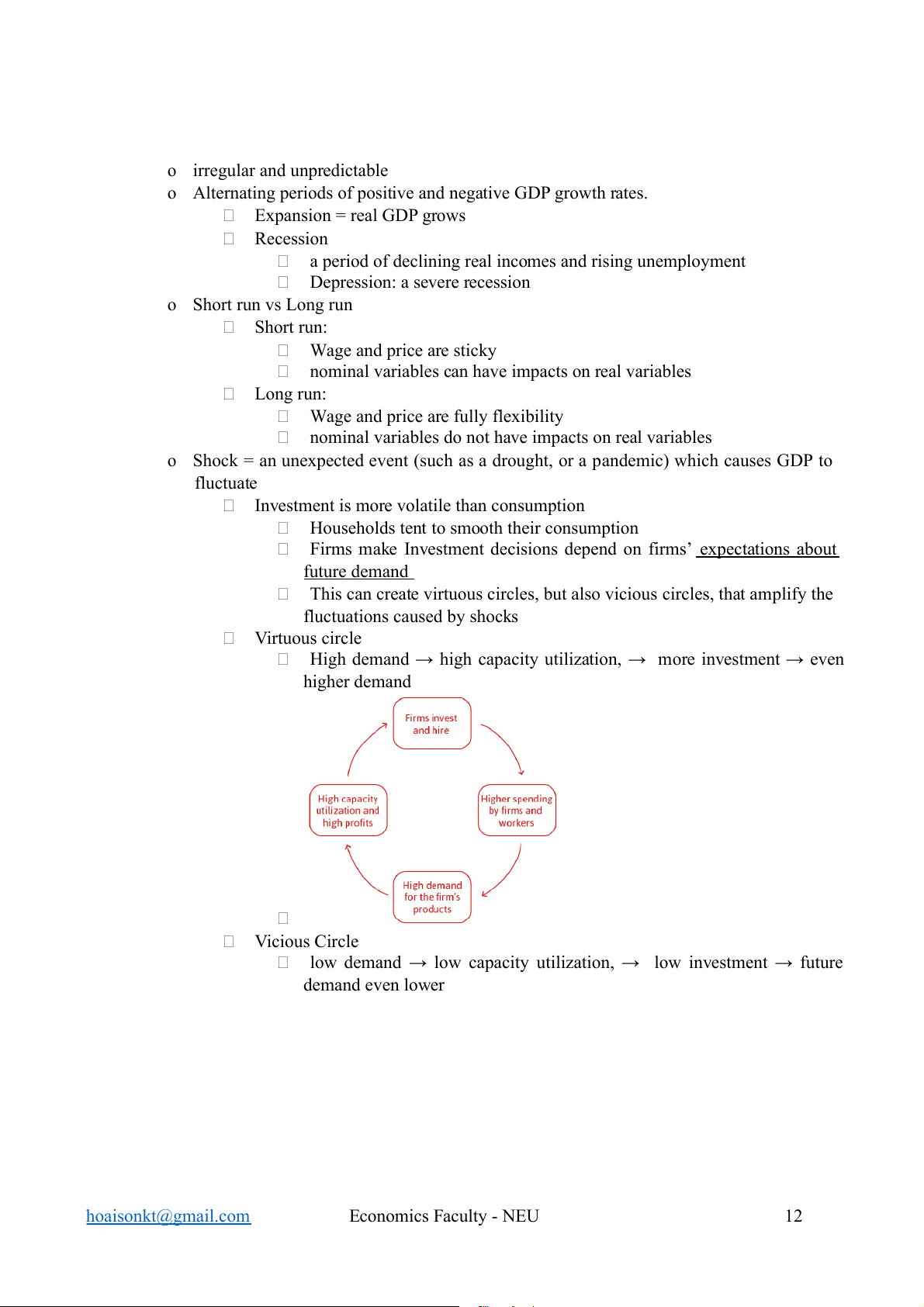

This can create virtuous circles, but also vicious circles, that amplify the fluctuations caused by shocks Virtuous circle

High demand → high capacity utilization, → more investment → even higher demand Vicious Circle

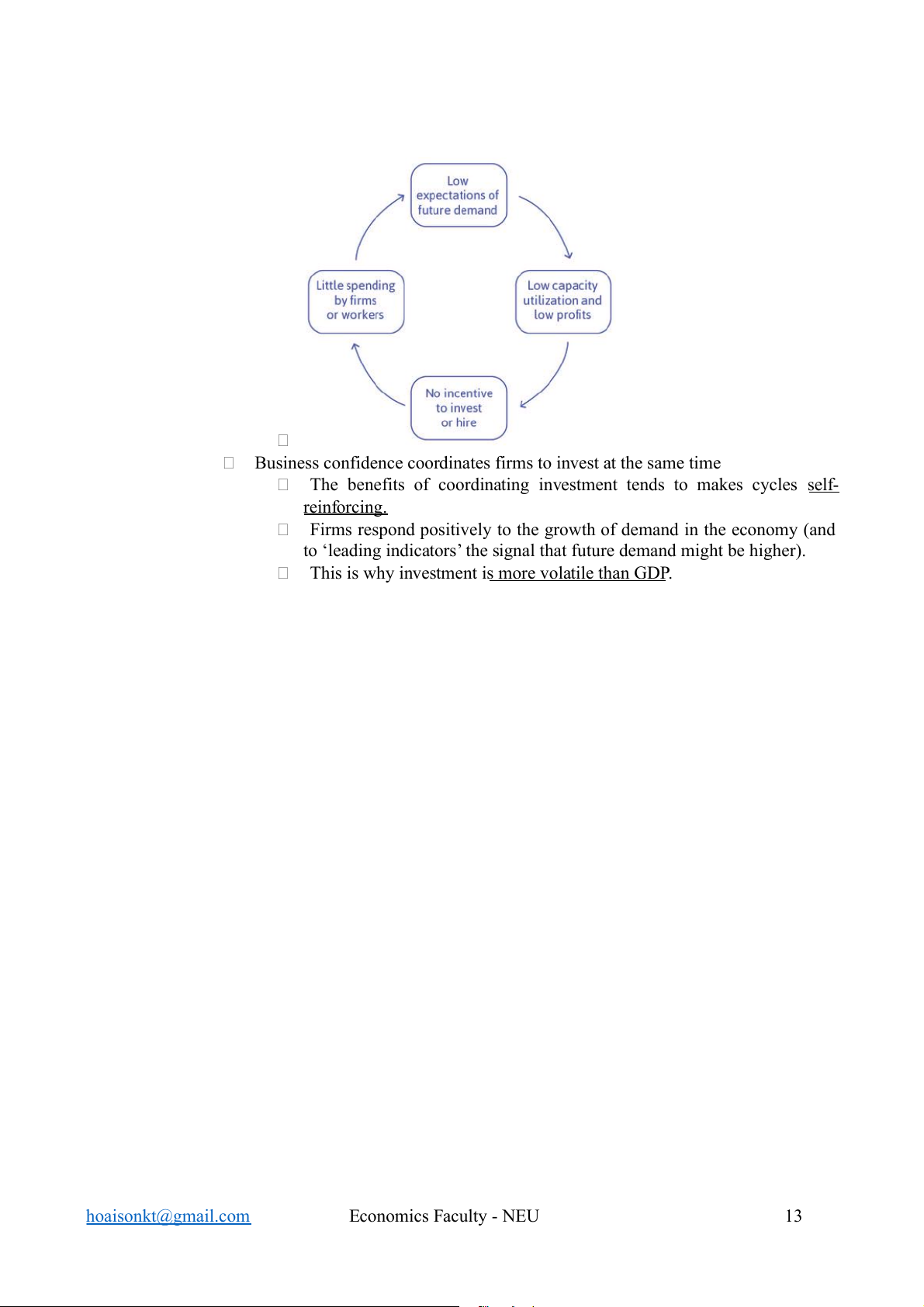

low demand → low capacity utilization, → low investment → future demand even lower hoaisonkt@gmail.com Economics Faculty - NEU 12

Business confidence coordinates firms to invest at the same time

The benefits of coordinating investment tends to makes cycles self- reinforcing.

Firms respond positively to the growth of demand in the economy (and

to ‘leading indicators’ the signal that future demand might be higher).

This is why investment is more volatile than GDP. hoaisonkt@gmail.com Economics Faculty - NEU 13