Preview text:

PRINCIPLES OF MICROECONOMICS

Chapter 1: Thinking Like an Economist

Economics:the study ofhow people make choices under conditions of

opportunitycost,defined asthe valuesofthe mosthighly valued

scarcityandtheresultsofthosechoicesforsociety.

alternativesthatmustbeforgonetocarryouttheaction.

Economicanalysis ofhumanbehaviour beginswith theassumptionthat

Pitfall3:failuretoignoresunkcosts.E.g.Eventhoughatickettoa peoplearerational.

concertmayhavecostyou€100,ifyouhavealreadyboughtitand

Rational person:someone with well-defined goals and will fulfil those

cannotsellittoanyoneelse,the€100isasunkcostandshouldnot

goalsasbestashecan.

influenceyourdecisionaboutwhethertogototheconcert.

Peoplenormallyfacetrade-offswhentheywanttoachievetheirgoals,this

Pitfall4:failuretounderstandtheaverage-marginaldistinction.The

isaresultofscarcity.

focusshouldalwaysbeonthebenefitsandcostsofanadditionalunit

The Scarcity Principle (No-Free-Lunch Priciple): although we have

activity.Thus,thelevelofanactivityshouldbeincreasedif,andonly

boundlessneedsandwants,resourcesavailabletousarelimited,sohaving

if,itsmarginalbenefitexceedsitsmarginalcost.

moreofongoodthingusuallymeanshavinglessofanother.

Marginal costs:theincreaseintotalcoststhatresultfromcarryingoutone

The Cost-Benefit Priciple: anactionshouldonlybetakenifitsbenefits

additionalunitofactivity. exceeditscosts.

Marginal benefit:anincreaseinthetotalbenefitthatresultfromcarrying

Economic surplus:thebenefitoftakinganaction-thecostoftakingthat

outoneadditionalunitofactivity. action

Average cost:thetotalcostofundertaking‘n’unitsofanactivitydivided

Opportunity cost (of an activity): thevalueofthenextbestalternative by‘n’

thatmustbeforgonetoundertakethatactivity.E.g.Watchingmoviesfor

Average benefit: thetotalbenefitofundertaking‘n’unitsdividedby‘n’

hours,whileyoucouldalsoworkfor5euroanhour.

Microeconomics: the study of individual choice under scarcity and its

Sunk costs:coststhatarebeyondrecoveryatthemomentadecisionmust

implications for the behaviourof the prices and quantities in individual

bemade.E.g.watchaboringmovietilltheendinsteadofleaving,because markets.

youpaidfortheticket.

Macroeconomics:study of performance of national economics and the

The role of economic models:

policiesthatgovernmentsusetotryimprovingthatperformance.

Economistsusethecost-benefitprincipleasanabstractmodelofhowan

Positive economics (kinh tế học thực chứng)consistsintheconclusionof

idealisednationalindividualwouldchooseamongcompetingalternatives.

economics that are independent of the ethical value system of the

Themodelisasimplifiedrepresentationofreality

economist.(IfAhappensthenBhappens):howpeoplewillbehave

4 important decision pitfalls:

Normative economics(kinh tế học chuẩn tắc)consist in statements in

economics that reflect or are based on the ethical value system of the

Pitfall 1: measuring costs and benefits as proportions rather than

absolute moneyamount. E.g.Walk3km to save €10on a €1000

economist,implicitly,explicitly,oromission.(IfAhappensthenBshould computer?

happen):howpeopleshouldbehave.

Pitfall2:ignoringopportunitycosts.Whenperformingacost-benefit

analysisofanaction,itisimportanttoaccountforallrelevant

Chapter 2 : Comparative Advantage

Absolute advantage:1personhasanabsoluteadvantageifanhourspentin

performingataskearnsmorethantheotherpersoninperformingthesame task.

Comparative advantage:1personhasthiswhenhisopportunitycostof

performing a task is lower than the other person’s opportunity cost in

performingthesametask.

The principle of increasing opportunity cost ( Low-hanging-fruit

The principle of comparative advantage:thismeansthateveryonedoes

principle): When resources have different opportunity costs, we should

bestwheneachpersonconcentratesontheactivitiesforwhichhisorher

always exploit the resource with the lowest opportunity cost first, and

opportunitycostislowest.

afterwardsusetheresourceswithhigheropportunitycost(pickingthemost

E.g:Ifapersonproducesnutsandcoffee,theopportunitycostsofnutscan accessiblefruitfirst).

becalculatedthisway:

Factorsthatshifttheeconomy’sPPF:Aneconomicgrowthresultsinan

OCnuts:Lossincoffee/Gaininnuts

outwardshiftintheeconomy’sPPF.

OCcoffee:Lossinnuts/Gainincoffee

Economic growth:the ability of the economy to produce increasing

PPC (production possibility curve): agraphthatshowstherelationship

quantitiesofgoodsandservices.

betweenthequantityofonegoodthatcanbeproducedforeverypossible

Economicgrowthiscausesbydifferentfactors,e.g.increasesinproductive

levelofproductionofanothergood.

resourcesandimprovementsinknowledgeandtechnology(thosearethe2 mainfactors)

PointsthatlieeitheralongorwithinthePPCareattainablepoints:

Attainable point:anycombinationofgoodsthatcanbeproducedusing

Factorsthatmaylimitspecialisation:

currentavailableresources. lowpopulationdensity Isolation

PointsthatlieoutsidethePPCareunattainable:

Unattainable point:any combination of goods thatcannot be produced

Lawsandcustomsthatlimitpeople’sfreedomtotransactfreelywith

usingcurrentlyavailableresources. oneanother Sizeofthemarket

PointsthatliealongthePCCareefficient:

Efficient point:anycombination ofgoodsfor whichcurrentlyavailable

onceyouarebehind,youstaybehind

resourcesdonotallowanincreaseintheproductionofonegoodwithout

Developingcountriesdonotwanttohavecomparativeadvantagein reductionoftheother.

rawmaterialsandagricultureforever.

PointsthatliewithinthePCCareinefficient:

Developingstrategiesaimedatchangingthecomparativeadvantage

Inefficient point:any combination ofgoods forwhich currently

Nationscanalsobenefitfromexchangebasedoncomparativeadvantage.

available resources enable an increase in the production of one good

Outsourcing: a term increasingly used to connote having services

withoutreductionofproductionoftheother.

performedbylow-wageworkersoverseas.

Chapter 3: Supply and Demand

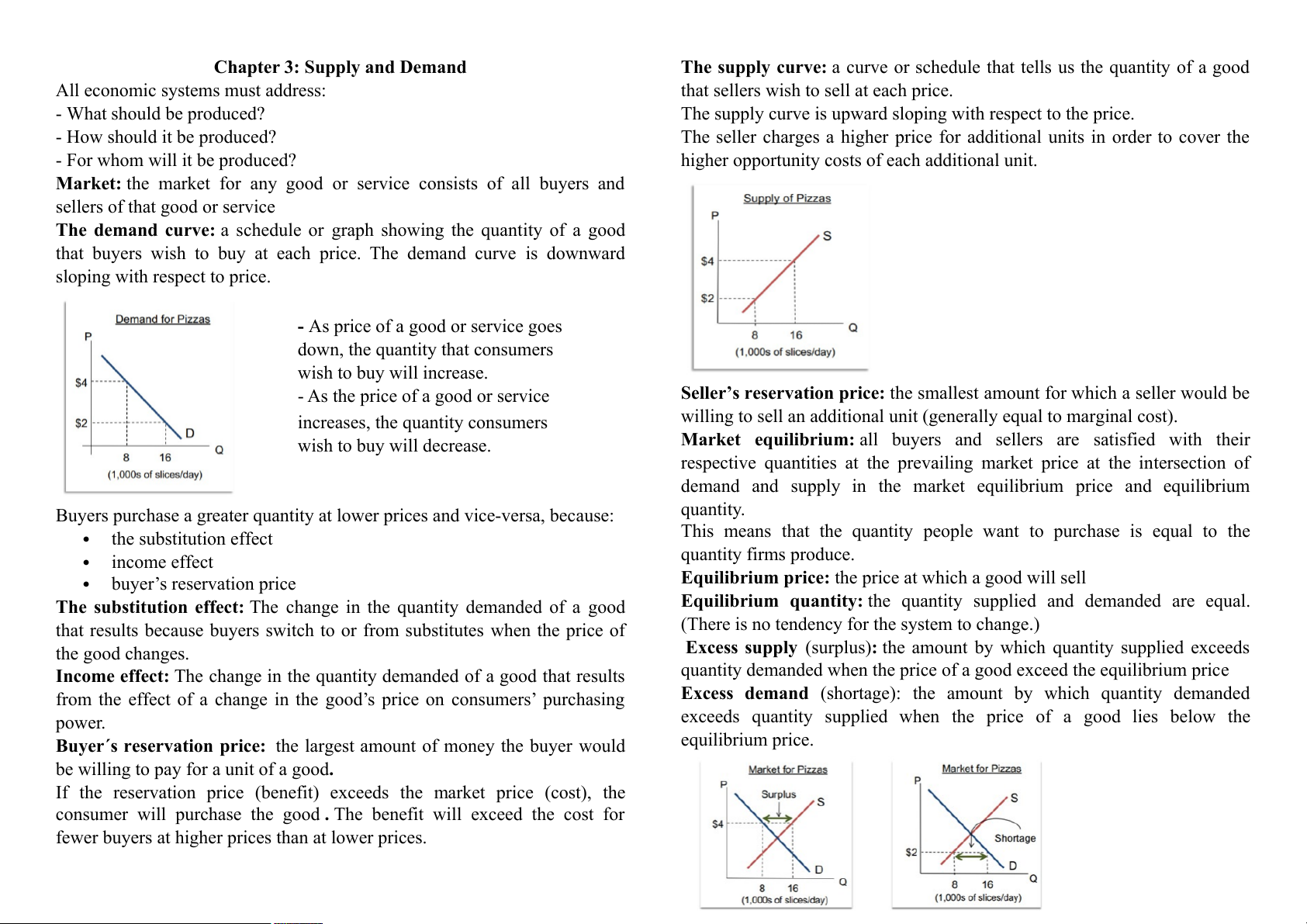

The supply curve:acurveorschedulethattellsusthequantityofagood

Alleconomicsystemsmustaddress:

thatsellerswishtosellateachprice.

-Whatshouldbeproduced?

Thesupplycurveisupwardslopingwithrespecttotheprice.

-Howshoulditbeproduced?

Thesellerchargesahigherpriceforadditionalunitsinordertocoverthe

-Forwhomwillitbeproduced?

higheropportunitycostsofeachadditionalunit.

Market: the market for any good or service consists of all buyers and

sellersofthatgoodorservice

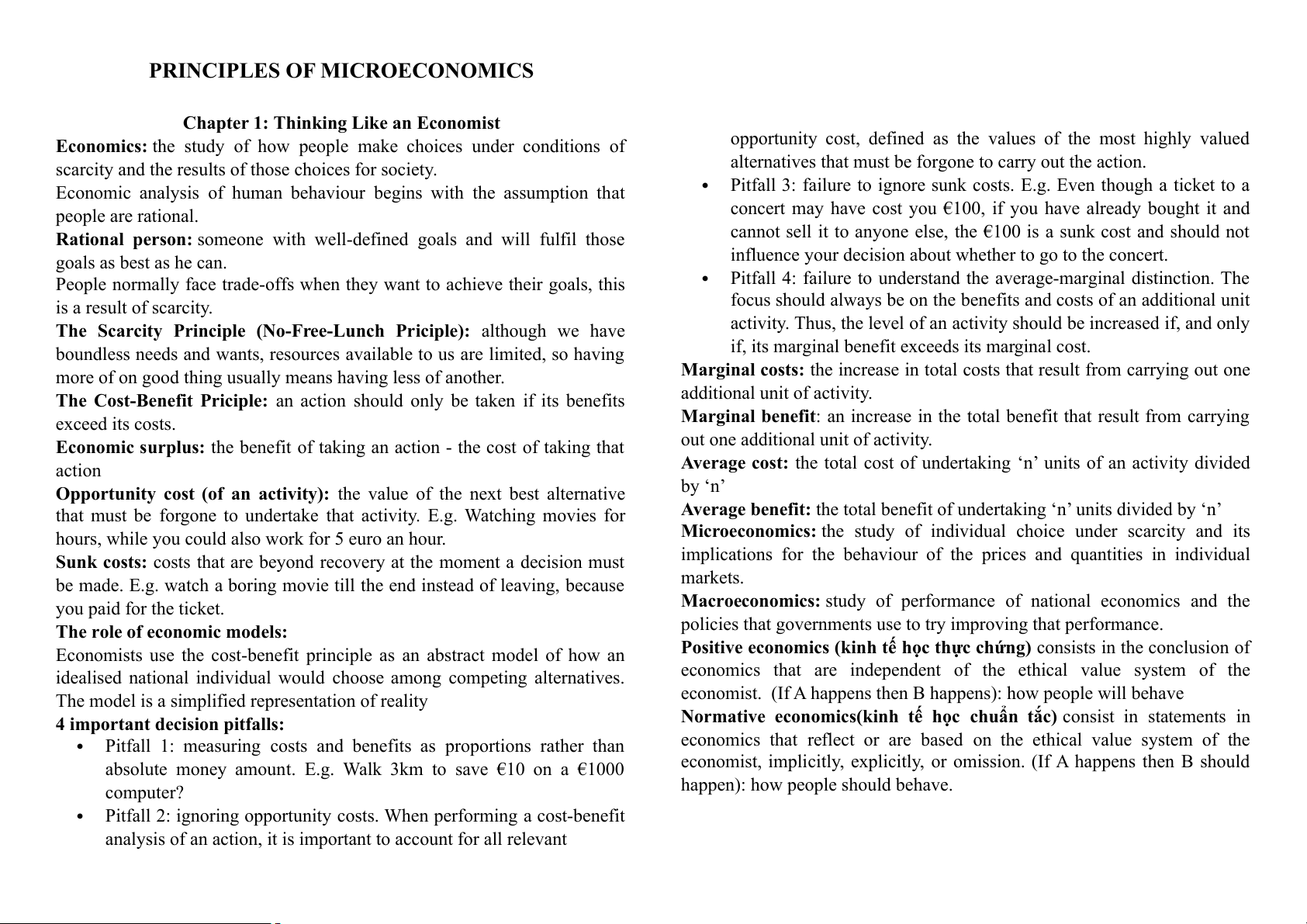

The demand curve: ascheduleorgraphshowingthequantityofagood

that buyers wish to buy at each price.The demand curve is downward

slopingwithrespecttoprice.

- Aspriceofagoodorservicegoes

down,thequantitythatconsumers

wishtobuywillincrease.

-Asthepriceofagoodorservice

Seller’s reservation price:thesmallestamountforwhichasellerwouldbe

willingtosellanadditionalunit(generallyequaltomarginalcost).

increases,thequantityconsumers

Market equilibrium:all buyers and sellers are satisfied with their

wishtobuywilldecrease.

respectivequantitiesattheprevailingmarketpriceattheintersectionof

demand and supply in the market equilibrium price and equilibrium

Buyerspurchaseagreaterquantityatlowerpricesandvice-versa,because: quantity.

This means that the quantity people want to purchase is equal to the thesubstitutioneffect quantityfirmsproduce. incomeeffect

Equilibrium price:thepriceatwhichagoodwillsell

buyer’sreservationprice

The substitution effect:Thechangeinthequantitydemandedofagood

Equilibrium quantity:the quantity supplied and demanded are equal.

thatresultsbecausebuyersswitchtoorfromsubstituteswhenthepriceof

(Thereisnotendencyforthesystemtochange.) thegoodchanges.

Excess supply (surplus)

:theamountbywhichquantitysuppliedexceeds

Income effect: Thechangeinthequantitydemandedofagoodthatresults

quantitydemandedwhenthepriceofagoodexceedtheequilibriumprice

fromtheeffectofachangeinthegood’spriceonconsumers’purchasing

Excess demand (shortage): the amount by which quantity demanded power.

exceeds quantity supplied when the price of a good lies below the

Buyer´s reservation price: thelargestamountofmoneythebuyerwould equilibriumprice.

bewillingtopayforaunitofagood.

If the reservation price (benefit) exceeds the market price (cost), the

consumer will purchase the good The .

benefit will exceed the cost for

fewerbuyersathigherpricesthanatlowerprices.

expectedfuturelowerprices

Price ceiling:amaximumallowableprice,specifiedbylaw

improvementinweather(farming)

Price floor:aminimumallowableprice,specifiedbylaw

Anincreaseindemandwillleadtoanincreaseinboth,the

Change in quantity demanded:amovementalongthedemandcurvethat

equilibriumpriceandquantity.

occursinresponsetoapricechange.

Adecreaseindemandwillleadtoadecreaseinboth,the

Change in demand:ashiftoftheentiredemandcurve:ademandchangeat

equilibriumpriceandquantity. thesameprice.

Shift in demand due to complements:

-2goodsarecomplementsinconsumptionifanincreaseordecreaseinthe

priceofonecausesaleftwardorrightwardshiftinthedemandcurveforthe other

E.g.tennisracquetsandballs,ginandtonic,printersandpaper.

Shift in demand due to substitutes:

-2goodsaresubstitutesinconsumptionifanincreaseordecreaseinthe

priceofonecausesarightwardorleftwardshiftinthedemandcurveforthe

Anincreaseinsupplywillleadtoadecreaseintheequilibriumprice other

andanincreaseintheequilibriumquantity.

E.g.beerandwine,coffeeandtea.

Adecreaseinsupplywillleadtoanincreaseintheequilibriumprice

Shift in demand due to income change:

andadecreaseintheequilibriumquantity. -normal demand good:

curveshiftsrightwardswhentheincomeofbuyers

increasesandleftwardswhentheincomesofbuyersdecrease. -inferior demand good:

curveshiftleftwardswhentheincomeofbuyers

increasesandrightwardswhentheincomeofbuyersdecreases Otherfactors: increasepreference increaseinpopulation

expectedfuturehigherprices

Change in quantity supplied: a movement along thesupply curve that

Buyer’s surplus:thedifferencebetweenthebuyer’sreservationprice

occursinresponsetoapricechange

andthepriceheactuallypaid.

Change in supply:a shift of the entire supply change at the same

Seller’s surplus:thedifferencebetweenthepricereceivedbytheseller

price.

andhisreservationprice.

Shiftsinsupply(righwardordownward)

Total surplus:thedifferencebetweenthebuyer’sreservationpriceand

decreasepricesofinputsandtheirsubstitutes.

theseller’sreservationprice

improvements of technology, which means that there can be

Economic efficiency:whentheeconomicsurplusismaximised.

producedmorewiththesameinputprices.

increasenumberoffirmsinthemarket

The Efficiency Principle: Efficiency is an important social goal

becausewhentheeconomicpiegrowslargereveryonecanhavealarger slice.

The Equilibrium Principle (No-Cash-on-the-TablePrinciple):Amarketin

quilibriumleavesnounexploitedopportunityforindividuals butmaynot

exploitallgainsachievablethroughcollectiveaction. Chapter 4: Elasticity

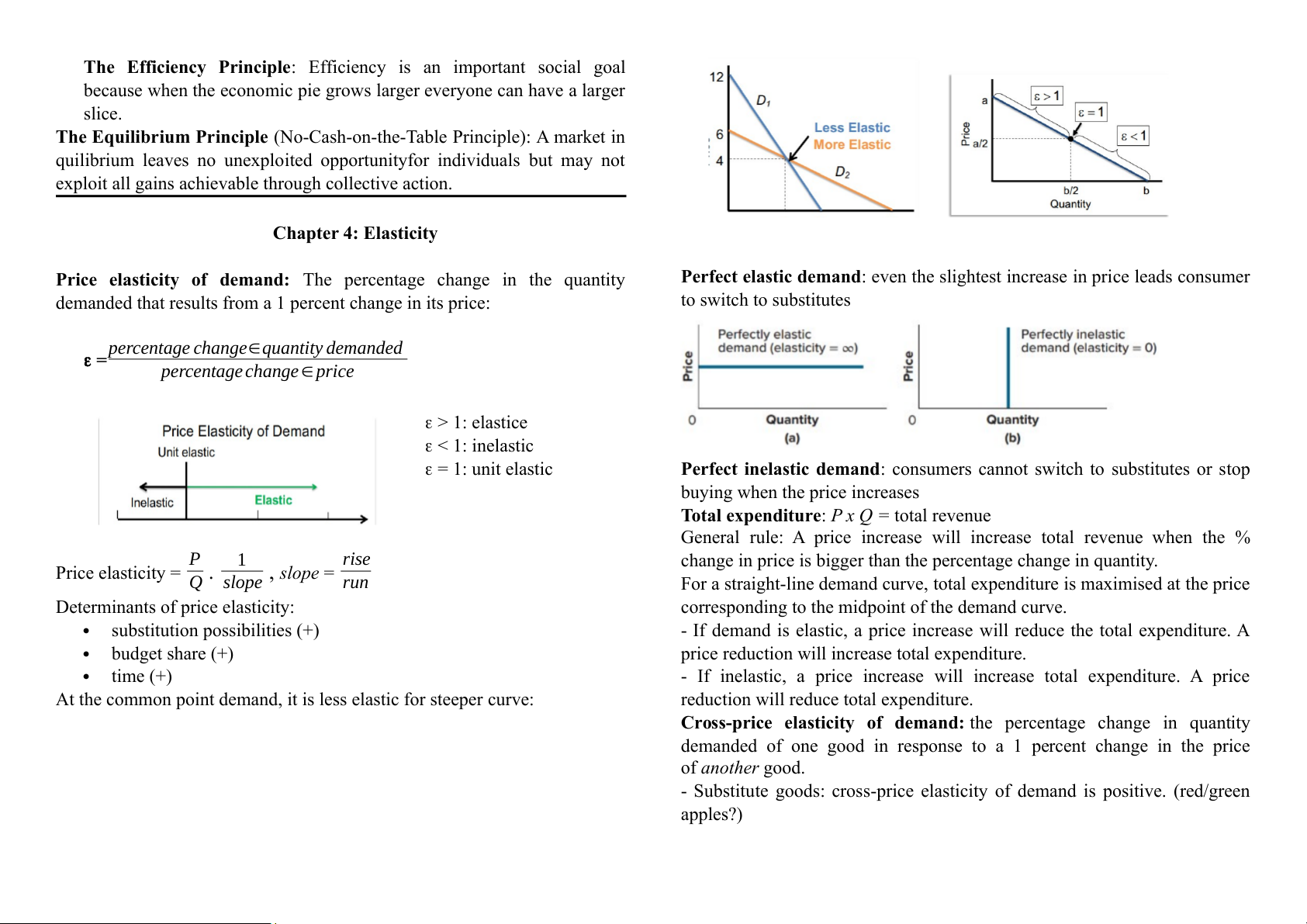

Price elasticity of demand: The percentage change in the quantity

Perfect elastic demand:eventheslightestincreaseinpriceleadsconsumer

demandedthatresultsfroma1percentchangeinitsprice: toswitchtosubstitutes

=percentage change∈quantity demanded

percentage change ∈ price >1:elastice <1:inelastic =1:unitelastic

Perfect inelastic demand:consumerscannotswitchtosubstitutesorstop

buyingwhenthepriceincreases

Total expenditure:P x Q =totalrevenue

General rule: A price increase will increase total revenue when the % P rise

changeinpriceisbiggerthanthepercentagechangeinquantity.

Priceelasticity= 1 ,slope= Q slope run

Forastraight-linedemandcurve,totalexpenditureismaximisedattheprice

Determinantsofpriceelasticity:

correspondingtothemidpointofthedemandcurve.

substitutionpossibilities(+)

-Ifdemandiselastic,apriceincreasewillreducethetotalexpenditure.A budgetshare(+)

pricereductionwillincreasetotalexpenditure. time(+)

- If inelastic, a price increase will increase total expenditure. A price

Atthecommonpointdemand,itislesselasticforsteepercurve:

reductionwillreducetotalexpenditure.

Cross-price elasticity of demand:the percentage change in quantity

demanded of one good in response to a 1 percent change in the price ofanothergood.

-Substitutegoods:cross-priceelasticityofdemandispositive.(red/green apples?)

-complement goods: cross-price elasticity ofdemand is negative (pizza

The law of demand: peopledolessofwhattheywanttodoasthecostof dough/pizzasauce) doingitrises.

Income elasticity of demand is the percentage change in quantity

Utility (or benefit): thesatisfactionpeoplederivefromtheirconsumption

demandedinresponsetoa1percentchangeinincome activities

-normalgoods:incomeelasticityofdemandispositive

Marginal utility:the additional utility gained from consuming an

-inferiorgoods:incomeelasticityofdemandisnegative additionalunitofgood ∈ marginal utility= change utility

change∈consumption

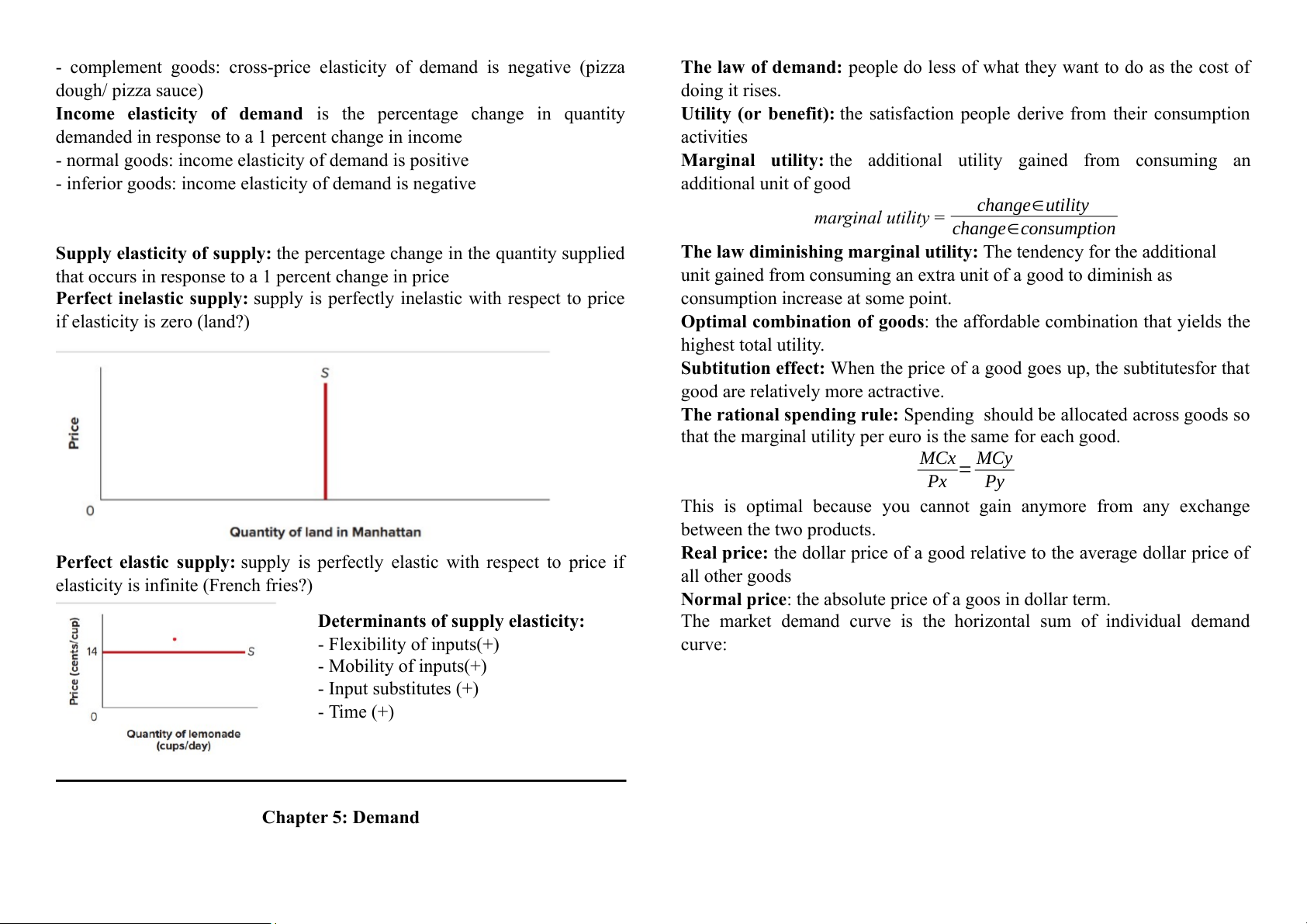

Supply elasticity of supply:thepercentagechangeinthequantitysupplied

The law diminishing marginal utility:Thetendencyfortheadditional

thatoccursinresponsetoa1percentchangeinprice

unitgainedfromconsuminganextraunitofagoodtodiminishas

Perfect inelastic supply:supplyisperfectlyinelasticwithrespecttoprice

consumptionincreaseatsomepoint.

ifelasticityiszero(land?)

Optimal combinationof goods:theaffordablecombinationthatyieldsthe highesttotalutility.

Subtitution effect:Whenthepriceofagoodgoesup,thesubtitutesforthat

goodarerelativelymoreactractive.

The rational spending rule:Spendingshouldbeallocatedacrossgoodsso

thatthemarginalutilitypereuroisthesameforeachgood. MCx MCy = Px Py

This is optimal because you cannot gain anymore from any exchange

betweenthetwoproducts.

Perfect elastic supply: supplyisperfectlyelasticwithrespecttopriceif

Real price:thedollarpriceofagoodrelativetotheaveragedollarpriceof

elasticityisinfinite(Frenchfries?) allothergoods

Normal price:theabsolutepriceofagoosindollarterm.

Determinants of supply elasticity:

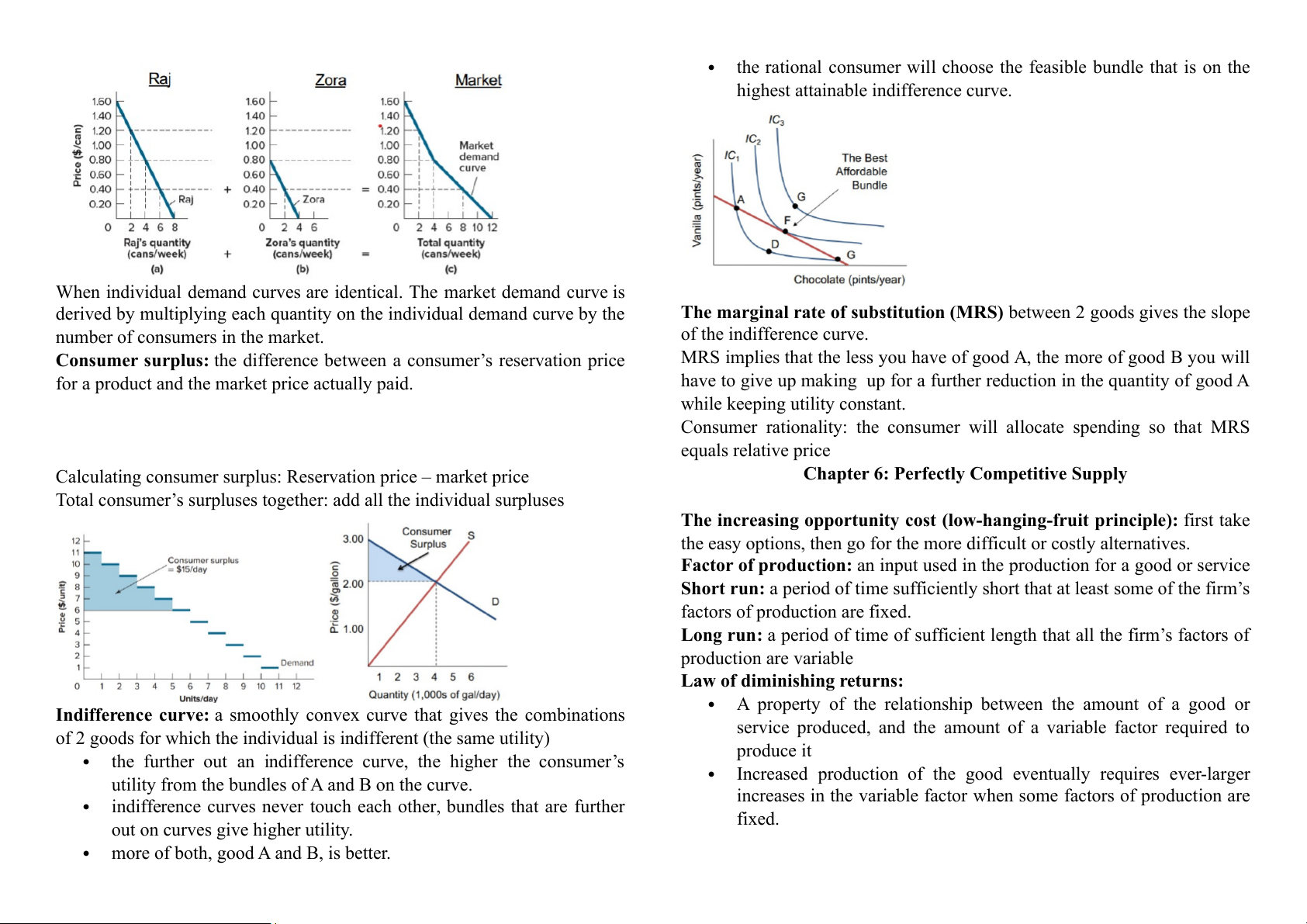

The market demand curve is the horizontal sum of individual demand

-Flexibilityofinputs(+) curve: -Mobilityofinputs(+) -Inputsubstitutes(+) -Time(+) Chapter 5: Demand

therationalconsumerwillchoosethefeasiblebundlethatisonthe

highestattainableindifferencecurve.

Whenindividualdemandcurvesareidentical.Themarketdemandcurveis

derivedbymultiplyingeachquantityontheindividualdemandcurvebythe

The marginal rate of substitution (MRS) between2goodsgivestheslope

numberofconsumersinthemarket.

oftheindifferencecurve.

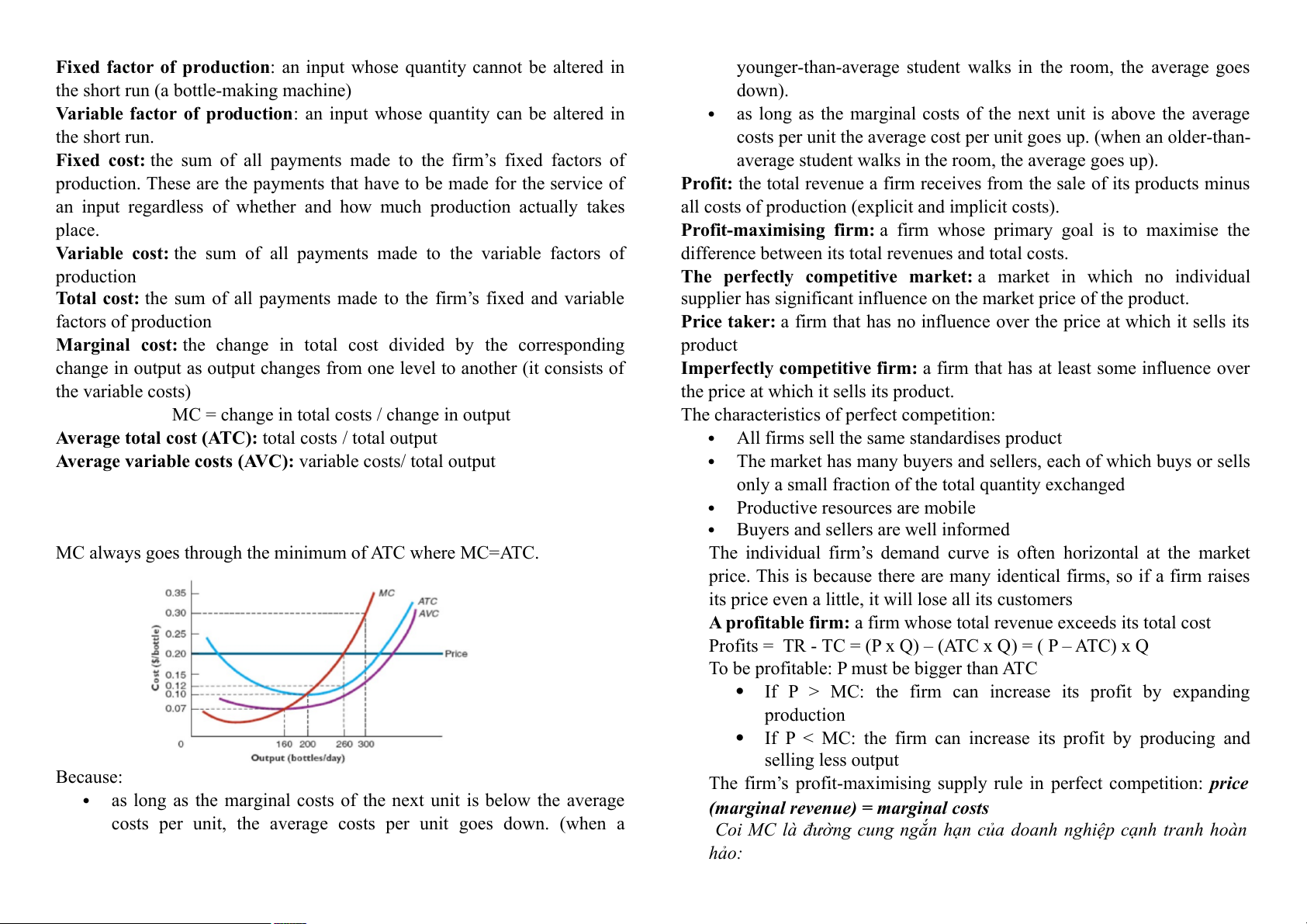

Consumer surplus:thedifferencebetweenaconsumer’sreservationprice

MRSimpliesthatthelessyouhaveofgoodA,themoreofgoodByouwill

foraproductandthemarketpriceactuallypaid.

havetogiveupmakingupforafurtherreductioninthequantityofgoodA

whilekeepingutilityconstant.

Consumer rationality: theconsumer willallocate spending sothat MRS equalsrelativeprice

Calculatingconsumersurplus:Reservationprice–marketprice

Chapter 6: Perfectly Competitive Supply

Totalconsumer’ssurplusestogether:addalltheindividualsurpluses

The increasing opportunity cost (low-hanging-fruit principle): firsttake

theeasyoptions,thengoforthemoredifficultorcostlyalternatives.

Factor of production:aninputusedintheproductionforagoodorservice

Short run: aperiodoftimesufficientlyshortthatatleastsomeofthefirm’s

factorsofproductionarefixed.

Long run:aperiodoftimeofsufficientlengththatallthefirm’sfactorsof productionarevariable

Law of diminishing returns:

Indifference curve:asmoothlyconvexcurvethatgivesthecombinations

Aproperty of therelationshipbetween the amount ofa good or

serviceproduced,andtheamountofavariablefactorrequiredto

of2goodsforwhichtheindividualisindifferent(thesameutility) produceit

the further out an indifference curve, the higher the consumer’s

utilityfromthebundlesofAandBonthecurve.

Increased production of the good eventually requires ever-larger

increasesinthevariablefactorwhensomefactorsofproductionare

indifferencecurvesnevertoucheachother,bundlesthatarefurther fixed.

outoncurvesgivehigherutility.

moreofboth,goodAandB,isbetter.

Fixed factor of production:aninputwhosequantitycannotbealteredin

younger-than-averagestudentwalksintheroom,theaveragegoes

theshortrun(abottle-makingmachine) down).

Variable factor of production:aninputwhosequantitycanbealteredin

aslongasthemarginalcostsofthenextunitisabovetheaverage theshortrun.

costsperunittheaveragecostperunitgoesup.(whenanolder-than-

Fixed cost:the sumofallpaymentsmadetothefirm’sfixedfactorsof

averagestudentwalksintheroom,theaveragegoesup).

production.Thesearethepaymentsthathavetobemadefortheserviceof

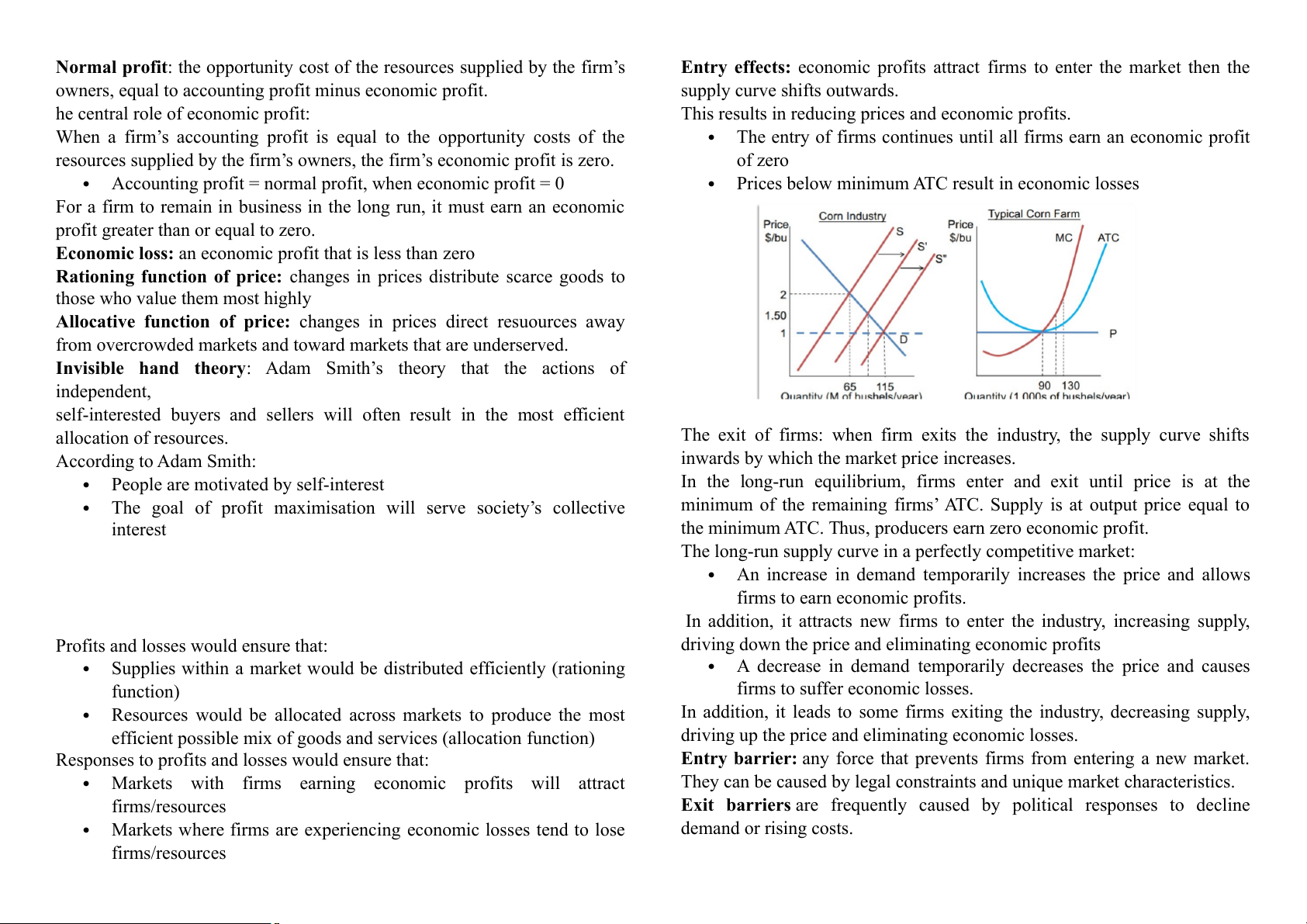

Profit:thetotalrevenueafirmreceivesfromthesaleofitsproductsminus

aninputregardless ofwhether andhowmuch productionactually takes

allcostsofproduction(explicitandimplicitcosts). place.

Profit-maximising firm:a firm whose primary goal isto maximise the

Variable cost:the sum of all payments made to the variable factors of

differencebetweenitstotalrevenuesandtotalcosts. production

The perfectly competitive market:a market in which no individual

Total cost:thesumofallpaymentsmadetothefirm’sfixedandvariable

supplierhassignificantinfluenceonthemarketpriceoftheproduct. factorsofproduction

Price taker:afirmthathasnoinfluenceoverthepriceatwhichitsellsits

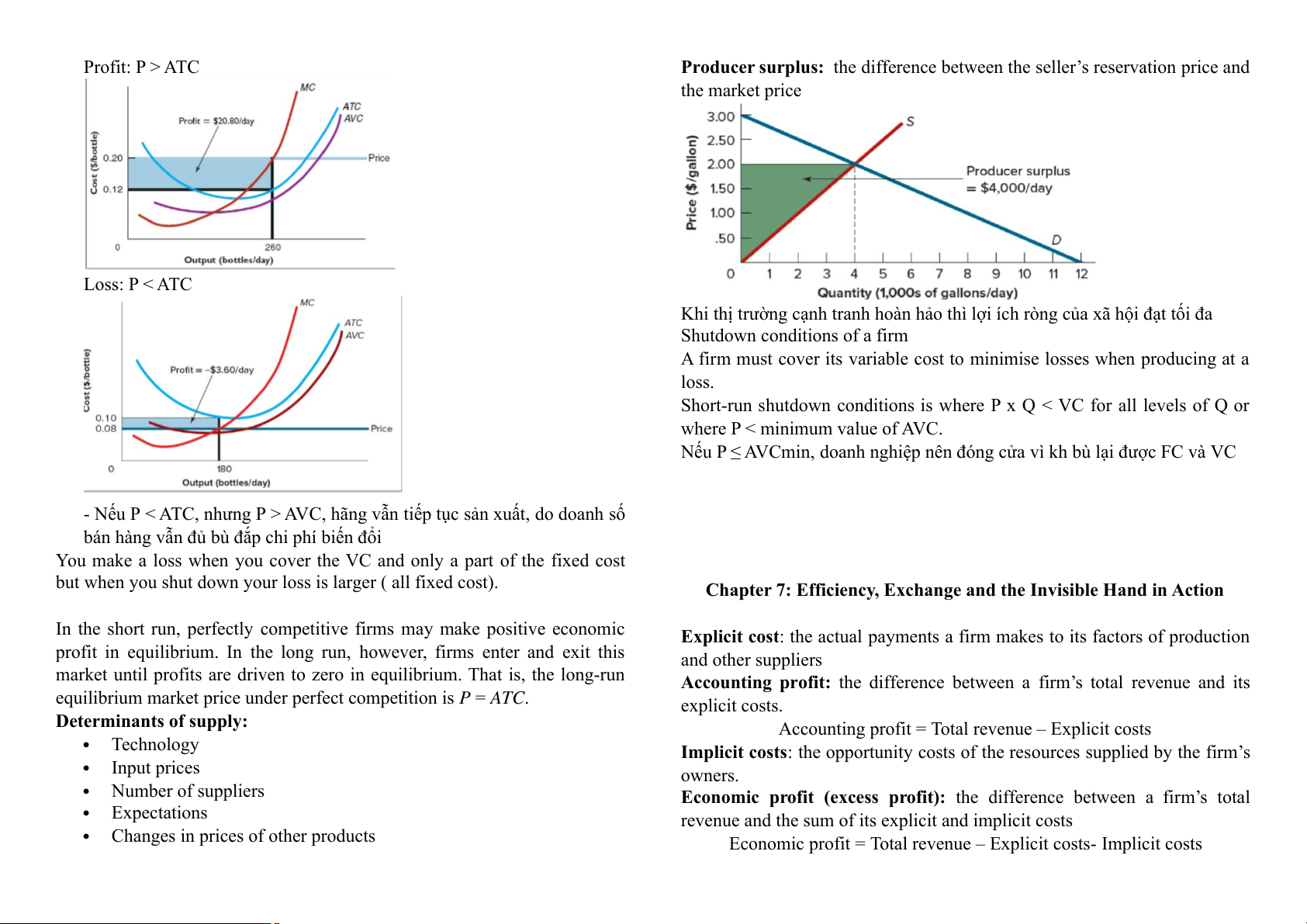

Marginal cost:the change in total cost divided by the corresponding product

changeinoutputasoutputchangesfromoneleveltoanother(itconsistsof

Imperfectly competitive firm:afirmthathasatleastsomeinfluenceover thevariablecosts)

thepriceatwhichitsellsitsproduct.

MC=changeintotalcosts/changeinoutput

Thecharacteristicsofperfectcompetition:

Average total cost (ATC):totalcosts/totaloutput

Allfirmssellthesamestandardisesproduct

Average variable costs (AVC):variablecosts/totaloutput

Themarkethasmanybuyersandsellers,eachofwhichbuysorsells

onlyasmallfractionofthetotalquantityexchanged

Productiveresourcesaremobile

Buyersandsellersarewellinformed

MCalwaysgoesthroughtheminimumofATCwhereMC=ATC.

Theindividualfirm’sdemandcurveisoftenhorizontalatthemarket

price.Thisisbecausetherearemanyidenticalfirms,soifafirmraises

itspriceevenalittle,itwillloseallitscustomers

A profitable firm:afirmwhosetotalrevenueexceedsitstotalcost

Profits=TR-TC=(PxQ)–(ATCxQ)=(P–ATC)xQ

Tobeprofitable:PmustbebiggerthanATC

If P > MC: the firm can increase its profit by expanding production

IfP<MC: the firm can increaseitsprofitbyproducingand sellinglessoutput Because:

Thefirm’sprofit-maximisingsupplyruleinperfectcompetition: price

aslongasthemarginalcostsofthenextunitisbelowtheaverage

(marginal revenue) = marginal costs

costs per unit, the average costs per unit goes down. (when a

Coi MC là đường cung ngắn hạn của doanh nghiệp cạnh tranh hoàn hảo: Profit:P>ATC

Producer surplus: thedifferencebetweentheseller’sreservationpriceand themarketprice Loss:P<ATC

Khithịtrườngcạnhtranhhoànhảothìlợiíchròngcủaxãhộiđạttốiđa

Shutdownconditionsofafirm

Afirmmustcoveritsvariablecosttominimiselosseswhenproducingata loss.

Short-runshutdownconditionsiswherePxQ<VCforalllevelsofQor

whereP<minimumvalueofAVC.

NếuP≤AVCmin,doanhnghiệpnênđóngcửavìkhbùlạiđượcFCvàVC

-NếuP<ATC,nhưngP>AVC,hãngvẫntiếptụcsảnxuất,dodoanhsố

bánhàngvẫnđủbùđắpchiphíbiếnđổi

YoumakealosswhenyoucovertheVCandonlyapartofthefixedcost

butwhenyoushutdownyourlossislarger(allfixedcost).

Chapter 7: Efficiency, Exchange and the Invisible Hand in Action

Intheshortrun,perfectlycompetitivefirmsmaymakepositiveeconomic

Explicit cost:theactualpaymentsafirmmakestoitsfactorsofproduction

profitinequilibrium.Inthelongrun,however,firmsenterandexitthis andothersuppliers

marketuntilprofitsaredriventozeroinequilibrium.Thatis,thelong-run

Accounting profit: thedifferencebetweenafirm’stotalrevenueandits

equilibriummarketpriceunderperfectcompetitionis𝑃 =𝐴𝑇𝐶. explicitcosts. Determinants of supply:

Accountingprofit=Totalrevenue–Explicitcosts Technology

Implicit costs:theopportunitycostsoftheresourcessuppliedbythefirm’s Inputprices owners. Numberofsuppliers

Economic profit (excess profit): the difference between a firm’s total Expectations

revenueandthesumofitsexplicitandimplicitcosts

Changesinpricesofotherproducts

Economicprofit=Totalrevenue–Explicitcosts-Implicitcosts

Normal profit:theopportunitycostoftheresourcessuppliedbythefirm’s

Entry effects: economicprofitsattractfirmstoenterthemarketthenthe

owners,equaltoaccountingprofitminuseconomicprofit.

supplycurveshiftsoutwards.

hecentralroleofeconomicprofit:

Thisresultsinreducingpricesandeconomicprofits.

Whenafirm’saccountingprofitisequaltotheopportunitycostsofthe

Theentryoffirmscontinuesuntilallfirmsearnaneconomicprofit

resourcessuppliedbythefirm’sowners,thefirm’seconomicprofitiszero. ofzero

Accountingprofit=normalprofit,wheneconomicprofit=0

PricesbelowminimumATCresultineconomiclosses

Forafirmtoremaininbusinessinthelongrun,itmustearnaneconomic

profitgreaterthanorequaltozero.

Economic loss:aneconomicprofitthatislessthanzero

Rationing function of price: changesinpricesdistributescarcegoodsto

thosewhovaluethemmosthighly

Allocative function of price: changes in prices direct resuources away

fromovercrowdedmarketsandtowardmarketsthatareunderserved.

Invisible hand theory: Adam Smith’s theory that the actions of independent,

self-interested buyers and sellers will often result in the most efficient allocationofresources.

Theexit of firms: whenfirm exits the industry, the supply curveshifts AccordingtoAdamSmith:

inwardsbywhichthemarketpriceincreases.

Peoplearemotivatedbyself-interest

In the long-run equilibrium, firms enter and exit until price is at the

The goal of profit maximisation will serve society’s collective

minimumoftheremainingfirms’ATC.Supplyisatoutputpriceequalto interest

theminimumATC.Thus,producersearnzeroeconomicprofit.

Thelong-runsupplycurveinaperfectlycompetitivemarket:

Anincreaseindemandtemporarilyincreasesthepriceandallows

firmstoearneconomicprofits.

Inaddition,itattractsnewfirmstoentertheindustry,increasingsupply,

Profitsandlosseswouldensurethat:

drivingdownthepriceandeliminatingeconomicprofits

Supplieswithinamarketwouldbedistributedefficiently(rationing

Adecreaseindemandtemporarilydecreasesthepriceandcauses function)

firmstosuffereconomiclosses.

Resourceswouldbeallocatedacrossmarketstoproducethemost

Inaddition,itleadstosomefirmsexitingtheindustry,decreasingsupply,

efficientpossiblemixofgoodsandservices(allocationfunction)

drivingupthepriceandeliminatingeconomiclosses.

Responsestoprofitsandlosseswouldensurethat:

Entry barrier: anyforcethatpreventsfirmsfromenteringanewmarket.

Markets with firms earning economic profits will attract

Theycanbecausedbylegalconstraintsanduniquemarketcharacteristics. firms/resources

Exit barriersare frequently caused by political responses to decline

Marketswherefirmsareexperiencingeconomiclossestendtolose demandorrisingcosts. firms/resources

Efficiency (Pareto efficeiency):asituationwherenofurthertransactionis

possiblethatwillhelpsomewithoutharmingpeople.

Deadweight loss:thereductionintotaleconomicsurplusthatresultsfrom

theadoptionofapolicy

Observationonefficiency:whenthepriceisaboveorbelowtheequilibrium

price,thequantityexchangedwillbelower thanthemarketequilibrium quantity. Cost-saving innovations: Intheshortrun:

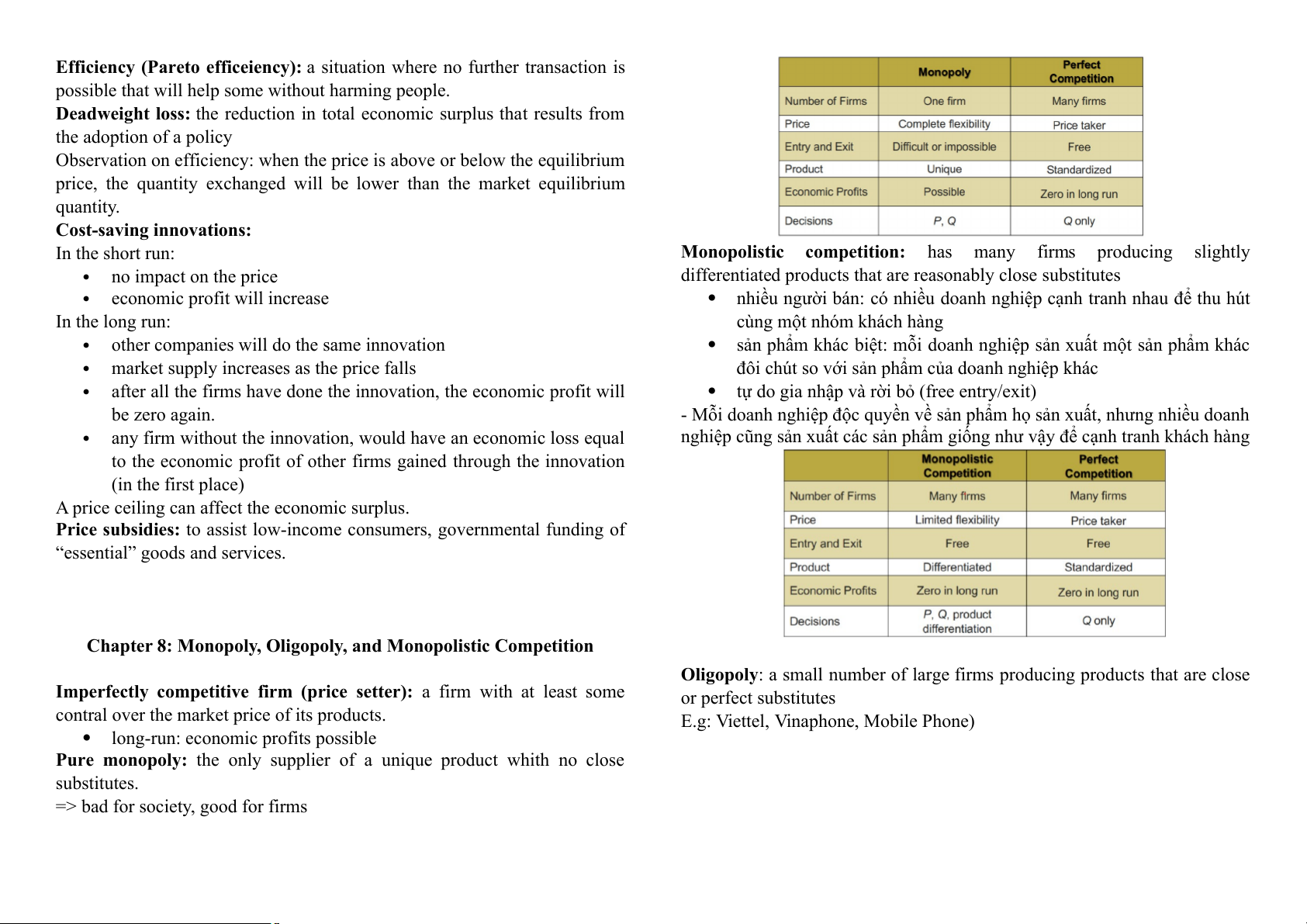

Monopolistic competition: has many firms producing slightly noimpactontheprice

differentiatedproductsthatarereasonablyclosesubstitutes

economicprofitwillincrease

nhiềungườibán:cónhiềudoanhnghiệpcạnhtranhnhauđểthuhút Inthelongrun:

cùngmộtnhómkháchhàng

othercompanieswilldothesameinnovation

sảnphẩmkhácbiệt:mỗidoanhnghiệpsảnxuấtmộtsảnphẩmkhác

marketsupplyincreasesasthepricefalls

đôichútsovớisảnphẩmcủadoanhnghiệpkhác

afterallthefirmshavedonetheinnovation,theeconomicprofitwill

tựdogianhậpvàrờibỏ(freeentry/exit) bezeroagain.

-Mỗidoanhnghiệpđộcquyềnvềsảnphẩmhọsảnxuất,nhưngnhiềudoanh

anyfirmwithouttheinnovation,wouldhaveaneconomiclossequal

nghiệpcũngsảnxuấtcácsảnphẩmgiốngnhưvậyđểcạnhtranhkháchhàng

totheeconomicprofitofotherfirmsgainedthroughtheinnovation (inthefirstplace)

Apriceceilingcanaffecttheeconomicsurplus.

Price subsidies:toassistlow-incomeconsumers,governmentalfundingof

“essential”goodsandservices.

Chapter 8: Monopoly, Oligopoly, and Monopolistic Competition

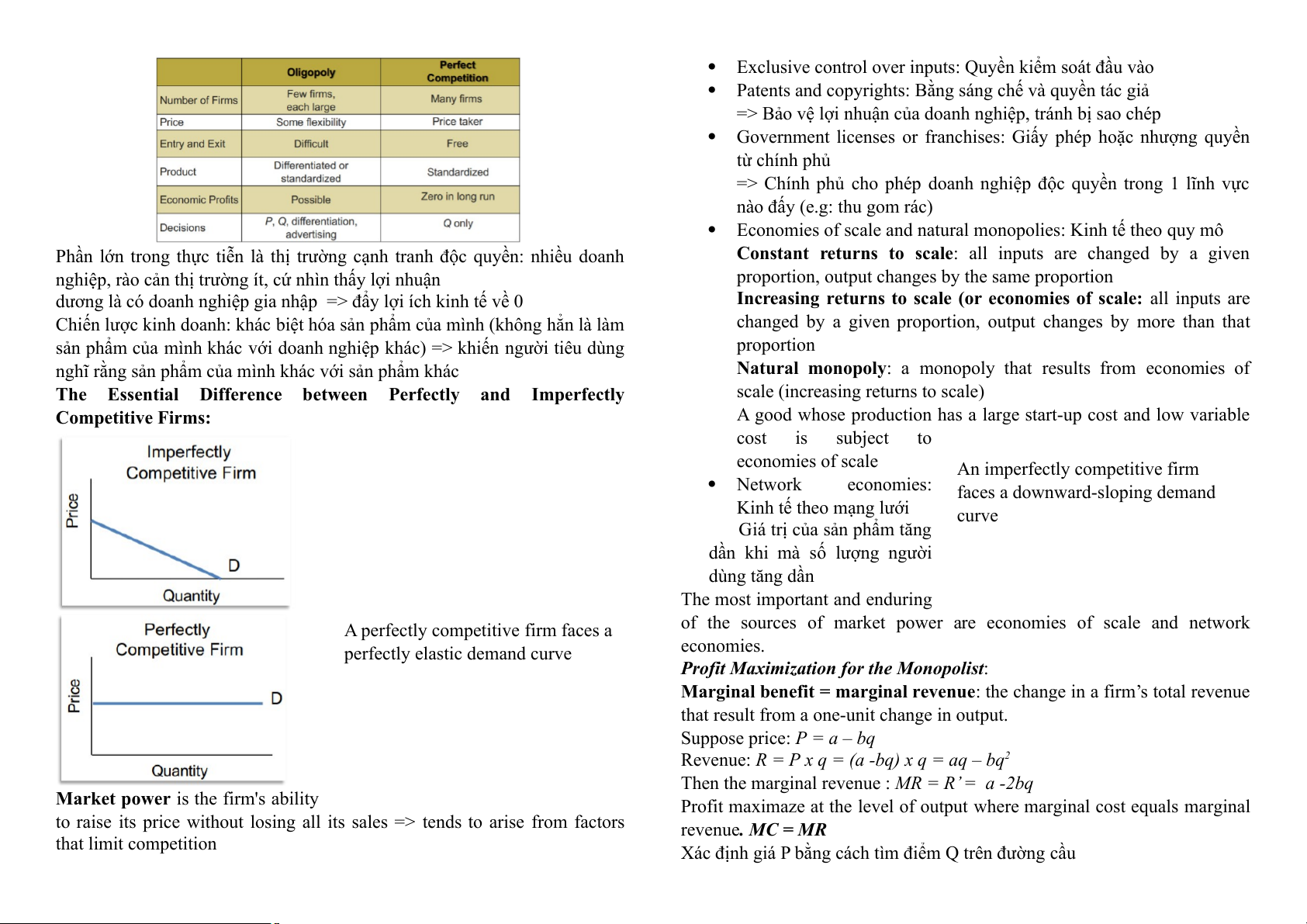

Oligopoly:asmallnumberoflargefirmsproducingproductsthatareclose

Imperfectly competitive firm (price setter): a firm withat leastsome orperfectsubstitutes

contraloverthemarketpriceofitsproducts.

E.g:Viettel,Vinaphone,MobilePhone)

long-run:economicprofitspossible

Pure monopoly: the only supplier of a unique product whith no close substitutes.

=>badforsociety,goodforfirms

Exclusivecontroloverinputs:Quyềnkiểmsoátđầuvào

Patentsandcopyrights:Bằngsángchếvàquyềntácgiả

=>Bảovệlợinhuậncủadoanhnghiệp,tránhbịsaochép

Governmentlicensesorfranchises:Giấyphéphoặcnhượngquyền từchínhphủ

=>Chínhphủchophépdoanhnghiệpđộcquyềntrong1lĩnhvực

nàođấy(e.g:thugomrác)

Economiesofscaleandnaturalmonopolies:Kinhtếtheoquymô

Phầnlớntrongthựctiễnlàthịtrườngcạnhtranhđộcquyền:nhiềudoanh

Constant returns to scale: all inputs are changed by a given

nghiệp,ràocảnthịtrườngít,cứnhìnthấylợinhuận

proportion,outputchangesbythesameproportion

dươnglàcódoanhnghiệpgianhập=>đẩylợiíchkinhtếvề0

Increasing returns to scale (or economies of scale:allinputsare

Chiếnlượckinhdoanh:khácbiệthóasảnphẩmcủamình(khônghẳnlàlàm

changedbyagivenproportion,outputchangesbymorethanthat

sảnphẩmcủamìnhkhácvớidoanhnghiệpkhác)=>khiếnngườitiêudùng proportion

nghĩrằngsảnphẩmcủamìnhkhácvớisảnphẩmkhác

Natural monopoly: a monopoly that results from economies of

The Essential Difference between Perfectly and Imperfectly

scale(increasingreturnstoscale) Competitive Firms:

Agoodwhoseproductionhasalargestart-upcostandlowvariable cost is subject to economiesofscale

Animperfectlycompetitivefirm Network economies:

facesadownward-slopingdemand

Kinhtếtheomạnglưới curve

Giátrịcủasảnphẩmtăng

dần khi mà số lượng người dùngtăngdần

Themostimportantandenduring

of the sources of market power are economies of scale and network

Aperfectlycompetitivefirmfacesa economies.

perfectlyelasticdemandcurve

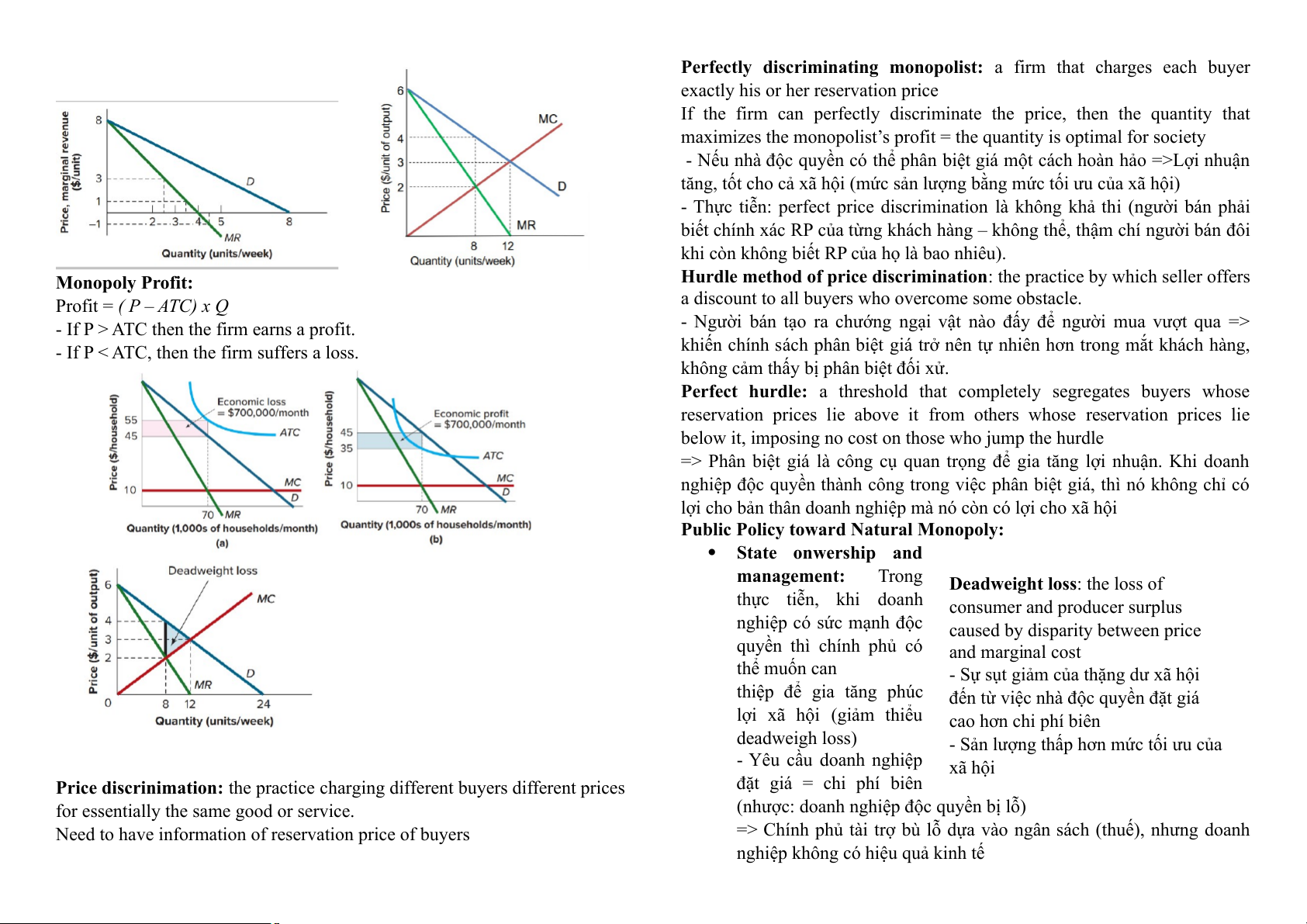

Profit Maximization for the Monopolist:

Marginal benefit = marginal revenue:thechangeinafirm’stotalrevenue

thatresultfromaone-unitchangeinoutput.

Supposeprice:P = a – bq

Revenue:R = P x q = (a -bq) x q = aq – bq 2

Thenthemarginalrevenue:MR = R’ = a -2bq

Market poweristhefirm'sability

Profitmaximazeatthelevelofoutputwheremarginalcostequalsmarginal

toraiseitspricewithoutlosingallitssales=>tendstoarisefromfactors revenue. MC = MR thatlimitcompetition

XácđịnhgiáPbằngcáchtìmđiểmQtrênđườngcầu

Perfectly discriminating monopolist: a firm that charges each buyer

exactlyhisorherreservationprice

If the firm can perfectly discriminate the price, then the quantity that

maximizesthemonopolist’sprofit=thequantityisoptimalforsociety

-Nếunhàđộcquyềncóthểphânbiệtgiámộtcáchhoànhảo=>Lợinhuận

tăng,tốtchocảxãhội(mứcsảnlượngbằngmứctốiưucủaxãhội)

-Thựctiễn:perfectpricediscriminationlàkhôngkhảthi(ngườibánphải

biếtchínhxácRPcủatừngkháchhàng–khôngthể,thậmchíngườibánđôi

khicònkhôngbiếtRPcủahọlàbaonhiêu). Monopoly Profit:

Hurdle method of price discrimination:thepracticebywhichselleroffers

Profit=( P – ATC) x Q

adiscounttoallbuyerswhoovercomesomeobstacle.

-IfP>ATCthenthefirmearnsaprofit.

-Ngườibántạorachướngngạivậtnàođấyđểngườimuavượtqua=>

-IfP<ATC,thenthefirmsuffersaloss.

khiếnchínhsáchphânbiệtgiátrởnêntựnhiênhơntrongmắtkháchhàng,

khôngcảmthấybịphânbiệtđốixử.

Perfect hurdle: a threshold that completely segregates buyers whose

reservation prices lie above it from others whose reservation prices lie

belowit,imposingnocostonthosewhojumpthehurdle

=>Phânbiệtgiálàcôngcụquantrọngđểgiatănglợinhuận.Khidoanh

nghiệpđộcquyềnthànhcôngtrongviệcphânbiệtgiá,thìnókhôngchỉcó

lợichobảnthândoanhnghiệpmànócòncólợichoxãhội

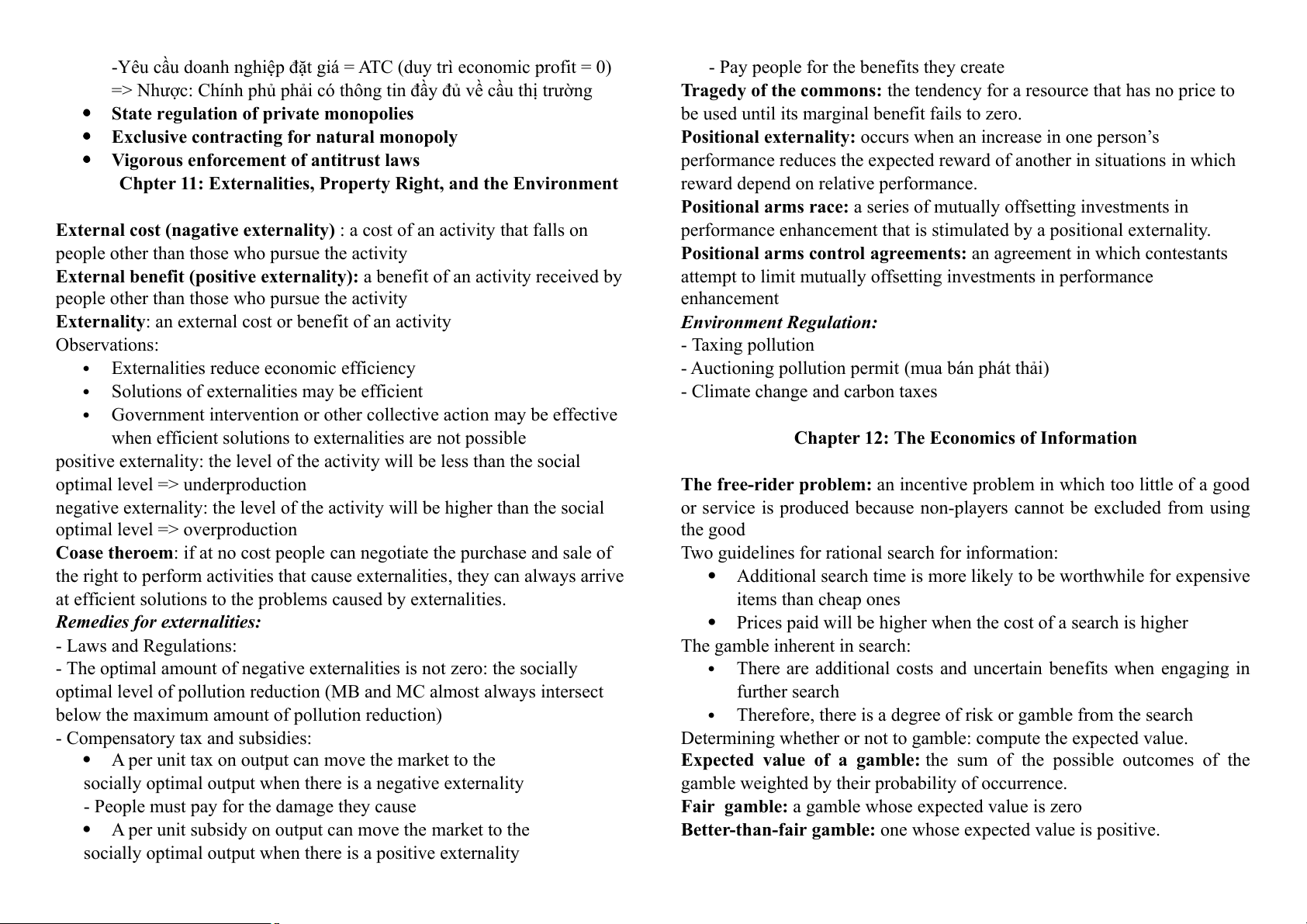

Public Policy toward Natural Monopoly: State onwership and management: Trong

Deadweight loss:thelossof

thực tiễn, khi doanh

consumerandproducersurplus

nghiệpcósứcmạnhđộc

causedbydisparitybetweenprice

quyềnthì chínhphủ có andmarginalcost thểmuốncan

-Sựsụtgiảmcủathặngdưxãhội

thiệp để gia tăng phúc

đếntừviệcnhàđộcquyềnđặtgiá

lợi xã hội (giảm thiểu

caohơnchiphíbiên deadweighloss)

-Sảnlượngthấphơnmứctốiưucủa

-Yêucầudoanhnghiệp xãhội

Price discrinimation:thepracticechargingdifferentbuyersdifferentprices

đặt giá = chi phí biên

foressentiallythesamegoodorservice.

(nhược:doanhnghiệpđộcquyềnbịlỗ)

Needtohaveinformationofreservationpriceofbuyers

=>Chínhphủtàitrợbùlỗdựavàongânsách(thuế),nhưngdoanh

nghiệpkhôngcóhiệuquảkinhtế

-Yêucầudoanhnghiệpđặtgiá=ATC(duytrìeconomicprofit=0)

-Paypeopleforthebenefitstheycreate

=>Nhược:Chínhphủphảicóthôngtinđầyđủvềcầuthịtrường

Tragedy of the commons:thetendencyforaresourcethathasnopriceto

State regulation of private monopolies

beuseduntilitsmarginalbenefitfailstozero.

Exclusive contracting for natural monopoly

Positional externality:occurswhenanincreaseinoneperson’s

Vigorous enforcement of antitrust laws

performancereducestheexpectedrewardofanotherinsituationsinwhich

Chpter 11: Externalities, Property Right, and the Environment

rewarddependonrelativeperformance.

Positional arms race:aseriesofmutuallyoffsettinginvestmentsin

External cost (nagative externality):acostofanactivitythatfallson

performanceenhancementthatisstimulatedbyapositionalexternality.

peopleotherthanthosewhopursuetheactivity

Positional arms control agreements:anagreementinwhichcontestants

External benefit (positive externality):abenefitofanactivityreceivedby

attempttolimitmutuallyoffsettinginvestmentsinperformance

peopleotherthanthosewhopursuetheactivity enhancement

Externality:anexternalcostorbenefitofanactivity

Environment Regulation: Observations: -Taxingpollution

Externalitiesreduceeconomicefficiency

-Auctioningpollutionpermit(muabánphátthải)

Solutionsofexternalitiesmaybeefficient

-Climatechangeandcarbontaxes

Governmentinterventionorothercollectiveactionmaybeeffective

whenefficientsolutionstoexternalitiesarenotpossible

Chapter 12: The Economics of Information

positiveexternality:theleveloftheactivitywillbelessthanthesocial

optimallevel=>underproduction

The free-rider problem: anincentiveprobleminwhichtoolittleofagood

negativeexternality:theleveloftheactivitywillbehigherthanthesocial

orserviceisproducedbecausenon-playerscannotbeexcludedfromusing

optimallevel=>overproduction thegood

Coase theroem:ifatnocostpeoplecannegotiatethepurchaseandsaleof

Twoguidelinesforrationalsearchforinformation:

therighttoperformactivitiesthatcauseexternalities,theycanalwaysarrive

Additionalsearchtimeismorelikelytobeworthwhileforexpensive

atefficientsolutionstotheproblemscausedbyexternalities. itemsthancheapones

Remedies for externalities:

Pricespaidwillbehigherwhenthecostofasearchishigher -LawsandRegulations:

Thegambleinherentinsearch:

-Theoptimalamountofnegativeexternalitiesisnotzero:thesocially

Thereareadditionalcostsanduncertainbenefitswhenengagingin

optimallevelofpollutionreduction(MBandMCalmostalwaysintersect furthersearch

belowthemaximumamountofpollutionreduction)

Therefore,thereisadegreeofriskorgamblefromthesearch

-Compensatorytaxandsubsidies:

Determiningwhetherornottogamble:computetheexpectedvalue.

Aperunittaxonoutputcanmovethemarkettothe

Expected value of a gamble:the sum of the possible outcomes of the

sociallyoptimaloutputwhenthereisanegativeexternality

gambleweightedbytheirprobabilityofoccurrence.

-Peoplemustpayforthedamagetheycause

Fair gamble:agamblewhoseexpectedvalueiszero

Aperunitsubsidyonoutputcanmovethemarkettothe

Better-than-fair gamble: onewhoseexpectedvalueispositive.

sociallyoptimaloutputwhenthereisapositiveexternality

Risk-neutral person:someonewhowouldbewillingto acceptanyfair

gamble(orbetterthanfairgamble)

Risk-averse person:someonewhowouldrefuseanyfairgamble.

Asymmetric information:where buyers and sellers are not equally

Chapter 14: Public Goods and Tax Policy

informedaboutthecharacteristicsofproductsorservices.

Lemons model:George Akerlof’s explanation of how asymmetric

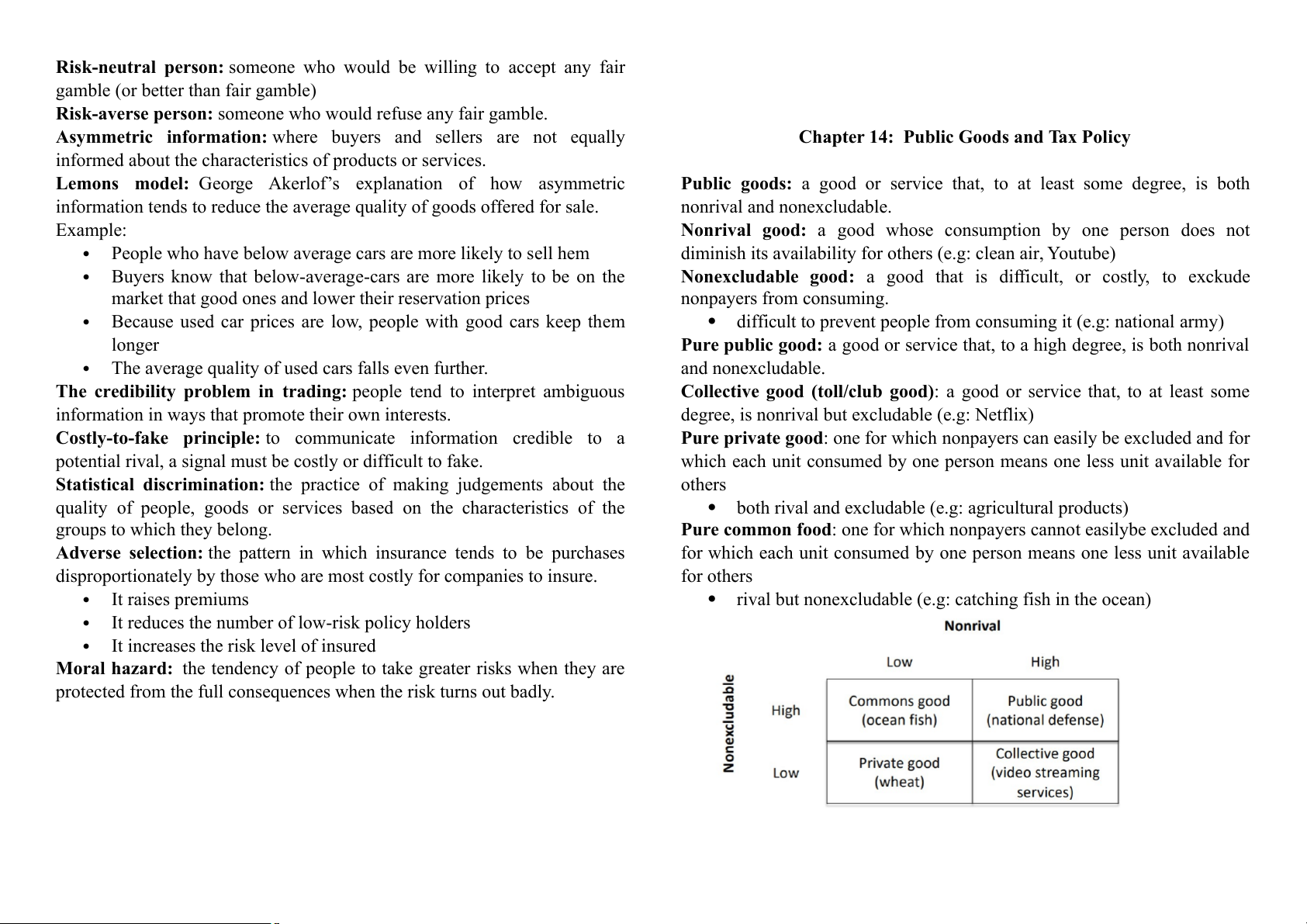

Public goods: a good or service that, to at least some degree, is both

informationtendstoreducetheaveragequalityofgoodsofferedforsale.

nonrivalandnonexcludable. Example:

Nonrival good: a good whose consumption by one person does not

Peoplewhohavebelowaveragecarsaremorelikelytosellhem

diminishitsavailabilityforothers(e.g:cleanair,Youtube)

Buyersknowthatbelow-average-carsaremorelikelytobeonthe

Nonexcludable good: a good that is difficult, or costly, to exckude

marketthatgoodonesandlowertheirreservationprices nonpayersfromconsuming.

Becauseusedcarpricesarelow,peoplewithgoodcarskeepthem

difficulttopreventpeoplefromconsumingit(e.g:nationalarmy) longer

Pure public good:agoodorservicethat,toahighdegree,isbothnonrival

Theaveragequalityofusedcarsfallsevenfurther. andnonexcludable.

The credibility problem in trading:peopletendtointerpretambiguous

Collective good (toll/club good):agoodorservicethat,toatleastsome

informationinwaysthatpromotetheirowninterests.

degree,isnonrivalbutexcludable(e.g:Netflix)

Costly-to-fake principle:to communicate information credible to a

Pure private good:oneforwhichnonpayerscaneasilybeexcludedandfor

potentialrival,asignalmustbecostlyordifficulttofake.

whicheachunitconsumedbyonepersonmeansonelessunitavailablefor

Statistical discrimination:the practice of making judgements about the others

quality ofpeople, goods or services based on the characteristics of the

bothrivalandexcludable(e.g:agriculturalproducts)

groupstowhichtheybelong.

Pure common food:oneforwhichnonpayerscannoteasilybeexcludedand

Adverse selection:thepatterninwhichinsurancetendsto bepurchases

forwhicheachunitconsumedbyonepersonmeansonelessunitavailable

disproportionatelybythosewhoaremostcostlyforcompaniestoinsure. forothers Itraisespremiums

rivalbutnonexcludable(e.g:catchingfishintheocean)

Itreducesthenumberoflow-riskpolicyholders

Itincreasestherisklevelofinsured

Moral hazard: thetendencyofpeopletotakegreaterriskswhentheyare

protectedfromthefullconsequenceswhentheriskturnsoutbadly.

Hànghóakhôngcótínhloạitrừ =>khôngmanglạidoanhthu,lợi

nhuậnchodoanhnghiệp=>doanhnghiệpkhôngcóđộnglựcđểcung

cấphànghóachoxãhội

Noteveryonebenefitsequallyformpublicgoodandservice=>taxingin

WLP=>don’tknowexactlyWLPofeveryone,andpeoplealsodon’tknow theirWLP

(Nhữngngườigiàuhơn,cảmnhậnrõrànghơnlợiíchcủapublicgood)

head tax (thuế đầu người):ataxthatcollectsthesameamountfromevery taxpayer

regressive tax (thuế lũy thoái):ataxunderwhichtheproportionofincome

paidintaxesdeclinesasincomerises

proportional income tax (thuế phần trăm thu nhập):oneunderwhichall

taxpayerspaythesameproportionofincomeintaxes

progressive tax (thuế lũy tiến): oneinwhichtheproportionofincome

paidintaxesrisesasincomerises

Public good demand curve: the vertical summation of the individual demandcurves.