Preview text:

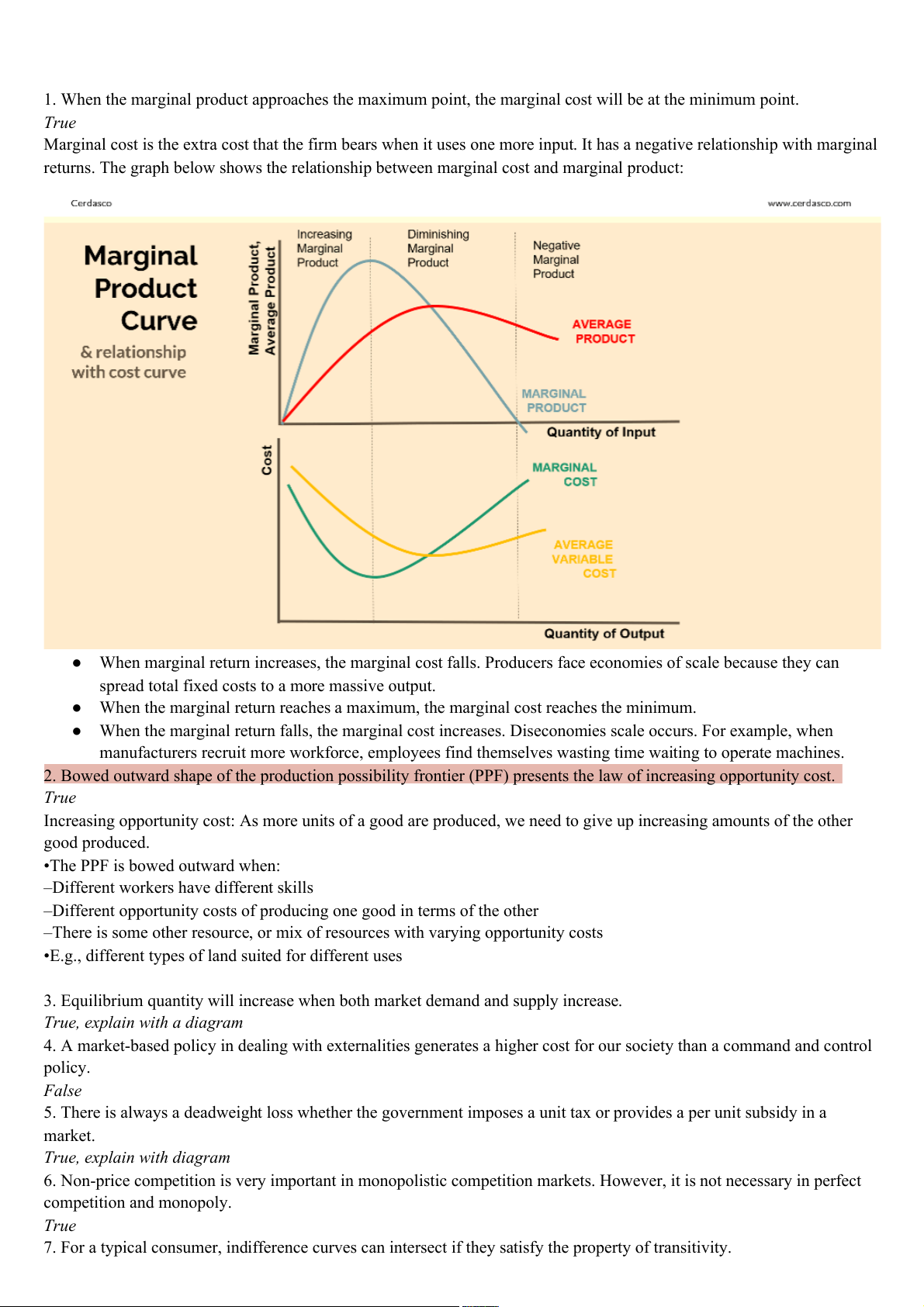

1. When the marginal product approaches the maximum point, the marginal cost will be at the minimum point. True

Marginal cost is the extra cost that the firm bears when it uses one more input. It has a negative relationship with marginal

returns. The graph below shows the relationship between marginal cost and marginal product: ●

When marginal return increases, the marginal cost falls. Producers face economies of scale because they can

spread total fixed costs to a more massive output. ●

When the marginal return reaches a maximum, the marginal cost reaches the minimum. ●

When the marginal return falls, the marginal cost increases. Diseconomies scale occurs. For example, when

manufacturers recruit more workforce, employees find themselves wasting time waiting to operate machines.

2. Bowed outward shape of the production possibility frontier (PPF) presents the law of increasing opportunity cost. True

Increasing opportunity cost: As more units of a good are produced, we need to give up increasing amounts of the other good produced.

•The PPF is bowed outward when:

–Different workers have different skills

–Different opportunity costs of producing one good in terms of the other

–There is some other resource, or mix of resources with varying opportunity costs

•E.g., different types of land suited for different uses

3. Equilibrium quantity will increase when both market demand and supply increase.

True, explain with a diagram

4. A market-based policy in dealing with externalities generates a higher cost for our society than a command and control policy. False

5. There is always a deadweight loss whether the government imposes a unit tax or provides a per unit subsidy in a market. True, explain with diagram

6. Non-price competition is very important in monopolistic competition markets. However, it is not necessary in perfect competition and monopoly. True

7. For a typical consumer, indifference curves can intersect if they satisfy the property of transitivity.

8. A decrease in the price of a product and an increase in the number of buyers in the market affect demand curve in the same general way. False.

The decrease in the price of a product only affects quantity demanded. Factor shift demand curve - Number of buyer - Taste - Expectation - Income - Prices of related goods

9. In competitive markets, firms that raise their price are typically rewarded with larger profit. False

10. A monopolist produces where P = MC = MR False

11. The government puts a price ceiling on the cost of a large pizza. Consumers will lose from this policy.

12. All goods, normal or inferior, satisfy the Law of Demand. False – Giffen goods are

special inferior goods. These Giffen goods do not satisfy the law of demand.

13. When the market price is greater than average variable cost but less than average total cost, a perfectly competitive

firm will continue its production even losing money.

14. A decrease in the price of a complement will shift the demand curve for a good to the left. False

15. In the short run, a competitive firm should exit the industry if its marginal cost exceeds its marginal revenue.

False, should decrease Q to raise profit.

16. A monopolist produces an output level where marginal revenue equals marginal cost and charges a price where

marginal cost equals average total cost.

False, charge a price on Demand curve at Q.

Chapter 8: Application of Tax

Chapter 10: Externalities

1. A Pigovian tax is shown in the supply-and-demand model as an upward shift of the demand curve.

2. Instituting a Pigovian tax will increase the equilibrium price and decrease the equilibrium quantity.

3. A tax on coal extracted from a coal mine is an example of an upstream tax.

4. An example of a nonuse benefit would be the welfare gain a person gets who visits a lake but doesn’t go swimming or boating.

5. The cost-of-illness method provides an upper-bound estimate to the true willingness to pay to avoid diseases.

6. Economists generally prefer revealed preference methods over other approaches to nonmarket valuation.

7. Contingent valuation has been criticized for producing willingness to pay estimates that tend to be exaggerated.

8. The higher the discount rate, the lower the present value of a future cost or benefit.

9 The main advantage of pollution standards is that they are cost effective.

10. When faced with a pollution tax, a firm will reduce its pollution as long as the marginal cost of pollution reduction is lower than the tax. Answer: 1. False 2. True 3. True 4. False 5. False 6. True 7. True 8. True 9. False 10. True

11. A positive externality is an external benefit that accrues to the buyers in a market while a negative externality is

an external cost that accrues to the sellers in a market. - F

12. If a market generates a negative externality, the social cost curve is above the supply curve (private cost curve). - T

13. If a market generates a positive externality, the social value curve is above the demand curve (private value curve). - T

14. A market that generates a negative externality that has not been internalized generates an equilibrium quantity

that is less than the optimal quantity. - F

15. If a market generates a negative externality, a Pigovian tax will move the market toward a more efficient outcome. - T

16. According to the Coase theorem, an externality always requires government intervention in order to internalize the externality. - F

17. To reduce pollution by some targeted amount, it is most efficient if each firm that pollutes reduces its pollution by an equal amount. - F

18. When a group of neighbors ask a householder to tidy his front garden because they keep their own gardens tidy

and attractive, they are attempting to use moral codes and social sanctions to internalize the externality associated

with an untidy garden in a residential area. - T

19. A tax always makes a market less efficient. - F

20. If Roberto values smoking in a restaurant at €10 and Natalie values clean air while she eats at €15, according to

the Coase theorem, Roberto will not smoke in the restaurant only if Natalie owns the right to clean air. - F

21. If transaction costs exceed the potential gains from an agreement between affected parties to an externality, there

will be no private solution to the externality. - T

22. A Pigovian tax sets the price of pollution while tradable pollution permits sets the quantity of pollution. - T

23. An advantage of using tradable pollution permits to reduce pollution is that the regulator need not know anything

about the demand for pollution rights. - T

24. The majority of economists do not like the idea of putting a price on polluting the environment. - F

25. For any given demand curve for pollution, a regulator can achieve the same level of pollution with either a

Pigovian tax or by allocating tradable pollution permits. - T

Chapter 13: Cost of production

1. Economists normally assume that people start their own businesses to help society maximize its income. - FALSE

2. When economists speak of a firm's costs, they are usually excluding the opportunity costs. - FALSE

3. Implicit costs are costs that do not require an outlay of money by the firm. - TRUE

4. Accountants keep track of the money that flows into and out of firms. - TRUE

5. Accountants often ignore implicit costs. - TRUE

6. When trying to understand the decision making process of different firms, economists assume that people think at the margin. - TRUE

7. The shape of the total cost curve is unrelated to the shape of the production function. - FALSE

8. Diminishing marginal product exists when the total cost curve becomes flatter as output increases. - FALSE

9. Diminishing marginal product exists when the production function becomes flatter as inputs increase. - TRUE

10. Fixed costs are incurred even when a firm does not produce anything. - TRUE

11. Variable costs usually change as the firm alters the quantity of output produced. - TRUE

12. Variable costs equal fixed costs when nothing is produced. - FALSE

13. The cost of producing an additional unit of a good is not the same as the average cost of the good. - TRUE

14. Average variable cost is equal to total variable cost divided by quantity of output. - TRUE

15. The average total cost curve is unaffected by diminishing marginal product. - FALSE

16. The average total cost curve reflects the shape of both the average fixed cost and average variable cost curves. - TRUE

17. If the marginal cost curve is rising, so is the average total cost curve. - FALSE

18. The marginal cost curve intersects the average total cost curve at the minimum point of the average total cost curve. - TRUE

19. Assume Jack received all A's in his classes last semester. If Jack gets all C's in his classes this semester, his GPA may or may not fall. - TRUE

20. A second or third worker may have a higher marginal product than the first worker in certain circumstances. - TRUE

21. Average total cost and marginal cost are merely ways to express information that is already contained in a firm's total cost. - TRUE

22. Average total cost reveals how much total cost will change as the firm alters its level of production. - FALSE

23. The shape of the marginal cost curve tells a producer something about the marginal product of her workers. - TRUE

24. When average total cost rises if a producer either increases or decreases production, then the firm is said to be

operating at an efficient scale. - TRUE

25. In the long run, a factory is usually considered a fixed input. - FALSE

26. Fixed costs are those costs that remain fixed no matter how long the time horizon is. - FALSE

27. As a firm moves along its long-run average cost curve, it is adjusting the size of its factory to the quantity of production. - TRUE

28. Because of the greater flexibility that firms have in the long run, all short-run cost curves lie on or above the long- run curve. - TRUE

29. Diseconomies of scale often arise because higher production levels allow specialization among workers. - FALSE

30. The fact that many decisions are fixed in the short run but variable in the long run has little impact on the firm's cost curves. - FALSE

31. In some cases, specialization allows larger factories to produce goods at a lower average cost than smaller factories. - TRUE

32. The use of specialization to achieve economies of scale is one reason modern societies are as prosperous as they are. - TRUE

Chapter 14: Firms in competitive market

1. The only requirement for a market to be perfectly competitive is for the market to have many buyers and sellers

(T/F) - False. The goods offered for sale are largely the same and possibly firms can freely enter or exit the

marketFor a competitive firm, marginal revenue equals the price of the good it sells (T/F) - True

2. If a competitive firm sells three times the amount of output, its total revenue also increase by a factor of three (T/F) - True

3. A firms maximizes profit when it produces output up to the point where marginal cost equals marginal revenue (T/F) - True

4. If marginal cost exceeds marginal revenue at a firm's current level of output, the firm can increase profit if it

increases its level of output (T/F) - False. The firm increases profits if it reduces output.

5. A competitive firm's short run supply curve is the portion of its marginal cost curve that lies above its average

total cost curve (T/F) - False. It's the portion of the MC curve that lies above the average variable cost curve

6. A competitive firm's long run supply curve is the portion of its marginal cost curve the total above its average

variable cost curve (T/F) - False. It's the portion of the MC curve that lies above the total variable cost curve

7. In the short run if the price a firm receives for a good is above its average variable cost but below its average total

cost of production the firm will temporarily shut down (T/F) - False. The firm will continue to operate in the short

run as long as the price exceeds average variable costs

8. In a competitive market, both buyers and sellers are price takers (T/F) - True

9. In the long run, if the price the firm receives for their output is below their average total costs off reduction, some

firms will exit the market (T/F) - True

10. In the short run, the market supply curve for a good is the sum of the quantities supplied by each firm at each price (T/F) - True

11. The short run market supply curve is more elastic than the long run market supply curve (T/F) - False. The long

run market supply curve is more elastic than the short run market supply curve

12. In the long run, perfectly competitive firms earn small but positive economic profits (T/F) - False. They earn zero

economic profits in the long run

13. In the long run, if firms are identical and there is free entry and exit in the market, all firms in the market operate

at their efficient scale (T/F) - True

14. If the price of a good rises above the minimum average total cost of production, positive economic profits will

cause new firms to enter the market, which drives the price back down to the minimum average total cost of production (T/F) - True

Chapter 15: Monopoly

1. A monopoly with a more elastic demand curve will have more market power

2. Monopolistic competition is a market structure characterized by many small firms selling a homogeneous product. - F

3. Monopolistic competitors in long-run equilibrium will generally find that they are earning economic profits. - F

4. By differentiating their products and promoting brand name loyalty, monopolistically competitive firms can raise

prices without losing all their customers. - T

Chapter 16: Monopolistic Competition

1. In the short run, monopolistic competitive firm behaves like a monopoly

2. In monopolistic competition all firms produce exactly the same product

3. Like a competitive firm, a monopolistically competitive firm makes a zero economic profit in the long run

4. A monopoly and a monopolistically competitive firm both result in a deadweight loss

5. Monopoly and monopolistic competition result in average total cost above the minimum.

6. In the long run, firms exit a monopolistically competitive industry when other firms enter

7. In monopolistic competition price equals marginal costs

8. The deadweight loss and excess costs can be viewed as the price of product variety

9. Many firms, homogenous product, free entry – are characteristic of monopolistic competition

10. In monopolistic competition, if there are profits, firms enter an industry shifting the demand and marginal revenues curves to the left.

Chapter 16 17: Oligopoly

1. Monopolistic competition is characterized by many buyers and sellers, product differentiation, and barriers to entry.

2. A monopolistically competitive market is characterized by barriers to entry.

3. The market for wheat is most likely considered a monopolistically competitive market

4. Oligopoly is characterized by a few sellers offering similar products, whereas monopolistic competition is

characterized by many sellers offering differentiated products.

5. To be considered an oligopoly, the market must have a concentration ratio below 50%.

6. Monopolistic competition and monopoly are examples of a market structure called imperfect competition.

7. Monopolistic competition is characterized by a few sellers offering similar products, whereas oligopoly is

characterized by many sellers offering differentiated products.

8. A profit-maximizing firm in a monopolistically competitive market can earn positive, negative, or zero profits in the short run.

9. When a firm in a monopolistically competitive market earns zero economic profit, its product price must equal marginal cost.

10. In a long-run equilibrium, firms in both perfectly competitive markets and monopolistically competitive markets

produce a quantity below the efficient scale of production.

11. When all firms choose their best strategy given the strategies that all the other firms have chosen, the result is a Nash equilibrium.

12. If two players engaged in a prisoner's dilemma game are likely to repeat the game, they are more likely to

cooperate than if they play the game only once.

13. For a firm, strategic interactions with other firms in the market become more important as the number of firms in the market becomes larger.

14. False - In monopolistic competition, profits in the long run can be positive.

15. True - In monopolistic competition, profits in the long run are zero because of competition and high advertising expenses.

16. False - In oligopoly, products are differentiated, whereas in monopolistic competition, products may or may not be differentiated.

17. True - A firm may start in monopolistic competition and end in oligopoly.

18. True - Duopoly is a form of oligopoly.

19. True - In oligopoly with homogeneous products, firms continuously lower costs to gain market share until they reach cost.

20. False - The only outcome in oligopoly with homogeneous products is long run profits = 0.

21. True - Collusion is illegal under all antitrust legislation.

22. False - Even if products are differentiated, firms cannot charge higher prices because they will lose market share.

23. False - If Coke raises its price, it will lose all sales to Pepsi.

24. True - Collusion is illegal all over the world.

25. True - Firms in monopolistic competition can expect to earn profits in the short run, but not in the long run.

26. True - In monopolistic competition, economic profits decrease as more firms enter the market.

27. False - The higher the HHI, the less concentrated the industry.

28. True - FTC can block mergers and acquisitions if it believes it will have an impact on competition.

29. False - On the HHI, the closer you get to 1000, the closer you get to monopoly. Factors shift supply curve: - Input price - Number of seller - Expectation - Technology

Income elasticity of demand: Change in quantity demanded for good, divided by change in income Normal good>0 Inferior good<0

Cross-price elasticity of demand: Change in quantity demanded for the first good, to change in the price of the second good Substitute > 0 Complement < 0

Tax incidence heavier for who is more inelastic More elastic cause more DWL