Preview text:

Assignment4

Ex1: How can you use the theory of ‘’Supply, Demand – and elasticity’’ to explain the case (by using graphs)?

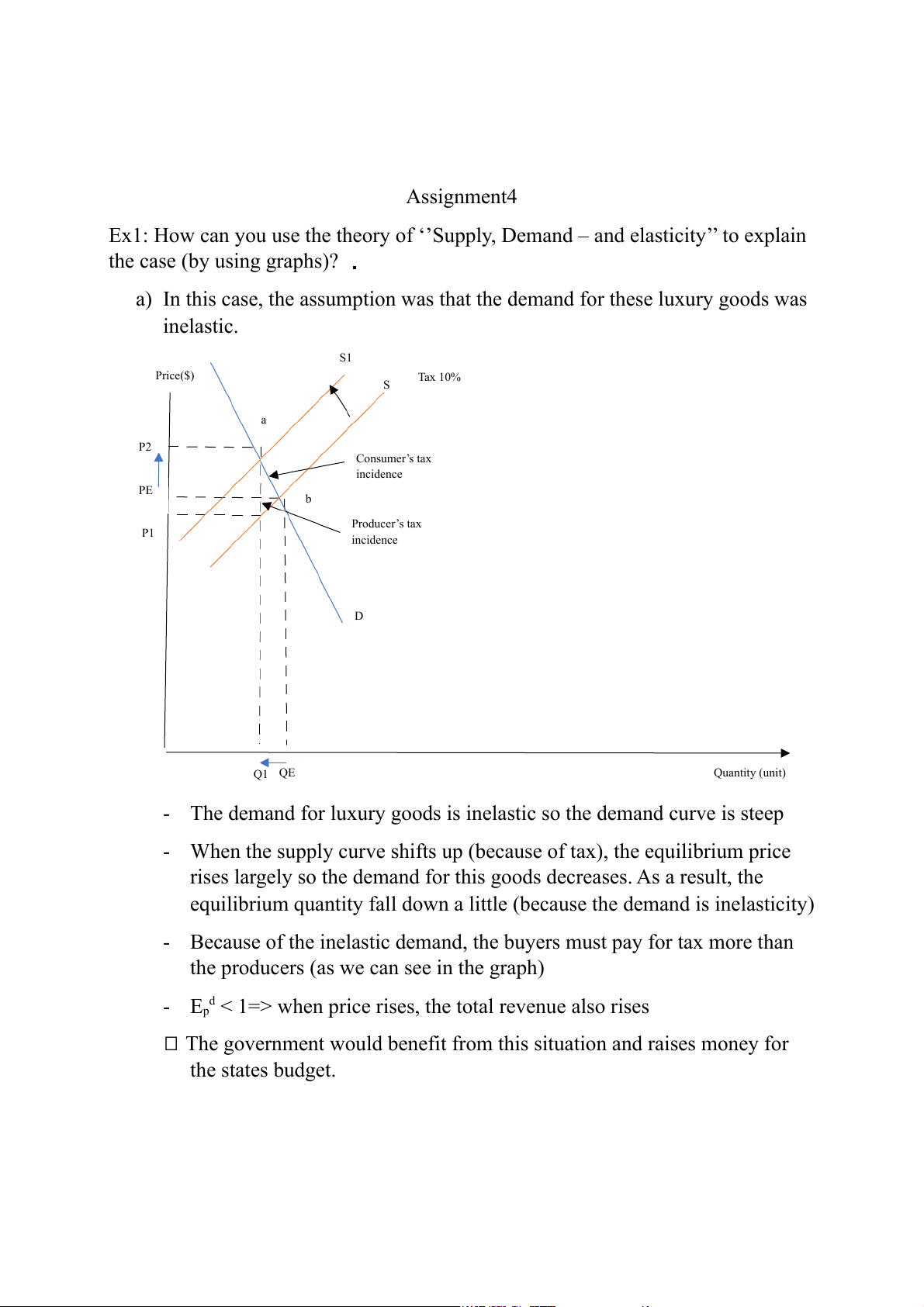

a) In this case, the assumption was that the demand for these luxury goods was inelastic. S1 Price($) Tax 10% S a P2 Consumer’s tax incidence PE b Producer’s tax P1 incidence D Q1 QE Quantity (unit)

- The demand for luxury goods is inelastic so the demand curve is steep

- When the supply curve shifts up (because of tax), the equilibrium price

rises largely so the demand for this goods decreases. As a result, the

equilibrium quantity fall down a little (because the demand is inelasticity)

- Because of the inelastic demand, the buyers must pay for tax more than

the producers (as we can see in the graph) - E d

p < 1=> when price rises, the total revenue also rises

The government would benefit from this situation and raises money for the states budget.

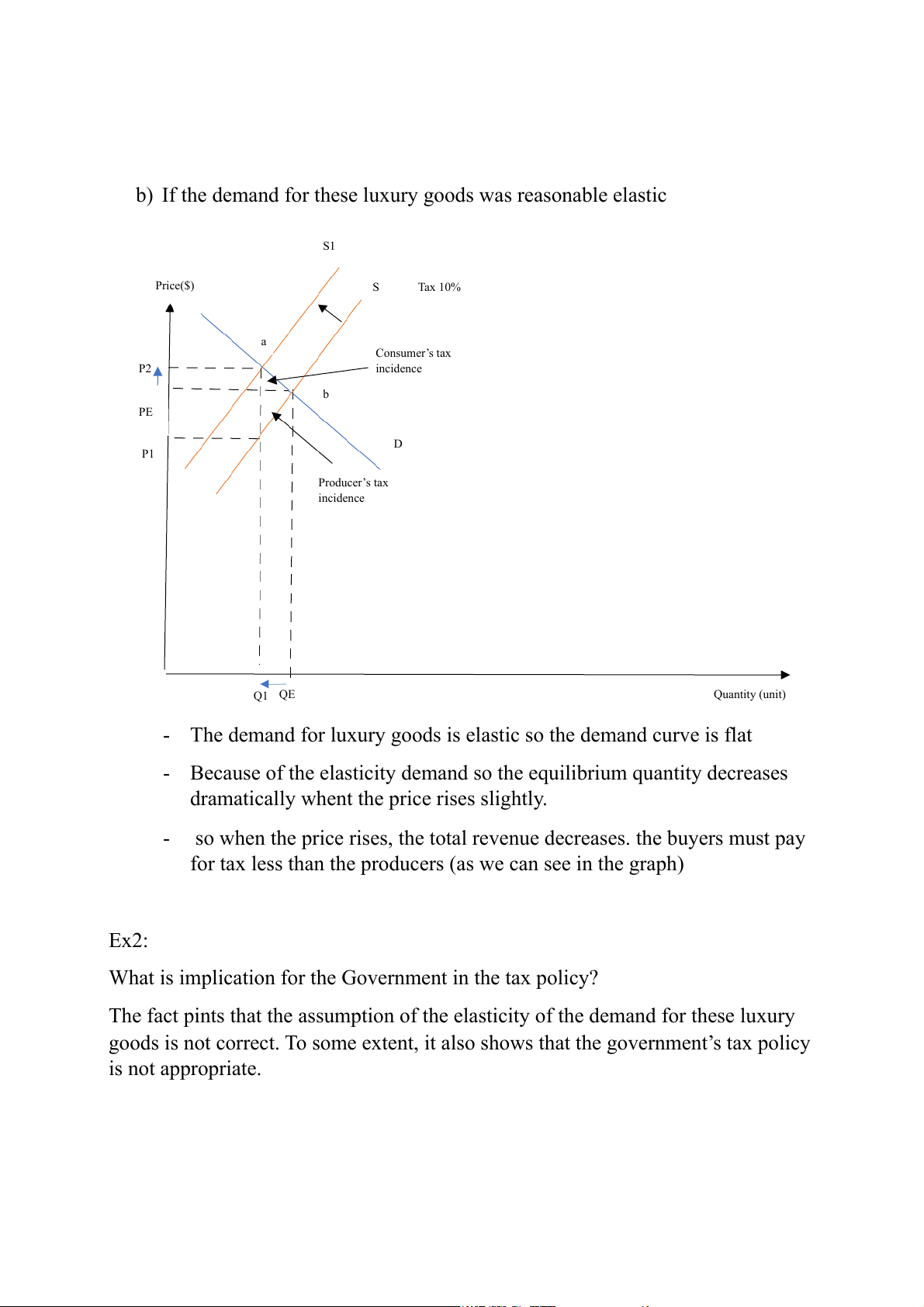

b) If the demand for these luxury goods was reasonable elastic S1 Price($) S Tax 10% a Consumer’s tax P2 incidence b PE D P1 Producer’s tax incidence Q1 QE Quantity (unit)

- The demand for luxury goods is elastic so the demand curve is flat

- Because of the elasticity demand so the equilibrium quantity decreases

dramatically whent the price rises slightly.

- so when the price rises, the total revenue decreases. the buyers must pay

for tax less than the producers (as we can see in the graph) Ex2:

What is implication for the Government in the tax policy?

The fact pints that the assumption of the elasticity of the demand for these luxury

goods is not correct. To some extent, it also shows that the government’s tax policy is not appropriate.

The Congress adopted a 10% ‘’luxury tax’’ which is an inappropriate tax. This

leads to the loss of money in the government and the fall of the supply quantity ->

making this kind of policy detrimental to entire economy.

The Congress should have put lower tax (4-5%) or put 20% tax in some states as a

trial and analysis the result to make next move.

Additional measures to avoid the negative effect of the taxation 1. Anti-dumping

2. Raising the import duty to prevent consumers from buying the substitution

products with lowers or no taxes

3. Setting import quota on certain luxury goods to benefit the local producers and workers.