Preview text:

1. How can you use the theory of "Supply, Demand- and elasticity "

to explain the case (by using graphs)?

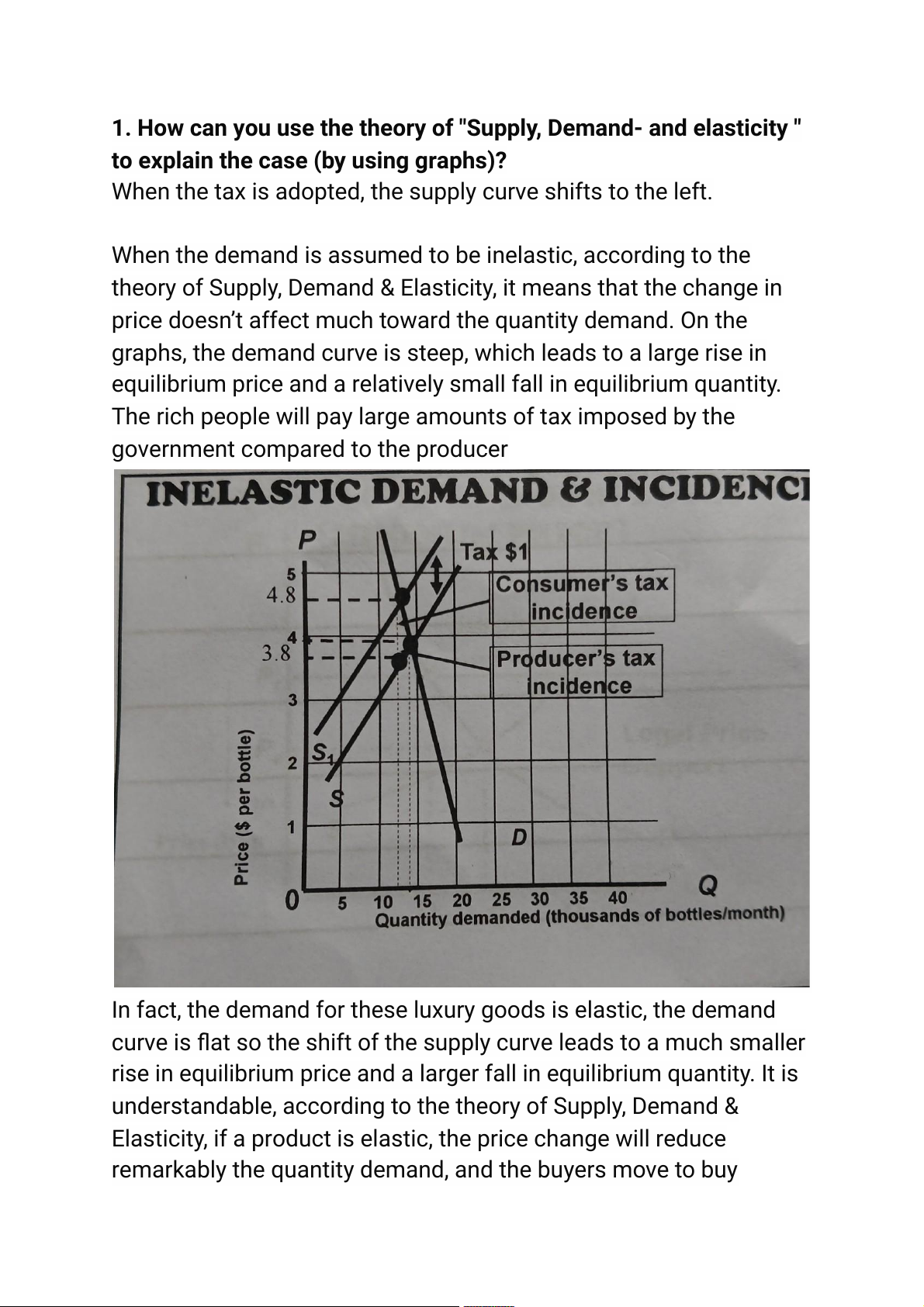

When the tax is adopted, the supply curve shifts to the left.

When the demand is assumed to be inelastic, according to the

theory of Supply, Demand & Elasticity, it means that the change in

price doesn’t affect much toward the quantity demand. On the

graphs, the demand curve is steep, which leads to a large rise in

equilibrium price and a relatively small fall in equilibrium quantity.

The rich people will pay large amounts of tax imposed by the

government compared to the producer

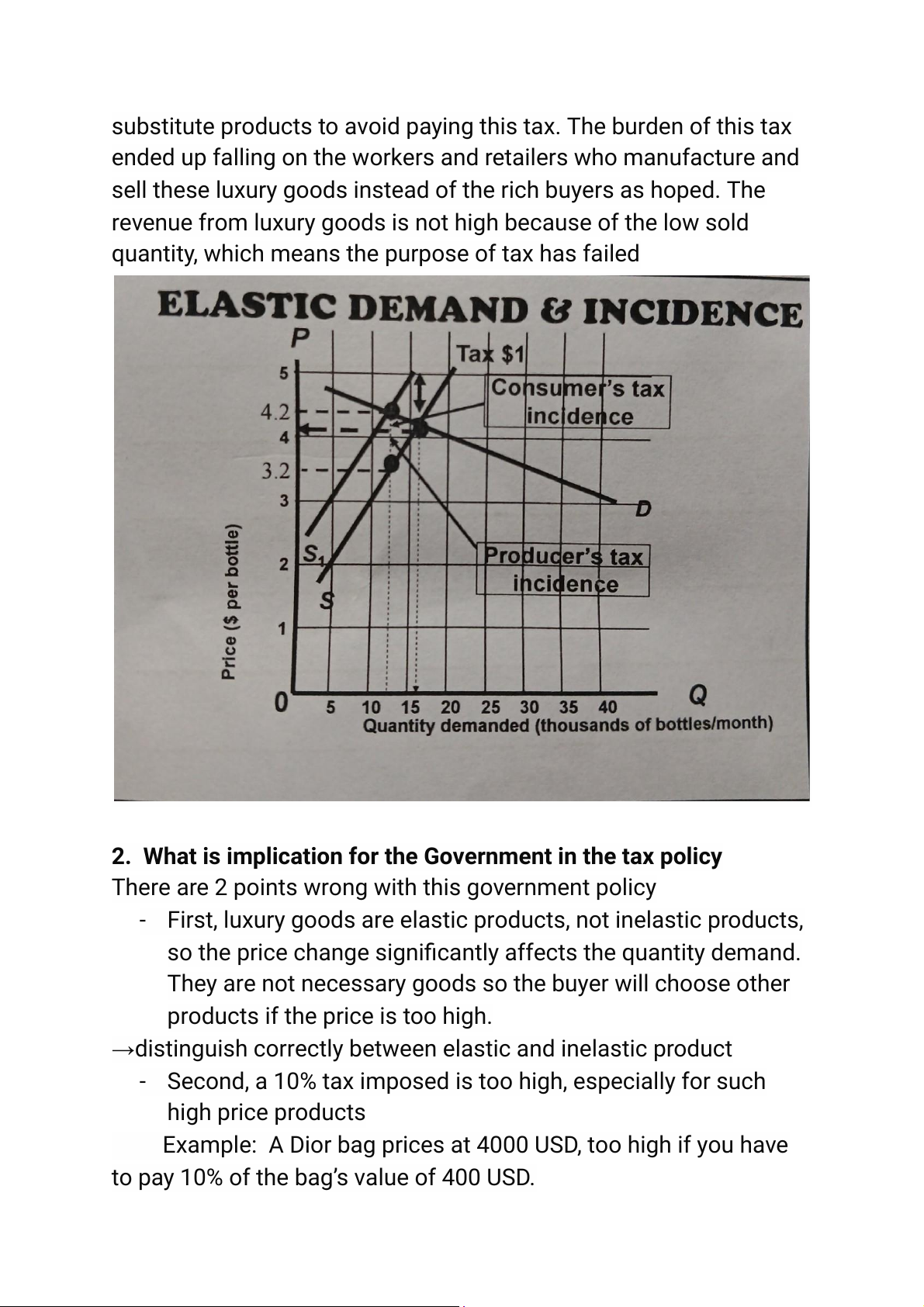

In fact, the demand for these luxury goods is elastic, the demand

curve is flat so the shift of the supply curve leads to a much smaller

rise in equilibrium price and a larger fall in equilibrium quantity. It is

understandable, according to the theory of Supply, Demand &

Elasticity, if a product is elastic, the price change will reduce

remarkably the quantity demand, and the buyers move to buy

substitute products to avoid paying this tax. The burden of this tax

ended up falling on the workers and retailers who manufacture and

sell these luxury goods instead of the rich buyers as hoped. The

revenue from luxury goods is not high because of the low sold

quantity, which means the purpose of tax has failed

2. What is implication for the Government in the tax policy

There are 2 points wrong with this government policy

- First, luxury goods are elastic products, not inelastic products,

so the price change significantly affects the quantity demand.

They are not necessary goods so the buyer will choose other

products if the price is too high.

→distinguish correctly between elastic and inelastic product

- Second, a 10% tax imposed is too high, especially for such high price products

Example: A Dior bag prices at 4000 USD, too high if you have

to pay 10% of the bag’s value of 400 USD.

→3-5% is quite enough, it doesn’t change the price too much so

the quantity demand doesn’t reduce a lot