Preview text:

I How Taxes on Sellers affect Market Outcomes Example:

Suppose the local government passes a law requiring sellers of ice-cream cones to

send $0.50 to the government of every cone they sell. To answer this question, we

can follow the three steps in Chapter 4 for analyzing supply and demand

1. Step One: We decide whether the law affects the supply curve or the demand curve

2. Step Two: We decide which way the curve shifts

3. Step Three: We examine how the shift affects the equilibrium price and quantity

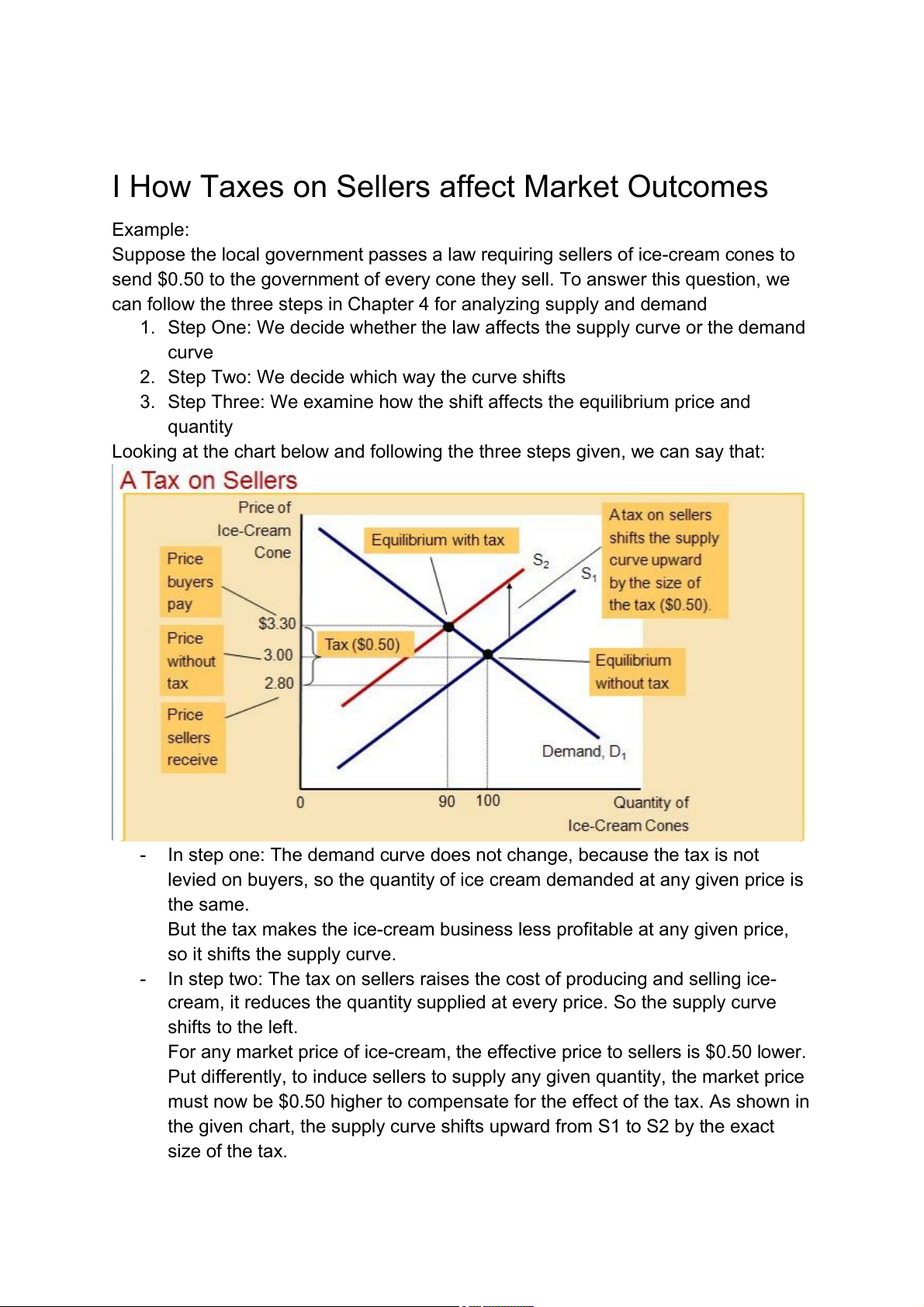

Looking at the chart below and following the three steps given, we can say that: -

In step one: The demand curve does not change, because the tax is not

levied on buyers, so the quantity of ice cream demanded at any given price is the same.

But the tax makes the ice-cream business less profitable at any given price,

so it shifts the supply curve. -

In step two: The tax on sellers raises the cost of producing and selling ice-

cream, it reduces the quantity supplied at every price. So the supply curve shifts to the left.

For any market price of ice-cream, the effective price to sellers is $0.50 lower.

Put differently, to induce sellers to supply any given quantity, the market price

must now be $0.50 higher to compensate for the effect of the tax. As shown in

the given chart, the supply curve shifts upward from S1 to S2 by the exact size of the tax. -

In step three: After having determined how the supply curve shifts, we can

now compare the initial and the new equilibriums. The chart shows that the

equilibrium price of the ice-cream rises from $3.00 to $3.30, and the

equilibrium quantity falls from 100 to 90 cones. Because sellers sell less and

buyers buy less in the new equilibrium, the tax reduces the size of the ice- cream market.

Implications: Because the market price rises from $3.00 to $3.30 when the tax is

introduced, buyers pay $0.30 more for each ice-cream cone than they did without the

tax. Thus, the tax makes buyers worse off.

What sellers get to keep after paying the tax is only $2.80 compared with $3.00

before the tax. Thus, the tax also makes sellers worse off.

Taxes discourage market activity. When a good is taxed, the quantity of good

sold is smaller in the new equilibrium.

Buyers and sellers share the burden of taxes. In the new equilibrium, buyers

pay more for the good, and sellers receive less.

II. How taxes on buyers affect market outcomes

Suppose that our local government passes a law requiring buyers of ice-cream

cones to send $0.50 to the government for each ice-cream cone they buy. We follow

3 steps to investigate the effects of this law.

1. Step one: We decide whether the law affects the supply curve or demand

curve. The initial impact of the tax is on the demand for ice cream

2. Step two: We determine the direction of the shift.

3. Step three: Having determined how the demand curve shifts, we can now see

the effect of the tax by comparing the initial equilibrium and the new equilibrium.

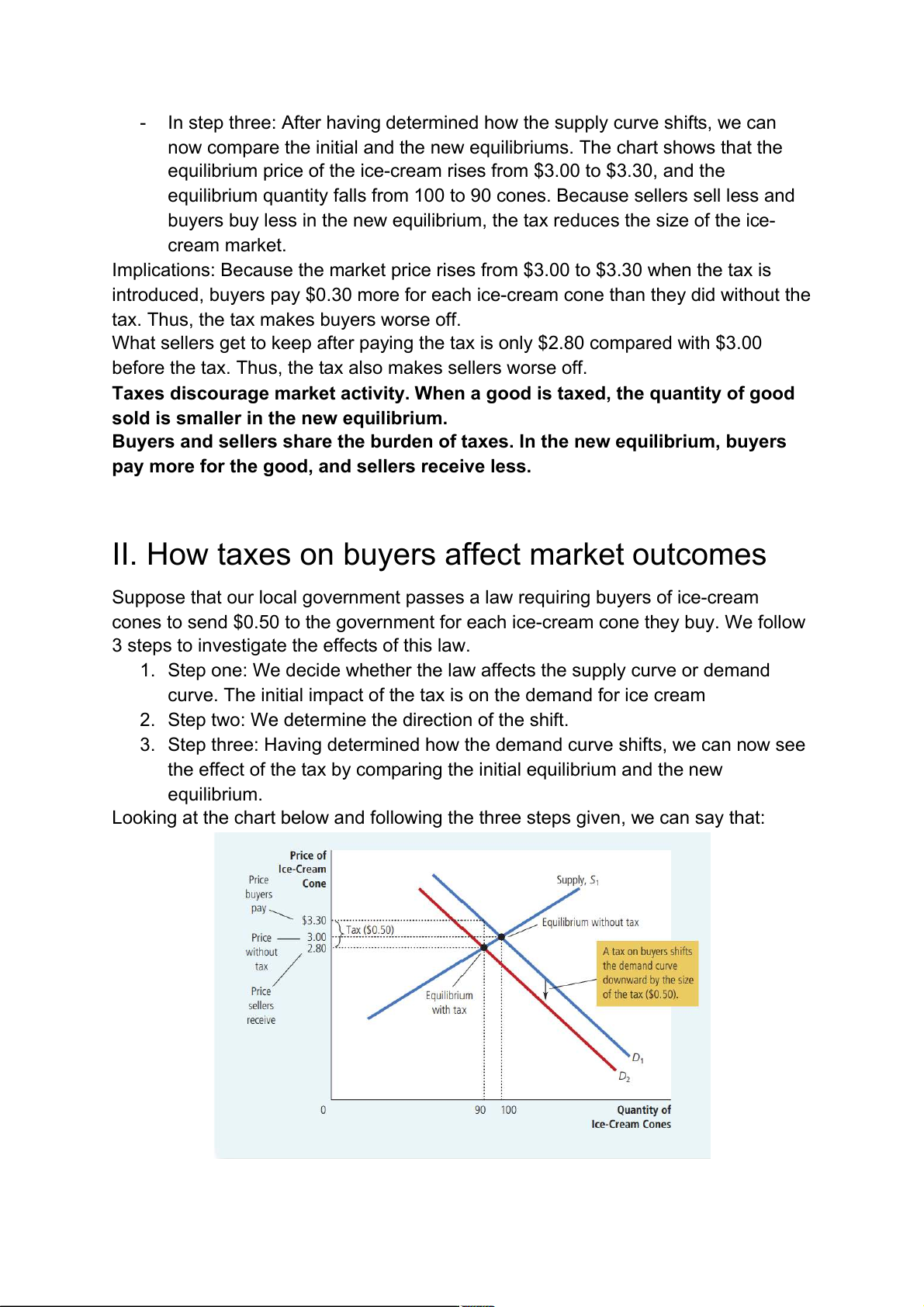

Looking at the chart below and following the three steps given, we can say that: -

In step one: The supply curve is not affected because, for any given price of

ice cream, sellers have the same incentive to provide ice cream to the market.

By contrast, buyers now have to pay a tax to the government (as well as the

price to the sellers) whenever they buy ice cream. Thus, the tax shifts the demand curve for ice cream. -

In step two: Because the tax on buyers makes buying ice cream less

attractive, buyers demand a smaller quantity of ice cream at every price. We

can, in this case, be precise about how much the curve shifts. Because of the

$0.50 tax levied on buyers, the effective price to buyers is now $0.50 higher

than the market price whatever the market price happens to be.

For example, if the market price of a cone happened to be $2.00,

the effective price to buyers would be $2.50. Because buyers look at their total

cost including the tax, they demand a quantity of ice cream as if the market

price were $0.50 higher than it actually is. In other words, to induce buyers to

demand any given quantity, the market price must now be $0.50 lower to

make up for the effect of the tax. Thus, the tax shifts the demand downward

by the exact size of the tax ($0.50). -

In step three: Having determined how the demand shifts, we can now see the

effect of the tax by comparing the initial equilibrium and the new equilibrium.

You can see that the equilibrium price of ice cream falls from $3.00 to $2.00

and the equilibrium quantity falls from 100 to 90 cones. Because sellers sell

less and buyers buy less in the new equilibrium, the tax on ice cream reduces

the size of the ice cream market.

=> mplicationI: Who pays the tax? -

Buyers and sellers share the tax burden: Because the market price falls from

$3.00 to $2.80 when the tax is introduced, sellers receive $0.20 less for each

ice cream cone than they did without ($2.80) but the effectively including the

tax rises from $3.00 before the tax to $3.30 with the tax ($2.80 + $0.50 =

$3.30). Thus, the tax also makes buyers worse off. => Sum up: -

Taxes discourage market activity. When a good is taxed, the quantity of the

good sold is smaller in the new equilibrium. -

Buyers and sellers share the burden of taxes. In the new equilibrium, buyers

pay more for the good, and sellers receive less. QUESTION

1. How does a tax on consumers affect demand?

Placing a tax on a good, shifts the supply curve to the left. It leads to a fall in demand

and higher price. However, the impact of a tax depends on the elasticity of demand.

If demand is inelastic, a higher tax will cause only a small fall in demand

2. How does taxes influence consumer decisions and buying power?

Besides altering the equilibrium price, which takes demand into account, sales tax

also impacts consumers' buying power. When sales tax rates are high, consumers

spend more money on taxes and have less to spend on additional goods.

III. ELASTICITY AND TAX INCIDENCE

As we know it, Tax incidence is the manner in which the tax burden is divided

between buyers and sellers. But it is rarely shared equally.

Depending on the circumstance, the burden of tax can fall more on consumers or on

producers. The tax incidence depends on the relative price elasticity of supply and

demand. When supply is more elastic than demand, buyers bear most of the tax

burden. When demand is more elastic than supply, producers bear most of the cost

of the tax. In the case of cigarettes, for example, demand is inelastic—because

cigarettes are an addictive substance—and taxes are mainly passed along to

consumers in the form of higher prices.

Typically, the incidence, or burden, of a tax falls both on the consumers and

producers of the taxed good. But if we want to predict which group will bear most of

the burden, all we need to do is examine the elasticity of demand and supply. In the

tobacco example above, the tax burden falls on the most inelastic side of the market.

If demand is more inelastic than supply, consumers bear most of the tax burden. But,

if supply is more inelastic than demand, sellers bear most of the tax burden.

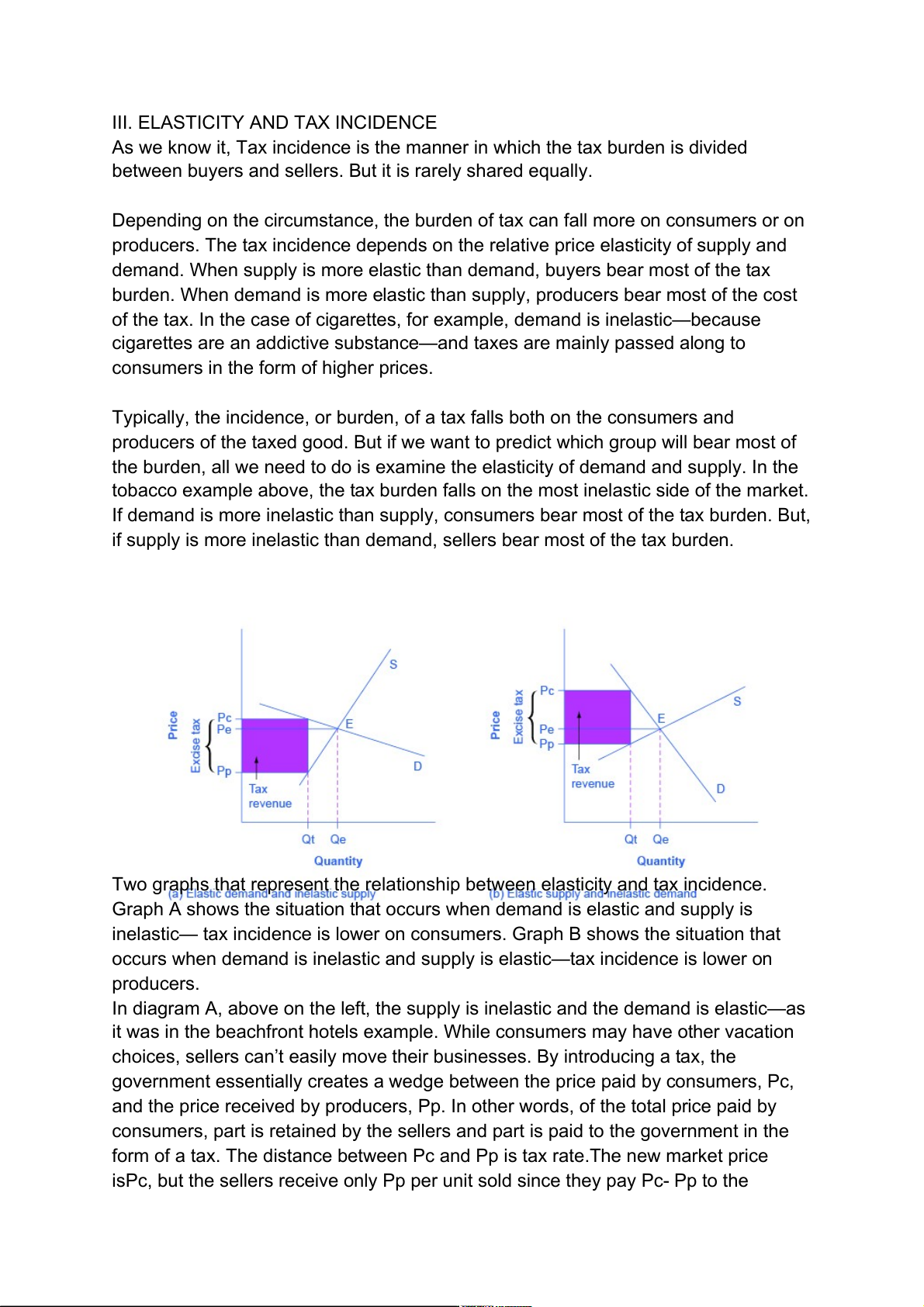

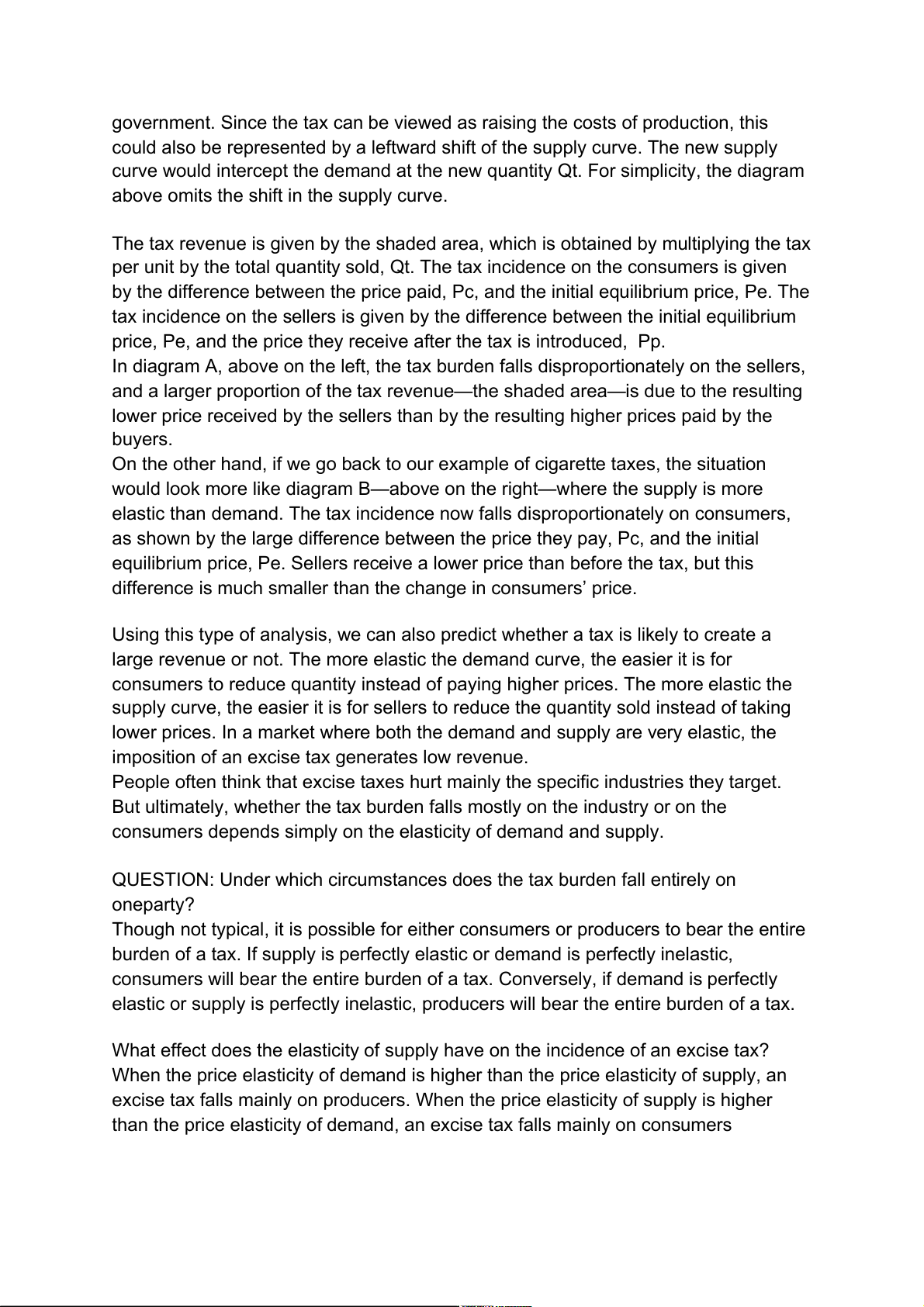

Two graphs that represent the relationship between elasticity and tax incidence.

Graph A shows the situation that occurs when demand is elastic and supply is

inelastic— tax incidence is lower on consumers. Graph B shows the situation that

occurs when demand is inelastic and supply is elastic—tax incidence is lower on producers.

In diagram A, above on the left, the supply is inelastic and the demand is elastic—as

it was in the beachfront hotels example. While consumers may have other vacation

choices, sellers can’t easily move their businesses. By introducing a tax, the

government essentially creates a wedge between the price paid by consumers, Pc,

and the price received by producers, Pp. In other words, of the total price paid by

consumers, part is retained by the sellers and part is paid to the government in the

form of a tax. The distance between Pc and Pp is tax rate.The new market price

isPc, but the sellers receive only Pp per unit sold since they pay Pc- Pp to the

government. Since the tax can be viewed as raising the costs of production, this

could also be represented by a leftward shift of the supply curve. The new supply

curve would intercept the demand at the new quantity Qt. For simplicity, the diagram

above omits the shift in the supply curve.

The tax revenue is given by the shaded area, which is obtained by multiplying the tax

per unit by the total quantity sold, Qt. The tax incidence on the consumers is given

by the difference between the price paid, Pc, and the initial equilibrium price, Pe. The

tax incidence on the sellers is given by the difference between the initial equilibrium

price, Pe, and the price they receive after the tax is introduced, Pp.

In diagram A, above on the left, the tax burden falls disproportionately on the sellers,

and a larger proportion of the tax revenue—the shaded area—is due to the resulting

lower price received by the sellers than by the resulting higher prices paid by the buyers.

On the other hand, if we go back to our example of cigarette taxes, the situation

would look more like diagram B—above on the right—where the supply is more

elastic than demand. The tax incidence now falls disproportionately on consumers,

as shown by the large difference between the price they pay, Pc, and the initial

equilibrium price, Pe. Sellers receive a lower price than before the tax, but this

difference is much smaller than the change in consumers’ price.

Using this type of analysis, we can also predict whether a tax is likely to create a

large revenue or not. The more elastic the demand curve, the easier it is for

consumers to reduce quantity instead of paying higher prices. The more elastic the

supply curve, the easier it is for sellers to reduce the quantity sold instead of taking

lower prices. In a market where both the demand and supply are very elastic, the

imposition of an excise tax generates low revenue.

People often think that excise taxes hurt mainly the specific industries they target.

But ultimately, whether the tax burden falls mostly on the industry or on the

consumers depends simply on the elasticity of demand and supply.

QUESTION: Under which circumstances does the tax burden fall entirely on oneparty?

Though not typical, it is possible for either consumers or producers to bear the entire

burden of a tax. If supply is perfectly elastic or demand is perfectly inelastic,

consumers will bear the entire burden of a tax. Conversely, if demand is perfectly

elastic or supply is perfectly inelastic, producers will bear the entire burden of a tax.

What effect does the elasticity of supply have on the incidence of an excise tax?

When the price elasticity of demand is higher than the price elasticity of supply, an

excise tax falls mainly on producers. When the price elasticity of supply is higher

than the price elasticity of demand, an excise tax falls mainly on consumers