Preview text:

Chương I .Cơ sở lý luận. I.

Tăng trưởng kinh tế (Tăng trưởng GDP) 1. Khái niệm

Economic growth refers to the increase in the output of final goods and services

produced by an economy over a certain period, typically one year.

2. Vai trò, ý nghĩa của tăng trưởng kinh tế.

The economic growth index reflects the level of development and performance of

the economy, and is an important basis for assessing living standards and social

welfare. Economic growth contributes to job creation, unemployment reduction, and

improvement of people's income and quality of life. At the same time, it provides the

basis for policy making and demonstrates the country's position in the international arena.

3. Chỉ tiêu đo lường (GDP, GNP).

To evaluate how much an economy has grown, economists typically use two

main indicators: GDP (Gross Domestic Product) and GNP (Gross National Product).

GDP-Gross Domestic Product (Real GDP growth rate): is the total value of all

goods and services produced within a country in a given period of time (usually a year or a quarter)

GDP = C + I + G + NX

GDP∈currentyear−GDP∈previousyear

Economic Growth Rate =

GDP∈previousyear

GNP- Gross National Product: is the total value of all goods and services produced

by a country's citizens and businesses in a given period of time, regardless of where they are produced

GNP= GDP+Net income from abroad.

( Net income from abroad= income earned by nationals overseas-income earned by

foreigners domestically).

GNP∈current year−GNP∈previousyear

Economic Growth Rate =

GNP∈previousyear II. Lạm phát a) Khái niệm:

Inflation is the general increase in prices of goods and services in an economy over

a period of time, resulting in a decrease in the real value of money. b) Vai trò, ý nghĩa

The inflation index reflects the average increase in prices of goods and services in

the economy over time, thereby showing how much money has depreciated and how

people's purchasing power has changed. This is an important indicator to assess the

level of macroeconomic stability and the effectiveness of management policies such

as monetary and fiscal. Inflation at a reasonable level can promote growth, but if it is

too high or too low, it will pose risks to the economy. c) Thước đo:

Inflation is measured by the percentage increase in the price of a typical basket

of goods and services over a period of time. There are several popular indicators such as:

- CPI (Consumer Price Index): This is the most common measure of inflation. It

measures the average change in prices of consumer goods and services that households typically buy

- PPI (Producer Price Index): It measures the change in prices from the producer side,

which indirectly affects the CPI.

-GDP Deflator: It measures the general price level of all domestically produced goods

and services. It reflects inflation across the economy. 3. Cán cân thương mại: a) Khái niệm:

- Export: Goods and services produced domestically that are sold abroad

- Imports: Goods and services produced in foreign countries and sold domestically

- Trade balance (net exports): reflects the difference between the total export

value and total import value of a country's goods in a certain period of time b) vai trò, ý nghĩa:

This is one of the important components of the balance of payments and is used to

evaluate the economy's production capacity, level of integration and competitiveness in the international market.

A surplus trade balance shows that the country is exporting more, thereby

accumulating foreign currency, improving national reserves and supporting a stable

exchange rate; on the contrary, a prolonged trade deficit can lead to increased foreign

debt and pressure on the exchange rate. c) Chỉ tiêu đo lường

The trade balance is affected by many factors such as: exchange rate - domestic

currency depreciation increases exports and reduces imports; domestic and

international income – as domestic income increases, demand for imports may

increase, creating deficit pressure; prices and production costs – affecting the

competitiveness of domestic goods; and trade and tariff policies – tariff barriers, free

trade agreements can promote exports or restrict imports

-Formula: Net exports = exports - imports 4. Chính sách tiền tệ

a) Khái niệm và phân loại

Concept: Monetary Policy is a macroeconomic management tool used by the

central bank to control the money supply, interest rates and credit in the economy,

thereby achieving the goals of price stability, economic growth, and full employment.

Classification: including expansionary monetary policy and tight monetary policy

- Expansionary monetary policy (loosening): Increase money supply, lower

interest rates to stimulate economic demand

- Contractionary monetary policy: Reduce money supply, increase interest rates to control inflation b) Vai trò, mục tiêu

Monetary policy plays a central role in regulating the macro economy. Monetary

policy helps the central bank regulate interest rates, money supply and credit to

control inflation, promote growth and stabilize the economy. By adjusting borrowing

costs and liquidity, it affects consumption, investment, exchange rates and financial

markets. As a result, monetary policy contributes to stabilizing the economic cycle

and supporting sustainable development.

c) Công cụ hỗ trợ chính sách tiền tệ:

The central bank uses a number of main tools to implement monetary policy: Công cụ Tác động chính Open market operations (OMO)

Buying/selling bonds to adjust money supply

Discount rate charged on loans to banks

Adjusting credit costs, affecting investment Reserve requirements

Controlling the lending capacity of commercial banks 5. Chính sách tài khóa a) Khái niệm:

Fiscal policy refers to how the government uses spending and taxes to influence the economy

Fiscal policy includes 2 types: Expansionary fiscal policy and contractionary fiscal policy

- Expansionary fiscal policy: Increase spending, reduce taxes, stimulate the economy

- Constrictive fiscal policy: Reduce spending, increase taxes, control inflation, reduce public debt b) Vai trò, mục tiêu

Fiscal policy is a macroeconomic tool used by the government to regulate the

economy through taxes and public spending. The main goals of this policy are to

promote economic growth, stabilize prices, create jobs and ensure fair income

distribution. With an important role in controlling aggregate demand, fiscal policy

helps the government respond flexibly to economic fluctuations: stimulate demand

during recessions and control inflation when the economy is hot. At the same time,

through public investment and social spending, fiscal policy contributes to improving

the quality of infrastructure, social security and long-term competitiveness of the economy. c) Công cụ hỗ trợ

Fiscal policy is implemented through two main groups of tools: Group of tools Specific examples Public spending

Investment in infrastructure, health, education, social security Taxation

Income tax, VAT, corporate tax, tax exemptions

Chương II. Thực trạng I.

Tăng trưởng kinh tế (tăng trưởng GDP)

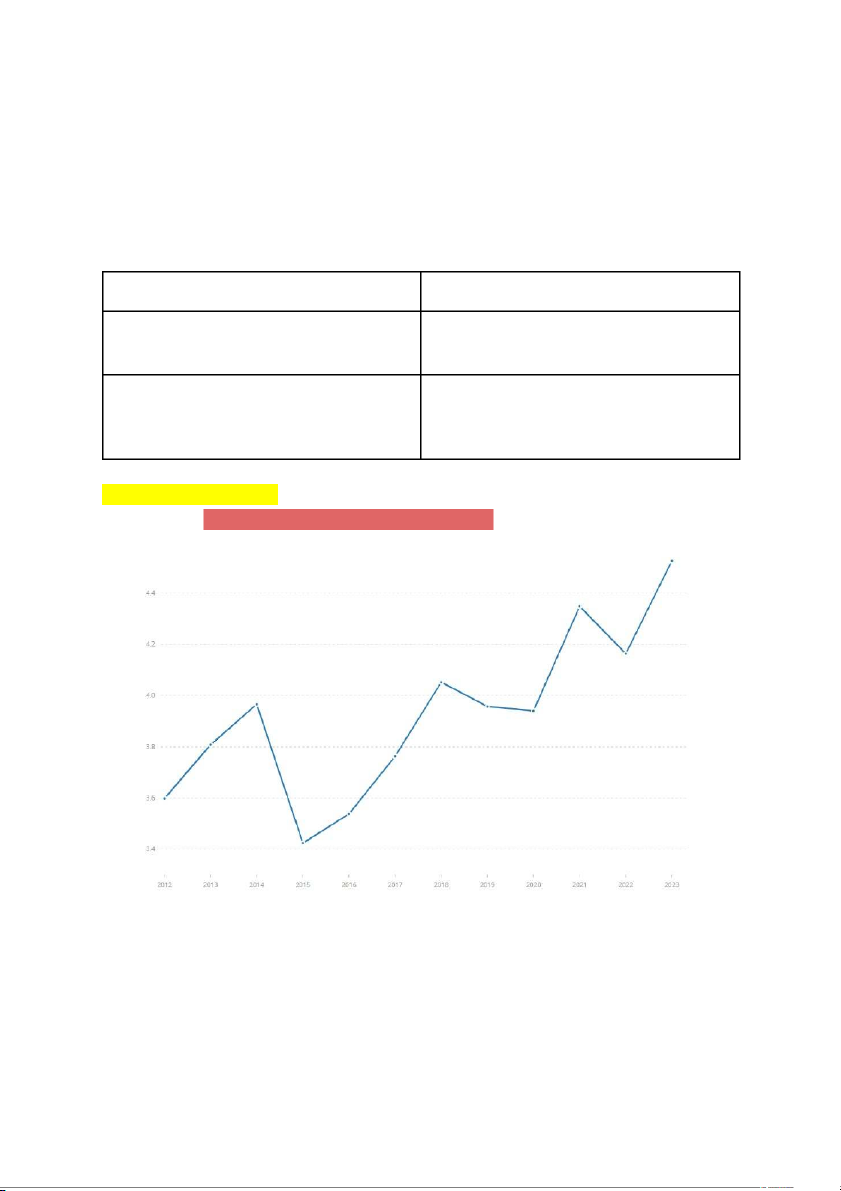

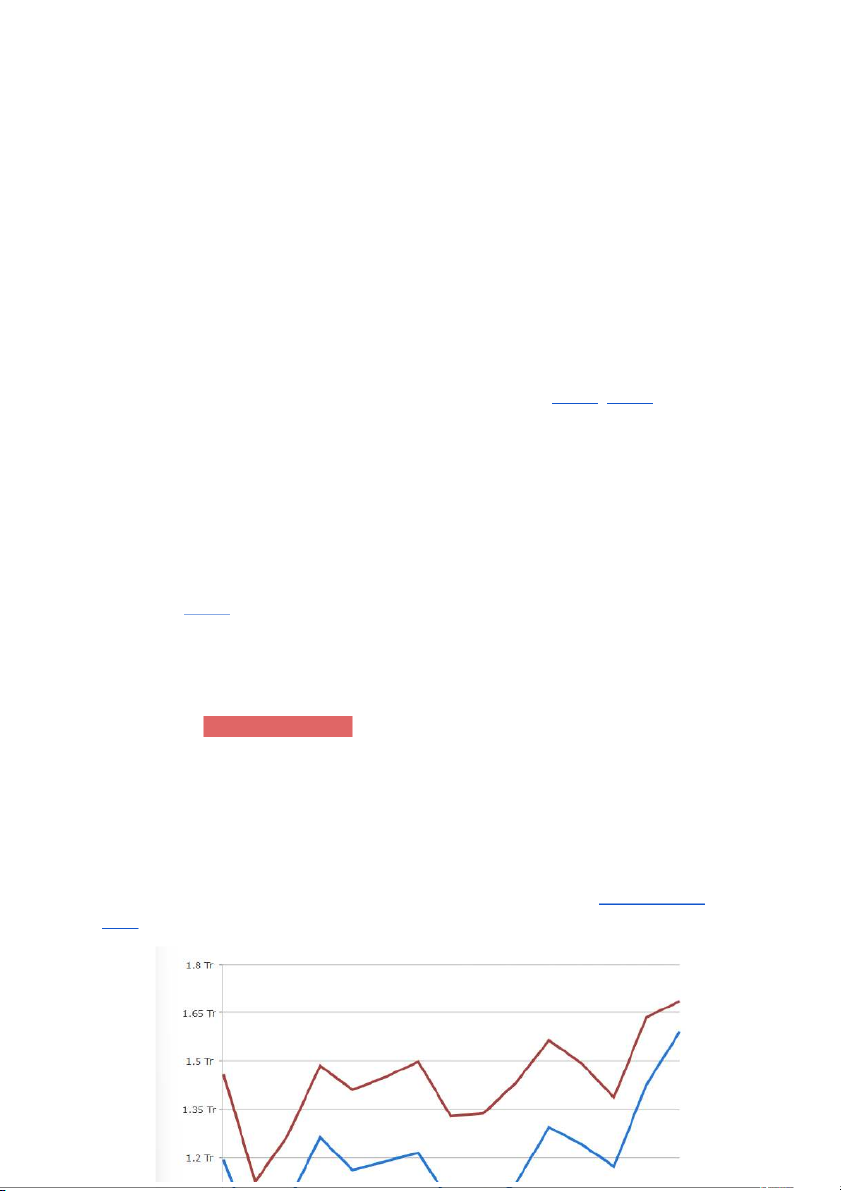

The chart illustrates Germany's Gross Domestic Product (GDP) in current

US dollars (in trillions) from 2012 to 2023, based on data from the World Bank and

the OECD. Over this period, Germany's GDP shows fluctuations, reflecting changes

in the national economy as well as global influences. Notably, the period from 2017 to

2018 saw a significant increase in GDP, rising from approximately $3.77 trillion to

over $4.06 trillion. This marked one of the strongest growth phases in over a decade,

highlighting Germany’s solid economic recovery and development following a slowdown in 2015.

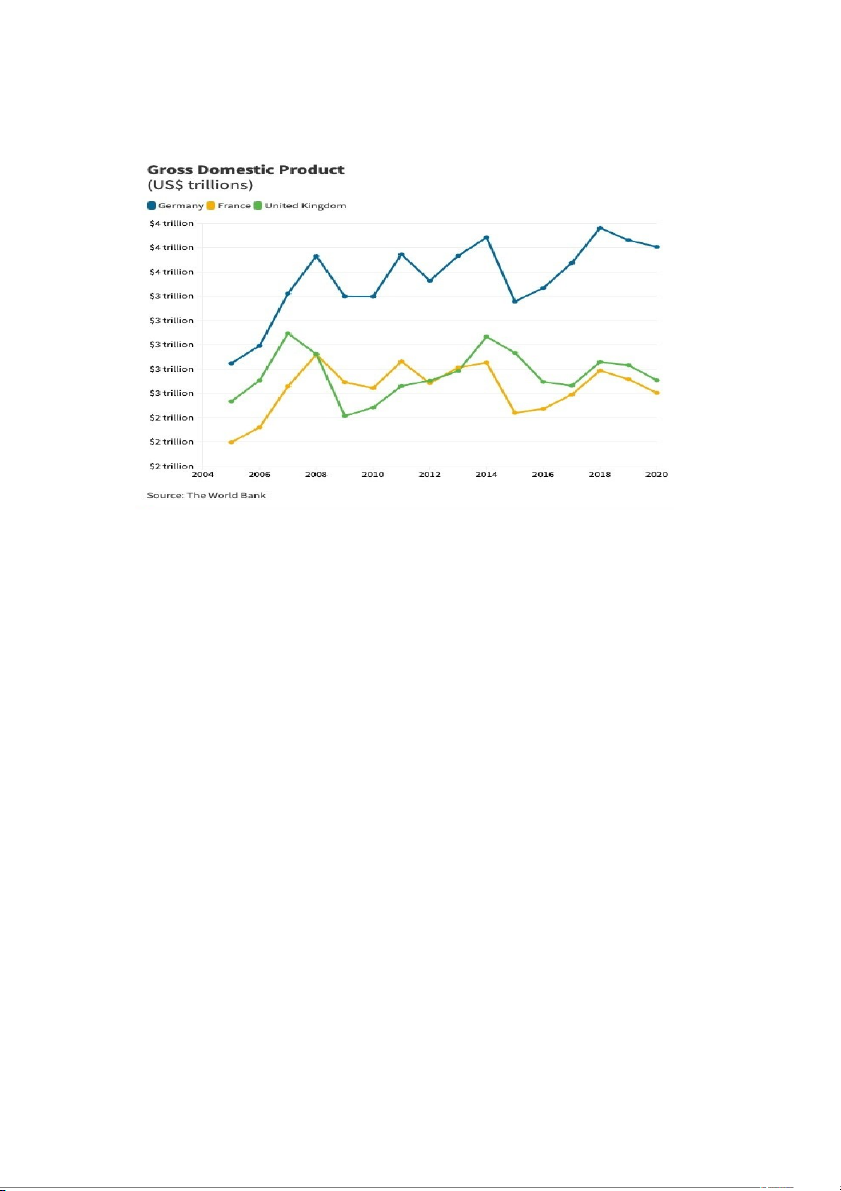

The line chart compares the GDP (in trillion USD) of Germany, France and the

United Kingdom between 2004 and 2020. During 2017-2018, Germany maintained its

clear lead over the other two major European economies. While France and the UK

exhibited more fluctuation and slower growth, Germany’s GDP remained above $4

trillion in both 2017 and 2018. This highlights Germany’s position as the dominant

economic force in the European Union, with a diversified economy and a strong

export-oriented industrial base.

This change reflects the combined impact of components of spending patterns, as

well as external factors such as global trade tensions and political uncertainty in Europe.

During the period 2017-2018, domestic consumption played a key role in

promoting the economic growth of the Federal Republic of Germany. According to

data from the German Federal Statistical Office, household consumption expenditure

increased by 1.9% in 2017 and 1.2% in 2018, respectively - a significant contribution

to the gross domestic product (GDP). The steady increase in disposable income and

low unemployment rate are fundamental factors that contribute to strengthening

domestic purchasing power. At the end of 2017, the average unemployment rate in

Germany continued to fall to a record low of 5.7% and by 2018 this figure was only

5.2%, with the total number of employed people reaching its highest level since the

period of national reunification with more than 44 million people participating in the

labor force. At the same time, real wages continued to increase slightly, accordingly,

the national minimum wage increased by 62 euros per month compared to the

previous year, i.e. 4.29%. This increase was larger than the CPI in 2016 of 1.5%, so

workers had more purchasing power over the past year, especially the demand for

buying houses, renovating, and interior decoration increased sharply during this

period. Thereby contributing to growth in the retail, construction materials, and furniture industries. ( ngu ồn)

Private investment, especially in the machinery, equipment, and construction

sectors, contributed significantly to Germany's economic growth during this period.

Specifically, in 2017, gross fixed capital in machinery and equipment increased by

3.5%, and gross fixed capital formation in construction increased by 2.6%. Compared

to 2016, gross fixed capital formation increased by 3.6%. In particular, private

investment continued to increase in 2018 with gross fixed capital formation in

machinery and equipment increasing by 4.5%, and gross fixed capital formation in

construction rising by 3.0%. The total value of gross fixed capital formation adjusted

by price increased by 4.8% compared to the same period in 2017. nguồn, nguồn

In addition, government spending was one of the stabilizing factors and

contributed positively to Germany's GDP growth in both years. In 2017, Germany's

government spending reached 1,676.5 billion EUR, an increase of about 4.3%

compared to the previous year, accounting for about 44.6% of GDP. In 2018, this

figure continued to increase to 1,811.6 billion EUR, accounting for about 44.7% of

GDP. This increase reflects the government's efforts to maintain stable aggregate

demand through expanding public investment, especially in areas such as social

security (accounting for ~43% of total expenditure), health (~17%) and education

(~10%). In addition, spending on infrastructure, immigration management and defense

was also increased to meet the needs of sustainable development and social stability. NGUỒN SỐ LIỆU

In the period 2017–2018, import and export activities had a clear impact on

Germany's economic growth. According to the German Federal Statistical Office

(Destatis), Germany's export turnover in 2017 reached about 1,279 billion euros, an

increase of 6.2% compared to the previous year, contributing to GDP growth of 2.5%,

the highest level in the past six years. However, in 2018, exports increased slightly by

3%, reaching about 1,317 billion euros, while imports increased faster, about 5.7%, to

1,090 billion euros, reducing the trade surplus - an important factor for Germany's

growth model. Therefore, in the same year, Germany's GDP growth decreased to 1.5%. Nguồn: II. Lạm phát:

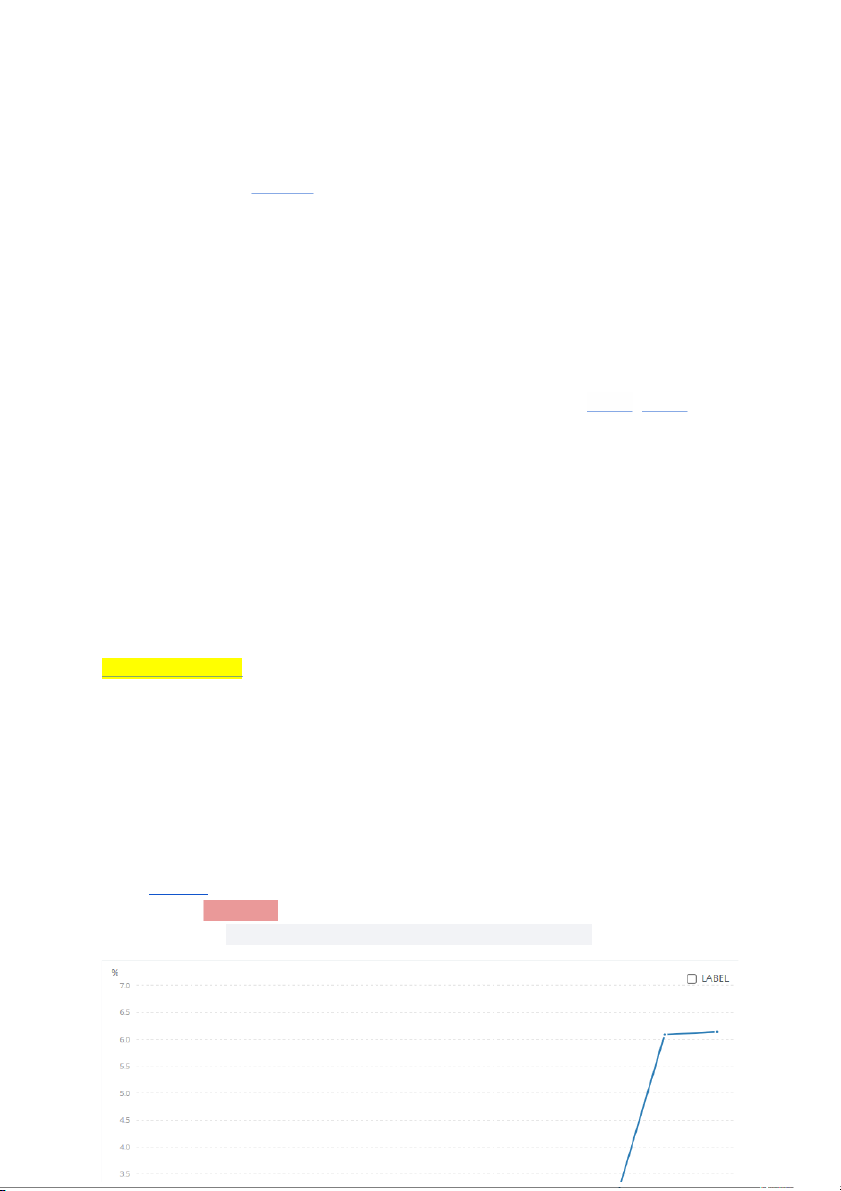

Inflation, GDP deflator (annual %) - Germany

In 2017 and 2018, the German economy witnessed remarkable fluctuations in

the consumer price index (CPI), clearly reflected in the annual inflation rate. From the

chart above, we can see that the inflation rate according to the German GDP deflator

in the period 2017-2018 remained low and stable. Specifically, the average inflation

rate in Germany in 2017 reached 1.5% and continued to increase slightly to 1.9% in 2018.

In 2017, inflation remained relatively stable, with the highest rate recorded in

April (2.0%) and the lowest in March (1.4%). However, starting from the second

quarter of 2018, inflation began to rise more sharply. Notably, in September 2018, the

inflation rate reached 2.3%—the highest level since November 2011. , nguồn nguồn

The main reason is the sharp increase in energy prices - "short-term

momentum". In the context of high world oil prices, Germany - a large industrial

country heavily dependent on energy imports - has been significantly affected.

According to Destatis, in 2018, energy prices increased by 4.9% compared to 2017, a

larger increase than a year earlier (2017: +3.1% compared to 2016) nguồn, with

September 2018 alone increasing by 7.7%, of which heating oil prices increased by

35.6% and fuel prices increased by 13.0%. The main reason is the recovery in global

oil prices and increased energy demand, causing production and living costs to

increase, contributing to the increase in inflation. This reflects cost-push inflation (ie

increased input costs (energy, transportation) increase the selling price of products and services).

In addition, the growth of domestic consumption also contributed to the

increase in the inflation rate. In the period 2017–2018, the German labor market

recorded a clear tightening, with the unemployment rate falling to a record low (as

mentioned in the GDP growth section), leading to upward pressure on wages. This

increase in income has boosted domestic consumption. According to the German

Federal Statistical Office (Destatis), household final consumption expenditure

increased by 3.6% in 2017, the highest increase since 1994. However, real wage nguồn

growth is still limited due to slow productivity growth and cautious collective

bargaining, so inflation does not explode strongly but only remains stable at around

1.5–1.9%. This makes domestic consumption demand not strong enough to create demand-pull inflation.

Food prices also made a substantial contribution to inflation, with an average

increase of 3.0% in 2017 and 2.8% in September 2018. Certain food items saw

particularly high price hikes, such as edible oils and fats (+21.4% in 2017; +14.9% in

March 2018), dairy products and eggs (+9.7% in 2017; +10.4% in March 2018),

vegetables (+12.3%), and potatoes (+14.6%) in September 2018.

In addition, housing rental costs—a component of service prices—rose steadily

by around 1.5–1.6% annually. Interestingly, in September 2018, education costs

decreased by 11.4% due to tuition-free policies implemented in several federal states,

which helped ease inflationary pressure in the service sector. nguồn, nguồn

During 2017–2018, the European Central Bank’s (ECB) loose monetary policy,

especially the asset purchase program (APP), contributed significantly to maintaining

stable inflation in Germany, close to the 2% target. The monetary policy was

extremely loose, but the spillover effect was uneven. The ECB maintained a 0%

interest rate and asset purchase program (QE) in both years, aiming to push Eurozone

inflation close to 2%. However, in Germany – where people tend to save a lot – the

stimulus to consumption from low interest rates was not as strong as in other countries in the bloc.nguồn

In summary, inflation in Germany during 2017–2018 showed a gradual upward

trend, peaking in late 2018. The increase in energy and food prices were the main

contributing factors, reflecting significant changes in household living costs and

posing challenges for the federal government's monetary and price control policies. III. Cán cân thương mại

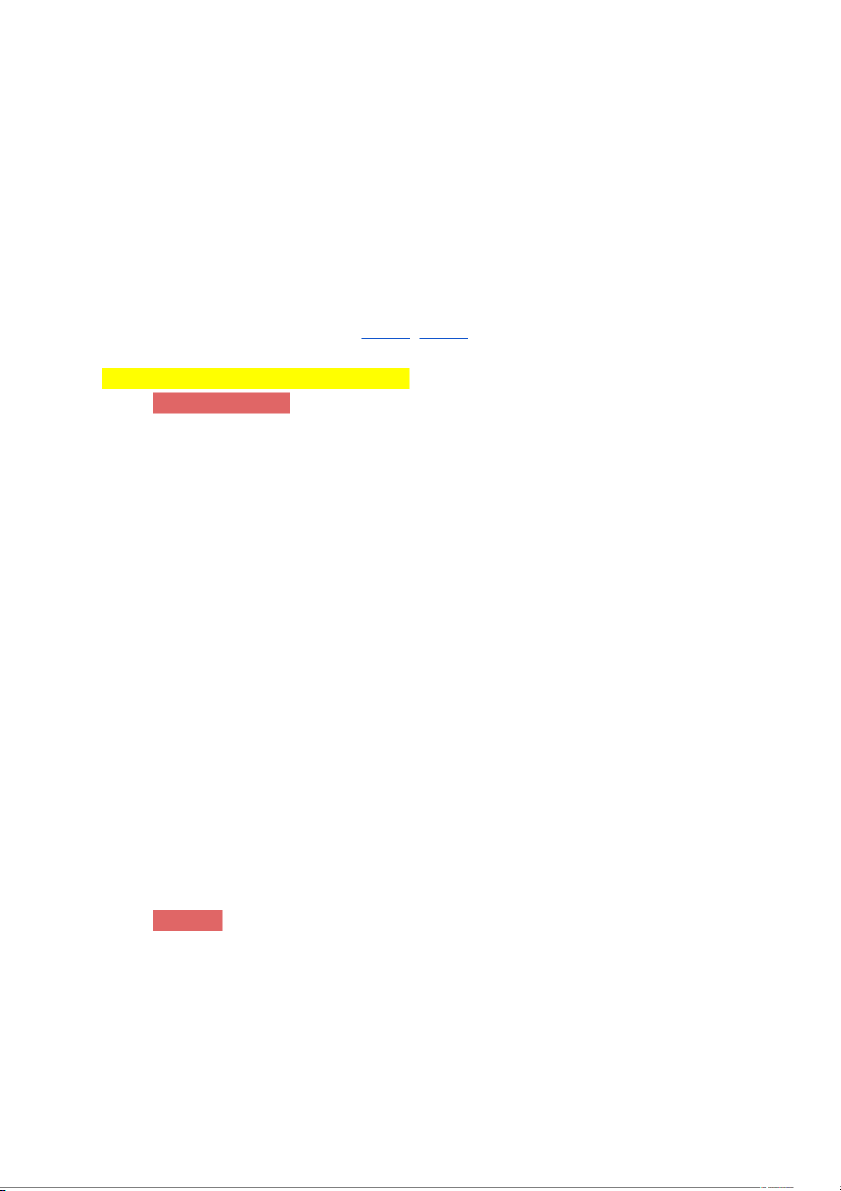

During 2017–2018, Germany continued to assert its position as the largest

economy in Europe and one of the world's leading exporters. In 2017, the German

economy achieved an impressive growth rate of 2.5%, the highest since 2011, mainly

due to strong exports and steady growth in household consumption. However, in

2018, GDP growth slowed to 1.5%, due to external uncertainties. However,

international trade continues to play a central role in Germany's economic structure,

with exports accounting for approximately 42.6% of GDP in 2018 (World Bank, 2020). Specifically: link

According to data from the World Bank (WITS), in 2017, the trade surplus

reached approximately 310.9 billion USD, strong export growth coupled with

moderate imports created a significant difference between the two trading directions.

Specifically, Germany's export turnover reached approximately 1,430.5 billion USD

(FOB), while imports were at 1,119.6 billion USD (CIF). This shows a positive trade

balance, reflecting the superior competitiveness of German goods in the world market.

By 2018, exports increased to 1,562.4 billion USD, an increase of about 9.2% over the

previous year; imports also increased to 1,292.7 billion USD, corresponding to an

increase of about 15.5%. Although total exports continued to grow, the import growth

rate was even higher, reflecting a recovery in domestic consumption and increased

domestic investment, the trade surplus narrowed slightly to around $269.7 billion. In

addition, global uncertainties such as the US-China trade war and Brexit reduced

demand for exports; economic weakness in major trading partners such as Italy,

Greece and China also affected German exports. In addition, the strengthening of the

euro in the first half of 2018 made German exports more expensive, reducing their

price competitiveness in the international market. However, this surplus is still among

the highest in the world, demonstrating the superior competitiveness of German goods.

The United States was Germany's largest export partner in both years,

accounting for around 8.6–8.9% (USD 126.7 billion) of total turnover, emphasizing

the strategic importance of the US market in the country's trade orientation. In

addition, there are countries such as France (8.18–7.96%), and China (6.83–7.07%). In

addition, Germany also imports mainly from countries with traditional and strategic

trade relationships, reflecting the dependence of the German economy on global

supply chains. In 2017-2018, China was Germany's largest import partner, accounting

for about 8.9-10.24% of total imports, with a value of about 108.6 billion USD. This

was followed by the Netherlands (7.76-8.12%) and France (5.98-6.17%), two partners

in the European Union, emphasizing the important role of the EU's internal market for Germany's trade activities.

With a diverse import-export portfolio, including more than 4,400 items,

Germany shows a deeply industrialized economy and is highly integrated into the

global supply chain. The export structure focuses on high-value-added products such

as automobiles, industrial machinery, electrical equipment and chemicals such as

Automobiles with reciprocating piston engines d, Automobiles with diesel engines

displacing more, and Germany exported Other medicaments of mixed or unmixed

products. In contrast, Germany imports mainly in the fields of electronic components,

machinery, transport equipment and consumer goods such as Petroleum oils and oils

obtained from bituminous, Natural gas in gaseous state, Human and animal blood, microbial cultures; tox…

In summary, during 2017-2018, Germany continued to maintain a high trade

surplus but slightly decreased in 2018. The main export items include cars, machinery,

industrial equipment and chemicals. In contrast, Germany imports a lot of raw

materials, consumer goods and high-tech components from China, the Netherlands

and EU countries. Although the economy still maintains a large trade surplus, the

decline in growth rate and pressure from the international environment show signs of

adjustment in the development model that depends heavily on exports. IV.

Chính sách tiền tệ và tài khóa:

*Bối cảnh kinh tế và tài chính:

As analyzed above, in the period 2017-2018, the German economy recorded

stable growth, with GDP increasing by about 2.2% in 2017 and 1.5% in 2018, mainly

due to strong exports and increased domestic consumption. Inflation averaged about

1.7% in 2017 and 1.9% in 2018, putting pressure on the European Central Bank

(ECB) monetary policy to adjust interest rates. Germany maintained a budget surplus

and the public debt/GDP ratio fell below 60% (source), allowing the government to

invest in infrastructure and social programs. The global economic context recovered

strongly, but also faced political and trade uncertainties, especially the trade wars

between the US and China. These factors have influenced the ECB's loose monetary

policy and the German government's fiscal measures to promote sustainable growth in an uncertain global context. 1. Chính sách tiền tệ:

Since 1999, Germany has been a founding member of the Eurozone, which

uses the euro (EUR) as its common currency. This means that Germany no longer has

independent control over its monetary policy, having fully delegated it to the

European Central Bank (ECB). Thus, Germany cannot unilaterally adjust interest

rates, issue currency, or control inflation, and must follow the collective policy set by the ECB.

Các biện pháp chính sách

During 2017–2018, the European Central Bank (ECB) continued to maintain

an accommodative monetary policy to promote economic recovery and bring inflation

back close to the 2% target, in the context of uncertain growth in the euro area. Specifically:

The ECB kept the refinancing rate unchanged at 0.00%, the overnight lending

rate at 0.25% and the central bank deposit rate at -0.40%. This policy was applied

steadily from March 2016 to the end of 2018 (ECB, Press Release on December 14,

2017). This ultra-low interest rate is aimed at stimulating credit, reducing borrowing

costs for businesses and households, thereby promoting investment and domestic

consumption in countries in the region, including Germany.nguồn

The ECB also continued its asset purchase programme (APP), initially at a

monthly rate of €60 billion. From January 2018, the rate was reduced to €30 billion

and then to €15 billion from October. In December 2018, the ECB officially ended its

net asset purchases but continued to reinvest maturing funds to stabilize the bond

market (ECB, Monetary Policy Report, 2018). This large-scale injection of money

helped lower long-term interest rates, support financial markets and stabilize the

investment environment.nguồn

Tác động của chính sách tới nền kinh tế

During 2017–2018, the ECB’s loose monetary policy brought many

convenient benefits to the German economy. The operating base maintained at 0%

and the large-scale asset purchase program (QE) contributed to keeping the euro low,

thereby providing exporters – one of the main pillars of German economic growth. At

the same time, low borrowing costs facilitated business investment, especially in the

real estate and manufacturing sectors, as well as household consumption. In addition,

the ECB’s boom policy still helped stabilize the euro area’s financial system,

minimize the risk of crisis contagion from resource-poor countries, and indirectly

strengthen the stable macroeconomic environment for Germany. nguồn

However, the ultra-loose monetary policy also caused many consequences for

the German economy. Slow interest rates have led to a sharp decline in bond yields,

which has negatively affected the banking system, insurance companies and especially

pensions – which depend on long-term investment returns nguồn . Many German

financial institutions have struggled with low returns amid interest rates. Moreover,

the influx of cheap money into real estate and asset markets has fueled a surge in

house prices, especially in major cities such as Berlin and Munich, raising the risk of

asset bubbles nguồn. The IMF (2018) nguồn report warned that house prices in some

areas of Germany were overvalued. In addition, the ECB’s overall policy stance has

provided stability to Germany’s domestic situation, as the country is growing strongly

and does not need further stimulus, leading to domestic criticism that the ECB has

kept its policy accommodative for too long, endangering the detection and economic imbalances. 2. Chính sách tài khóa: Các biện pháp chính sách

During 2017–2018, the German government implemented a mildly expansionary

fiscal policy, focusing on increasing public spending to maintain stable growth and

improve the quality of life. Notably, the federal budget strongly prioritized education,

research and infrastructure. Specifically:

The government invested around 3.5 billion euros in digital education through

the "DigitalPakt Schule" program, in addition to 2 billion euros to expand the full-day

school system and nearly 3.5 billion euros to support preschool education to reduce

the financial burden on young families (European Commission, Education and

Training Monitor 2018 – Germany)nguồn .

In addition to education, the government also increased spending on

infrastructure such as transport and social housing – partly to cope with the influx of

immigrants and the housing shortage in major cities nguồn. The government has

taken steps to strengthen the social security system, including improving health

services and support for low-income earners. According to Caixabank Research

(2018), these public investments not only directly support the economy but also

contribute to long-term productivity growth through improvements in human capital and productive capacity.

Along with increased spending, Germany has also adjusted its tax policy to

stimulate domestic consumption and reduce the financial burden on households and

businesses. The 2018–2022 medium-term budget plan shows that the government

plans to reduce taxes and social security contributions by 2.8% of GDP over the

period, or about 0.6% of GDP per year (S&P Global, 2018). Measures include

increasing the personal income tax exemption, adjusting the tax schedule to avoid

“bracket creep,” and cutting unemployment insurance contributions. These reforms

help increase people's disposable income, thereby boosting consumption - the main

factor keeping Germany's GDP growth stable in the context of slowing exports. At the

same time, businesses have reduced social contribution costs, creating conditions for

investment and production expansion. The combined impact of tax policy is assessed

by the IMF as contributing to a better balance between the growth drivers of the

German economy, instead of being overly dependent on exports. nguồn

Tác động của chính sách

Germany's prudent but flexible fiscal policy in 2017–2018 contributed to

stable economic growth, with GDP increasing by 2.5% in 2017 and 1.5% in 2018.

Public spending was directed to key areas such as education, infrastructure and social

security, helping to improve productivity and support domestic consumption. At the

same time, maintaining a budget surplus (1.3% of GDP in 2017) nguồn and

effectively controlling public debt strengthened the country's financial position,

creating room to respond to future risks. This policy also contributed to a more stable

labor market, with the unemployment rate falling to its lowest level in decades

(around 3.4% in 2018 - as analyzed in the section "Economic growth"), reflecting

good labor absorption in the context of positive growth.

Despite its considerable fiscal space, Germany has been criticized for failing

to take advantage of opportunities to increase public investment to boost long-term

growth. Institutions such as the IMF and the European Commission have warned that

a lack of decisive spending on infrastructure, innovation and digitalization could limit

sustainable growth potential and leave the economy overly reliant on exports. In

addition, inflation remains below the ECB’s target, suggesting that domestic demand

is not being sufficiently stimulated.nguồn, nguồn

Chương III. Nhận định và khuyến nghị: 1. Tăng trưởng GDP:

Overall, the period from 2017-2018 saw a significant increase in Germany's

GDP, although there were signs of slowing down compared to the previous year. In

2017, the German economy grew by 2.5% – the highest rate in six years – driven by

strong domestic demand, stable exports, and a solid labor market. However, entering

2018, the growth rate slowed to around 1.5%, reflecting challenges from the

international environment such as global trade tensions, Brexit uncertainty, and the

impact of US protectionist policies. In addition, internal factors also played a role,

such as Germany's failure to fully exploit its long-term potential due to a lack of

investment in infrastructure, particularly digital technology (causing the economy to

lag somewhat in the Industry 4.0 revolution), and insufficient focus on innovation and

startups. Investment capital was largely concentrated in a few large-scale transactions,

making it difficult for small, innovative startup projects to access resources.

To support sustainable growth in the coming years, the German government

should focus on stimulating public investment, particularly in transport and digital

infrastructure. Simultaneously, improving conditions for the private sector – through

tax reforms and reducing administrative barriers – will provide further impetus for

growth. Given the volatile external landscape, Germany should also diversify export

markets and strengthen trade relations with partners outside Europe, aiming to reduce

dependence on traditional markets and enhance the economy's resilience. 2. Lạm phát

Inflation in Germany in 2017–2018, although stable, still has some potential

limitations. Inflation below 2% is considered by the ECB and Germany to be stable

and acceptable in the context of economic recovery after the Eurozone sovereign debt

crisis. However, persistently low inflation may be a sign of weak demand, and is not

enough to encourage investment or reduce real debt. In addition, inflation is mainly

driven by external factors such as energy prices, while core inflation (excluding

energy and food) remains low, reflecting the lack of sustainability in domestic price

pressures. In addition, the heavy reliance on the ECB's loose monetary policy also

shows that the domestic fiscal policy space has not been effectively utilized to create a

natural price increase momentum through consumption and investment.

To improve the quality and sustainability of future inflation, Germany should

strengthen the role of fiscal policy by promoting public investment, especially in

digital infrastructure and the energy transition. At the same time, it is necessary to

develop policies that support a more flexible labor market, encourage productivity and

wage growth, thereby boosting domestic demand. In the long term, reducing

dependence on the ECB's monetary policy through strengthening the domestic

economy will help Germany regulate inflation more effectively and be more proactive

in responding to external shocks. 3. Cán cân thương mại

In 2017–2018, the trade surplus continued to be the mainstay of German

economic growth, contributing to maintaining a stable GDP growth rate (2.5% in 2017

and 1.5% in 2018). Strong exports helped maintain production and create jobs in key

industries such as automobiles, machinery and chemicals. As a result, the

unemployment rate fell to its lowest level in many years (around 3.4% in 2018), while

increasing tax revenues, creating favorable conditions for fiscal policy and social security.

However, the heavy dependence on exports also makes the German economy

vulnerable to external fluctuations such as trade wars, Brexit or China's slow growth.

In addition, the consistently high trade surplus has led to criticism from major partners

such as the US and the EU, who believe that the country has not sufficiently promoted

domestic consumption and investment. This not only creates imbalances in the global

macro balance but also poses risks of trade tensions and future growth decline.

To address these constraints, Germany needs to move towards a more balanced

growth model by promoting public investment, especially in infrastructure and

technological innovation, to increase domestic productivity and reduce dependence on

exports. At the same time, it is necessary to expand export markets to regions less

affected by geopolitical risks, such as Southeast Asia or Africa. In addition,

developing domestic value chains and supporting small and medium-sized enterprises

to participate in the global market are also important directions to increase the

sustainable competitiveness of German goods.

4. Chính sách tài khóa và chính sách tiền tệ

During 2017-2018, Germany’s monetary and fiscal policies interacted closely,

supporting each other to achieve economic goals. The European Central Bank’s

(ECB) loose monetary policy, with low interest rates and an asset purchase program,

facilitated the German government’s implementation of expansionary fiscal measures.

Specifically, the budget surplus allowed the government to invest in infrastructure and

social programs, thereby boosting domestic consumption and investment. This

combination helped maintain stable economic growth while controlling inflation at a

reasonable level, creating a positive economic environment for businesses and

consumers (OECD, 2018).nguồn

However, this interaction also poses some challenges. Maintaining a loose

monetary policy for a long time may lead to inflation risks in the future, while

expansionary fiscal measures may increase public debt if not carefully managed.

Therefore, assessing the effectiveness of the combination of these two policies is

important to ensure the long-term sustainability of the German economy.

In summary, Germany's monetary and fiscal policies in 2017-2018 achieved

many successes, including stable economic growth and controlled inflation. However,

there are also challenges that need to be faced, such as inflation risks and rising public

debt. To ensure future sustainability, policy recommendations include adjusting

monetary policy more flexibly as the economy recovers, while maintaining

responsible fiscal measures to support growth without increasing public debt. Close

monitoring of economic indicators and timely policy adjustments will be key to

maintaining the stability and growth of the German economy.