Preview text:

SET 1 + Code 1001

1. FALSE. A market-based policy creates an economic incentive for firms to

deal with their externalities at a lower cost to society. In contrast, a

command-and-control policy may be more expensive, as it requires hiring

regulators to monitor and enforce compliance with regulations.

(Xem lại Chap. 10, Public Policies to deal with Externalities, xem kĩ ví dụ 2 firms)

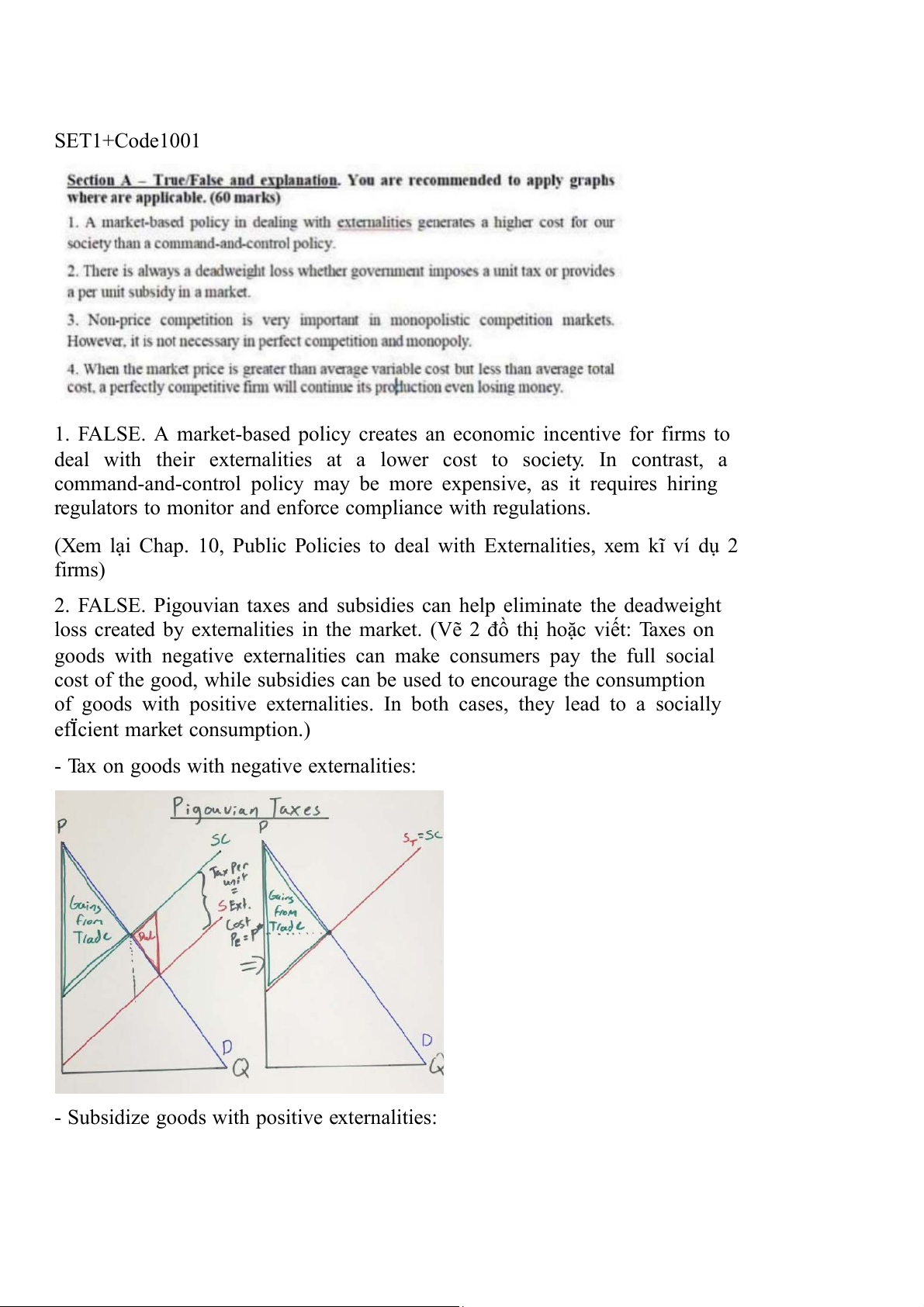

2. FALSE. Pigouvian taxes and subsidies can help eliminate the deadweight

loss created by externalities in the market. (Vẽ 2 đồ thị hoặc viết: Taxes on

goods with negative externalities can make consumers pay the full social

cost of the good, while subsidies can be used to encourage the consumption

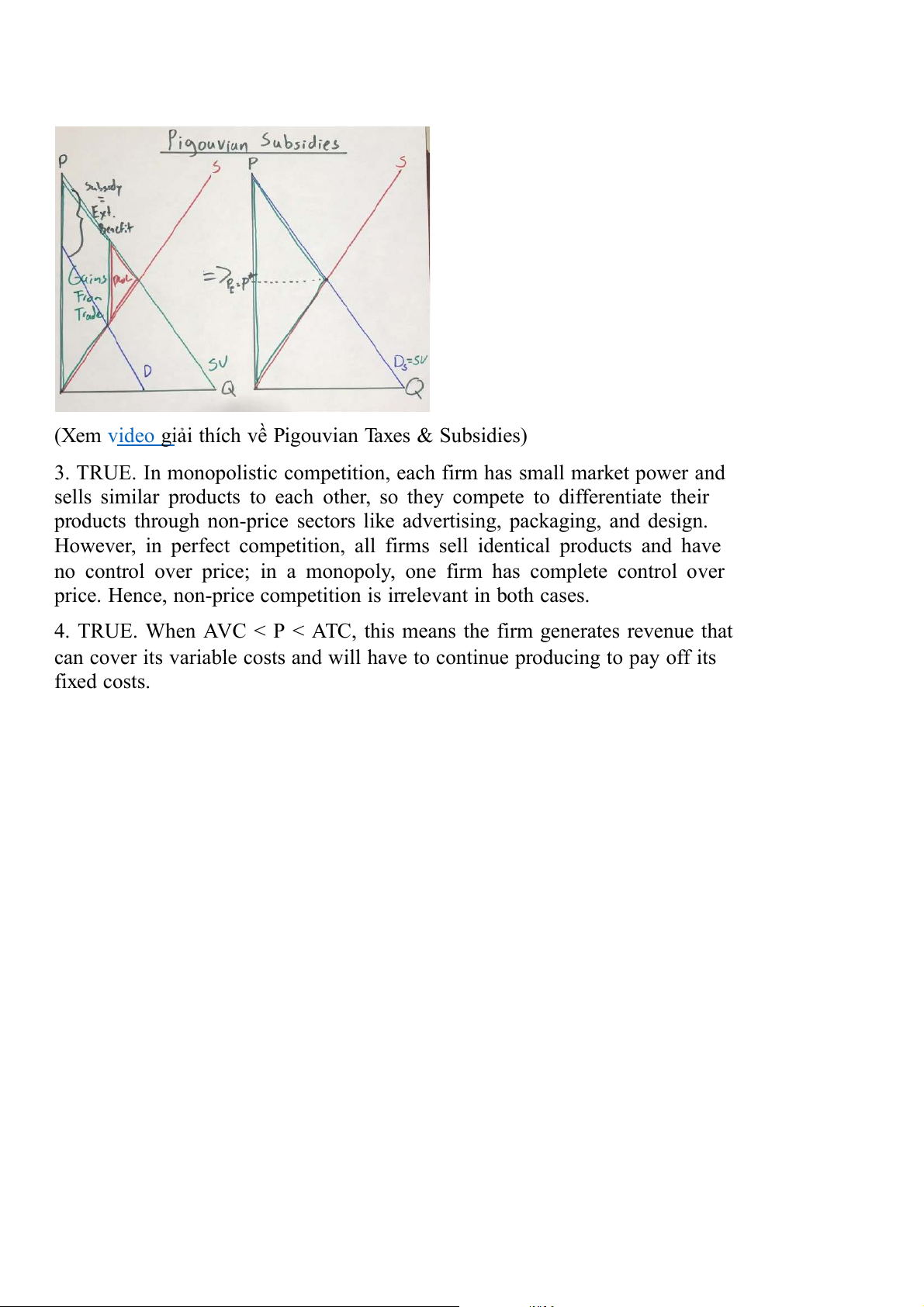

of goods with positive externalities. In both cases, they lead to a socially efÏcient market consumption.)

- Tax on goods with negative externalities:

- Subsidize goods with positive externalities:

(Xem video giải thích về Pigouvian Taxes & Subsidies)

3. TRUE. In monopolistic competition, each firm has small market power and

sells similar products to each other, so they compete to differentiate their

products through non-price sectors like advertising, packaging, and design.

However, in perfect competition, all firms sell identical products and have

no control over price; in a monopoly, one firm has complete control over

price. Hence, non-price competition is irrelevant in both cases.

4. TRUE. When AVC < P < ATC, this means the firm generates revenue that

can cover its variable costs and will have to continue producing to pay off its fixed costs. Code 12

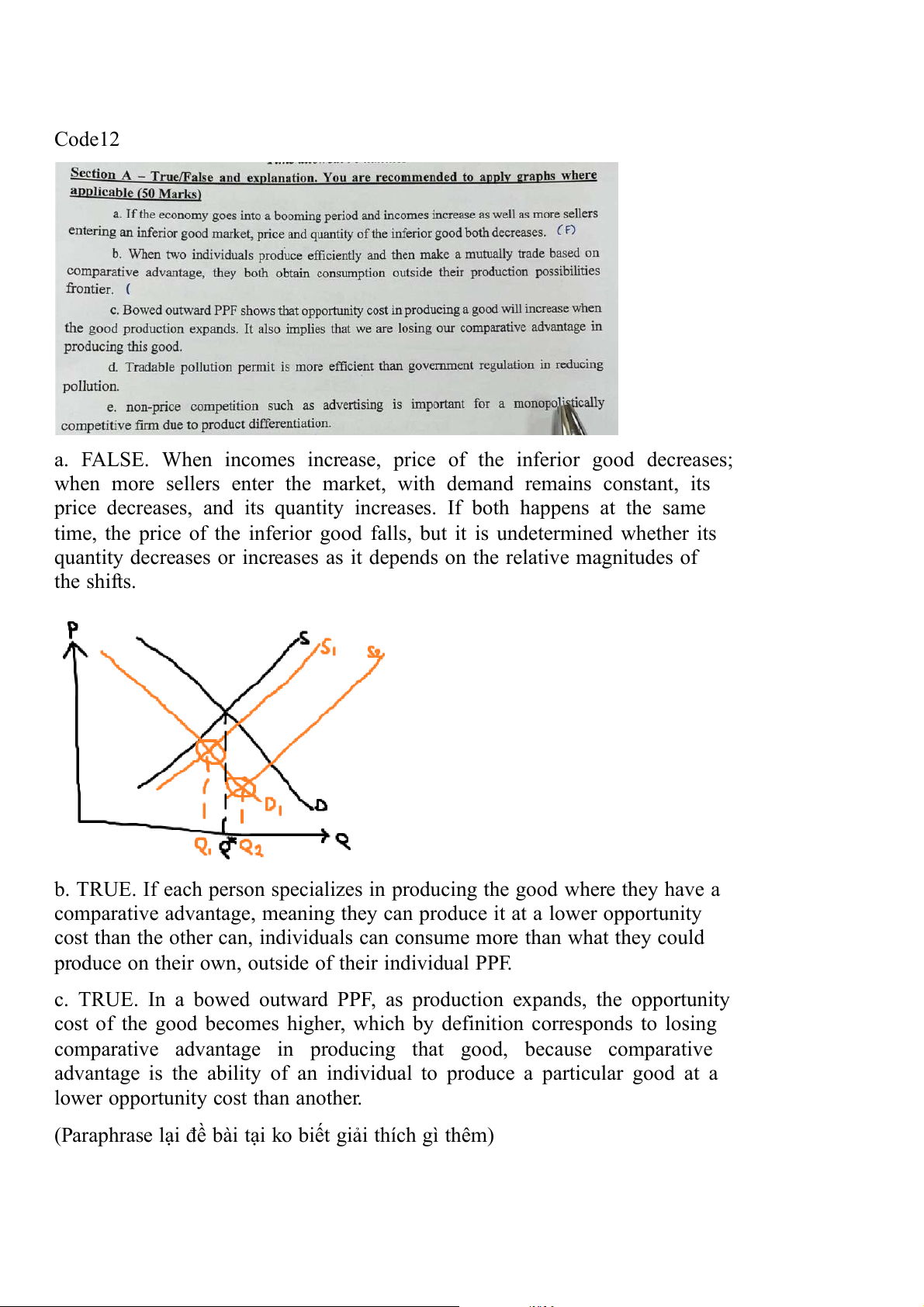

a. FALSE. When incomes increase, price of the inferior good decreases;

when more sellers enter the market, with demand remains constant, its

price decreases, and its quantity increases. If both happens at the same

time, the price of the inferior good falls, but it is undetermined whether its

quantity decreases or increases as it depends on the relative magnitudes of the shifts.

b. TRUE. If each person specializes in producing the good where they have a

comparative advantage, meaning they can produce it at a lower opportunity

cost than the other can, individuals can consume more than what they could

produce on their own, outside of their individual PPF.

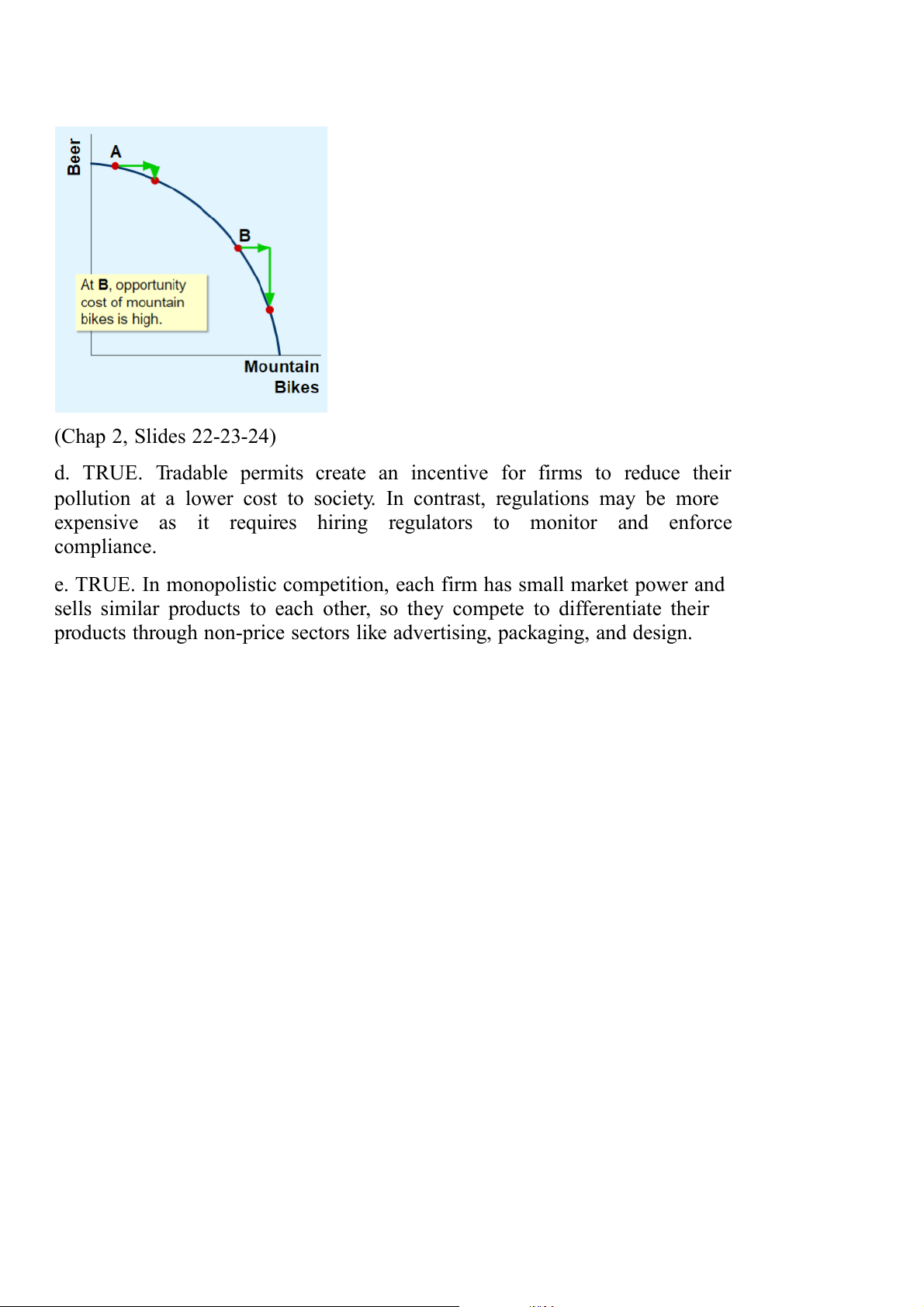

c. TRUE. In a bowed outward PPF, as production expands, the opportunity

cost of the good becomes higher, which by definition corresponds to losing

comparative advantage in producing that good, because comparative

advantage is the ability of an individual to produce a particular good at a

lower opportunity cost than another.

(Paraphrase lại đề bài tại ko biết giải thích gì thêm) (Chap 2, Slides 22-23-24)

d. TRUE. Tradable permits create an incentive for firms to reduce their

pollution at a lower cost to society. In contrast, regulations may be more

expensive as it requires hiring regulators to monitor and enforce compliance.

e. TRUE. In monopolistic competition, each firm has small market power and

sells similar products to each other, so they compete to differentiate their

products through non-price sectors like advertising, packaging, and design.

Code 04 / Code 10

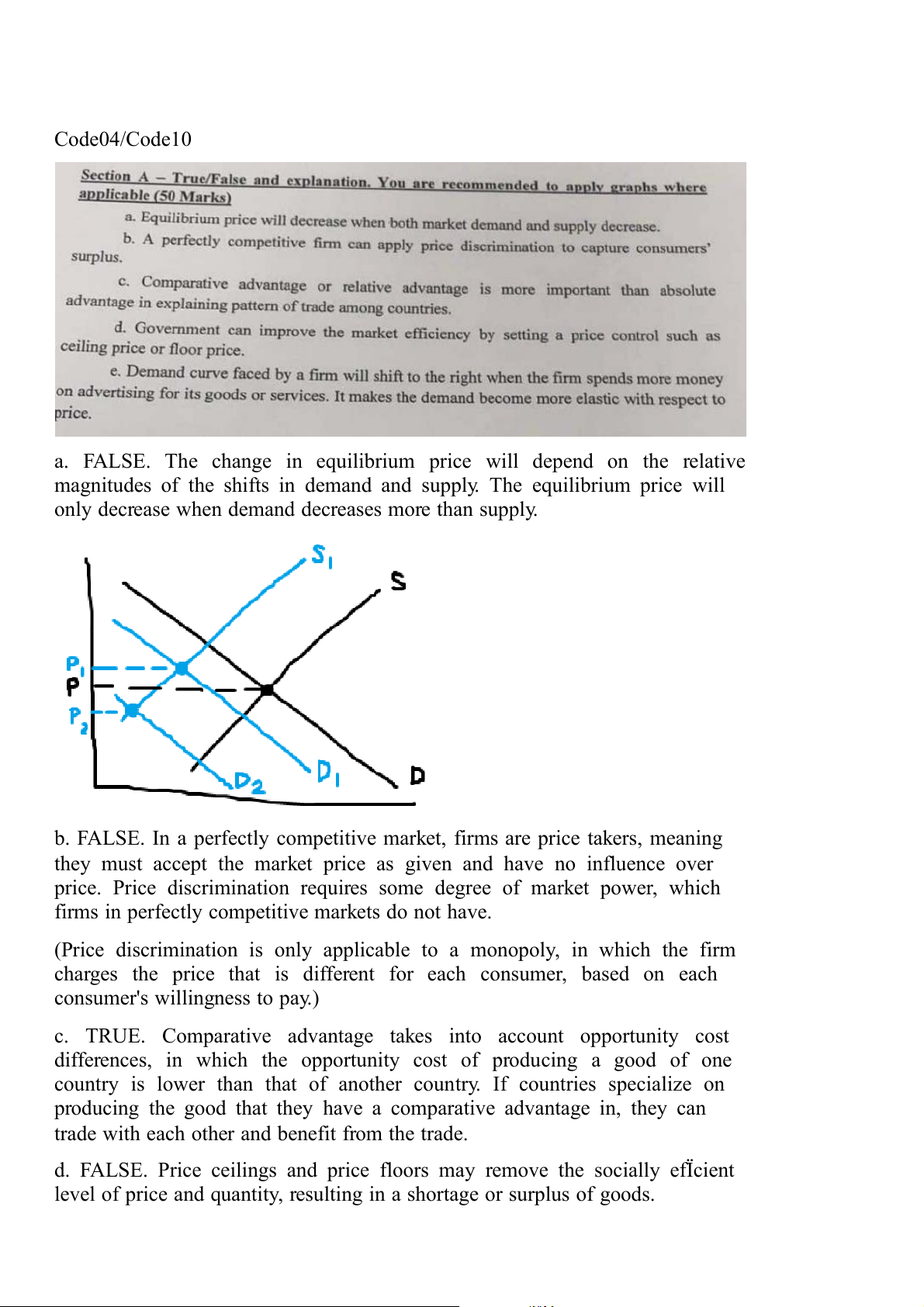

a. FALSE. The change in equilibrium price will depend on the relative

magnitudes of the shifts in demand and supply. The equilibrium price will

only decrease when demand decreases more than supply.

b. FALSE. In a perfectly competitive market, firms are price takers, meaning

they must accept the market price as given and have no influence over

price. Price discrimination requires some degree of market power, which

firms in perfectly competitive markets do not have.

(Price discrimination is only applicable to a monopoly, in which the firm

charges the price that is different for each consumer, based on each

consumer's willingness to pay.)

c. TRUE. Comparative advantage takes into account opportunity cost

differences, in which the opportunity cost of producing a good of one

country is lower than that of another country. If countries specialize on

producing the good that they have a comparative advantage in, they can

trade with each other and benefit from the trade.

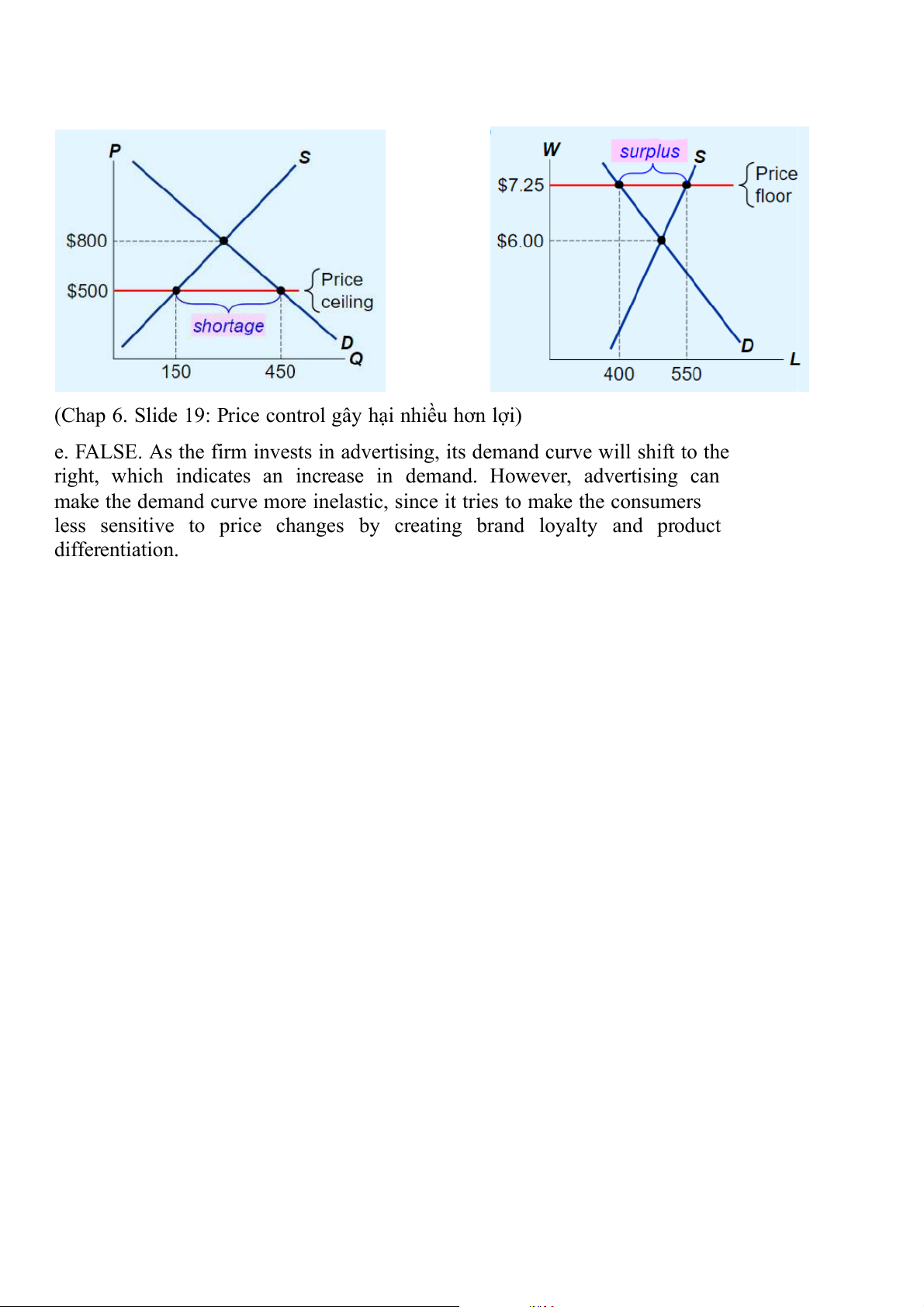

d. FALSE. Price ceilings and price floors may remove the socially efÏcient

level of price and quantity, resulting in a shortage or surplus of goods.

(Chap 6. Slide 19: Price control gây hại nhiều hơn lợi)

e. FALSE. As the firm invests in advertising, its demand curve will shift to the

right, which indicates an increase in demand. However, advertising can

make the demand curve more inelastic, since it tries to make the consumers

less sensitive to price changes by creating brand loyalty and product differentiation. Code 05

a. FALSE. Comparative advantage takes into account opportunity cost

differences, in which the opportunity cost of producing a good of one

country is lower than that of another country. If countries specialize in

producing the good that they have a comparative advantage in, they can

trade with each other and benefit from the trade.

b. FALSE. When incomes fall, the demand for inferior good increases; when

more sellers enter the inferior good market, price decreases and quantity

increases (assuming that demand is constant). If both happens at the same

time, the effect on price and quantity will depend on the relative

magnitudes of these shifts; thus, it is undetermined.

(relative magnitudes of these shifts = how much the demand curve and the supply curve shift)

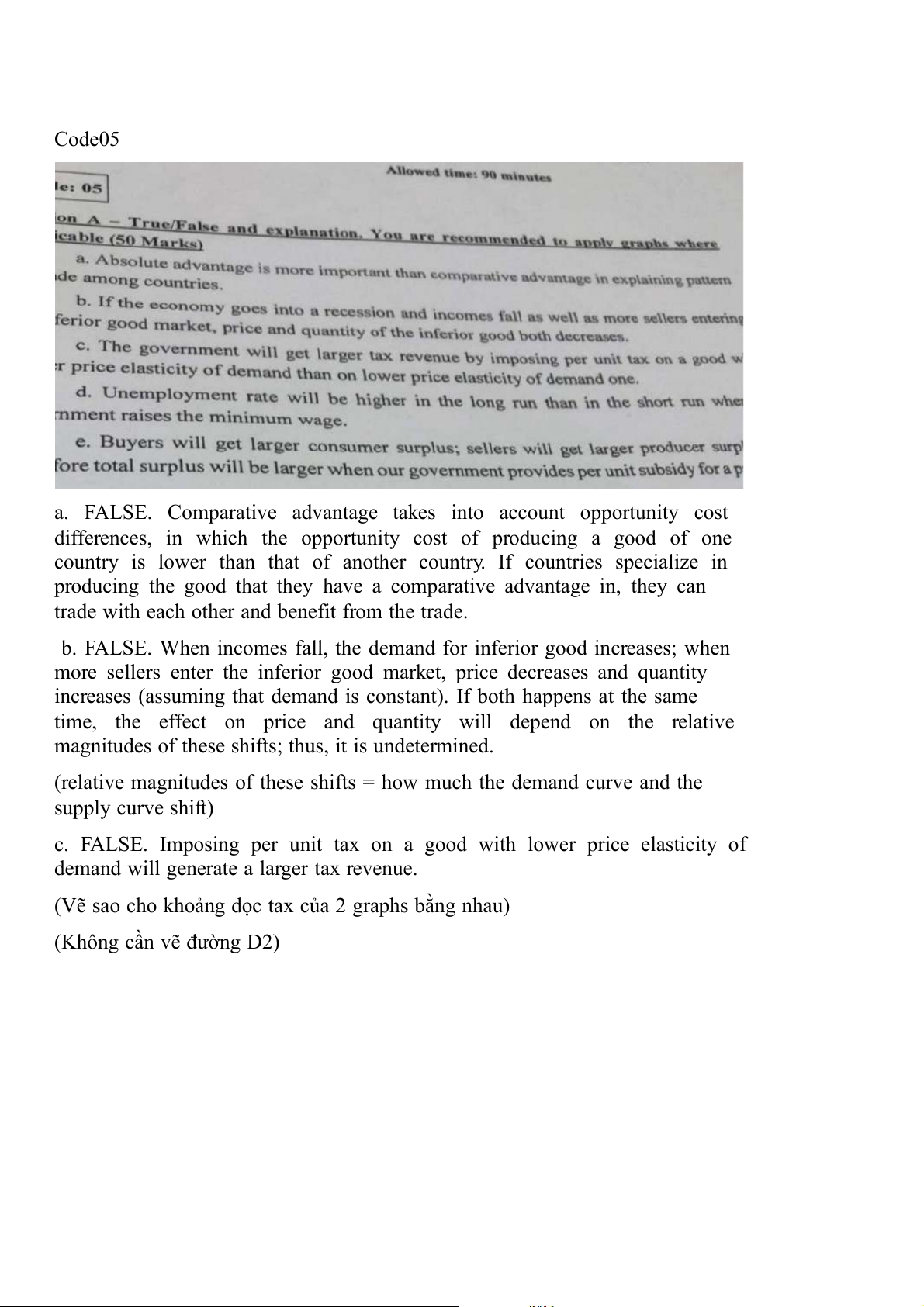

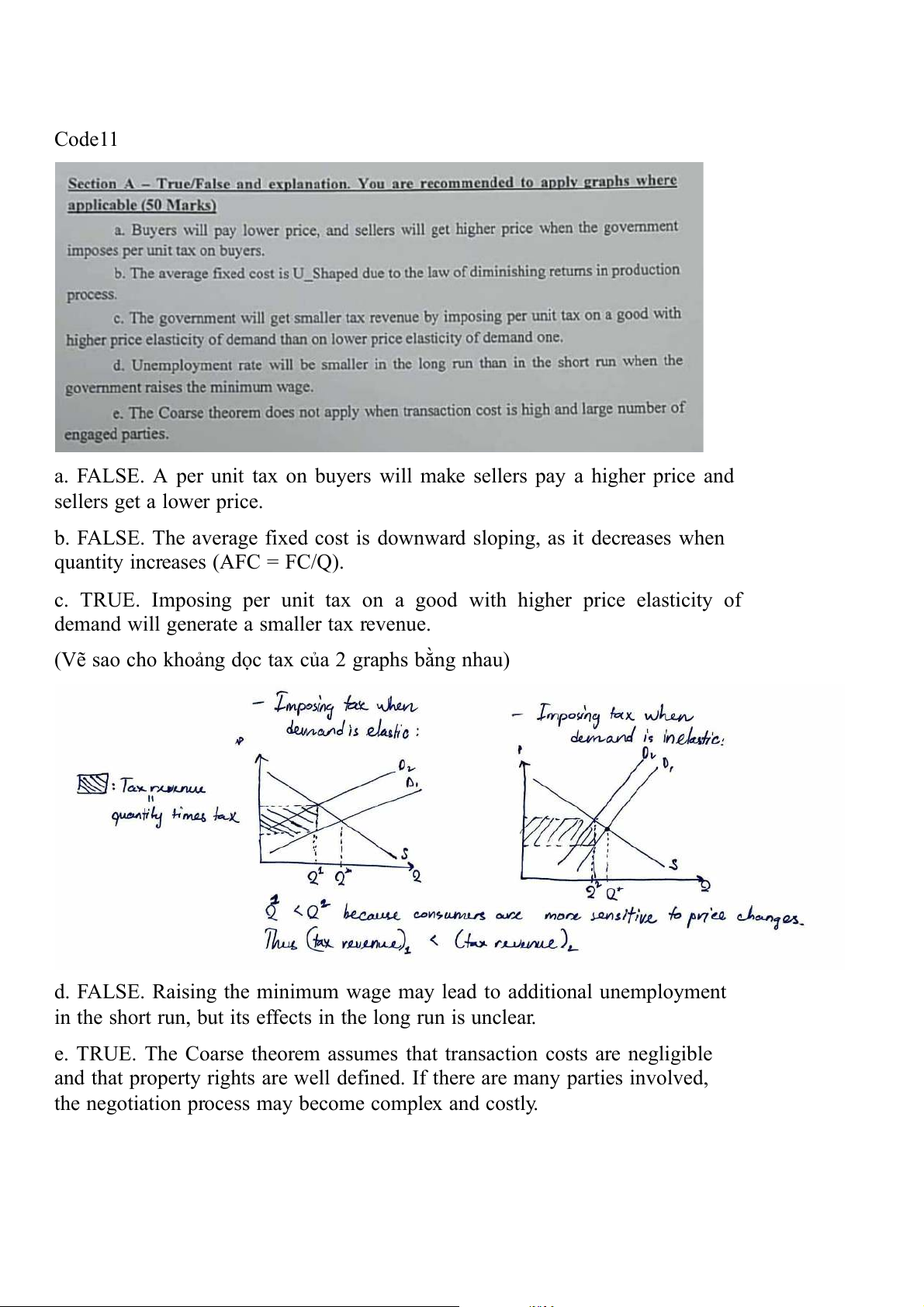

c. FALSE. Imposing per unit tax on a good with lower price elasticity of

demand will generate a larger tax revenue.

(Vẽ sao cho khoảng dọc tax của 2 graphs bằng nhau)

(Không cần vẽ đường D2)

d. FALSE. Raising the minimum wage may lead to additional unemployment

in the short run, but its effects in the long run is unclear.

(Wage raised => Incomes rise => Price rises => Inflation => Unemployment)

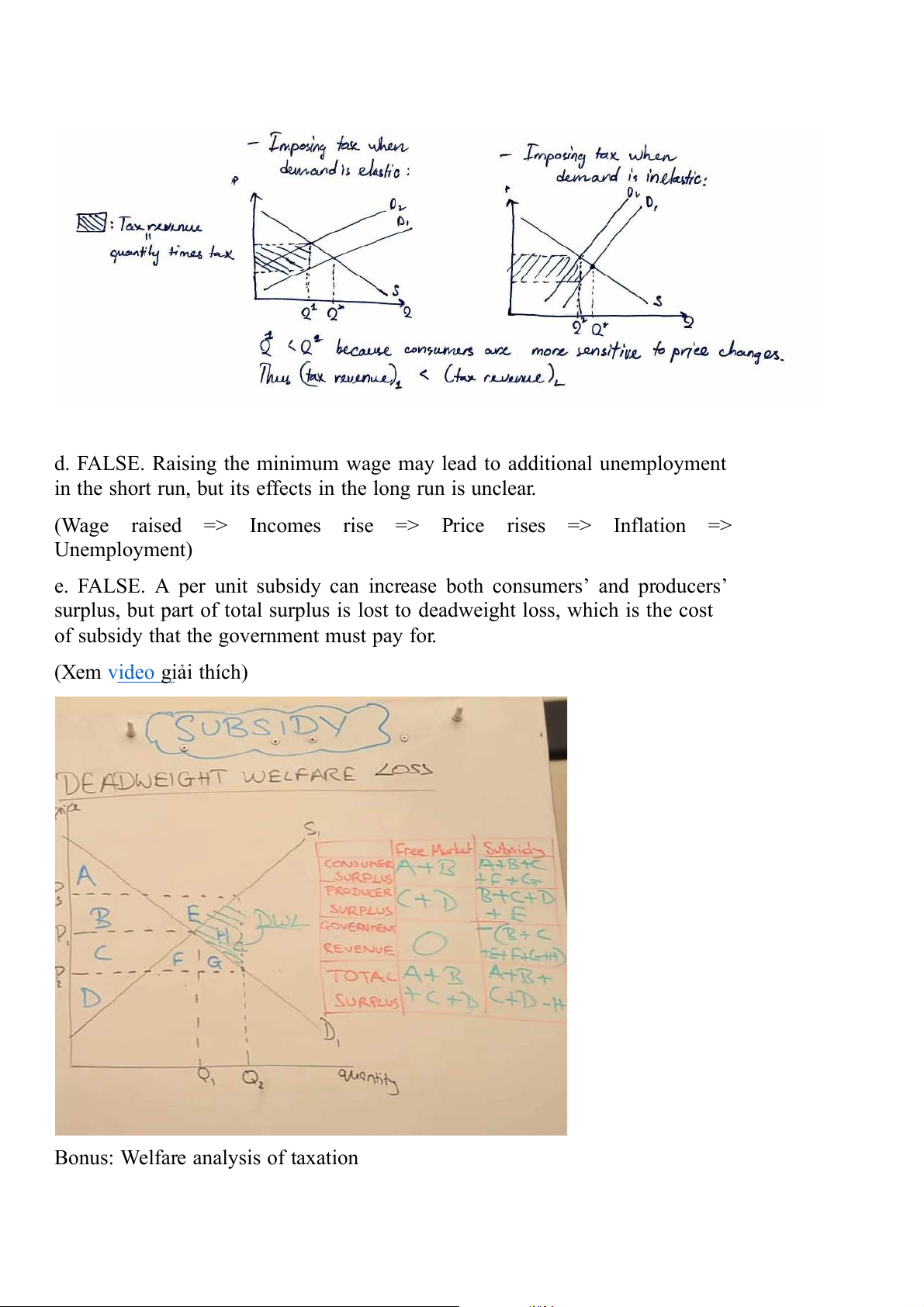

e. FALSE. A per unit subsidy can increase both consumers’ and producers’

surplus, but part of total surplus is lost to deadweight loss, which is the cost

of subsidy that the government must pay for. (Xem video giải thích)

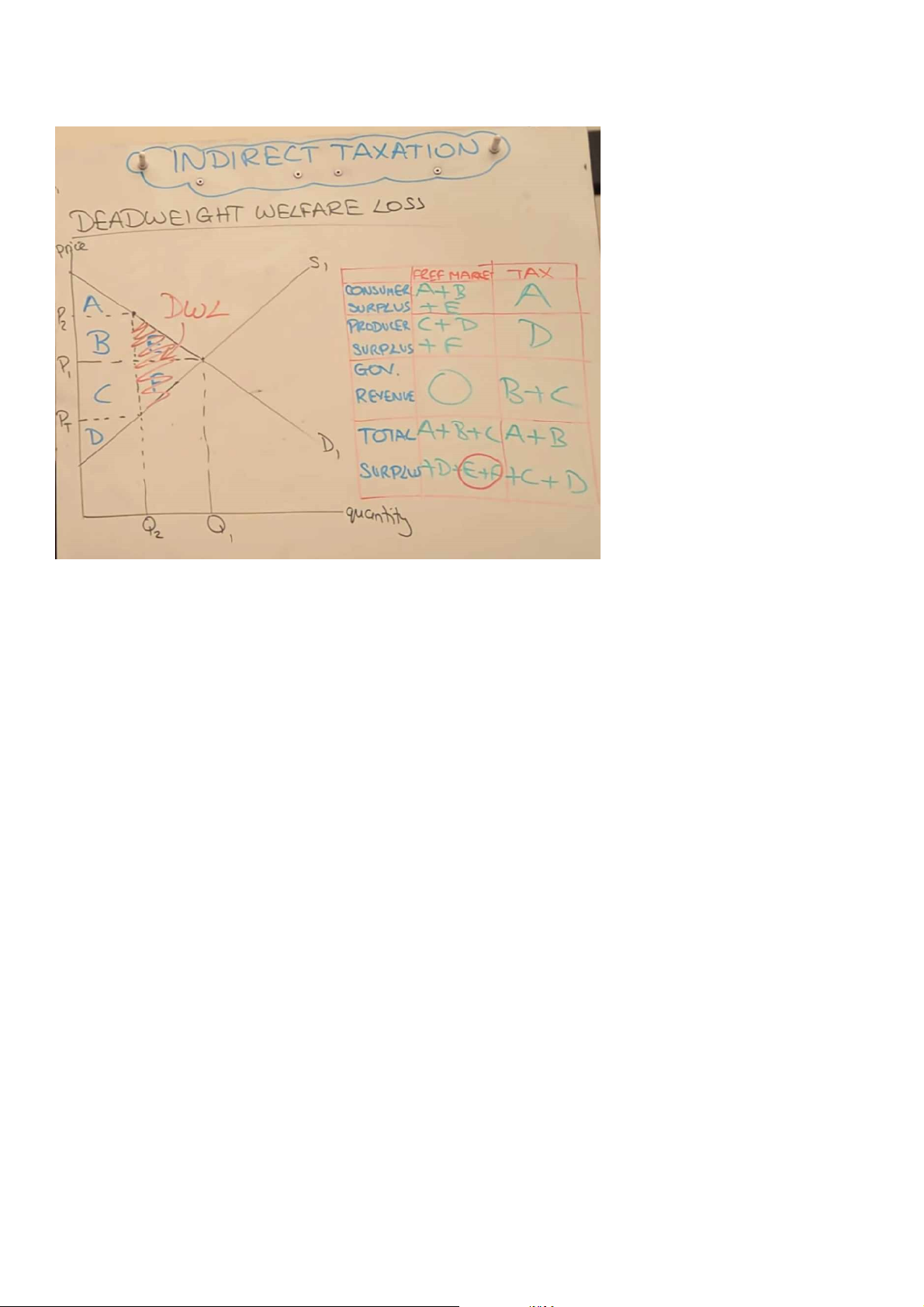

Bonus: Welfare analysis of taxation Code 11

a. FALSE. A per unit tax on buyers will make sellers pay a higher price and sellers get a lower price.

b. FALSE. The average fixed cost is downward sloping, as it decreases when

quantity increases (AFC = FC/Q).

c. TRUE. Imposing per unit tax on a good with higher price elasticity of

demand will generate a smaller tax revenue.

(Vẽ sao cho khoảng dọc tax của 2 graphs bằng nhau)

d. FALSE. Raising the minimum wage may lead to additional unemployment

in the short run, but its effects in the long run is unclear.

e. TRUE. The Coarse theorem assumes that transaction costs are negligible

and that property rights are well defined. If there are many parties involved,

the negotiation process may become complex and costly.

Code 7 – đề nài khó vải

a. TRUE. In perfect competition, firms are price takers and cannot influence

the market price; therefore, they must focus on minimizing costs to

maximize profits. In a monopolitically competitive market, firms have small

market power and can influence the price of their products to increase

profits by differentiating their products and charging higher prices.

b. FALSE. In perfect competition, the firm’s supply curve is its marginal cost

curve, because firms are price takers and will produce up to the point where

P = MC. Firms can still produce when P > AVC to pay off its fixed costs.

Therefore, the short-run supply curve of a firm in perfect competition is part

of the marginal cost curve above the minimum point of the average variable cost curve.

c. TRUE. In a monopoly, the price of all units lowers each time a firm

increases its output sold, which causes the firm to face a decreasing

marginal revenue. At the inelastic part of the demand curve, consumers are

less sensitive to lower prices, so any attempt to increase quantity will yield negative marginal revenue. (Đọc wikipedia bảo thế)

d. TRUE. A perfectly competitive firm will maximize its total revenue when

its marginal revenue equals zero. (Kieu giai thich gi nua)

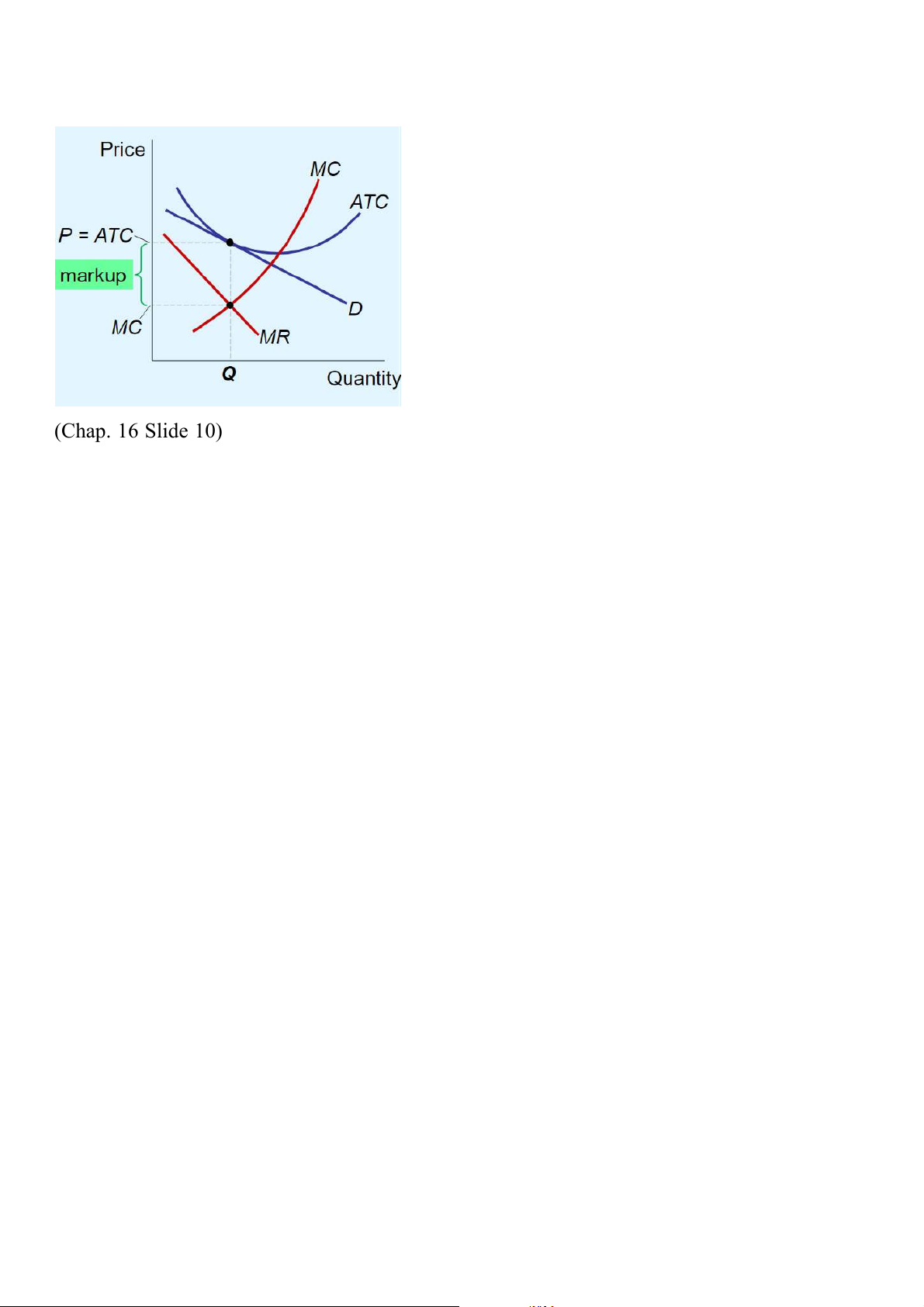

e. TRUE. In the long run, the entrance and exit of firms drives economic

profit to zero, but monopolistically competitive firms still charge its products

at a price that consumers are willing to pay. (Chap. 16 Slide 10)