Preview text:

Tutorial Questions 5 A. Pratice Problems

1. Which method is used to allocate the following scarce resources?

a. Campus parking space between student areas and faculty areas

b. A spot in a restricted student parking area c. Textbooks

d. Host city for the Olympic Games

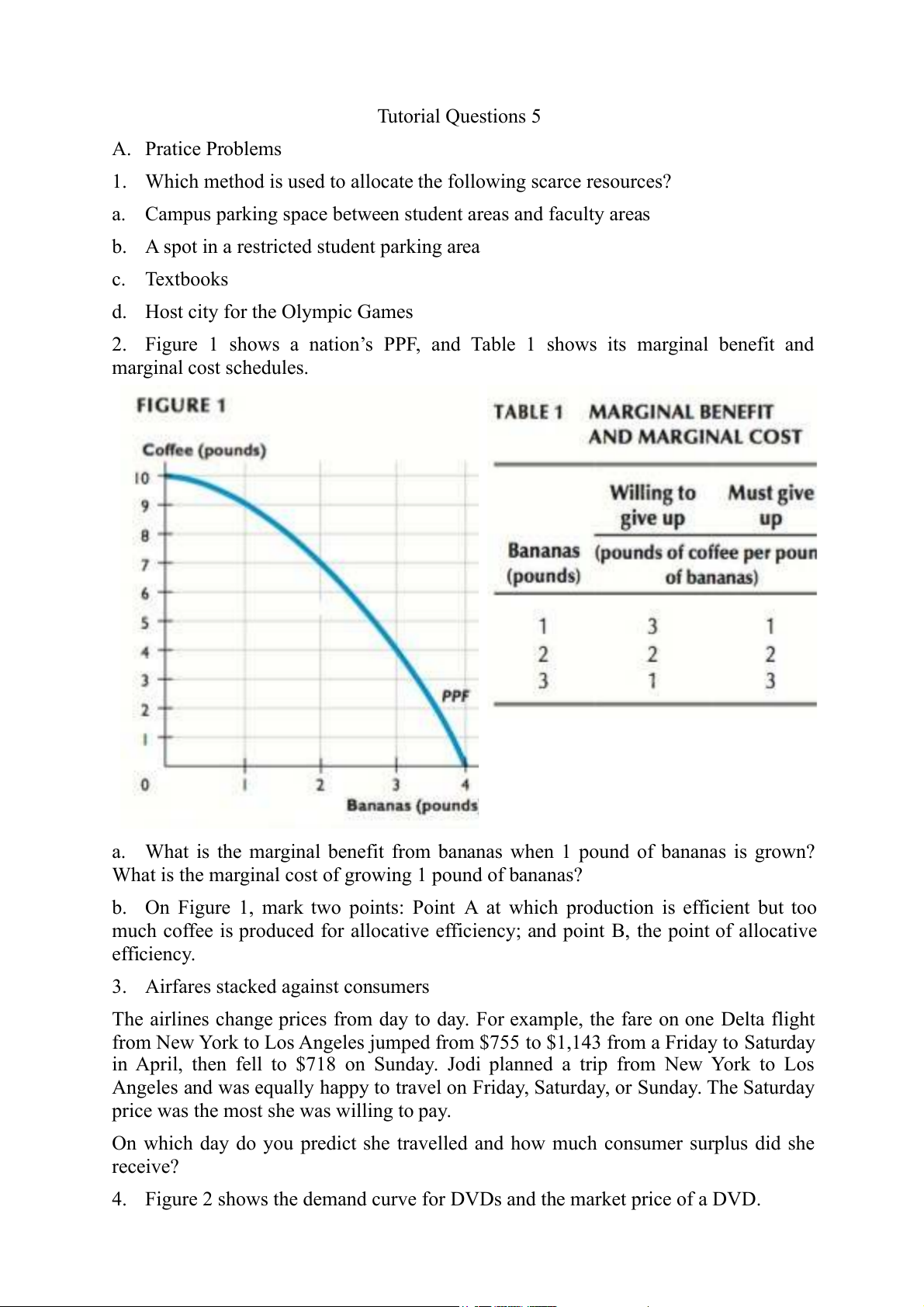

2. Figure 1 shows a nation’s PPF, and Table 1 shows its marginal benefit and marginal cost schedules.

a. What is the marginal benefit from bananas when 1 pound of bananas is grown?

What is the marginal cost of growing 1 pound of bananas?

b. On Figure 1, mark two points: Point A at

which production is efficient but too

much coffee is produced for allocative efficiency; and point B, the point of allocative efficiency.

3. Airfares stacked against consumers

The airlines change prices from day to day. For example, the fare on one Delta flight

from New York to Los Angeles jumped from $755 to $1,143 from a Friday to Saturday

in April, then fell to $718 on Sunday. Jodi planned a trip from New York to Los

Angeles and was equally happy to travel on Friday, Saturday, or Sunday. The Saturday

price was the most she was willing to pay.

On which day do you predict she travelled and how much consumer surplus did she receive?

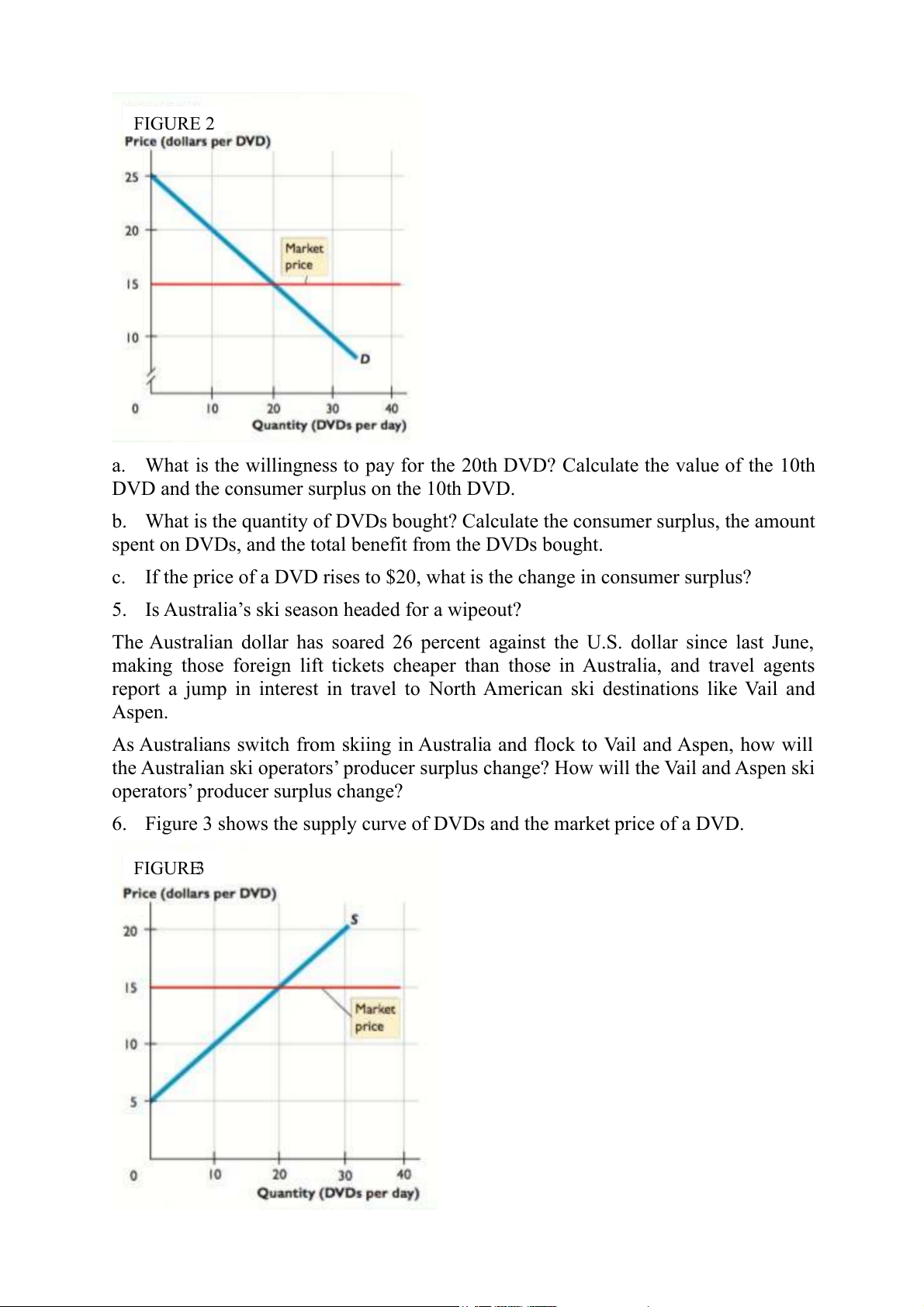

4. Figure 2 shows the demand curve for DVDs and the market price of a DVD. FIGURE 2

a. What is the willingness to pay for the 20th DVD? Calculate the value of the 10th

DVD and the consumer surplus on the 10th DVD.

b. What is the quantity of DVDs bought? Calculate the consumer surplus, the amount

spent on DVDs, and the total benefit from the DVDs bought.

c. If the price of a DVD rises to $20, what is the change in consumer surplus?

5. Is Australia’s ski season headed for a wipeout?

The Australian dollar has soared 26 percent against the U.S. dollar since last June,

making those foreign lift tickets cheaper than those in Australia, and travel agents

report a jump in interest in travel to North American ski destinations like Vail and Aspen.

As Australians switch from skiing in Australia and flock to Vail and Aspen, how will

the Australian ski operators’ producer surplus change? How will the Vail and Aspen ski

operators’ producer surplus change?

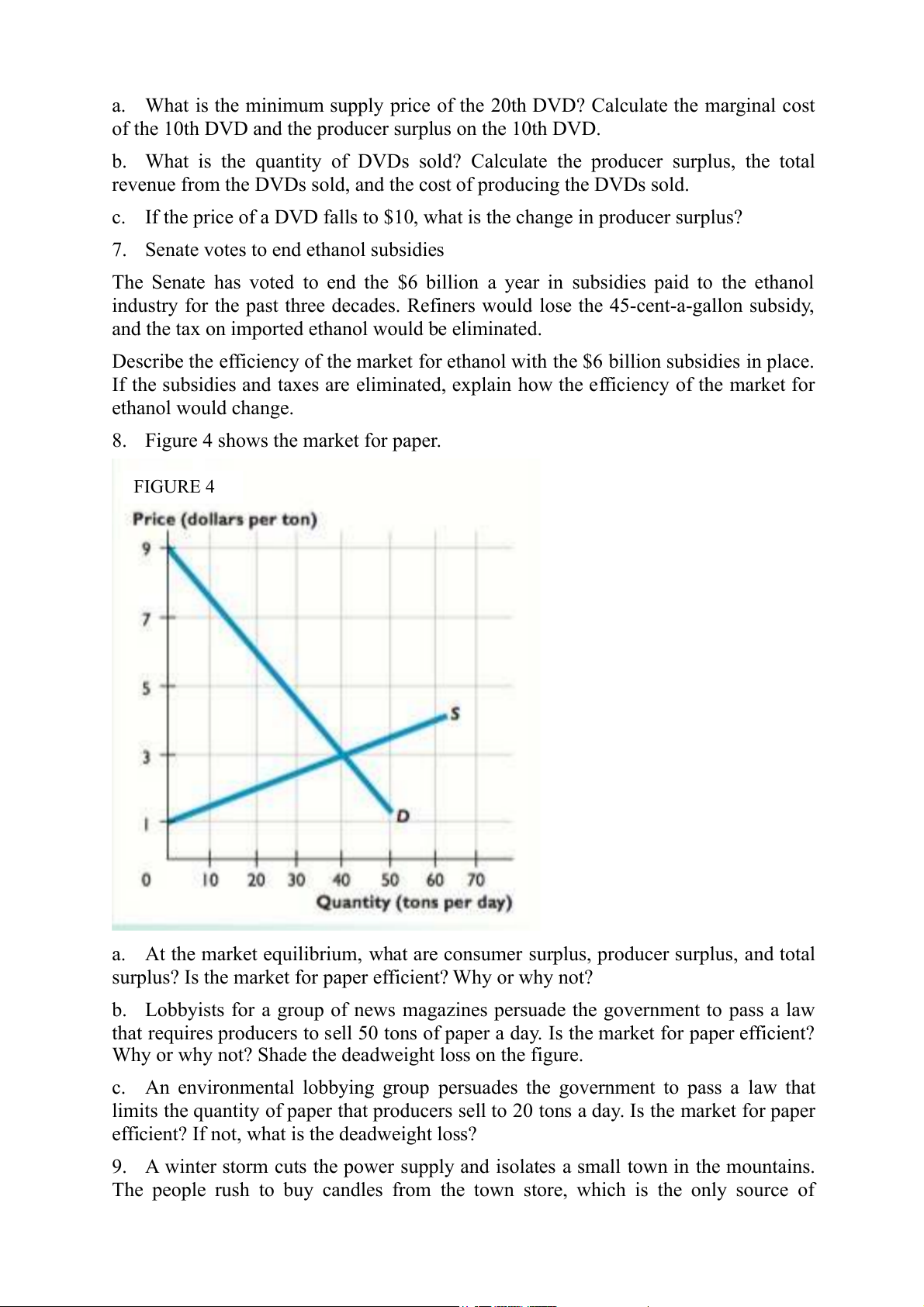

6. Figure 3 shows the supply curve of DVDs and the market price of a DVD. FIGURE 3

a. What is the minimum supply price of the 20th DVD? Calculate the marginal cost

of the 10th DVD and the producer surplus on the 10th DVD.

b. What is the quantity of DVDs sold? Calculate the producer surplus, the total

revenue from the DVDs sold, and the cost of producing the DVDs sold.

c. If the price of a DVD falls to $10, what is the change in producer surplus?

7. Senate votes to end ethanol subsidies

The Senate has voted to end the $6 billion a year in subsidies paid to the ethanol

industry for the past three decades. Refiners would lose the 45-cent-a-gallon subsidy,

and the tax on imported ethanol would be eliminated.

Describe the efficiency of the market for ethanol with the $6 billion subsidies in place.

If the subsidies and taxes are eliminated, explain how the efficiency of the market for ethanol would change.

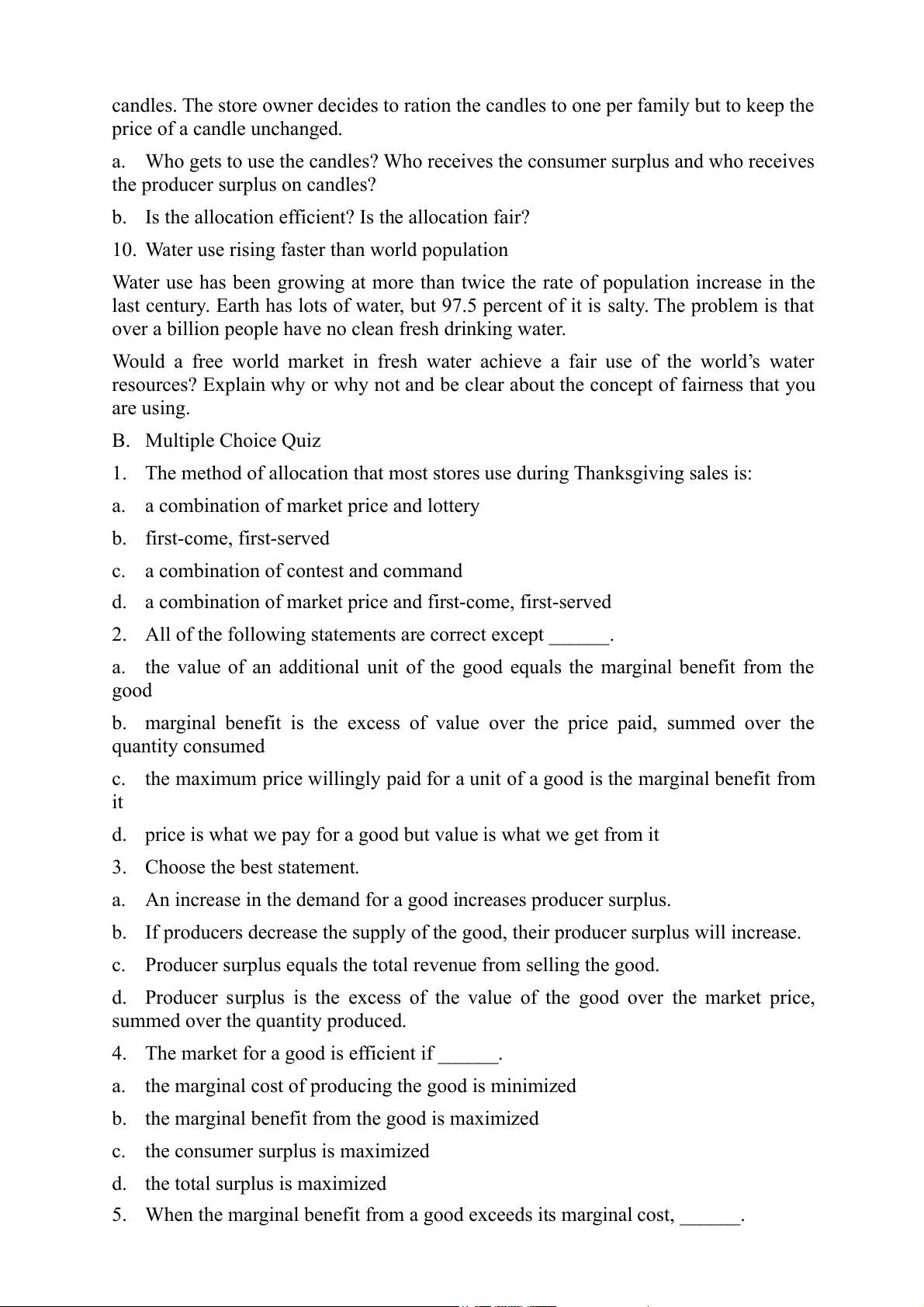

8. Figure 4 shows the market for paper. FIGURE 4

a. At the market equilibrium, what are consumer surplus, producer surplus, and total

surplus? Is the market for paper efficient? Why or why not?

b. Lobbyists for a group of news magazines persuade the government to pass a law

that requires producers to sell 50 tons of paper a day. Is the market for paper efficient?

Why or why not? Shade the deadweight loss on the figure.

c. An environmental lobbying group persuades the government to pass a law that

limits the quantity of paper that producers sell to 20 tons a day. Is the market for paper

efficient? If not, what is the deadweight loss?

9. A winter storm cuts the power supply and isolates a small town in the mountains.

The people rush to buy candles from the town store, which is the only source of

candles. The store owner decides to ration the candles to one per family but to keep the price of a candle unchanged.

a. Who gets to use the candles? Who receives the consumer surplus and who receives

the producer surplus on candles?

b. Is the allocation efficient? Is the allocation fair?

10. Water use rising faster than world population

Water use has been growing at more than twice the rate of population increase in the

last century. Earth has lots of water, but 97.5 percent of it is salty. The problem is that

over a billion people have no clean fresh drinking water.

Would a free world market in fresh water achieve a fair use of the world’s water

resources? Explain why or why not and be clear about the concept of fairness that you are using. B. Multiple Choice Quiz

1. The method of allocation that most stores use during Thanksgiving sales is:

a. a combination of market price and lottery b. first-come, first-served

c. a combination of contest and command

d. a combination of market price and first-come, first-served

2. All of the following statements are correct ______. except

a. the value of an additional unit of the good equals the marginal benefit from the good

b. marginal benefit is the excess of value over the price paid, summed over the quantity consumed

c. the maximum price willingly paid for a unit of a good is the marginal benefit from it

d. price is what we pay for a good but value is what we get from it 3. Choose the best statement.

a. An increase in the demand for a good increases producer surplus.

b. If producers decrease the supply of the good, their producer surplus will increase.

c. Producer surplus equals the total revenue from selling the good.

d. Producer surplus is the excess of the value of the good over the market price,

summed over the quantity produced.

4. The market for a good is efficient if ______.

a. the marginal cost of producing the good is minimized

b. the marginal benefit from the good is maximized

c. the consumer surplus is maximized

d. the total surplus is maximized

5. When the marginal benefit from a good exceeds its marginal cost, ______.

a. there is overproduction of the good

b. a deadweight loss, which is the excess of marginal benefit over marginal b. cost, arises

a. producer surplus decreases and consumer surplus increases

b. total production increases and efficiency increases

6. Market failure arises if ______.

a. there is overproduction of the good but not if there is underproduction

b. the deadweight loss is zero

c. producer surplus exceeds consumer surplus

d. total surplus is not maximized

7. Suppose your own demand curve for tomatoes slopes downward. Suppose also

that, for the last tomato you bought this week, you paid a price exactly equal to your willingness to pay. Then

a. you should buy more tomatoes before the end of the week.

b. you already have bought too many tomatoes this week.

c. your consumer surplus on the last tomato you bought is zero.

d. your consumer surplus on all of the tomatoes you have

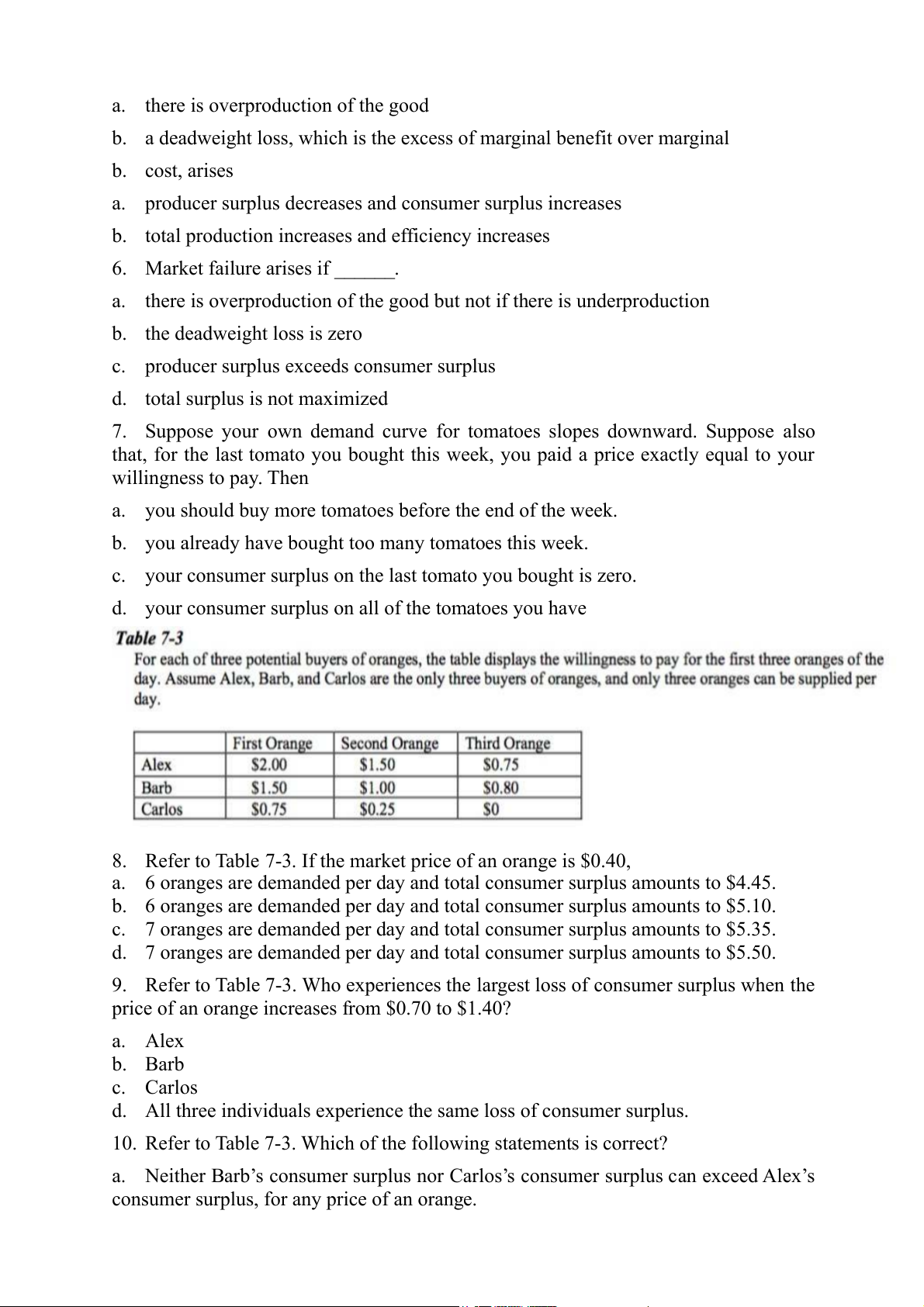

8. Refer to Table 7-3. If the market price of an orange is $0.40,

a. 6 oranges are demanded per day and total consumer surplus amounts to $4.45.

b. 6 oranges are demanded per day and total consumer surplus amounts to $5.10.

c. 7 oranges are demanded per day and total consumer surplus amounts to $5.35.

d. 7 oranges are demanded per day and total consumer surplus amounts to $5.50.

9. Refer to Table 7-3. Who experiences the largest loss of consumer surplus when the

price of an orange increases from $0.70 to $1.40? a. Alex b. Barb c. Carlos

d. All three individuals experience the same loss of consumer surplus.

10. Refer to Table 7-3. Which of the following statements is correct?

a. Neither Barb’s consumer surplus nor Carlos’s consumer surplus can exceed Alex’s

consumer surplus, for any price of an orange.

b. All three individuals will buy at least one orange only if the price of an orange is less than $0.25.

c. If the price of an orange is $0.60, total consumer surplus is $4.90.

d. All of the above are correct .

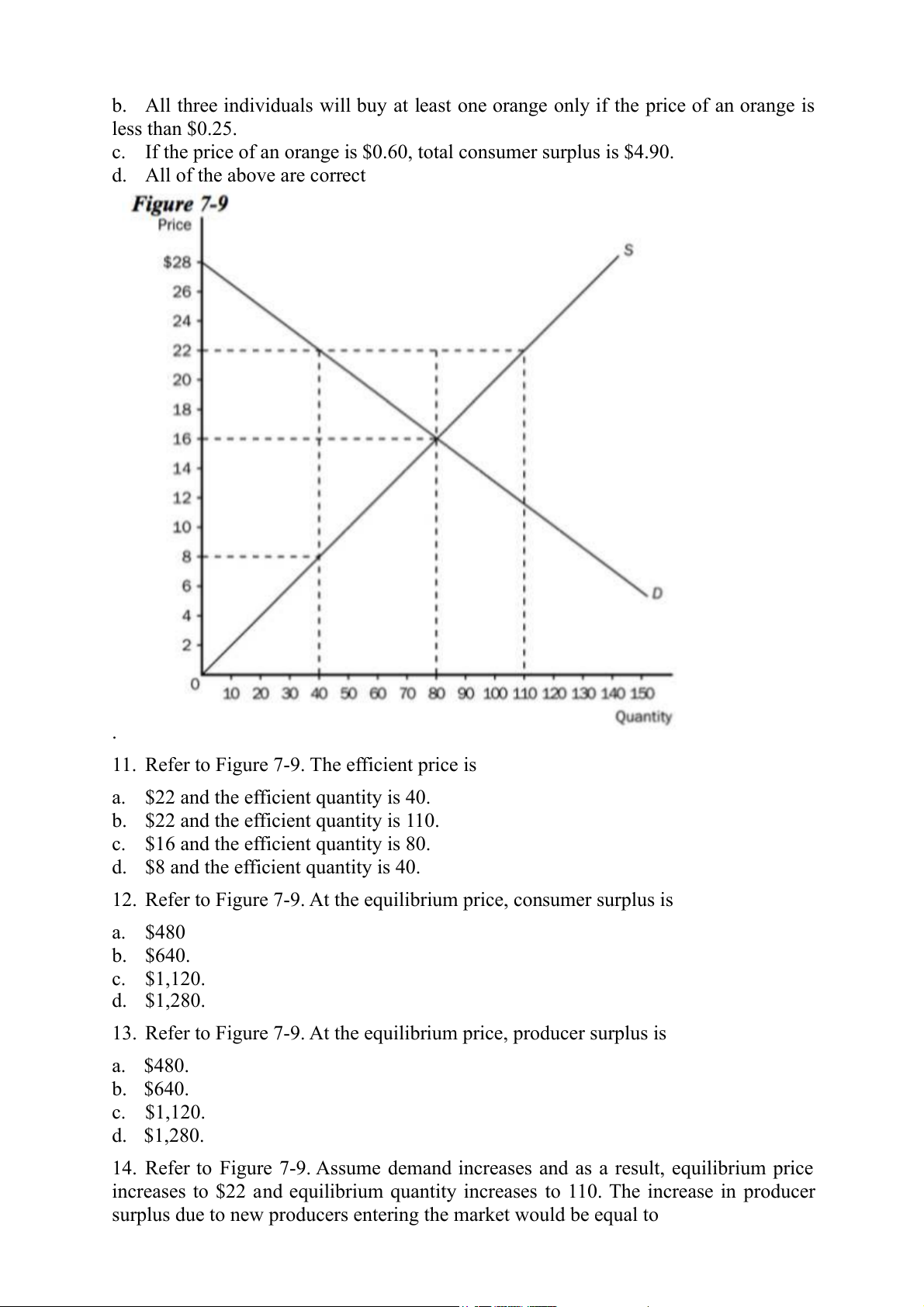

11. Refer to Figure 7-9. The efficient price is

a. $22 and the efficient quantity is 40.

b. $22 and the efficient quantity is 110.

c. $16 and the efficient quantity is 80.

d. $8 and the efficient quantity is 40.

12. Refer to Figure 7-9. At the equilibrium price, consumer surplus is a. $480 b. $640. c. $1,120. d. $1,280.

13. Refer to Figure 7-9. At the equilibrium price, producer surplus is a. $480. b. $640. c. $1,120. d. $1,280.

14. Refer to Figure 7-9. Assume demand increases and as a result, equilibrium price

increases to $22 and equilibrium quantity increases to 110. The increase in producer

surplus due to new producers entering the market would be equal to a. $90. b. $210. c. $360. d. $480.

15. Refer to Figure 7-9. Assume demand increases and as a result, equilibrium price

increases to $22 and equilibrium quantity increases to 110. The increase in producer

surplus to producers already in the market would be equal to a. $90. b. $210. c. $360. d. $480.

16. Inefficiency can be caused in a market by the presence of a. market power. b. externalities.

c. imperfectly competitive markets.

d. All of the above are correct.

17. Market failure is the inability of

a. buyers to interact harmoniously with sellers in the market.

b. a market to establish an equilibrium price.

c. buyers to place a value on the good or service.

d. some unregulated markets to allocate resources efficiently.

18. When markets fail, public policy

a. can do nothing to improve the situation.

b. can potentially remedy the problem and increase economic efficiency.

c. can always remedy the problem and increase economic efficiency.

d. can, in theory, remedy the problem, but in practice, public policy has proven to be ineffective.