Preview text:

lOMoARcPSD|47206521 GROUP ASSIGNMENT

SUBJECT: MANAGERIAL ACCOUNTING

ABC Ltd. Inc is a brand-new sport organization. Because it is still very young, the company does

not have a solid management accounting system to provide information for the decision making

of senior management. The main business that ABC operates is organizing football matches as

well as indoor and outdoor sports events. Let's say that you are hired to work as an accounting

assistant for the chief accountant of ABC and you are assigned some tasks as follows:

You have been provided with two different resources to help you complete this exercise. Use ONE of the two resources:

1. An instruction MS Word format

2. A worksheet in MS Excel format. Access the link below to download and finish the assignment:

https://docs.google.com/spreadsheets/d/1I1DkzGg2FHVI5HM7xNXFgtUoiUzz_DeO/edit?

usp=sharing&ouid=114655148697128018858&rtpof=true&sd=true lOMoARcPSD|47206521

Task number 1: Cost Classification

ABC is organizing a football festival in the city. Your task is to match the typical expenditures in

Table A with the scenarios in Table B.

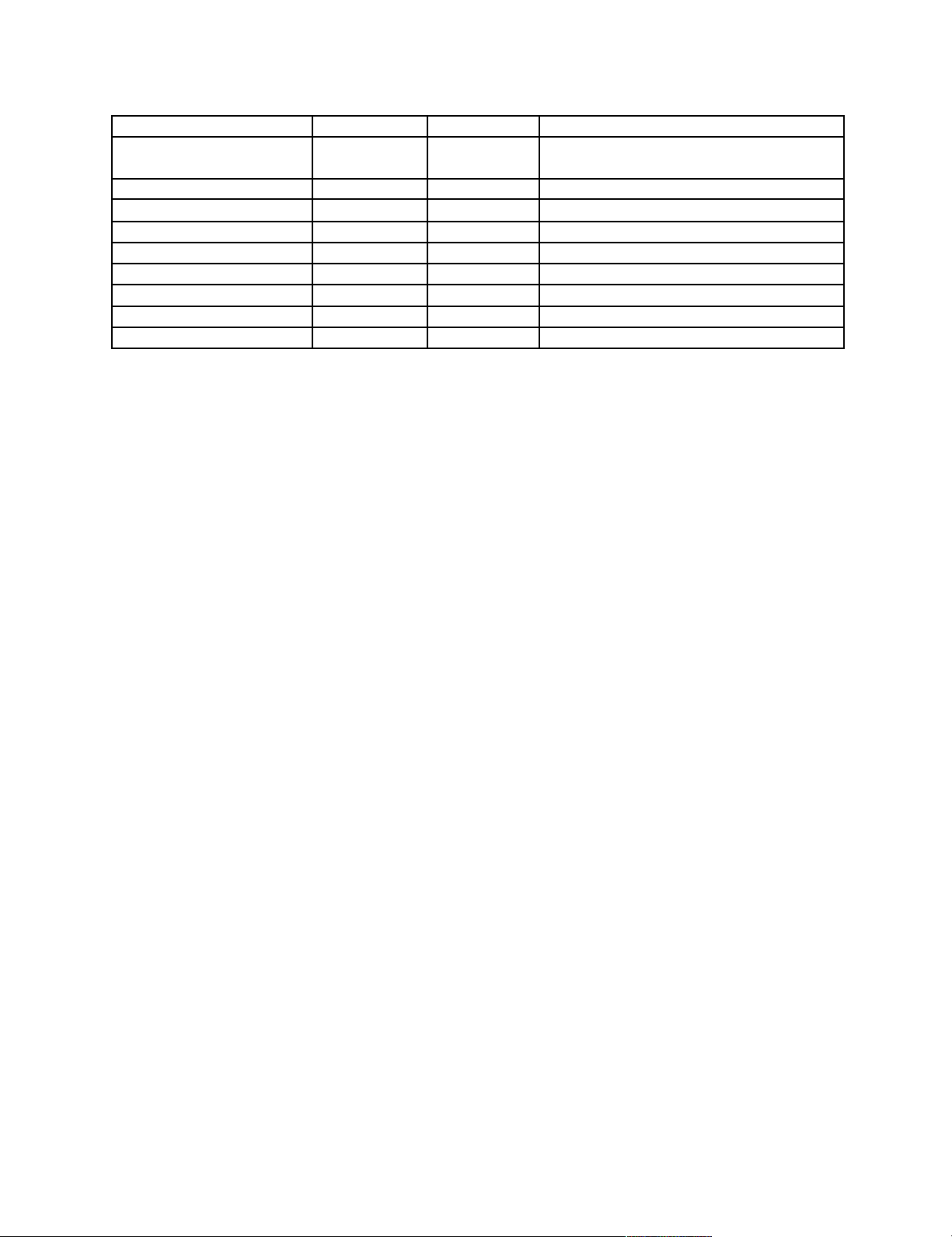

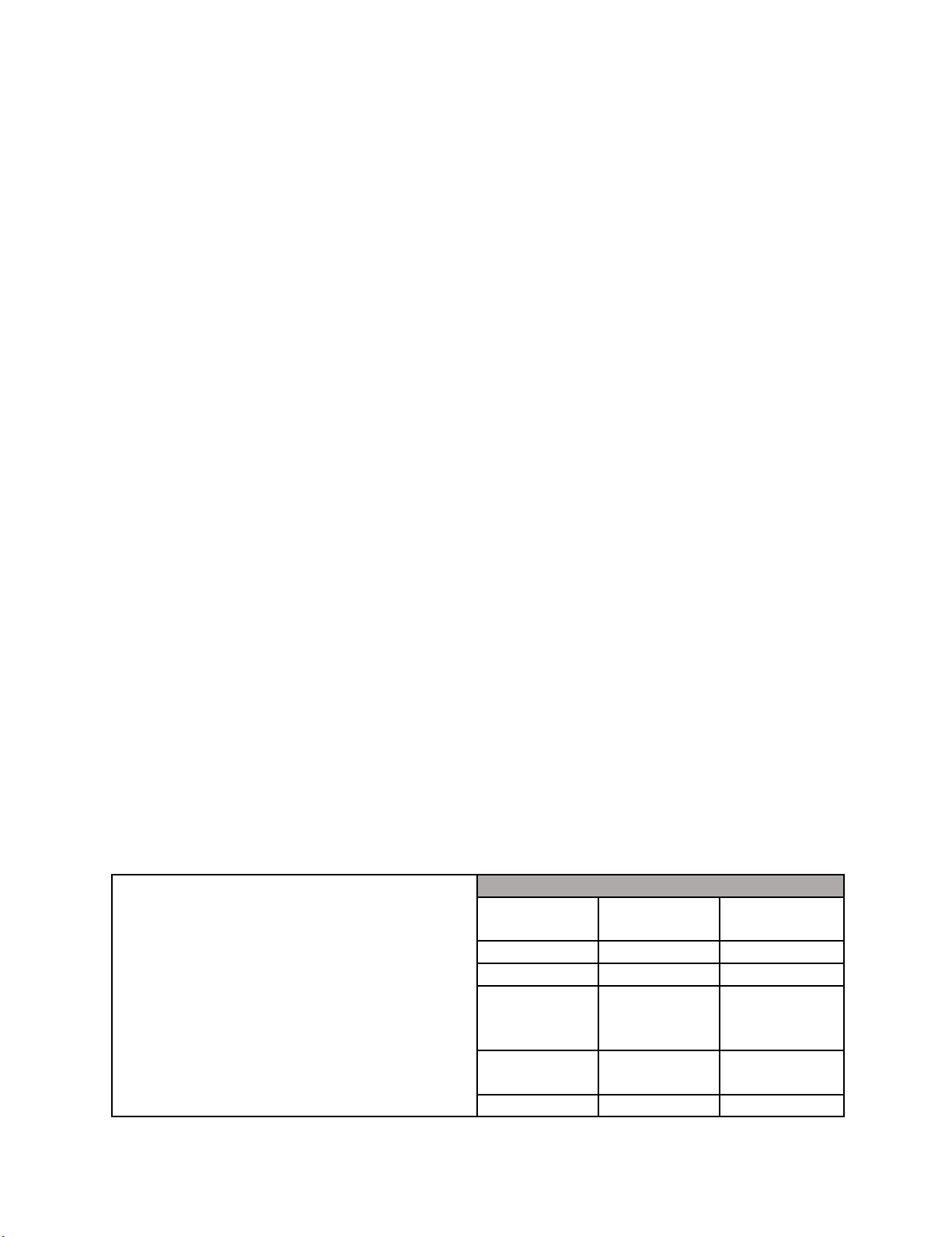

Table A - Typical Expenditures Group A Group B Repairs and Maintenance Trophies Balls, Electricity Flags and Whistles Canteen Supplies Referee Fees Cleaning Shade Tents Group C Group D Printing of Art Union Tickets Payments to coaches

Cost of Notice in Newspaper of Art Union Hire of courts Results Art Union Prizes Coaching manuals Group E Group F Computer Expenses Water Usage Telephone and Postage Fertiliser and Grass Seed Paper and Printing Mowing and Line Marking Group G Group H Airfares Supplies for Barbecue Accommodation and food

Hire of Jumping Castles for Children Team Apparel Giveaway T-Shirts and Caps Table B – Scenarios Scenarios

Put the Letter of the appropriate group in this column

1. Come n’ try promotional event 2. Junior football carnival 3. Fundraising campaign

4. General administration of the organisation

5. Running costs of the clubhouse

6. Indoor basketball clinic for coaches

7. Facility maintenance costs (outdoor)

8. Taking a team to a national championship lOMoARcPSD|47206521

Task number 2: Estimating Income and Expenditure

Using the information in Table A, your task is to estimate the items of income or expenditure

shown in column 1 of Table B and put your answer in column 4 of Table B.

You should also write in column 2 of Table B whether the item is an income or expenditure item.

Furthermore, you should also write in column 3 of Table C the letter of the factor group that you used to calculate your answer.

In making calculations, you are advised that none of the information in Table A is redundant.

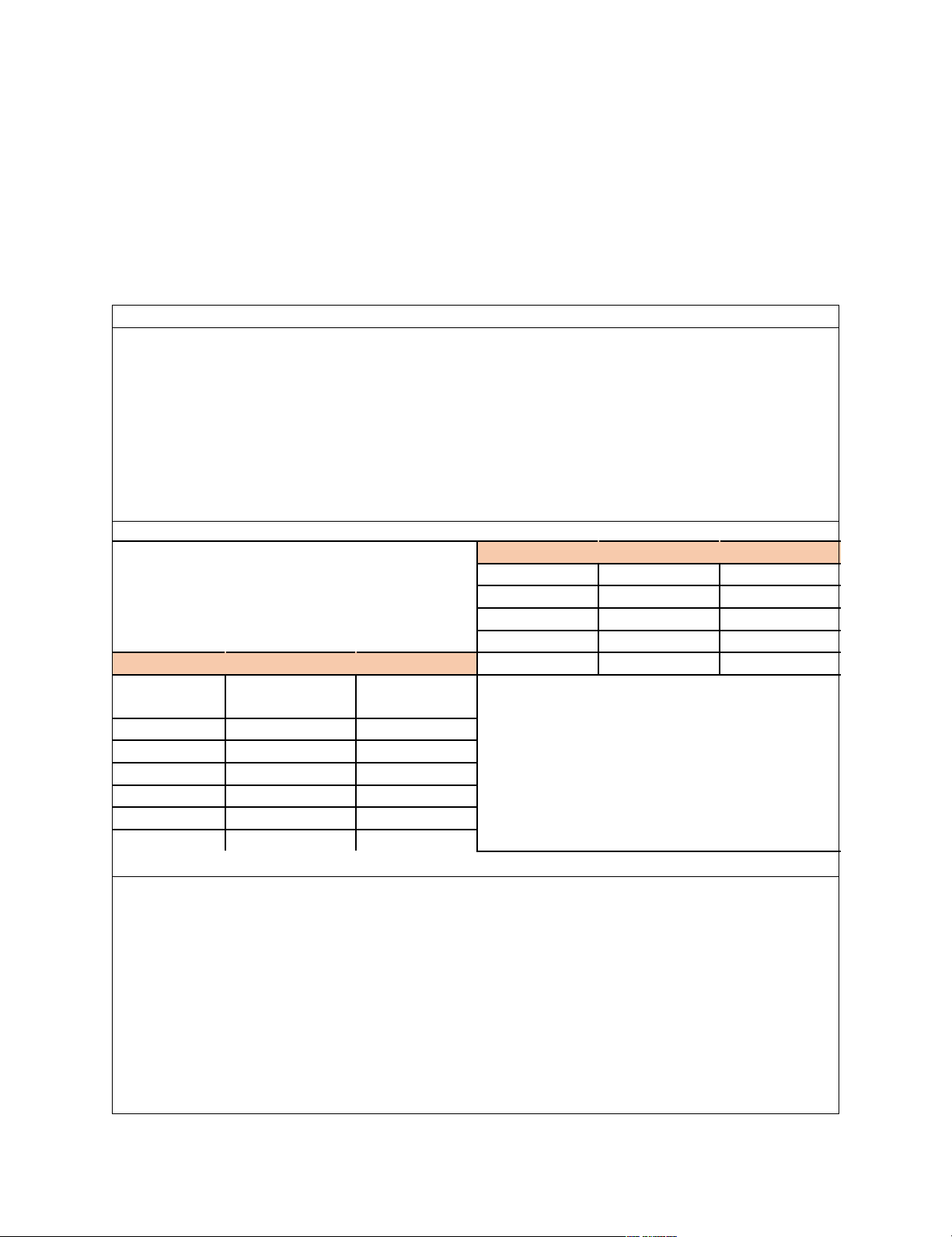

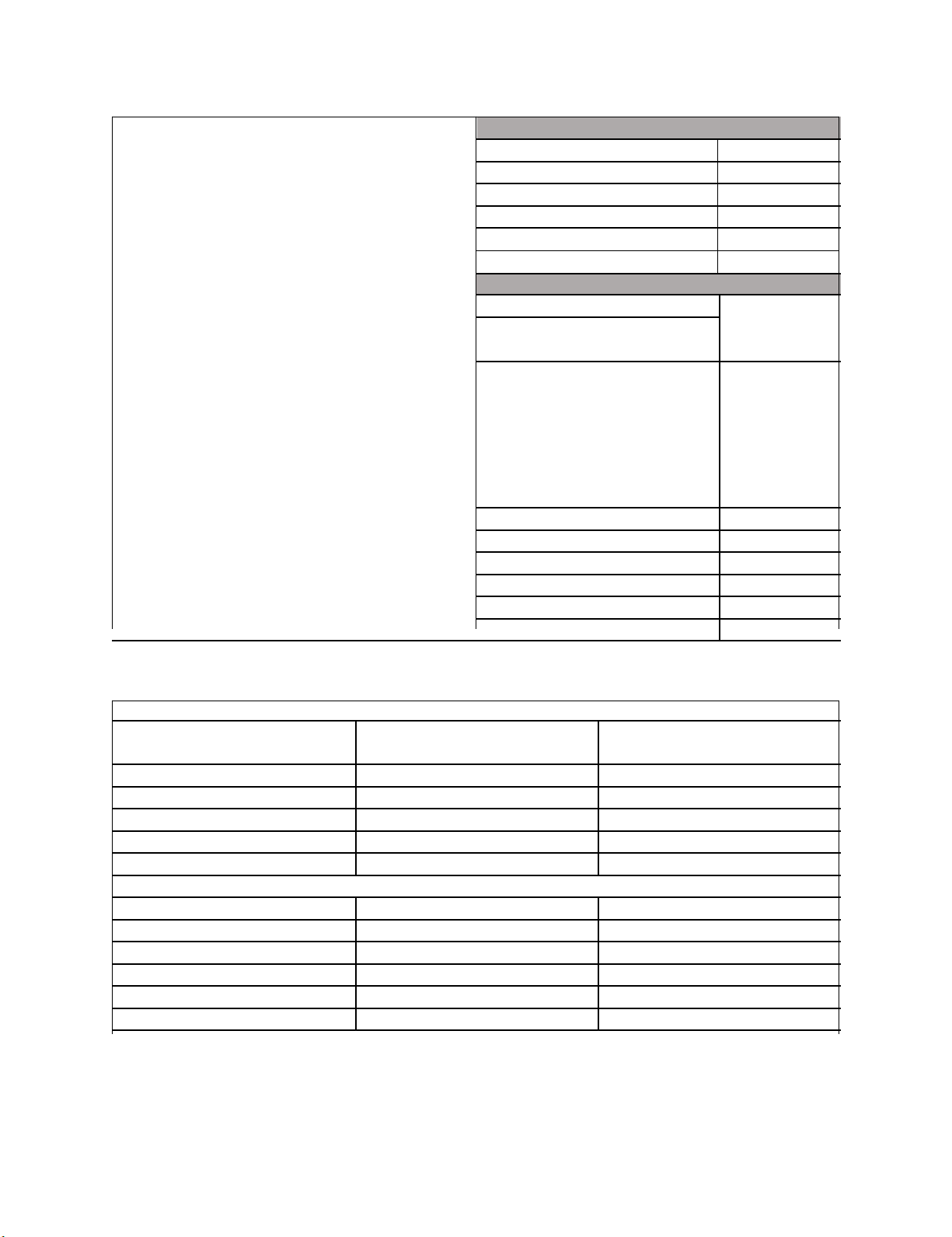

Table A – Typical Expenditures Factors Group A

Factors Group B (note 1)

The number of opening hours per week: 12 Width of advert: 2 columns

The average sales per hour: $100 Number of lines: 10

Number of weeks open per season: 30

Cost per line (per single column): $8.00 Number of adverts: 4 Factors Group C Factors Group D Wage rate per hour: $30.00 Number of members: 500

Number of hours worked per week: 25 Fee per member: $150 Weeks per year: 30

Factors Group E (note 2) Factors Group F Watts per globe: 500W Game fee per player: $6 Number of globes: 60

Total matches per week (all teams): 30 Hours of use: 18 hrs per week

Av. Number of players in a team: 14

Number of weeks in the season: 30

Number of weeks in the season: 30 Cost per kilowatt hour: $0.20

Factors Group G (note 3) Factors Group H

Hours to mow whole of fields: 8 Cost per shirt: $20 Number of mows per week: 1 Cost per shorts: $15 Wage rate per hour: $25 Cost per socks (pair): $6 Fuel cost per hour: $4 Number of players: 300

No of weeks mowed once per week: 26

No of weeks mowed twice per week: 26 Notes:

1. Newspaper advertising is often charged according to how many columns wide it is by how

many lines (of text) down the page (length).

2. 1 Kilowatt = 1000 watts (therefore a 500watt globe is a half kilowatt globe). Electricity is

charged according to how many kilowatt hours is used (i.e., the number of kilowatts multiplied by the number of hours)

3. Grass grows differently in summer and winter. In summer pitches need to be mowed twice per

week, whereas in winter once per week is adequate. Table B – Scenarios lOMoARcPSD|47206521 COLUMN 1 COLUMN 2 COLUMN 3 COLUMN 4 Item Income or Factor

Show your answer and workings in Expenditure Group this column 1. Canteen Sales 2. Newspaper Advertising 3. Bar Attendant 4. Membership Fees 5. Cost of Floodlights 6. Game Fees 7. Pitch Mowing 8. Team Apparel Cost lOMoARcPSD|47206521

Task number 3: Break- Even Analysis

You are provided the spreadsheet in which are six Break-Event point problems which increase in

degree of difficulty from Case A to Case F.

In each spreadsheet you will need to put in formulae to work out income, and then formulae to

work out costs. You should remember that the number of spectators/participants is a very

important element in working out the total income and the amount of variable costs.

Once you have set out the spreadsheet, find your solution by manipulating the number of

spectators/participants. Be aware that the model presented overleaf needs to be adjusted in design

and content for each problem. The main purpose of the example is mostly to demonstrate that

you will need an income and an expenditure section.

Case A – Basic break-even point problem

In this simple problem your task is to work out the number of participants required to ensure the event breaks-even.

The data you need to make your calculation is as follows: • Total Fixed Costs: $10,080

• Variable Cost per Participant: $2.00

• Ticket Price per Participant: $20

Case B – Variation of the basic break-even point problem

This problem is much the same problem as in case A except that you are given the number of

participants and you must work out what is the minimum price that spectators must be charged.

The data you need to make your calculation is as follows: • Total Fixed Costs: $10,000

• Variable Cost per Participant: $5.00

• Number of Participants Required: 500 Case C – Awards evening

The club committee are putting on an awards evening in the clubhouse. The ticket price will

be $30 per person, and it is expected that 100 people will attend.

The committee will spend $1500 on entertainment and prizes.

What is the maximum cost of the meal per person that can be afforded, if the event is not to make a loss?

Case D – Calculating the break-even point of three possible venues for an event

The committee of a sport organization is considering three different venues to stage a major

fundraising event. Venue A has a maximum seating capacity of 500 people and costs $1,200 to hire.

Venue B has a maximum capacity of 1000 and costs $3,500 and Venue C has a maximum

capacity of 2000 and costs $9,000.

If the variable cost for each participant is $5.20, which venue would be the most profitable at maximum capacity? lOMoARcPSD|47206521

To solve this problem, you will need three separate spreadsheets, one for each venue. Case

E – Two levels of ticket prices make the break-even point a little more difficult

In this problem there are two levels of spectator admission price – adults $20 and children $5.

This makes the break-even calculation problem a little more difficult. However, it is expected

that the ratio of adults to children is 2:1 (two adults to every one child). Knowing this ratio

will enable you to calculate the break-even point required for adults and children required.

Other important information includes: • Total Fixed Costs: $20,000

• Variable Cost per Participant: $2.00

• Ticket Price for accompanied children: $5

• Ticket Price for adults: $20

• Expected Ratio: 2 Adults to every 1 child

Case F – Two different break-even points dependent on the number of event spectators

In this problem, there are TWO break-even points. This scenario is commonplace in major

events such as Football matches. The two break-even points occur because there are two

possible levels of fixed expenditure depending on whether the spectator crowd is smaller or

greater than 20,000. If the crowd exceeds 20,000, the stadium manager has to open up the

second tier of seating and extra staffing and cleaning will result. The important data is as follows:

All spectators will be charged $15 each for entry to the stadium.

Fixed Costs if the total number of spectators is 20,000 or less will be $200,000. But if spectators are more

than 20,000, fixed costs will immediately rise to $300,000.

Irrespective of the number of spectators, the variable cost per participant: $3.00 lOMoARcPSD|47206521

Task number 4: Gross Profit Scenarios

Here are three budgeting problems that introduce Gross Profit as an important factor in setting

budgets where Sales of Products are involved.

As with all budgeting problems, utilize a spreadsheet wherever possible to set out your workings and perform your calculations.

Case A – Simple Gross Profit calculation – No inventory (stock) involved

ABC purchases the following items of clothing to resell to its members:

• Shirts – quantity 200, costing $20 each, selling price $30 each

• Shorts – quantity 200, costing $15 each, selling price $20 each

• Socks – quantity 200 (pairs), costing $6 each, selling price $10

each All items of clothing were sold.

Your task is to calculate the Gross Profit in dollars and percentage terms for each of the three lines of clothing.

What is the overall Gross Profit in dollar and percent terms, and which line of clothing was the most profitable?

Case B – Gross Profit calculation with changes of inventory(stock) involved

ABC runs a bar in its clubhouse. During the Table 1

month of June, the accounts show that Category Purchases Sales

purchases and sales for the four categories of Beer 6,000 10,000

products that are sold from the bar were as in Wine 4,500 8,000 Table 1. Spirits 2,000 3,500 Table 2 Other 800 900 Opening Closing

A stock take was taken at beginning and Stock 01-Jun

Stock 30-Jun end of June and the stock levels as shown Category $ $ in Table 2. Beer 500 800

Your task is to prepare a spreadsheet that Wine 1,000 1,200

calculates the Gross Profit for each category Spirits 750 900

in dollar and percent terms, and the same for Other 250 500

overall Gross Profit of the bar for the month Total 2,500 3,400 of June.

Case C – Increasing profit from the clubhouse bar

ABC runs a bar in its clubhouse which is open for business for 3 hours in the evening on

Friday, Saturday, and Sunday (a total of 9 hours per week). The number of sales per hour is

generally $500 per hour except on Saturday evening when sales rise to $600 per hour.

Over the last one year, according to financial accounting records, the Gross Profit on bar sales

is generally 36%. Keeping the bar open requires one bartender paid at the rate of $25.00 per

hour and it is also estimated that electricity costs $5.00 per hour.

The management committee wants to make more profit from the bar and is trying to decide between two options.

Option 1: Open one more hour on Saturday evening on the basis that the extra hour achieves the

same sales per hour as other hours on Saturday ($600/hr). There would be no attempt to lOMoARcPSD|47206521

change bar prices to increase Gross Profit.

Option 2: Keep the same opening hours for the three evenings but increase prices a small

amount to achieve a Gross Profit of 40%.

Prepare three spreadsheets that show the gross profit and net profit in the bar for (a) the

existing scenario (b) the extra hour on Saturday scenario and (c) the increase in Gross Profit percentage from 36% to 40%. lOMoARcPSD|47206521

Task number 5: Simple Event Budget

You are planning a one-day conference and you hope to make $1,000 profit out of it.

The expected number of people attending is 100. The conference program will have four (4)

speakers, and each will be paid $150 for their services on the day.

The venue is a hotel function room, and it will cost $1,000 for the day. Other expected costs include:

Advertising $1,000, photocopying, and printing $500, flowers and shrubs $200, table linen $100,

giveaway stationery $200, and food and refreshments for all the participants at $10 per head. What you must find out!

How much registration fees will you need to charge each conference participant to make the

target $1,000 profit if you have 100 registrations? lOMoARcPSD|47206521

Task number 6: Event Budget

Your task is to create a budget for a four-day weightlifting tournament. This exercise will assist

the learner to understand how to set out a financial statement that shows anticipated income and

expenditure for a project such as an event. Your Scenario

The ABC Company (ABC) has been invited to bid for a four-day international weightlifting

tournament. The event will take place in six months’ time.

Although it would seem a welcome boost to the organization to run this tournament, the ABC

committee are concerned as to whether the event can be run profitably. The last time this event

was run in Australia, the Western Australian Weightlifting Association hosted it and they made a loss of $20,000.

The ABC committee has asked you to investigate probable income and expenditure and prepare

a budget for next week's committee meeting.

After some initial investigations you have come up with the following information. Venue Costs

The Theatre of the Sleeman Sports Complex is available for the dates of this event. It is a great

venue as it was used for the Commonwealth Games in 1982. The venue will cost a $75 per hour

and it is expected that the event will start at 12:00 noon and finish at 8:00pm on each of the four

days. Therefore, is a need to hire the venue for 8 hours per day.

The venue has excellent sound and lighting systems and therefore there is no need to bring in

extra equipment. However, the venue manager does not allow users to have access to the

sound/lighting control room. Instead, there is a requirement to pay for a sound/lighting system

operator who will be hired by the venue manager. The cost of the sound/lighting system operator is $40 per hour.

The venue has a maximum capacity of 3,000 people. Equipment Costs

Although the association has plenty of weightlifting equipment, the ABC committee thinks it

appropriate to purchase a new bar and weights for the competition platform. A quote has been

received from the supplier as follows:

Item Required Qty Required Price Each

• 20Kg Bar and Collars 1 $1,250.00 • 25Kg Disc, Rubber 2 $250 • 20Kg Disc, Rubber 2 $200 lOMoARcPSD|47206521 • 15Kg Disc, Rubber 2 $170 • 10Kg Disc, Rubber 2 $150 • 5Kg Disc, Kevlar 2 $150 • 2.5Kg Disc, Kevlar 2 $140 • 1Kg Disc, Metal 2 $25 • .5Kg Disc, Metal 2 $15

Accommodation for Referees

There is no actual payment for referees, but it is generally the practice that referees who have

travelled interstate have fully paid accommodation provided. The number of such referees

requiring such accommodation is six (6) and the average accommodation cost is expected to be

$120 per night. Accommodation for these six referees needs to be provided the night before the

event starts and each night after there has been a day of competition. Program Printing

The official tournament program is expected to have eight (8) A4 pages, full color both sides,

folder and stapled in the middle to make a booklet of sixteen (16) A5 pages.

It has been agreed that should arrange for 1,000 programs to be made. This will require 8,000 pages to be printed.

You have received a quote from the printer that, for quantities of 1,000 sheets, one sheet full

color both sides will cost $0.40. There is an additional cost of $50 for stapling and folding and making 1,000 booklets.

You will be able to reduce the cost of this program printing by charging spectators $5 per program. Trophies

A very large number of trophies will be needed.

The tournament will have a total of eight bodyweight divisions, that is eight (8) for men and

seven (7) for women. There will be a need to present a 1st, 2nd and 3rd place trophy in each of

these 15 bodyweight divisions. It has been agreed that you have $100 to spend on trophies for

each bodyweight division, and that this will be apportioned as follows: • 1st place $50 • 2nd place $30 • 3rd place $20 Functions lOMoARcPSD|47206521

There will be two functions, one to open the event on the first day and one immediately after the

event on the last day. The first function is an Official Opening Function for dignitaries only. The

second event is a "Dinner" for all competitors, officials, and volunteers. A catering company has

been contracted for both events and has provided the following details of costs:

Opening function: The expected number of officials, sponsors and dignitaries will be 50 persons.

The catering company will provide finger food and beverages at a price of $15 per head.

Closing function: The expected number of people will be 300 at a cost of $20 each. There will

also be some entertainment at a cost of $500 for the night. Advertising

You will need to advertise the event in the regional newspaper at a cost of $500, and purchase

some 10 radio adverts of 30 second duration costing $3,000 in total. Ticket Sales

The normal cost of a spectator ticket to the four-day international weightlifting tournament is $10 per day.

It is estimated that you will achieve the following spectator numbers: Day 1 - 400 Day 2 - 400 Day 3 - 600 Day 4 - 1,000

Now that you have details of costs and income, you should draft a budget and determine whether

or not it is advisable to go ahead with a bid for this event. lOMoARcPSD|47206521

Task number 7: Create a simple program budget. Instructions

Using the data given below, create a spreadsheet that will work out what each participant must

be charged, so that the program will make a $2,000 profit on the basis that the maximum number of participants is achieved.

For this exercise, you are not provided with a ready-to-go Excel file. You must prepare the

spreadsheet yourself, however a suggested layout for your spreadsheet is given below. Your Scenario Data

ABC is planning to put on a ten-week program to introduce kids into drama. The maximum number of participants is 20.

A hall has been booked in the town's cultural center for two hours each Wednesday evening for $30 per hour.

A qualified teacher has been hired for the program who will cost $45 per hour.

ABC has a sound system of its own but there is likely to be a need to purchase music costing $30.

The program will be advertised in the local newspaper over a three-week period at a total cost of $390.

There will be photocopying costs of $80.

How much should ABC charge each participant for the ten-week program if ABC wants to make a $2,000 profit.

Produce a one-page summary that sets out all costs and shows how the participant’s fees are

calculated. Ensure your document has a professional appearance and has appropriate headers and footers. lOMoARcPSD|47206521

Task number 8: Employment Budgets

In this exercise provides you are provided with ready-to-go formatted spreadsheets and

instructions on how to complete. This exercise introduces several terms associated with

employment and the remuneration of workers. Using the provided spreadsheet, your task is to

find the total cost of employment of five positions in scenario A and the five positions in scenario B below. Scenario A – Salaries

Calculation of Superannuation and Total Employment Cost Positions Annual Employer's Total Salary Superannuation Employment Contribution Cost $ % $ $ Chief Executive Full-Time 40,000 24% Senior Team Coach Part-Time 26,000 24%

Participation Development Officer Full-Time 35,000 24% Junior Coaching Director Part-Time 20,000 24% Administration Assistant Full-Time 21,000 24% Total Employment Budget 142,000

Please turn over for Scenario B - Wages lOMoARcPSD|47206521 Scenario B – Wages

Calculation of Superannuation and Total Employment Costs Positions Rate / hr Hrs / Weeks / Gross Employer's Total Week Year Wages Superannuation Employmen Contribution t Cost $ % $ % $ $ A B C D E F G H I Grounds Caretaker Part-Time 25.00 20.00 52 24% Senior Bartender Part-Time 26.00 20.00 52 24% Bartender Casual 21.00 10.00 26 24% Canteen Salesperson Casual 18.00 10.00 30 24% Administration Assistant Part-Time 23.00 15.00 52 24% Total Employment Budget lOMoARcPSD|47206521

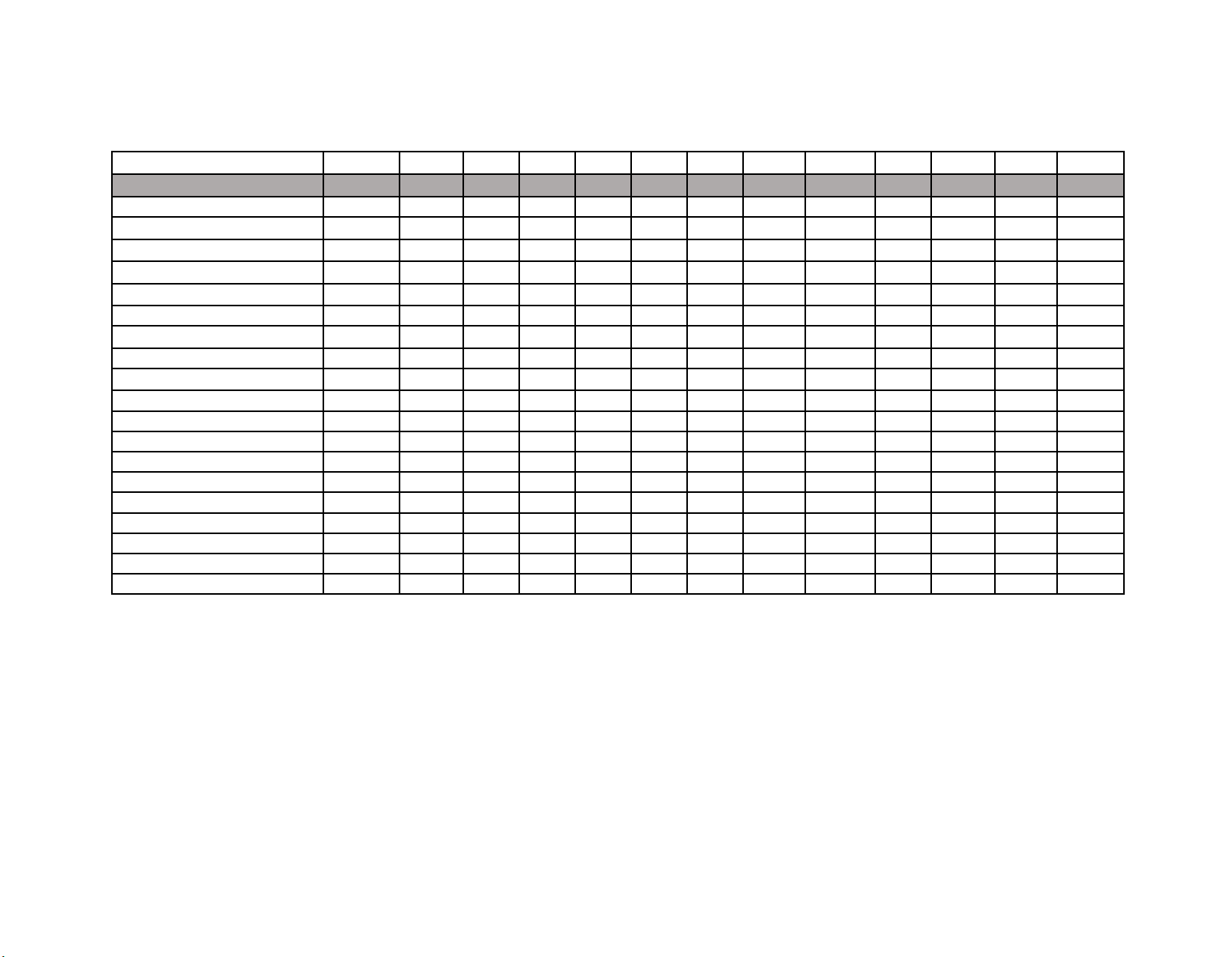

Task number 9: Cashflow Budgeting Your task

As a manager of ABC company, you are required to complete a cash flow forecast using the template provided.

Your cash flow forecast will predict the bank balance at the end of each month for every month of the year.

The information you have at your disposal to complete this task is as follows:

A. The event management company has on its books four (4) major events to run which will take

place in March, May, August, and October.

B. The total of $285,000 of ticket sales will be earned in the months that the events are held. The

March event will earn $65,000, and the other events in May, August and October will earn

$70,000, 85,000 and $65,000 respectively.

C. Expenditure on casual salaries, travel and transport, and venue hire will occur only in the

months in which the four events take place. These expenditures will be the same for each event.

D. Salaries and Office and administration expenses will occur evenly every month.

E. The company's opening bank balance on 1 January is $5,000

F. The company will receive a government grant of $50,000 in July.

G. The company will make a small income from Merchandising during the months in which the

four events are staged. The event in March will earn $1,300 merchandising income, and the other

events in May, August and October will earn $1,600, $1,800 and $1,300 respectively. lOMoARcPSD|47206521

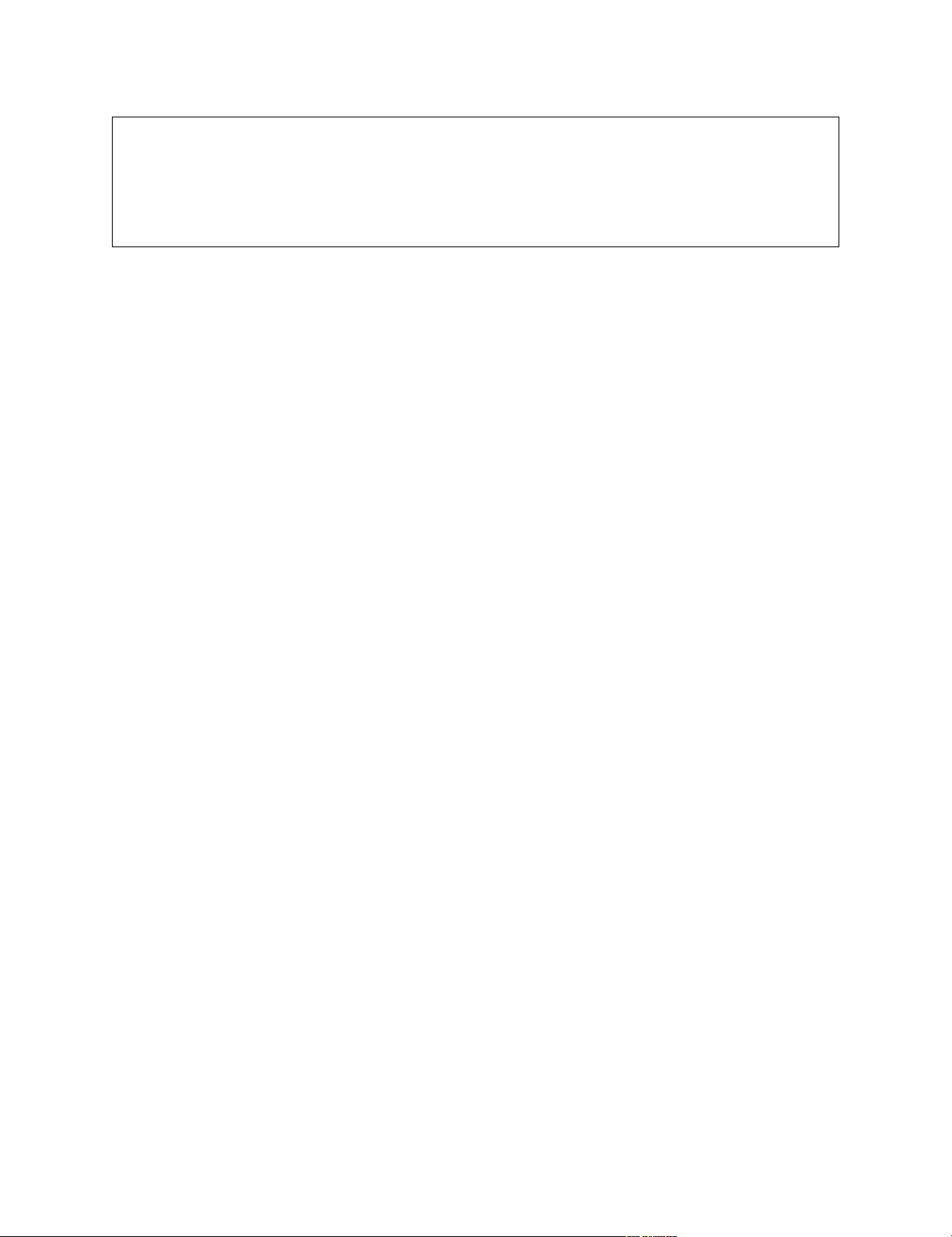

Cashflow Forecast Template Total Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Opening Balance 5,000 5,000 Income Ticket Sales Merchandising Government Grant Total Expenditure lOMoARcPSD|47206521

Task number 10: Evaluating Capital Expenditure Proposals Your Task

In this exercise, your task is to work out the costs and benefits of two competing business capital

expenditure proposals and determine which proposal would lead to better business performance.

The term capital expenditure means that the expenditure goes on assets and will have a lasting

value on producing income for the business.

The task of working out which proposal is best has been made easier for you as a template is

provided. The template will show you one way to set out the problem so that it is easy to read and understand. Your Scenario

ABC tennis center in southern Tasmania has four grass courts. The management committee is

considering two proposals for improving facilities. Both proposals will have some benefit on the long-term revenue of the club. Proposal A

The four grass courts will be resurfaced as hard courts. This is estimated to increase court usage

by 800 court hours per year. The capital cost will be $80,000. Proposal B

The four grass courts will be covered with an air dome. It will be the only tennis facility with an

air dome in Tasmania. It is estimated that there will be an increase in court usage of 1,000 court

hours per year. The air dome will increase the tennis centers operating costs by $15,000 per year.

The capital cost of this project is $120,000. Other details

The income raised per court hour while in use is estimated at $25.00 per hour.

The club will need to take a five-year loan from the bank in either case to raise the capital at 9% interest per annum.

Search for a loan repayments calculator on the Internet to assist you with this problem. lOMoARcPSD|47206521

Task number 11: Profit by Cost Centre Overview of Exercise

The purpose of this exercise is to show methods for estimating the profitability of individual

"departments" within a business. In this example, the business is "ABC Company”, and it has

four departments - a leisure pool, a sports hall, squash courts and a sauna/jacuzzi area.

The profitability of departments in a business entity can only be calculated if all income and all

costs of each department are known, or at least estimated. This poses a challenge, as it is often

the case that a business has no way of measuring, with any accuracy, all the costs incurred by

each department. For example, typical overheads such as electricity, administration, insurance,

rates, and financing costs can only be arbitrarily divided between departments. (arbitrary = at one's own discretion).

To estimate the profitability of individual departments, therefore, all overheads must be divided

up and apportioned among departments according to some form of internal metrics. In this

exercise, there are three types of internal metrics suggested:

A. The floor space of each department, measured in square meters (see table 4)

B. The proportion of the overall staff that work in the department (see table 5)

C. The capital cost of the building in which the department is situated if this is known (table 1)

Each of these criteria may be suitable as a means of apportioning different overheads. For

example, it might be suitable to choose floor space as the apportionment method for electricity

and/or rates. However, it would make sense to choose the proportion of the overall staff in each

department as a basis for apportioning the center manager’s salary and/or office administration costs.

In this exercise, your task is to work out the profitability of each department using the given

template below. The task has been made easier for you, as the method for apportioning each

overhead has been selected for you. All you need to do is to perform the arithmetic and find out

how each department in ABC Company contributes to overall business profitability. Your Scenario

The ABC Company was built at a cost of $6

Table 1: CAPITAL COST of Sports Centre

million (see Table 1) and has just finished its Department Capital Cost Capital Cost first year of operation. $’000s %

The Centre has the following facilities: Leisure Pool 2,700 45% • A leisure pool. Sports Hall 2,300 38% • A multipurpose sports hall Changing / 200 3% • Four (4) squash courts Sauna /

• Changing rooms that include saunas and Jacuzzis Jacuzzis Squash 800 14%

Corby City Council, owners of the complex, Courts

is keen to find out the profitability of the Total 6,000 100% lOMoARcPSD|47206521

whole business and each of its departments

Table 2: INCOME per Department separately. Department $’000s Leisure Pool 650

The total income from the complex was $1.55 Sports Hall 600

million and Table 2 provides a breakdown of Sauna / Jacuzzis 50 this amount per department. Squash Courts 250 Total 1550

The center had overhead costs of $400,000

Table 3: OVERHEADS to be apportioned for the year. These costs are identified in $’000s Table 3. Advertising 15

These costs must be apportioned across the Auditors Costs 10 Cleaning 20 four departments. The method of Electricity 40

apportionment for each overhead cost is given Financing Cost 65

to you in the worksheet accompanying this Insurance 10 exercise. Maintenance 50

You will need the data in Tables 4 and 5 Managers Salary 100

below and Table 1 above to carry out the Office Costs 75 apportionment. Rates 40 Security 15 Staff Uniforms 5 Vehicle Costs 20 Total 400

You will notice that the apportionment figures from tables 1, 4 and 5 have been transferred to the worksheet template.

Table 4: FLOOR SPACE for each department Cost Centre Floor Area Floor Area M2 % Leisure Pool 1,400 47% Sports Hall 1,200 40% Changing/Sauna/Jacuzzis 100 3% Squash Courts 300 10% Total 3,000 100%

Table 5: Proportions of STAFFING ESTABLISHMENT No of People Proportion Leisure Pool Staff 14 43% Sports Hall 10 30% Sauna/Jacuzzi 4 12% Squash Courts 5 15% Total Full-Time Equivalent 33 100%