Preview text:

(1)

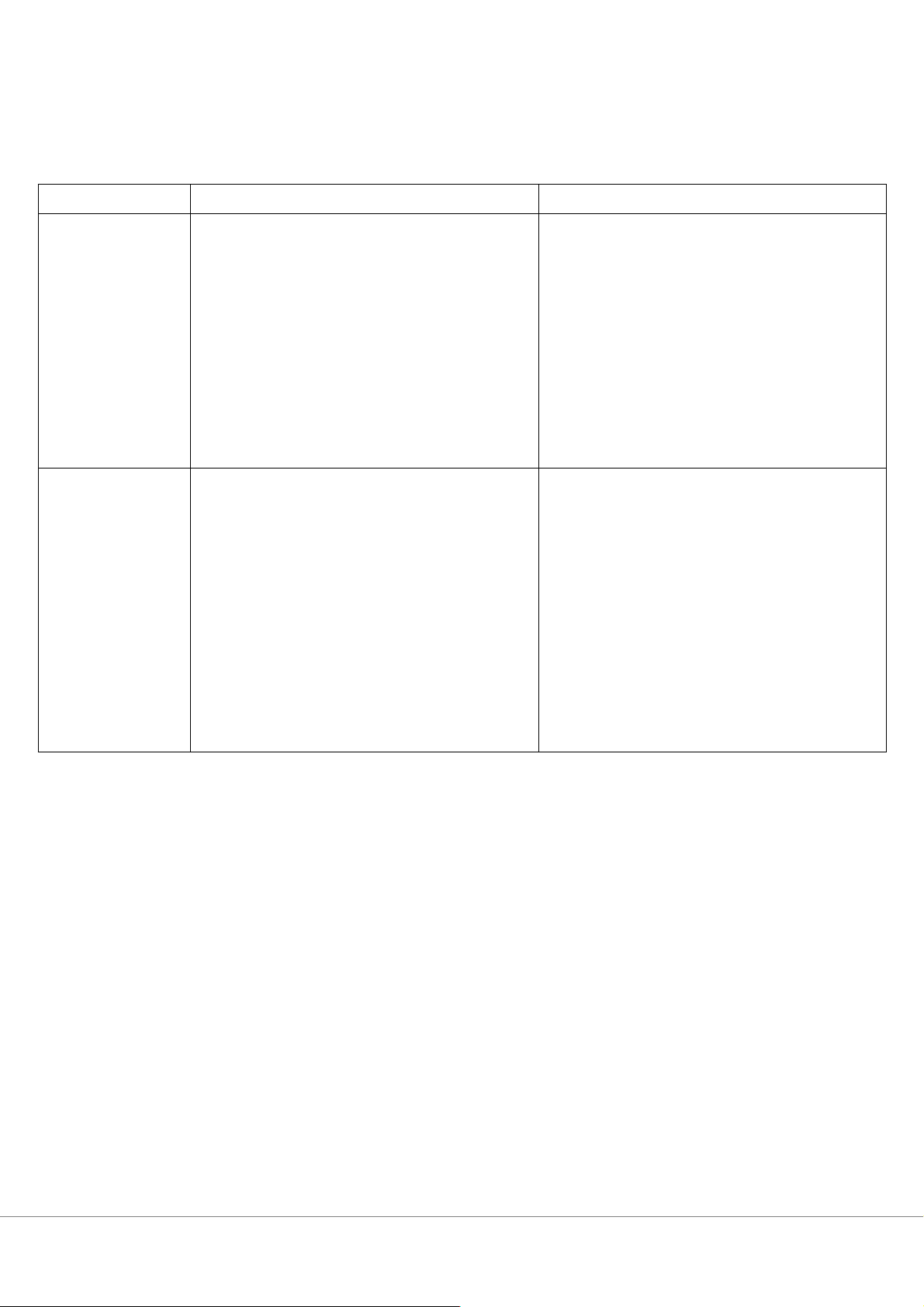

Bảng phân tích chi tiết ưu, nhược điểm trong ngắn hạn và dài hạn của Installment và Amortization Method Short-term Long-term Installment -

Advantages: Fixed and -

Advantages: Predictable in

lower monthly payments: Fixed the long term: Fixed schedule

installments make it easier to makes it easier to budget for manage short-term finances. future expenses. - Disadvantages: High - Disadvantages: Higher

total cost: Slow reduction of

interest share in the initial period: Slow reduction of

principal leads to higher interest

principal balance results in more payments over the loan period. interest over time. Amortization - Advantages: Faster -

Advantages: Lower overall

principal reduction: Interest

cost: Rapid reduction of principal

decreases over time, reducing balance leads to significant

overall interest costs from the savings on interest payments. start. -

Disadvantages: Declining - Disadvantages: Higher

payments: Monthly payments

initial payments: Heavier decrease over time, which can financial burden in the early make financial planning less

months due to the combination of predictable. fixed principal and interest. Installment:

- Suitable for individuals with stable but limited income who

prefer fixed and predictable payments.

- Ideal for large, long-term loans where affordability in the short term is a priority. Amortization:

- Suitable for individuals with higher short-term financial

capacity, willing to pay more initially to save on interest costs.

- Ideal for short or medium-term loans, helping to optimize total

borrowing costs in a shorter timeframe.

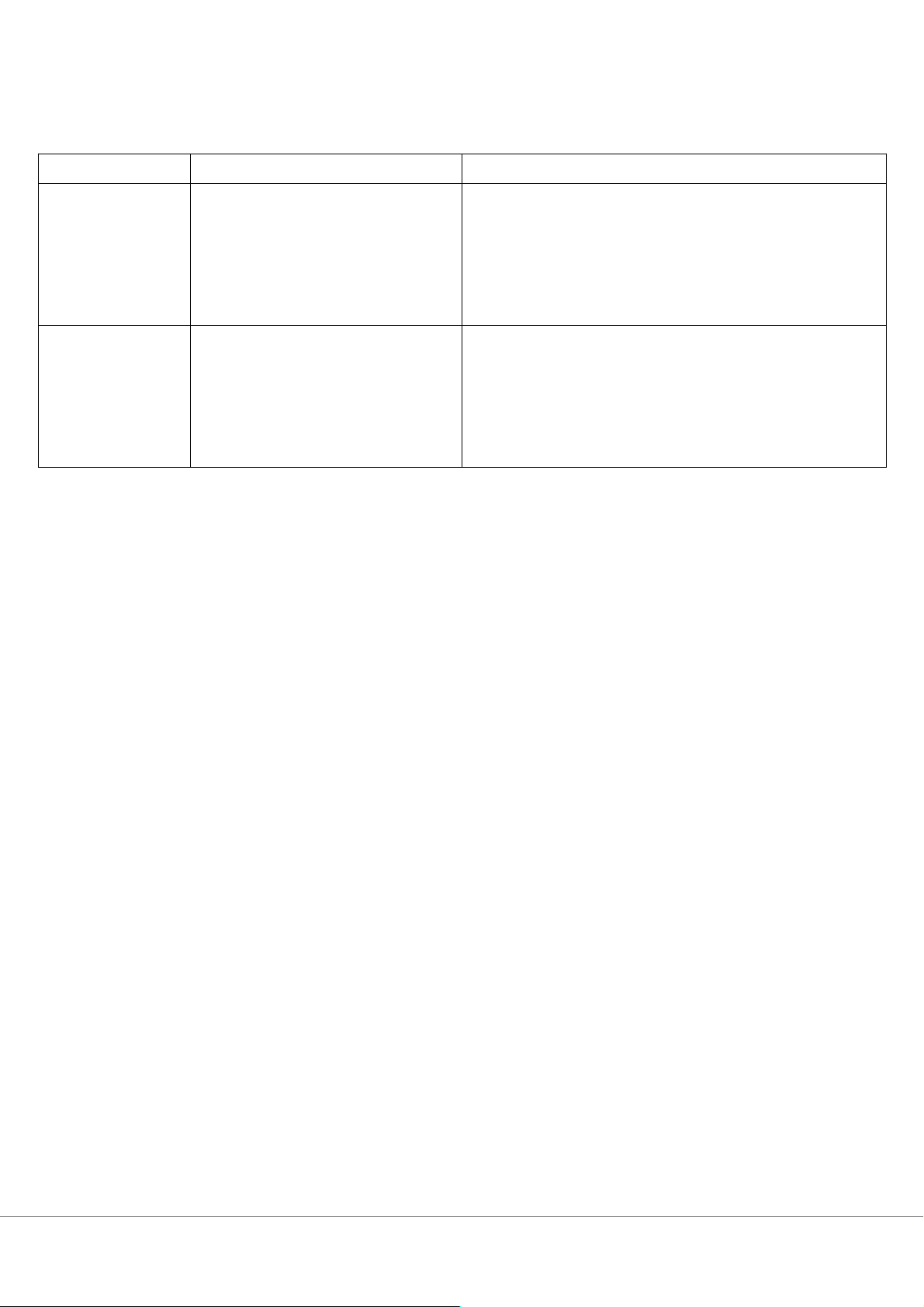

(2) Pros and Cons of the Add-On Method Advantages Disadvantages Short term - Simple and easy to

- Higher interest costs compared to other

understand due to fixedmethods like Amortization. monthly payments.

- Not beneficial for early repayment as

- Suitable for small loansinterest is calculated on the full initial or short-term periods. principal. Long term - Easy to manage for

- Total interest costs are significantly

larger loans withouthigher, especially for long-term loans. complex calculations. -

Does not encourage early repayment as interest remains fixed. When to choose:

- Ideal for small to medium-term loans with fixed monthly payments for easy financial planning.

- When simplicity and predictability matter more than minimizing total interest costs. When not to choose:

- If your goal is to minimize total borrowing costs, especially for large or long-term loans. Suitable for - Small, short-term loan

- Borrowers who prioritize stability in monthly payments over total cost efficiency Not suitable for

- Large, long-term loans or situations where reducing total borrowing costs is crucial. (3)

Cash flow cycle (slide p.g 8 chap3 part2)

Cash Flow Cycle refers to the process by which a company manages its

cash inflows and outflows over time. It represents the entire sequence of

events through which a business handles its money, from receiving

payments from customers to paying suppliers and other operational expenses.

The Cash Flow Cycle consists of several key stages:

1. Inflow (Customer Payments): The company receives payments

from customers for products or services sold.

2. Outflow (Payments to Suppliers and Employees): The company

pays its suppliers for raw materials and operational expenses, including employee salaries.

3. Inventory and Production: The business needs to maintain

inventory and convert raw materials into finished goods.

4. Sales and Receivables: After producing goods, the company sells

them to customers and receives payment for the products.

5. Management of Receivables and Payables: The company

monitors its receivables and payables to ensure that cash is flowing

smoothly without interruptions.

The Cash Flow Cycle is crucial for business success. Proper

management ensures that the business has enough liquidity to continue

operations, pay bills, and invest in growth. An efficient cash flow cycle

helps reduce reliance on external financing, lower costs, and improve profitability. (4)

Cash conversion cycle (slide p.g 9 chap3 part2)

The Cash Conversion Cycle

(CCC) measures the efficiency of cash

flow management in a business. It is the time taken to convert

investments in inventory and receivables into cash. CCC is calculated as:

CCC = Inventory Period + Delivery period + Account receivable – Accounts payable

CCC = tgian sản xuất + tgian giao hàng + tgian phải thu – tgian phải trả

Key Benefits (when managing CCC effectively)

1. Short-Term: Improves liquidity and reduces dependence on external funding.

2. Long-Term: Lowers capital costs, enhances profitability, and

increases operational resilience. Business Application:

A shorter CCC ensures faster cash flow and efficient resource

utilization, which is crucial for sustainable growth. Managing CCC

effectively allows businesses to balance liquidity, profitability, and competitiveness. (5)

Positive CCC and Negative CCC – What products should the bank provide for? Positive CCC

Means the business takes time to convert inventory and receivables

into cash. This situation indicates that the business is financing its

operations and production while waiting for customers to pay.

Banks would recommend short-term credit products (working

capital loans, business credit cards) to help the business maintain liquidity and cover costs. Negative CCC

Means the business collects cash from customers faster than it

needs to pay suppliers and other expenses. This indicates that the

business has good cash flow management and does not rely heavily on borrowing.

Banks would recommend savings and investment products

(savings accounts, certificates of deposit, financial investments)

because the business has enough cash flow to invest and does not require loans.

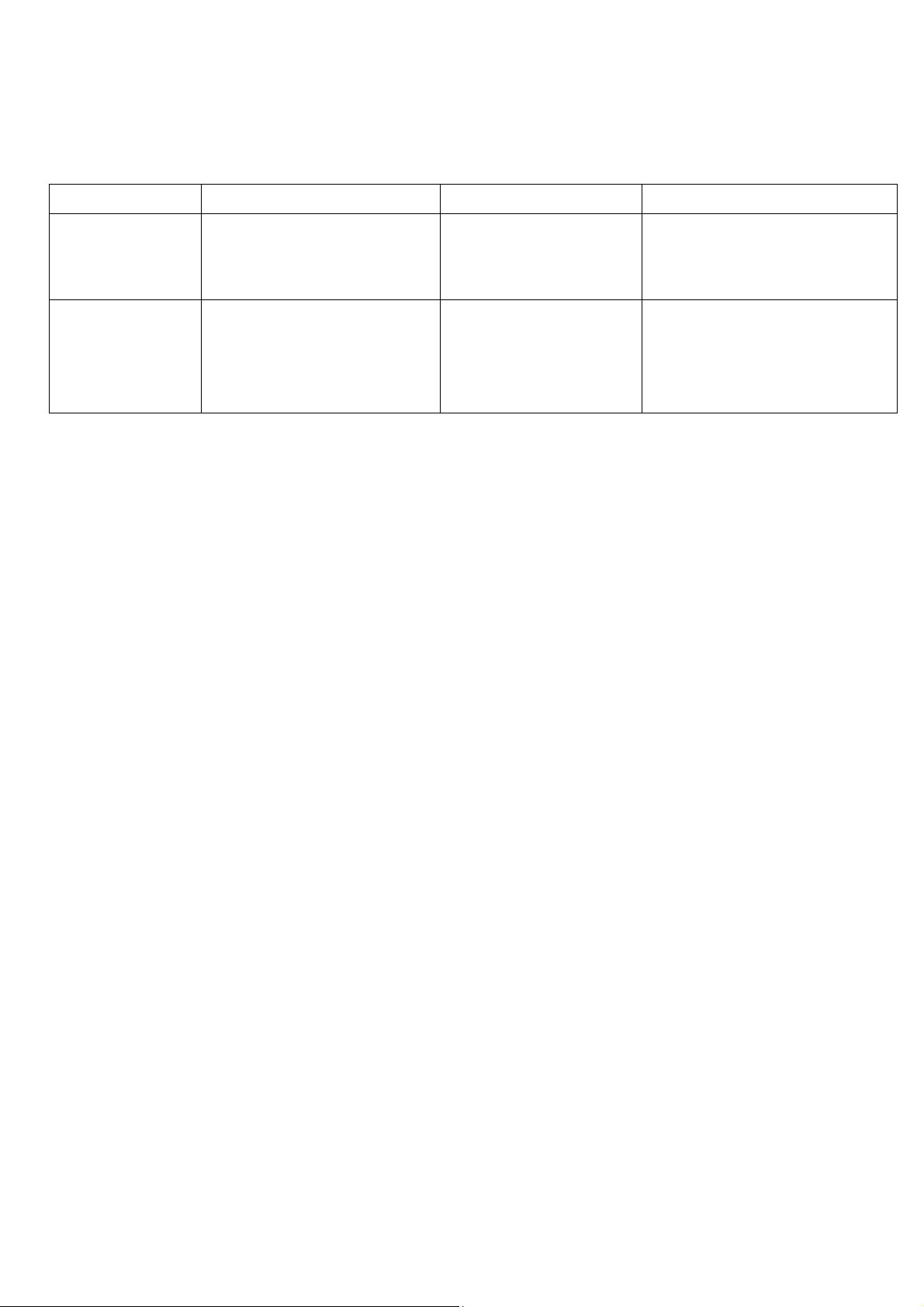

(6) Types of Working Capital Loan – Term loan and Line of Credit Types Advantages Disadvantages Best used for Term loan Fixed

amount, Less flexibility, Large investments or

(slide p.g 12 predictable payments, potential collateral expansion that requires

chap3 part2) low interest rates required set funding Line of

Flexible borrowing, Higher interest Fluctuating cash flow, Credit

only pay interest onrates, can lead tocovering short-term (slide p.g 14 borrowed amount

high debt ifworking capital needs chap3 part2) mismanaged