Preview text:

CHAPTER1:INTRODUCTION RECENTM&ATRENDS

- Thepaceofmergersandacquisitions(M&As)pickedupintheearly2000s afterashorthiatusin2001

- By2008theeffectsoftheglobalrecessionandthesubprimecrisisbeganto

takehold.TheU.S.recession,whichbeganinJanuary2008,causedpotential

acquirerstoreignintheiracquisition-orientedexpansionplans.

- Inthefifthmergerwave(1990s)therewasdramaticgrowthinthevolumeof dealsinEurope

- EuropeanandU.S.dealvolumewascomparable

- Inthefourthwave(1980s)M&AwasmoreofaU.S.phenomenon

- Newtypeofbidderthatbecameimportantinthefifthwaveandthe2000s.

Example:Mittal'sacquisitionsofsteelcompaniesacrosstheworld

→manyofthelargerAsiandealsfindtheiroriginsinHongKong TERMINOLOGY

- Amerger(sápnhập)differsfrom aconsolidation(hợpnhất)whichisa

businesscombinationwherebytwoormorecompaniesjointoformanentirely newcompany

- Theacquiredentitiesweremasterlimitedpartnershipsthatprovidedcertaintax

benefitsbutthatlimitedtheabilityoftheoverallbusinesstogrowanddolarger M&As

Amerger:A+B=A,wherecompanyBismergedintocompanyA

Aconsolidation:A+B=C,whereCisanentirelynewcompany→theoriginal

companiesceasetoexistandtheirstockholdersbecomestockholdersinthenew company

whenthecombiningfirmsareapproximatelythesamesize,theterm

consolidationapplies;whenthetwofirmsdiffersignificantlyinsize,mergeristhe moreappropriateterm.

VALUINGATRANSACTION:usedbyMergerstat→themostcommonmethod

Enterprisevalue= baseequityprice+thevalueofthetarget’sdebt(both

shortandlong-term)+preferredstock- cash

The base equity price = total price - the value of the debt

- The buyer: company with the larger market capitalization/company that is

issuing shares to exchange for the other company’s shares in a stock-for-stock transaction

TYPES OF MERGERS: horizontal, vertical, conglomerate

Horizontal merger: 2 competitors combine

Vertical mergers: combinations of companies that have a buyer-seller relationship

Conglomerate merger: companies are not competitors and do not have a buyer-seller relationship

NOTE: horizontal merger → vertical mergers → conglomerate merger → leveraged

finance (using LBO: leverage buyout → going private) → internet bubble → industry consolidation MERGER CONSIDERATION

- Mergers may be paid for in several ways: all cash, all securities (stock -

common stock/preferred stock - of the acquire, other securities: debentures), a

combination of cash and securities

If a bidder offers its stock in exchange for the target’s shares → provide for either

a fixed or floating exchange ratio

When the exchange ratio is floating, the bidder offers a dollar value of shares as

opposed to a specific number of shares.

The number of shares that are eventually purchased by the bidder is determined by

dividing the value offered by the bidder’s average stock price during a pricing period

(some months after the deal is announced and before the closing of the transaction)

The offer = the collar: provides for a maximum and minimum number of shares

within the floating value agreement

- Stock transactions may offer the seller certain tax benefits that cash transactions do not provide

- For large deals, all-cash compensation may mean that the bidder has to incur

debt → unwanted, adverse risk consequences

- Merger agreements can have fixed compensation or they can allow for variable payments to the target

It is common in deals between smaller companies, or when a larger company

acquires a smaller target, that the payment includes a contingent component

- Such payments may include an “earn out” where part of the payments are

based upon the performance of the target

- The opposite type of variable compensation is one that includes contingent value rights (CVRs)

The CVRs guarantee some future value if the acquirer’s shares that were given in

exchange for the target’s shares fall below some agreed-upon threshold.

If a seller believes that its stock is undervalued and will rise in value in the

foreseeable future, it may offer CVR as a way of guaranteeing this.

Buyers may possess asymmetric information on the possible future value of their

stock that sellers do not have.

Offers that include CVR were higher than stock-only bids.

- Merger agreements include a holdback provision MERGER PROFESSIONALS

- When a company decides it wants to acquire or merge with another firm, it

typically does so using the services of attorneys, accountants, and valuation experts

+ Smaller deals (closely held companies): selling firm employ a business

broker (represent the seller in marketing the company)

+ Larger deals (publicly held companies): the sellers and the buyers may

employ investment bankers (helping to select the appropriate target,

valuing the target, advising on strategy, raising the requisite financing to complete the transaction)

Investment Bankers: based upon whether they are on the sell side or the buy side of a transaction -On the buy side:

+ assist their clients in developing a proposal that, in turn, contemplates a specific deal structure.

+ handle initial communications with the seller and/or its representatives.

+ do due diligence and valuation so that they have a good sense of what the

market value of the business is - On the sell side:

+ consult with the client and develop an acquisition memorandum that may be

distributed to qualified potential buyers

+ screens potential buyers so as to deal only with those who both are truly

interested and have the capability of completing a deal → those who qualify

then have to sign a confidentiality agreement prior to gaining access to key

financial information about the seller Legal M&A Advisors

- Attorneys also play a key role in a successful acquisition process

- Part of the resistance of the target may come through legal maneuvering

→ Even more important in hostile takeovers than in friendly acquisitions

MERGER ARBITRAGE: fraught with risks

- Arbitrage: the buying of an asset in one market and selling it in another

- Practitioners of these kinds of transactions try to do them simultaneously

→ locking in their gains without risk

LEVERAGED BUYOUTS AND THE PRIVATE EQUITY MARKET

- In a leveraged buyout (LBO), a buyer uses debt to finance the acquisition of a company.

- The acquired company becomes private (going private) because all of the

public equity is purchased, usually by a small group/a single buyer, and the

company’s shares are no longer traded in securities markets

- Management buyout: the buyer of a company, or a division of a company, is the

manager of the entity → One version of an LBO

- Most LBOs are buyouts of small and medium-sized companies or divisions of large companies

- LBOs utilize a significant amount of debt along with an equity investment

- Equity investment comes from investment pools created by private equity firms CORPORATE RESTRUCTURING

- Corporate restructuring: asset sell-offs (divestitures)

- Refocus on its core business and sell off non-core subsidiaries

- Corporate sell-offs: divestitures, spin and equity carve-outs MERGER NEGOTIATIONS

- Buyer-initiated: takeovers the process usually begins when the management of

one firm contacts the target company’s management, often through the

investment bankers of each company

- Seller-initiated: deals the seller may hire an investment banker, who will contact prospective bidders

+ If the potential bidders sign a confidentiality agreement and agree to not

make an unsolicited bid, they may receive nonpublic information.

+ The seller and its investment banker may conduct an auction or may

choose to negotiate with just one bidder to reach an agreeable price.

+ Auctions can be constructed more formally, with specific bidding rules

established by the seller, or they can be less formal.

- Most merger agreements include a material adverse change clause → may

allow either party to withdraw from the deal if a major change in circumstances

arises that would alter the value of the deal Asset Deals

- All the assets acquired and liabilities incurred are listed in the asset purchase agreement. - Advantages:

+ The buyer does not have to accept all of the target’s liabilities + Limiting liability exposure

+ The buyer can pick and choose which assets it wants and not have to pay

for assets that it is not interested in + Potential tax benefits:

●buyer may be able to realize assets basis step-up (come from the

buyer raising the value of the acquired assets to fair market value

as opposed to the values they may have been carried at on the

seller’s balance sheet) → the buyer can enjoy more depreciation

in the future → lower their taxable income and taxes paid.

●seller may possibly get hit with negative tax consequences due to

potential taxes on the sale of the assets → taxes on a distribution to the owners of the entity - Drawbacks:

+ seller may have to secure third-party consents to the sale of the assets

+ In order to do an asset deal the target needs to get approval from the

relevant parties. The more of them there are, the more complicated the

deal becomes → an asset deal becomes less practical

Forward Merger = statutory merger

- 2 types of subsidiary mergers: forward & reverse -Drawbacks of forward merger:

+ The purchaser assumes the target’s liabilities

+ Delaware law treats forward mergers as though they were asset sales, so

if the target has many contracts with third-party consents or

nonassignment clauses → not be an advantageous route for the parties

+ The voting approval of the shareholders of both companies is needed

+ Buyer directly assumes all of the target’s liabilities → exposing the

buyer’s assets to the target’s liabilities → this deal structure is not that common

→ The solution is for the buyer to “drop down” a subsidiary and do a subsidiary deal Fairness Opinions

- Fairness Opinions: an opinion issued by a firm on the value of the company

being acquired → sometimes conducted by investment bankers

→ Create an issue of conflict of interest as they may have a stake in the deal: + Advisory fees + Financing fees

- Their opinion may be appended to the SEC filings

- To prevent this from being an issue, the firm may want to hire an independent valuation firm HOLDING COMPANIES

- Parent company owns sufficient stock in target to control target

+ Usually can be achieved for less than 51% + May be as low as 10%

- An alternative to 100% acquisition - Advantages:

+ Lower cost – do not have to buy 51% or 100%

+ No control premium: 51% of the shares are not purchased, the full

control premium that is normally associated with 51% to 100% stock

acquisitions may not have to be paid

+ May get control without soliciting target shareholder approval - Disadvantages: + Triple taxation of dividends

●If parent owns 80% or more dividends are exempt from taxation

●If own less than 80% then 80% of dividends are exempt from tax

+ Easier to disassemble if Justice Department finds: ●Antitrust ●Anticompetitive Problems

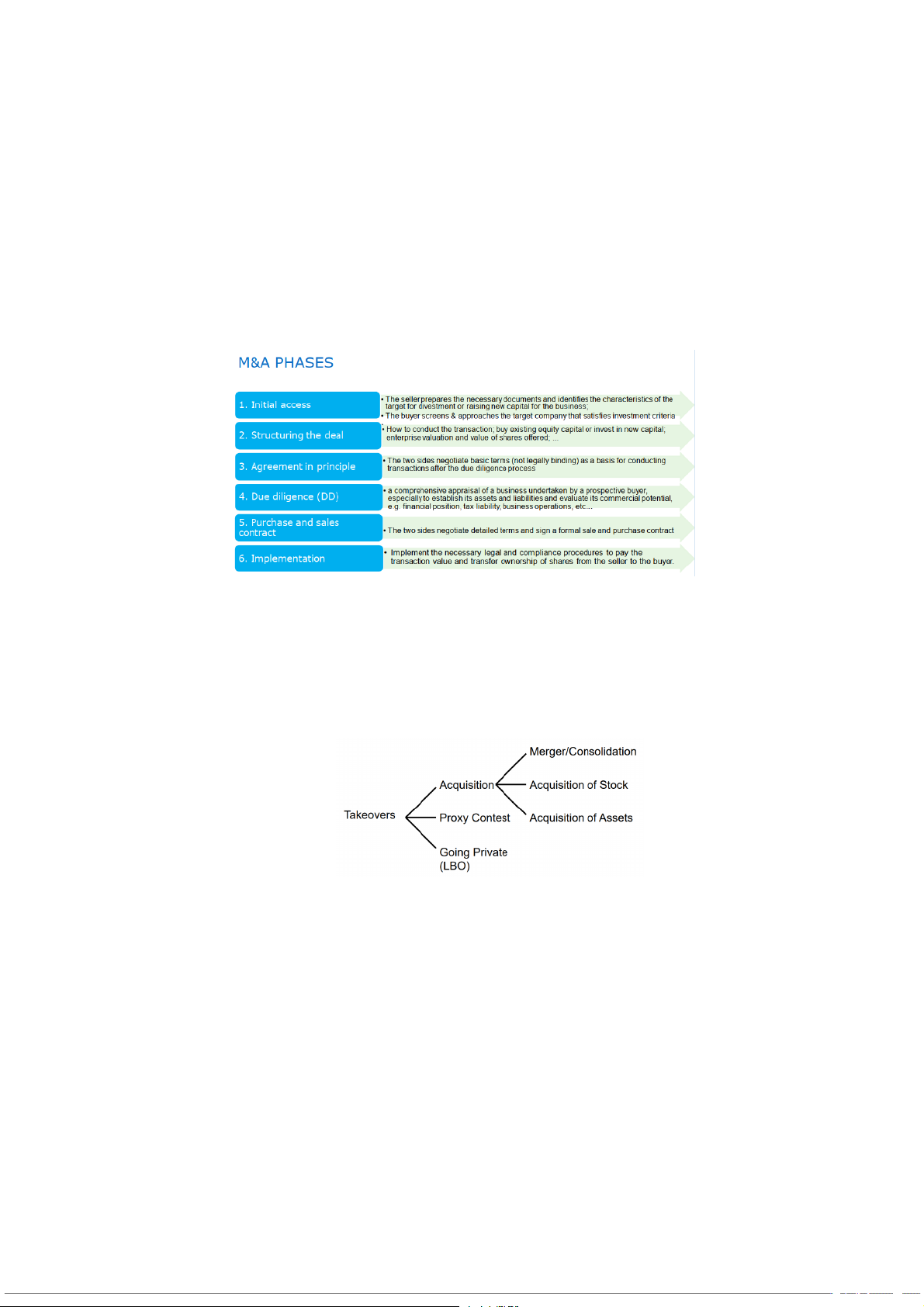

CHAP 2: FUNDAMENTALS OF M&A I. Varieties of Takeovers

- Takeovers: an act of assuming control of something, especially the buying out of one company by another

1. The basic forms of acquisitions - Agency problem:

+ type 1 (PA): manager and shareholder

+ type 2 (PP): among principles

- Acquisition: one company acquires another companies, usually one company is bigger than the other

- 3 basic legal procedures that one firm can use to acquire another firm: + Merger or Consolidation: ●Merger:

o One firm is acquired by another

o Acquiring firm retains name and acquired firm ceases to exist o Advantage: legally simple

o Disadvantage: must be approved by stockholders of both firms

o Statutory merger vs voluntary merger

backward merger: merger with supplier

forward merger: merger with customer

●Consolidation: a specific type of merger where a completely new entity is formed

+ Acquisition of Stock: a buyer acquires a target company's stock directly from the selling shareholders

●No stockholder vote required

●May be delayed if some target shareholders hold out for more money

●Complete absorption requires a merger

+ Acquisition of Assets: the purchase of a business by buying its assets instead of its shares - Classifications:

+ Horizontal: both firms are in the same industry → increase market share

+ Vertical: firms are in different stages of the production process →

increase efficiency (cost, revenue)

+ Conglomerate: firms are unrelated → diversify their businesses to reduce risks 2. Merger a. Merger of Equals - 2 companies of equal size

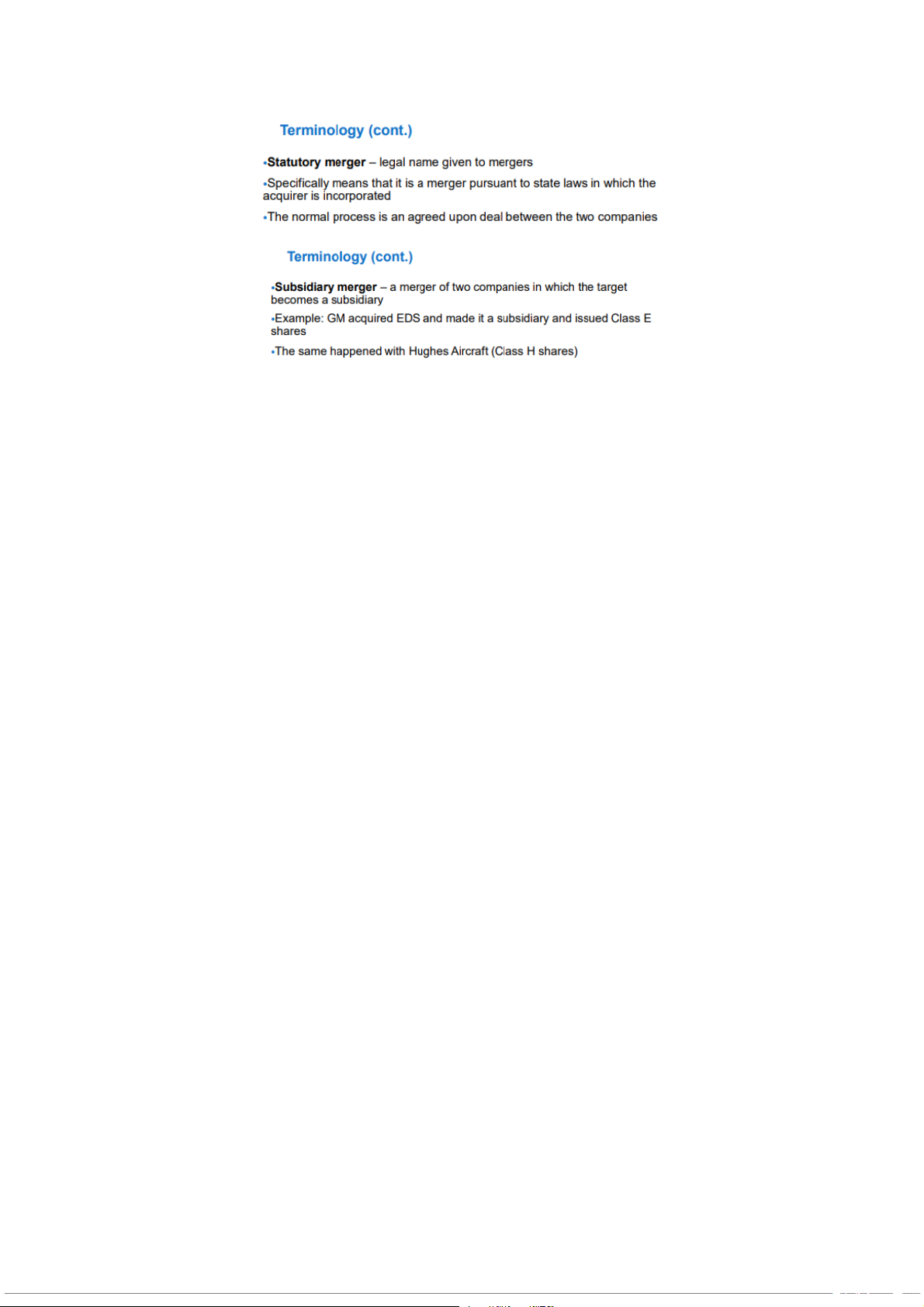

- 1 company ends up being the dominant one b. Statutory merger - legal name given to mergers

- a merger pursuant to state laws in which the acquirer is incorporated

- The normal process: an agreed upon deal between the two companies c. Subsidiary merger

- a merger of two companies in which the target becomes a subsidiary

- allow the buyer to keep the target as a separate subsidiary corporation and

insulate the parent company from the target’s liabilities

II. Synergy: giá trị hợp lực

- Synergy: the combined value of two companies coming together in an

acquisition can be greater than the sum of their individual values → the merged

entity can achieve certain benefits or advantages that would not have been

achievable by the individual companies operating separately

- Scale Economies and Market Power

- Enhanced Products and Services

- Learning and Knowledge Transfer

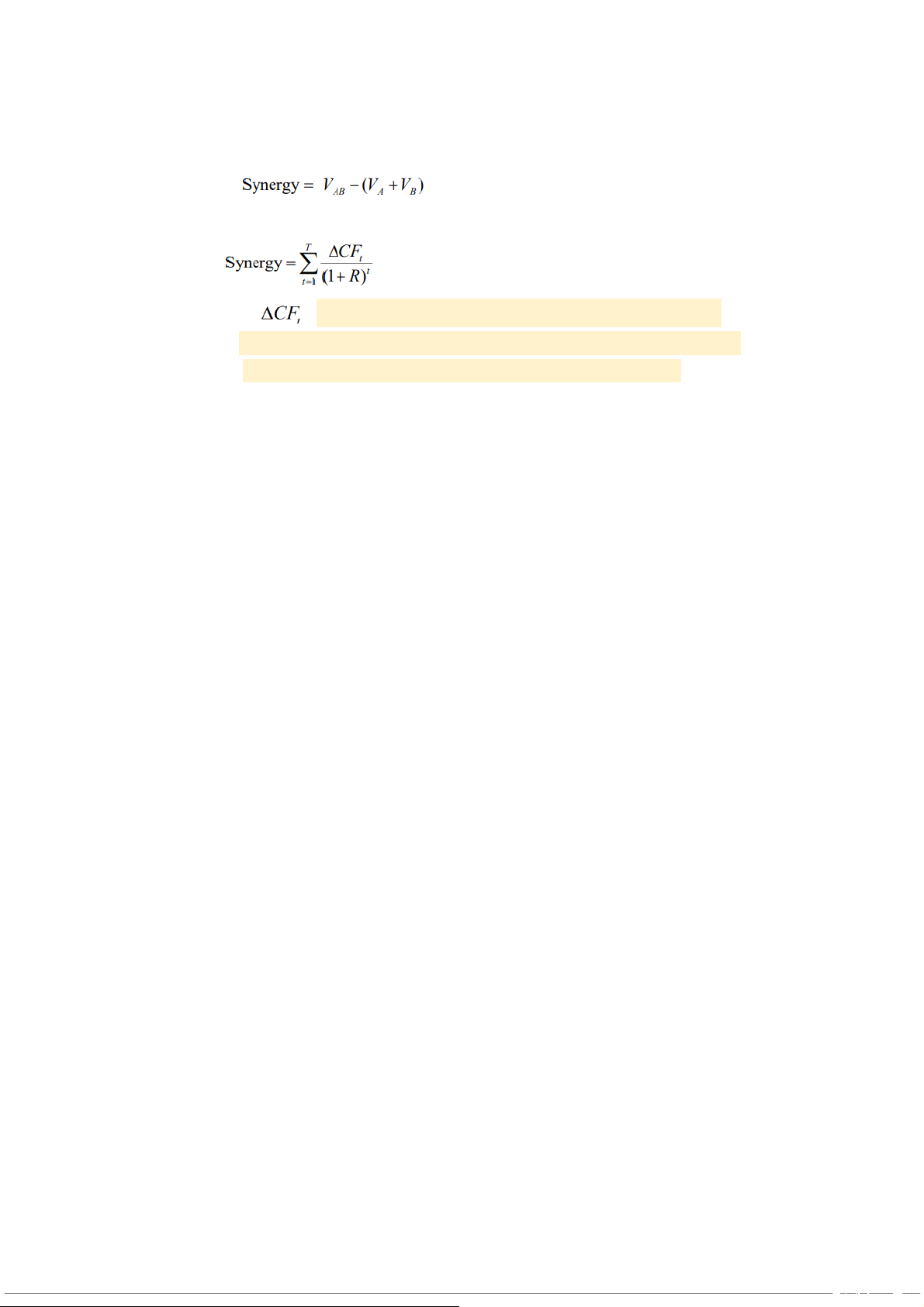

Ex: Suppose Firm A is contemplating acquiring Firm B. The synergy from the acquisition is:

The synergy of an acquisition can be determined from the standard discounted cash flow model:

: incremental cashflow = CF post-MA - CF pre-MA

=∆ 𝑅𝑒𝑣 − ∆ 𝑐𝑜𝑠𝑡 − ∆ 𝑡𝑎𝑥𝑒𝑠 − ∆ 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 𝑟𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡

Revenue post-MA = market share x market size = PxQ - Sources of Synergy + Revenue Enhancement + Cost Reduction:

●Replacement of ineffective managers. ●Economy of scale or scope + Tax Gains: ●Net operating losses ●Unused debt capacity ●Use of surplus funds

●Reduced Capital Requirements

III. Calculating Value: Avoiding Mistakes - Do not ignore market values

- Estimate only incremental cash flows

- Use the correct discount rate

- Do not forget transactions cos

IV. Two Financial Side Effects of Acquisitions

- Earnings Growth: if there are no synergies or other benefits to the merger, then

the growth in EPS is just an artifact of a larger firm and is not true growth (that

is, an accounting illusion: earnings growth is not sustainable) → the increased

size of the combined firm rather than true operational growth

- Diversification: Shareholders who wish to diversify can accomplish this at

much lower cost with one phone call to their broker than can management with a takeover

V. A Cost to Stockholders from Reduction in Risk

- The Base Case: If two all-equity firms merge, there is no transfer of synergies to bondholders, but if…

- Both Firms Have Debt: the value of the levered shareholder’s call option falls

→ value of the leveraged shareholder's call option (representing potential gains

in the value of the company's equity) decreases due to the increased presence of

bondholders and their claim on the company's assets

- How Can Shareholders Reduce their Losses from the Coinsurance Effect?

+ Coinsurance effect: the situation where shareholders, due to the presence

of bondholders, experience reduced potential gains in the value of their equity + To mitigate their losses:

●Retire Debt Premerger: reducing the company's debt levels before

the merger → decrease the influence of bondholders on the

company's value → potentially mitigating the coinsurance effect

●Increase Postmerger Debt Usage: increase its debt usage → have

the effect of favoring bondholders → a more balanced risk

distribution between shareholders and bondholders VI. The NPV of a Merger

- Typically, a firm would use NPV analysis when making acquisitions.

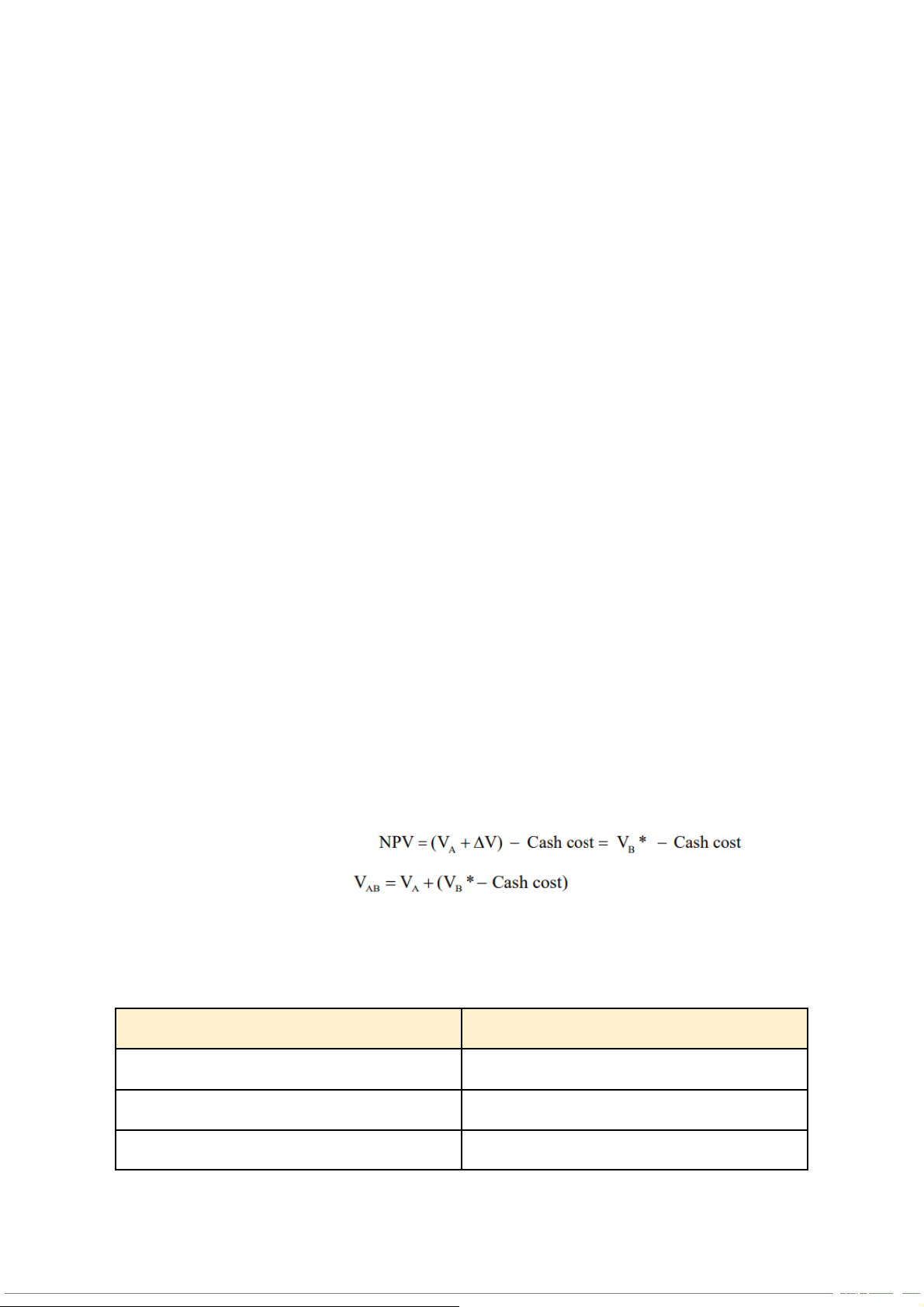

- The analysis is straightforward with a cash offer, but it gets complicated when the consideration is stock + Cash Offer:

●the acquiring company offers a certain amount of cash to the

shareholders of the target company in exchange for their shares

●initial cost of the investment is the cash payment made to acquire the target company + Stock Offer:

●the acquiring company offers its own shares to the shareholders

of the target company as consideration for the merger

●the value of the acquiring company's shares can fluctuate based

on market conditions, investor sentiment, and other factors → more intricate VII. Cash Acquisition The NPV of a cash acquisition: Value of the combined firm:

- Often, the entire NPV goes to the target firm

- Remember that a zero-NPV investment may also be desirable: enhancing brand

reputation, fulfilling regulatory requirements → contribute to market

positioning, competitive advantage, other non-financial goals Pros Cons certain amount of cash tax consequences faster and simplier cash out

less depend on stock market fluctuation

acquirers’s shareholders take all gain or

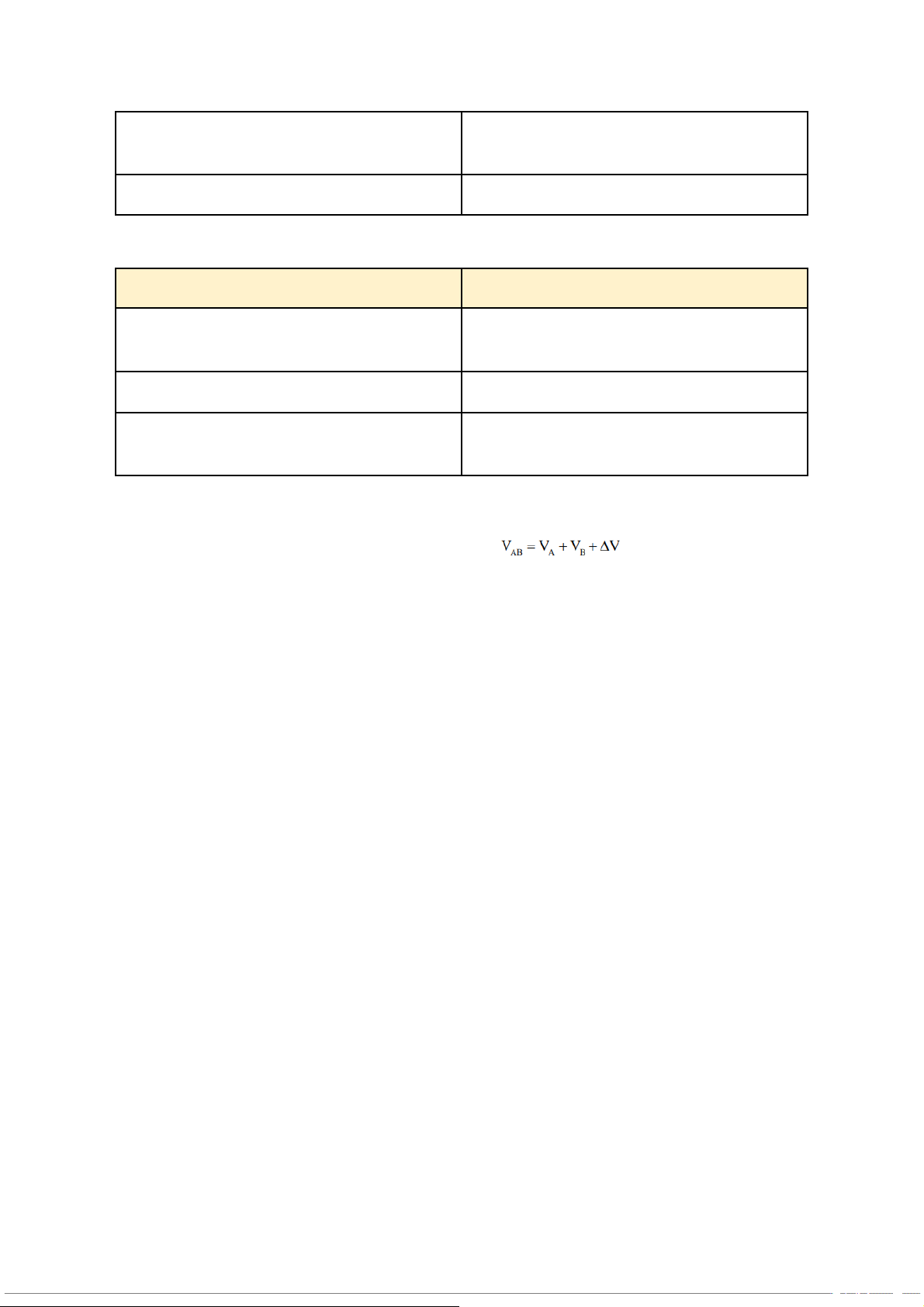

suffer all risk from the merger (synergy → acquirer’s shareholder) no dilusion stock acquisition Pros Cons

gain and risk are shared between complicated procedure

acquirer & acquiree’s shareholder tax are defluted dilution problem no cash out

it is affected by movement of stock market VIII. Stock Acquisition Value of combined firm: - Cost of acquisition:

+ Depends on the number of shares given to the target stockholders.

+ Depends on the price of the combined firm’s stock after the merger.

- Considerations when choosing between cash and stock:

+ Sharing gains: target stockholders do not participate in stock price

appreciation with a cash acquisition.

+ Taxes: cash acquisitions are generally taxable

+ Control: cash acquisitions do not dilute control

IX. Friendly versus Hostile Takeovers

- Friendly merger: both companies’ managements are receptive → mutual cooperation

- Hostile merger: the acquiring firm attempts to gain control of the target without their approval

+ Tender offer: a formal proposal by an acquiring company to purchase

the shares of a target company directly from its shareholders

+ Proxy fight: buying voting right ●Ad: cheap

●Dis: high risk of being betrayed X. Defensive Tactics

- Corporate charter (articles of incorporation, certificate of incorporation):

provisions that outline the company's structure, governance, certain rules

→ influence how takeovers are conducted and may require specific actions to

be taken before a takeover can proceed

+ Classified board (staggered elections)

+ Supermajority voting requirement

- Golden parachutes: financial arrangements that provide significant

compensation or benefits to top executives in the event of a change of control or merger

→ create financial incentives

- Poison pills (share rights plans): shareholder rights plans that grant existing

shareholders the right to purchase additional shares at a discounted price in the event of a hostile takeover

→ dilutes the ownership of the acquiring company and makes the takeover more expensive

- Targeted repurchase (also called “greenmail”): target company repurchasing its

own shares from a potential acquirer at a premium to the market price

→ discourage the acquirer from proceeding with the takeover and can also

provide a financial benefit to the selling shareholder

- Standstill agreements: contracts that potential acquirers may enter into with the target company

→ target company repurchasing its own shares from a potential acquirer at a premium to the market price

- Leveraged buyouts: a target company might go private through an LBO to

avoid the pressures of being a public company and to prevent the hostile takeover XI. More (Colorful) Terms

- Crown jewel: a valuable and strategic asset or division of a company

- White knight: a friendly and alternative acquirer that comes to the aid of a

target company facing a hostile takeover attempt

- White squire: an investor or company that acquires a significant stake in the

target company to support its management and prevent a hostile takeover

- Scorched earth policy: implementing drastic defensive measures to make the

target company less attractive to the acquiring company: selling off valuable

assets, taking on excessive debt

- Shark repellent: defensive provisions in a company's charter or bylaws

designed to deter hostile takeovers: staggered board elections, supermajority voting requirements

- Bear hug: an aggressive and persuasive offer made by an acquiring company

directly to the target company's management

- Fair price provision: a defensive measure that specifies a minimum price that

an acquiring company must offer in a takeover attempt

- Dual class capitalization: the creation of different classes of shares with varying voting rights

- Countertender offer: a response by the target company to a hostile tender offer made by the acquiring company XII. Have Mergers Added Value?

- Shareholders of target companies tend to earn excess returns in a merger:

+ Shareholders of target companies gain more in a tender offer than in a

straight merger: the acquiring company often offers a premium over the

current market price of the target company's shares to incentivize

shareholders to approve the merger

+ Target firm managers have a tendency to oppose mergers, thus driving up the tender price

- Shareholders of bidding firms earn a small excess return in a tender offer, but none in a straight merger:

+ Anticipated gains from mergers may not be achieved: integration

challenges, cultural mismatches, regulatory hurdles

+ Bidding firms are generally larger, so it takes a larger dollar gain to get the same percentage gain

+ Management may not be acting in stockholders’ best interest

+ Takeover market may be competitive

+ Announcement may not contain new information about the bidding firm

XIII. The Tax Forms of Acquisitions

- If it is a taxable acquisition, selling shareholders need to figure their cost basis

and pay taxes on any capital gains

+ If the sale price > the cost basis: have a capital gain → capital gains tax

+ If the sale price < the cost basis: have a capital loss → offset capital gains

- If it is not a taxable event, shareholders are deemed to have exchanged their old

shares for new ones of equivalent value → does not trigger an immediate taxable event

XIV. Accounting for Acquisitions: Purchase Method

- Assets of the acquired firm are reported at their fair market value: the acquiring

company's balance sheet at their fair market value on the acquisition date

- Any excess payment above the fair market value is reported as “goodwill”

- Historically, goodwill was amortized: the gradual write-down of an intangible

asset's value over its useful life

XV. Going Private and Leveraged Buyouts

- The existing management buys the firm from the shareholders and takes it private

- If it is financed with a lot of debt, it is a leveraged buyout (LBO)

- The extra debt provides a tax deduction for the new owners, while at the same

time turning the previous managers into owners

- This reduces the agency costs of equity XVI. Divestitures

- Divestiture: company sells a piece of itself to another company for streamlining

operations, focusing on core businesses, raising capital

- Spin-off: company creates a new company out of a subsidiary and distributes

the shares of the new company to the parent company’s stockholders

- Equity carve-out: company creates a new company out of a subsidiary and then

sells a minority interest to the public through an IPO

- Tracking stock: company creates a separate stock to track the performance of a division