Preview text:

R E P O R T IStrawB M A 0 2 | G R O U P 0 2 IStrawB Partnership Company 01 GroPlan up ni 0ng an 2

d Budgetting Report for 05/2024 EXECUTIVE SUMMARY

In recent years, the focus on ESG and sustainable development has grown significantly

across various research areas in economics and finance. Leveraging the principles of

Managerial Accounting, we have conducted a comprehensive master budget to

determine the cost and pricing structure for a pack of 10 rice drinking straws to be

marketed through our partnership company, IStrawB.

This report commences with an overview of the business, outlining our mission and

vision. Following this, we apply Porter's value chain model to elucidate the primary and

support activities involved in creating value for consumers. This includes a breakdown

of departments and their corresponding responsibilities within these activities.

The core section of this report centers on the operational plan, which is divided into

four sub-plans: Production, Labor, Sales & Administration, and Property, Plant, and

Equipment (PPE). Each sub-plan is meticulously detailed, presenting itemized

calculations along with underlying assumptions and legal considerations in Vietnam.

This thorough approach results in a product cost of 11,527 VND per pack of 10 rice

straws; in which direct material accounts for 9,480 VND for 1 pack while that of direct

labor and manufacturing overhead are 729 VND and 1,319 VND respectively.

We finance the entire operation by 3 main sources of capital. First, self-funded equity

is 300 million VND, unsecured borrowing is 500 million VND, and financial lease of

production line is 1,250 million VND.

The final P&L analysis shows that we would achieve a net profit of 957,158,611 VND after

tax under absorption costing and the break-even point was at the sales level of 473,914 packs. TABLE OF CONTENT INTRODUCTION 02 1. BUSINESS INTRODUCTION 02 2. PRODUCT ANALYSIS 02 3. MISSION 02 4. VISION 02 BUSINESS MODEL 03 1. PRIMARY ACTIVITIES 03 2. SUPPORT ACTIVITIES 03 OPERATIONAL PLAN 04 1. PRODUCTION 04 2. LABOR 06 3. S&A ACTIVITIES 08

4. PLANT, PROPERTY, AND EQUIPMENT 09 FINANCING PLAN 10 1. CAPITAL STRUCTURE 10 2. FINANCIAL LEASING 10 3. UNSECURED BORROWINGS 11 MASTER BUDGETING 13 IStrawB Partnership Company

Planning and Budgetting Report for 05/2024 02 Group 02 INTRODUCTION Business Introduction

IStrawB is a business that produces and provides eco-friendly drinking straws from

rice. The company resulted from the idea of manufacturing a product that contributes

less carbon footprint towards the environment while maintaining the customer

experience as high as possible. Product Analysis Mission

IStrawB’s rice drinking straws are no

IStrawB aims to promote eco-friendly

different from other plastic straws in

matters by providing drinking straws

length, width, color, and level of

generated from rice. Normal plastic

convenience. However, rice drinking

straws are only used, and on an average

straws are completely safe for the

day, if the population of Asia consumes a

environment, since they are edible, and

single plastic straw for each one, a total

when entering the waste system, they are

of 4.5 million plastic straws would enter biodegradable.

into the waste system (1). Imagine how

large the waste burden for a week, a

month, or a year would be when the

number above is on average on a single-

day basis only. Realizing the importance

of the environment in modern society

and our duty to protect it as a whole, we

plan to promote such actions through

the most basic need of people, which is

drinking. With the special feature of the

straws being edible, we hope that our

business could somehow emphasize the

importance of preventing the alteration

of nature around us, and therefore

directly affect the beverage-consuming habits of people. Vision

IStrawB’s is determined to move toward a

more sustainable future where plastic

pollution will be reduced in Ho Chi Minh

City. It is our goal where every single-

used plastic straw is replaced by a biodegradable rice drinking straw,

reducing plastic waste and protecting

our local ecosystems. By continuously

innovating and expanding our product

line, we aim to become the preferred

choice for environmentally conscious

consumers and businesses in our community, gradually setting the

standard for sustainable consuming solutions. IStrawB Partnership Company 03 Gr P o lan upn in 0 g an 2

d Budgetting Report for 05/2024 BUSINESS MODEL Primary Activities Infrastructure Human Resource Management

IStrawB’s office and production plant are

IStrawB’s team consists of 5 main

placed at the same facility of 400 square personnel focusing on operating

meters. The production line consists of 7

activities of the business. For the

machines which requires a space of 225

production and selling process, we hire 10

square meters. The rest of the facility is

workers and a supervisor to serve in the

dedicated for office space, with the

production plant, and 2 telesales to assist

equipment consisting of 1 laptop, 1 the selling process.

personal computer, and 1 printer. Technological Development Procurement

IStrawB’s factory adheres to international

All raw materials utilized by IStrawB,

standards becomes eligible for global

comprising both rice flour and tapioca

export, akin to a facility holding U.S. FDA

starch, are exclusively procured from certification. Additionally, production

Tam Trang Company Limited Liability

lines meeting ISO 22000 standards

Company. These ingredients undergo

ensure quality management systems for

stringent quality control measures,

food safety, while Hazard Analysis and

ensuring adherence to the ISO 22000 Critical Control Points (HACCP)

standards for food safety management certification ensures systematic systems.

preventive measures for food safety. Support Activities Inbound Logistics Operating

After selecting a reputable supplier and

The business operates based on 4

securing high-quality materials, we

departments, including financing, selling

initiate the quotation process with the

and marketing, manufacturing, and

supplier, discuss contract, and decide on customer service department.

a three-year partnership. The supplier

must deliver materials punctually and

periodically, and the materials will be

stored in the factory warehouse prior to production use. Marketing Outbound logistics

Our business targets at environmentally

After customers place orders on the conscious consumers, food and

Shopee platform, the sales department

beverage businesses, as well as event

will handle the orders. Subsequently, the

organizers. The main platform for our

requests will be sent to the inventory

advertisements would be TikTok due to its

management department to check and

popularity and our purpose to raise

package the items. Finally, the orders will

awareness about IStrawB’s sustainable

be dispatched through a delivery straw products and encourage company to the customers.

environmentally conscious consumption

among the target customer groups. IStrawB Partnership Company

Planning and Budgetting Report for 05/2024 04 Group 02 OPERATIONAL PLAN Production

The production of drinking straws from rice requires the main use of rice flour and

tapioca starch, which would be bought from legitimate sources. Generally, the

process for producing drinking straws from rice contains 5 main steps. However, a

reminder notice is that between the steps there would be no work in process, since

the work in process products between each step cannot be stored for long, for

example, the mixture of rice flour and tapioca starch, as their qualities can be altered. Step 1: Ingredient Mixing

Step 2: Steaming and Granulating Input: Rice flour, tapioca starch Output: Mixture Step 3: Shaping and Cutting Input: Dried Mixture Input: Mixture Output: Straws Output: Dried Mixture Step 4: Quality Cheking Step 5: Packaging Input: Straws Input: Qualified Straws Output: Qualified Straws Output: Pack of 10 Straws Step 1: Ingredient Mixing

After gathering the required raw materials, we create a mixture of rice flour and

tapioca starch with a ratio of 7:3. The specific ratio is chosen because, among other

ratios, this is the most common to be seen. With the consideration of the normal loss

ratio above, averagely 1.3 kg of rice flour can produce 100 straws. IStrawB Partnership Company 05 Gr P o lan upn in 0 g an 2

d Budgetting Report for 05/2024 OPERATIONAL PLAN

Step 2: Steaming and Granulating

Later on, the mixture gathered above would be cooked by a steamer to help the

mixture stick together, and then enter the granulation machine to form a uniform

mass that is easily stretched to form the length of the straws. Step 3: Shaping and Cutting

Next, the uniform mass of steamed rice flour and tapioca starch will enter the shaping

machine as well as the cutting machine to form a specific shape and length for the straw. Step 4: Quality Cheking

After this, the half-produced straws will enter the drying machine to dry, and then to

the quality checking department to check for the color, length, shape, and other qualities of the product. Step 5: Packaging

Lastly, the straws will be packed together into paper packaging bags, with a pack containing 10 straws. Value Chain

Rice straw value chains consist of 4 main functions:

Harvesting: the rice grains are harvested and collected from the fields.

Processing: The harvested rice undergoes processing, which may involve cleaning,

cutting, and grinding it into powder.

Rice straw production: Processed rice flour is then used to manufacture rice

straws, involving shaping, cutting, and packaging the straws.

Consumption in the F&B market: Consumers use rice straws for drinking

beverages, such as juice or coffee, as an alternative to plastic straws. Rice straws

may also be used for various other purposes, such as crafting or animal feed. IStrawB Partnership Company

Planning and Budgetting Report for 05/2024 06 Group 02 OPERATIONAL PLAN Labor

Another crucial aspect that needs to be considered when starting up a business is

Labor. Labor, as the backbone of any organization, plays a pivotal role in shaping a

company’s trajectory. From the assembly line to the boardroom, the efforts of

employees drive productivity, innovation, and overall performance. In this part, we will

cover working and resting hours, holiday and overtime policies wages policies,

insurance policies, and how we allocate workers to different departments and production stages. Working policy

(100% of workers agree with this term).

Normal working hours according to

According to Chapter VII: Working hours,

regulations are less than 48 hours/week, rest hours; Labor Law Code

and overtime working hours are less than

45/2019/QH14, there are clear regulations

50% of the total normal working hours

on the following three items: Working

per week. According to Chapter VI:

hours (including normal working hours

Salary; Labor Law Code 45/2019/QH14,

and overtime) and rest hours (including

the salary rate for normal working hours, holidays and mid-hour breaks).

overtime, and weekends are 100%, 150%,

According to the above law, normal

and 200% respectively (Insert image

working hours will not exceed 8

rates for different types). To ensure

hours/day, 48 hours/week and overtime

workers' rights, we need to specifically

is only allowed to account for 50% of the

calculate how many normal working

total normal working hours in a day. To

days per month, how many extra working

simplify the costs and time spent on

days on weekends, and how many days

calculating and estimating, every holiday

off. Finally, we calculate the "Net total

in the month, employees will be off. number of working days" of the

Each normal working day consists of 8

employee, and based on that, calculate

hours and is divided into 2 shifts, the employee's salary.

morning and afternoon. To ensure that

However, the hourly minimum wage and

employees can relax and not be too

the monthly minimum wage prescribed

stressed about work, each shift only lasts

by the government when converted into

for 4 hours. The morning shift starts early

the same unit of time has a certain

from 7 AM to 11 AM. After that, employees

difference between the two salaries.

have lunch, rest, and are free to do

Therefore, after determining the total

activities for 2 hours from 11 AM to 1 PM.

number of working hours, we will

The second shift starts after the lunch

calculate the employee's basic salary

break ends, and the second shift ends at

each month based on the hourly rate, 5 PM.

and compare it with the monthly Salary policy

minimum salary prescribed by the state

to decide the employee's basic salary

The estimate will be implemented for one

(Because there are cases where workers

year, starting on April 30, 2024, and

work fewer days than other months, and

ending on April 30, 2025 (fiscal year).

when calculating the hourly salary, it is

During the week, the normal working day

still less than the monthly salary

will start on Monday and end on Friday, prescribed by the government).

and workers will work extra on Saturday IStrawB Partnership Company 07

Planning and Budgetting Report for 05/2024 Group 02 OPERATIONAL PLAN Workforce structure

The employees are divided into two main categories: The group that participates in

the production process and the group that participates in S&A activities. Workforce Production activities S&A activities Workers (Quantity: 10) Salesperson (Quantity: Supervisor (Quantity: 1) 2) Security (Quantity: 1) Tax accountant (Quantity: 1) Production group

and tax accountant. The salesperson will

carry out sales work for individual online

The first group has 3 primary duties:

customers (B2C) and the tax accountant

carrying out production, supervising and

will assist the business in the amount of

managing production, and ultimately

value-added tax to be paid to the state

protecting goods and the production line.

every month and corporate tax every

The 3 roles are located for these

year. All the above employees are

responsibilities are: Workers, Supervisor,

entitled to full insurance and holiday

and Security. The group will consist of 10

benefits, but the tax accountant is not

workers who will alternatively start and

entitled to insurance because this

carry out the production process, 1

position is outsourced from outside of the

supervisor to oversee production, and 1 business.

security guard. Due to the specific

nature of the work, the monthly salary of Insurance policy

each role will vary. The monthly salary of

Under Decision No.595/QD-BHXH, both

workers will be calculated based on the

the employer and employee contribute

working hours mentioned above, the

to the government’s insurance fund. The

fixed salary of supervisors will be

employer contributes 17.5% to social

15,000,000 VND/month, and the fixed

insurance and 3% and 1% to health and

salary of security will be 10,000,000

unemployment insurance respectively.

VND/month. The main workplace of this

Employees contribute 10.5% of their basic

group will be in the production area.

salary to state insurance. The employer S&A group

can deduct this amount from the

employee’s salary for payment to the

On the other hand, the non-production state.

team will work in the office. This team

consists of 2 main roles: salesperson IStrawB Partnership Company

Planning and Budgetting Report for 05/2024 08 Group 02 OPERATIONAL PLAN S&A Activities

The S&A Expense includes variable and fixed expenses that are related to the selling,

general, and administrative activities. S&A Activities Variable Expense Fixed Expense Telesales commission Salary for 2 Transportation salespersons Shopee’s payment Salary for tax commission accountant Shopee’s fixed Advertising commission Others S&A Variable Expense S&A Fixed Expense

For variable expenses, the expenses are

For the fixed expenses, the expenses are

the transportation of goods to customers,

salaries for 2 telesales personnel, salary

Shopee’s payment commission, Shopee’s for a tax accountant, advertising fixed commission, and Telesales

expenses, utilities expenses, depreciation,

commission, since we plan to sell directly

and insurance. The salaries for 2 telesales

by ourselves and through Shopee, an e-

are based on the minimum wages set by

commerce platform. The percentage of

the law excluding the insurance paid by

commissions from Shopee are collected

the workers, whereas salaries for the tax

directly through the platform, resulting in

accountant are based on the fee they the same 4% for both types of

charge for the tax service performed

commission. The specific amount would (3,000,000 VND). Advertising is

be calculated based on the sales

estimated upon the bidding advertising

dedicated to e-commerce platforms, cost (5,600,000 VND) and the

which is 85% of the total sales. The rates

advertising cost of reach and frequency for telesales’ commission and

(1,200,000 VND), with the advertisements

transportation are estimated upon the

being placed mainly on TikTok. The

estimated sales per month, with both

insurance is calculated based on the rate

being 3%. The specific amount would be

paid by workers and by the owner from

calculated based on the sales dedicated

the Labor Information sheets. Lastly, the

to direct sales, which is 15% of the total

utilities and depreciation expenses are all sales.

office-oriented costs, with the utilities

being for office hours and depreciation

being for the office equipment. IStrawB Partnership Company 09

Planning and Budgetting Report for 05/2024 Group 02 OPERATIONAL PLAN Plant, Property, and Equipment

As mentioned before, the manufacturing process of rice straw contains five main

steps. In which, each step requires a type of machine. We plan to lease the entire

system, consisting of 7 machines, along with technology transfer rights from the supplier. Dough Mixer Machine Straw Cutting Automation

Function: The dough mixer machine

Function: Automatic Cross-Cutting

is a device used to blend ingredients

Device for segmenting long single or

to create a mixture for cooking rice

double straws into one or two straws, straws. The mixer is commonly

featuring integrated automatic and

employed in the rice straw production cross-cutting functionalities.

process to ensure the quality and Power consumption: 0.75 kWh

uniformity of the ingredient mixture.

Cutting speed: 1000 metres/minute Power consumption: 3 kWh

Capacity: 50kilograms/batch/minute Dryer System Powder Granulator Machine

Function: Dryer system is used to

remove moisture from products by

Function: Powder granulator machine

circulating hot air or another drying

is used to manufacture granular

medium.cross-cutting functionalities.

products as desired from wet powder Power consumption: 6.5 kWh raw materials. Capacity: 150 kilograms/hour Power consumption: 25 kWh Capacity: 200 kilograms/hour Preservation Equipment Straw Extrusion Machine

Function: The main function of the machine is to cool and quickly

Function: Straw Extrusion Machine is

package the rice straw to ensure

used to extrude and shape powdered product quality.

particles into long continuous straws. Power consumption: 2 kWh Power consumption: 50 kWh Airflow rate: 18,000 cubic Capacity: 700 sticks/minute meters/hour Straw Packaging Machine

Function: Packaging machine is used

to pack straws into bags with a quantity of 10 straws/bag. Power consumption: 1.2 kWh Capacity: 25 bags/minute

In addition to the machinery in the production system, we also purchased some

essential equipment for operating the company, including 1 desktop computer, 1

printer, and 4 80W light bulbs. All of these devices have a 10-year depreciation period. IStrawB Partnership Company

Planning and Budgetting Report for 05/2024 10 Group 02 FINANCING PLAN Capital Structure

It is widely admitted that financial resources play a critical role in providing startups

with the key to establishing, growing, and sustaining their businesses in ever-evolving

competitive markets. Therefore, choosing the right mix of financing options (i.e. capital

structure) and effectively managing these resources are key strategies for the success

of any startup. Acknowledging these unwritten norms, our company meticulously

prepares for the rice straw’s funding sources.

Our company’s capital structure includes two elements. First, the owner’s equity

will be formed by 300 million VND (60 million x 5) as charter capital from our

scholarship rewards. This amount of owners’ equity accounts for 15% of the entire

capital structure Second, the liabilities account for the remaining 85% which consists

of capital leases for PPE and unsecured borrowing to finance working capital.

At least four reasons can strongly support this decision. First, according to MM

proposition II in the world of corporate taxes, raising more debt to finance business

activities while efficiently managing its risk could enhance the firm’s value and the

required returns for the owners. Second, implementing the assigned tasks from

Directives 01 (2023) and 03 (2015) issued by the SBV, Vietnamese banks have been

launching many low-interest-rate credit packages to support businesses and green

startups to creatively recover and sustainably push up the economy. This concerted

and urgent effort aims to facilitate access to capital and stimulate the innovation of

eco-friendly startups in Vietnam. Third, inviting more owners to raise capital may lead

to dilution, which harms the current equity holders' benefits. Fourth, finally, we are five

university students facing significant budget constraints for startups and reputation to call for venture investors. Financial Leasing

The decision to lease the production line rather than entirely purchasing this

1,250,000,000 VND amount is due to two reasons.

First, by opting for a capital lease, we, as a startup, can avoid a significant upfront

cash outflow. This preserves our cash flow for other business needs such as operating

expenses, marketing, and expansion opportunities. Moreover, the ceiling amount that

we can borrow from the bank without collaterals is below 1 billion VND and we have to

use this amount to finance our working capital such as raw materials as well as repay

the upfront expense of rent. Second, the interest expenses portion of the lease

payment is considered as a financial expense and could be tax-deductible, thereby reducing our taxable income.

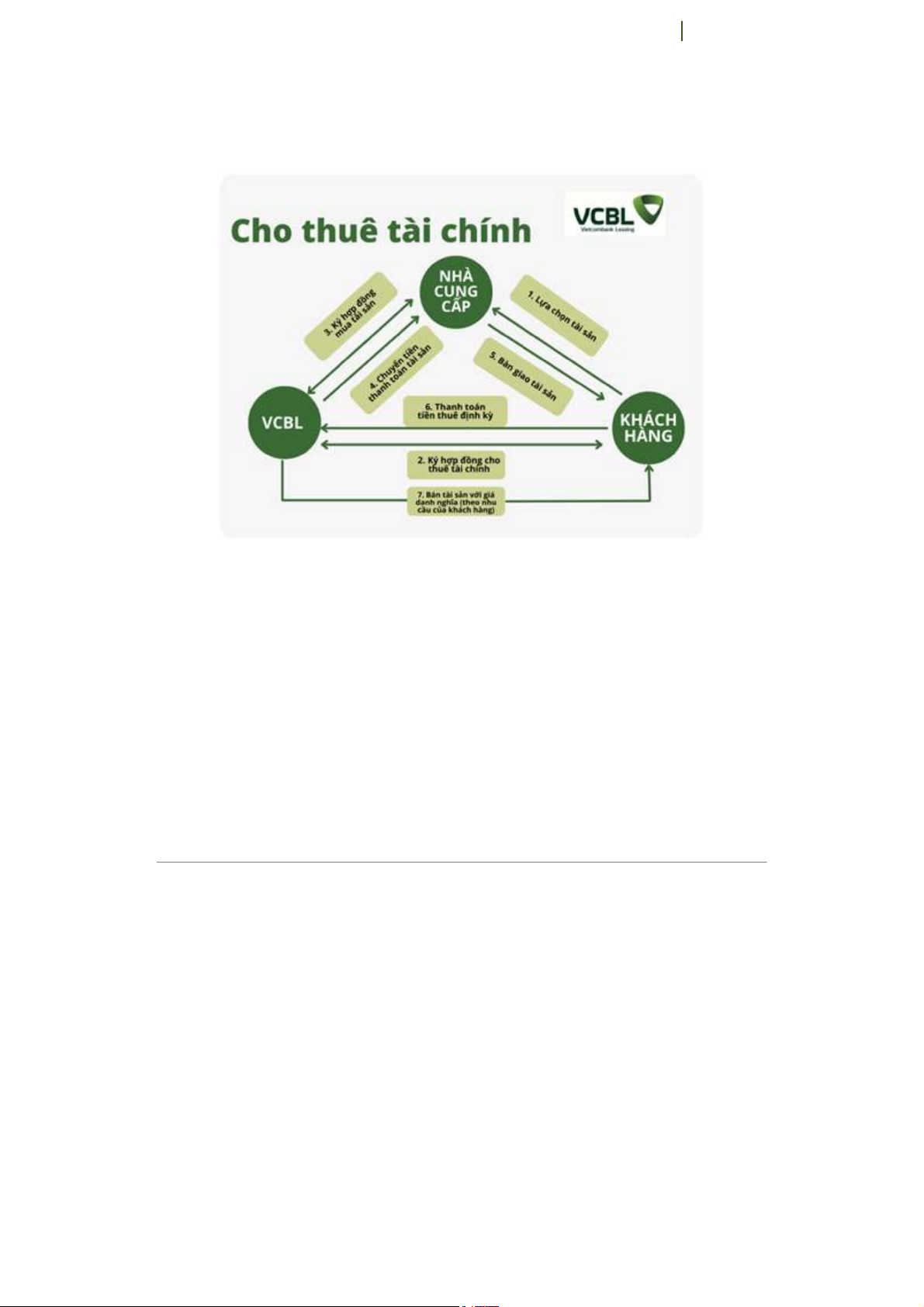

We chose VCBL (a subsidiary of VCB) to form a capital leasing contract. Reasons

for choosing VCBL include collateral-free, high financing rates of up to 100% of asset

value, fast-and-simple approval, and competitive lease payment.

Types of documents required by VCBL at the time of signing the contract include:

Business registration certificate, tax registration certificate, and company charter.

Notarized copies and originals of citizen identification cards, passports, and marital

status certificates of 5 owners.

Bank account statement and transaction history of the last 2 years of 5 owners.

Detailed supplier information profile, list of types, and prices of machines or equipment to be purchased. IStrawB Partnership Company 11 Gro P ulan p n 0 in

2 g and Budgetting Report for 05/2024 FINANCING PLAN

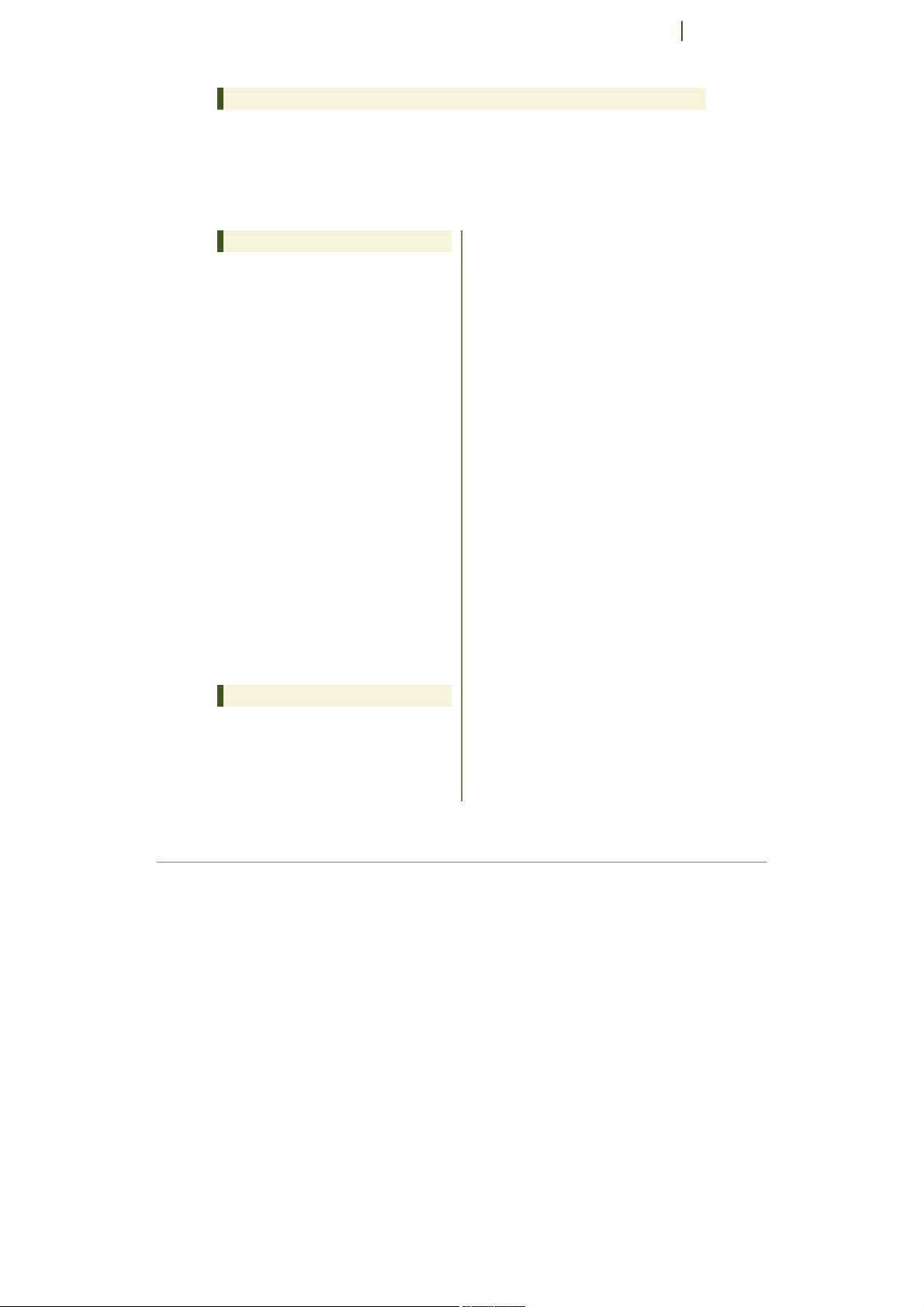

Our line of machines and equipment is priced at 1.25 billion VND and will be 100%

financially leased by VCBL to support our productions. After filling in some information

about our business mission and vision, they offer us a reasonable lease payment of

27,256,944 VND per month for 72 months. This amount includes a fixed principal

payment and fixed interest expense charged initially on the price of our production line

at 9.5% and will be repaid at the end of each month starting from 30/4/2024. Computations are as follows:

The monthly fixed principal amount to be repaid = 1,250,000,000/72 = 17,361,111 VND.

The monthly fixed interest expense to be repaid = 1,250,000,000 * (9.5%/12) = 9,895,833 VND. Unsecured Borrowings

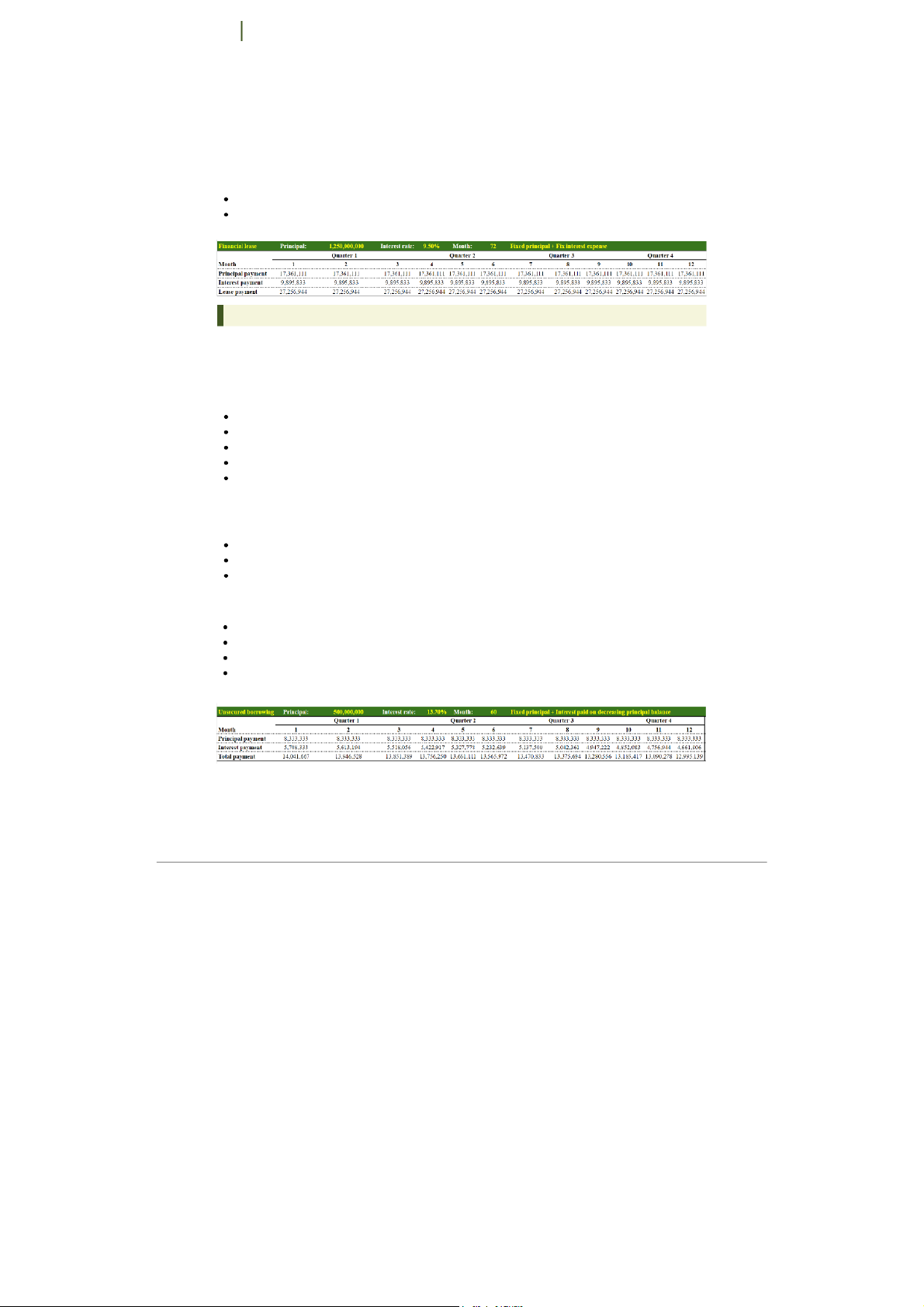

Regarding the unsecured borrowings to finance our working capital, after analyzing

and asking for lending rates and requirements from many banks, our final decision is

to borrow from TCB. After filling in some information about our business mission and

vision, and specifying our financing needs for working capital, they offer us a

reasonable lending rate. Below are the terms of this borrowing contract:

Loan Type: Unsecured loan from TCB Interest rate: 13.7%/year Repayment term: 60 months No need for collateralizations

Repayment method: Fixed monthly principal payments, and interest payments are

calculated based on the decreasing principal balance

Initial requirements from TCB that are submitted and checked before signing contracts:

Vietnamese nationality, age 20-70 years old

Minimum income of 5 project owners from 10,000,000 VND/person/month

Credit history: No overdue debt within the past 01 years, no overdue debt of 91 days

or more within the past 2 years (at CIC).

Required documents from TCB before signing contracts:

ID cards/Passports, household registration books (original + notarized copy)

Documents proving marital status

Documents proving monthly income (salary statement)

Loan application form according to the Bank's form (clearly stating the loan purpose) IStrawB Partnership Company 12 Group 02

Planning and Budgetting Report for 05/2024 FINANCING PLAN

Finally, by calculations, we have to pay the borrowing expense including a fixed

amount of principal and decreasing interest payment each month for 60 months in

total. The amounts that we have to pay in the first year of operations range from

14,041,667 VND to 12,995,139 VND each month due to the fashion of charging interest

based on decreasing principal balances. IStrawB Partnership Company 13 GroPlan up ni

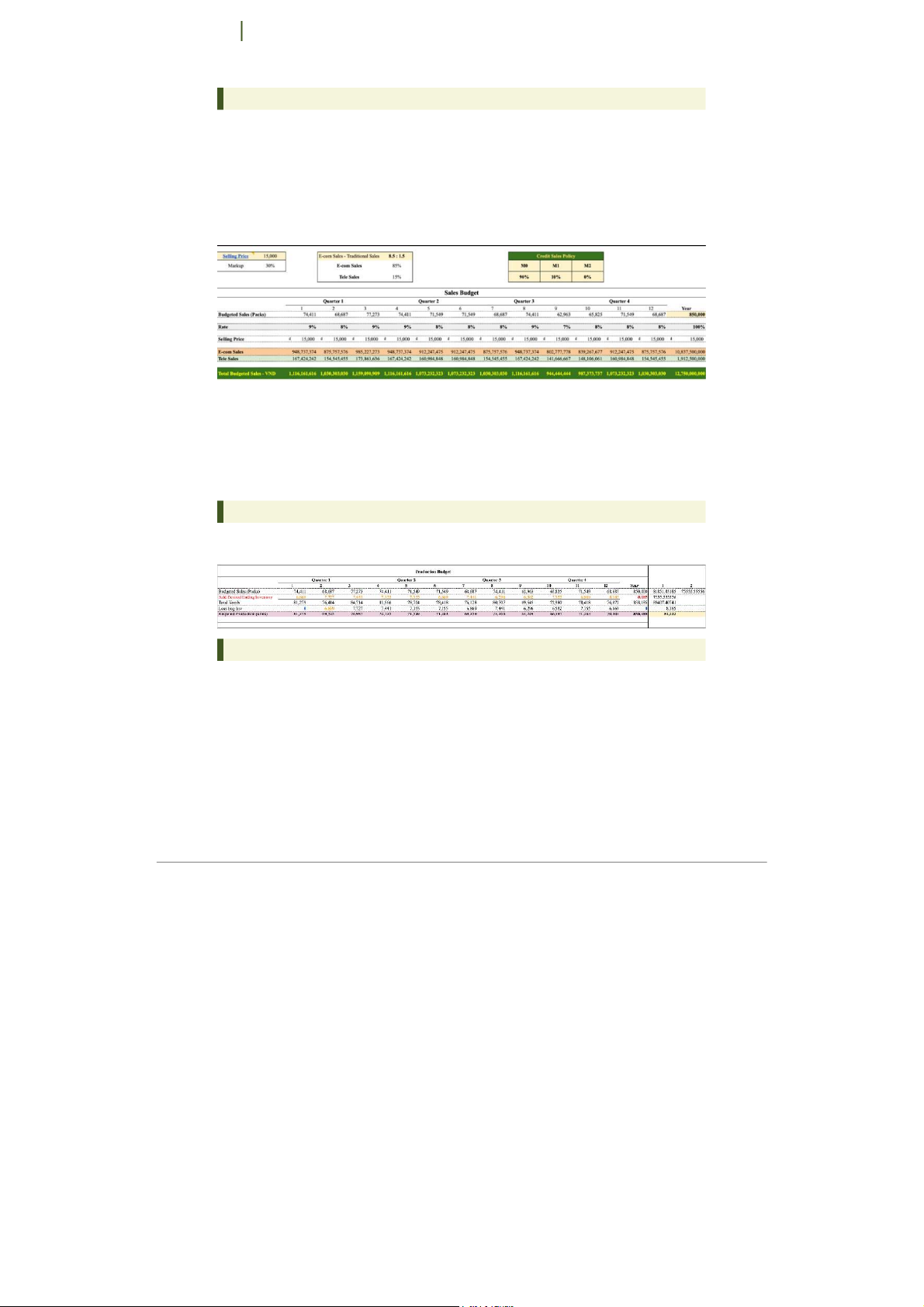

0n2g and Budgetting Report for 05/2024 MASTER BUDGETING Budgeted Sales

The Sales volume of our business is determined by two factors: The maximum

capacity of the business (950,400 packs per year) and the selling price of the

market. As shown in the Excel file, when the sales volume increases, the business may

enjoy the advantage of “Economies of Scale”, which helps minimize the Product Cost

per Pack. With the target of a 30% markup price and the identified market price of 1

pack of 10 rice straws, we can set our sales volume (at 850,000 packs per year) to

better match the market price. Hence, our budgeted sales, and selling prices are, as follows:

Regarding the quantity of packs sold in each month, we will need to calculate the Rate

- the percentage of the annual sales volume - for each month. The rate is computed

by dividing the minimum working hours each month by the total minimum working

hours per year. This helps match the expected revenue with the working hours needed

for production. As a result, the gap between the required working hours and the

minimum working hours of each month is reduced, which helps plant workers with fewer Overtime Hours. Production Budget

After the Sales Volumes are set, the required quantity for production is budgeted. The

desired ending for each month is equal to 10% of sales of the following month.

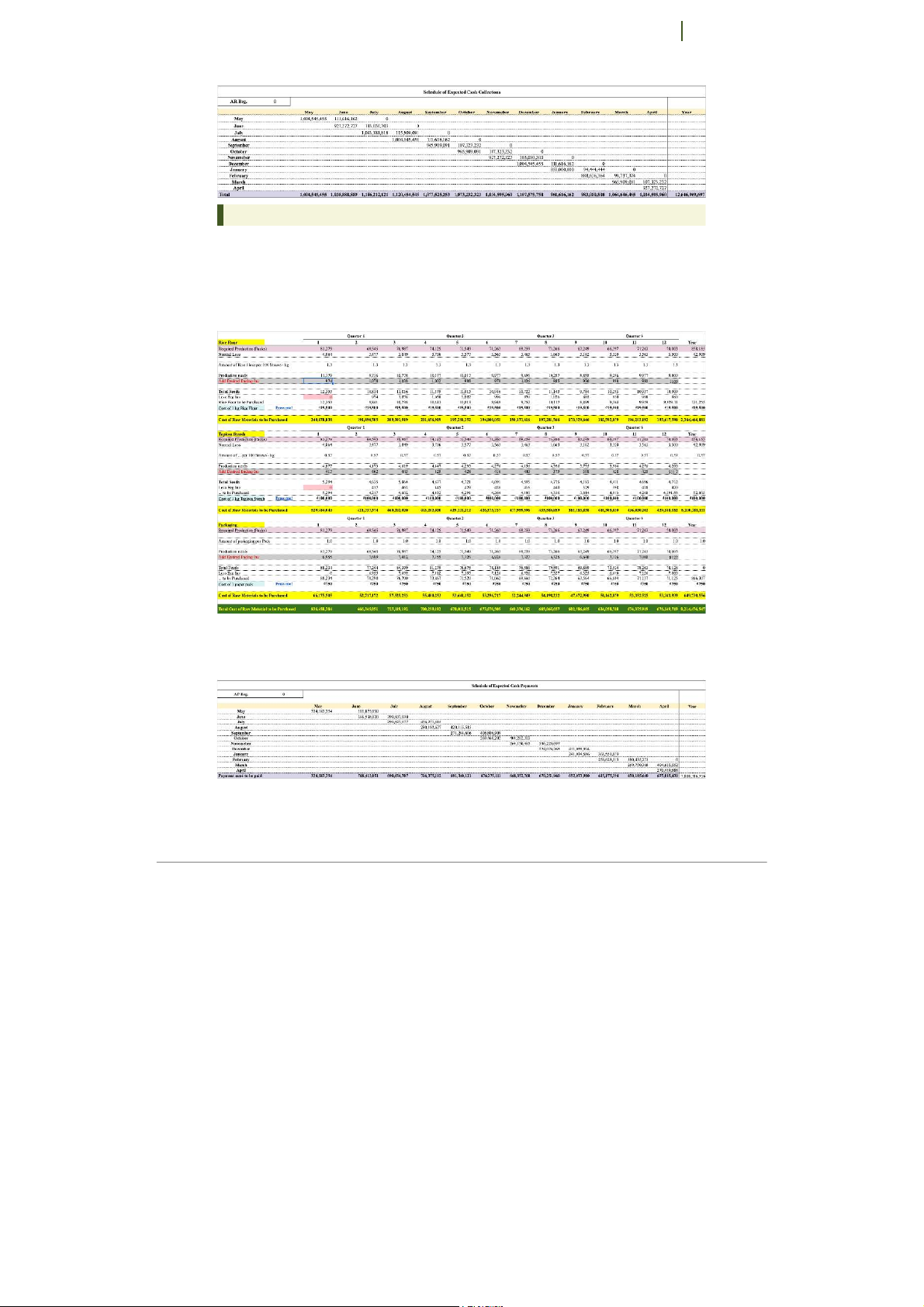

Cash Collection (Account Receivable)

The credit policy of our business includes the initial cash payments (90%) at the

month the sales occur, and the remaining 10% will be made in the following month.

This decision is made based on our business situation as we have the obligation to

make monthly interest/principal payments for our lease and borrowing. Therefore, a

90% cash payment can help shorten the cash conversion cycle, thereby, boosting the

short-term solvency of the business. IStrawB Partnership Company 14 Group 02

Planning and Budgetting Report for 05/2024 MASTER BUDGETING

Direct Material (Account Payable)

Starting the fiscal year, we assume the beginning balances for the three types of

direct materials - Rice Flour, Tapioca Starch, and Package are 0. Notably, the

production is assumed to have a normal loss of 5% for Rice Flour and Tapioca Starch.

As a result, apart from the ideal required amount, an additional 5% should be made to

reach the targeted production quantity. The desired ending is equal to 10% of the

required amount for the next month's production.

Our suppliers' policy cannot be determined clearly without negotiation among parties.

Therefore, we assume that IStrawB is obligated to make 40% of the payments for

materials when purchasing, and 60% remaining will be paid in the next month. IStrawB Partnership Company 15 GroPlan up ni 0ng an 2

d Budgetting Report for 05/2024 MASTER BUDGETING Direct Labor

Based on the budget production level from the sheet Prod. and the minimum labor

hours per month that we need to pay the salary to the employees, we can easily

estimate the direct labor time needed per pack. From that, we can approximate the

practical direct labor hours needed to produce the required amount. As we have

mentioned above, the minimum hours (taken from Labor-info) are the amount of

possible working hours per month, which do not include overtime hours. Therefore, the

direct labor cost has to be based on that, and if the required production hours exceed

that amount, the redundancy needs to be considered as overtime hours, which will be

the fixed overhead of that month. The salary for overtime hours is not taxable.

Moreover, according to Decision No.595/QD-BHXH, employees need to take away

10.5% of the basic salary, which is the salary based on the minimum working hours.

Last but not least, the average wage per hour is recommended to calculate the

overtime working hours wages, as salary on the weekend does not have the same weight as working days. Manufacturing Overhead

There are two components in manufacturing overhead, including variable

manufacturing overhead and fixed manufacturing overhead. The variable overhead

includes electricity and water used for machinery consumption, while fixed overhead

includes electricity used for office equipment, indirect labor salary, rent payment,

direct labor that is considered as fixed overhead and depreciation of ROU. Mnfg. OH Variable mnfg. oh Fixed mnfg. oh IStrawB Partnership Company

Planning and Budgetting Report for 05/2024 16 Group 02 MASTER BUDGETING

Variable Manufacturing Overhead

According to Directives 2941-BCT [2] dated November 8, 2023, regarding the retail

electricity tariffs for manufacturing sectors, the rates are as follows: Electricity Price (VND/kWh) Peak Hours 2.973 Normal Hours 1.649 Off-peak Hours 1.044

As per the regulations of the Vietnam Electricity Group (EVN) [2], peak hours are

designated from 09:30 to 11:30 (2 hours) and from 17:00 to 20:00 (3 hours) from

Monday to Saturday. Consequently, following the working hour policy of IStrawB

company, 1 hour and 30 minutes will be allocated as peak hours daily (from 9:30 to

11:00). In the case of overtime, any additional hours worked each day, if below 3 hours,

will also be considered peak hours.

Subsequently, based on the total power consumption of the machine (88.45 kWh)

and the price of electricity, we calculate electricity cost depending on actual hours of

Direct Labour. We allocate the electricity expenses of the 7 machines in the process to

variable manufacturing overhead, while the electricity expenses of office equipment

(desktop computers, printers, lights) are allocated to Selling and Administrative (S&A).

Cho Lon Water Supply Joint Stock Company has released information regarding the

unit price of water usage for manufacturing businesses, which is 12,100 VND per cubic meter of water consumed [2].

The variable manufacturing overhead includes water consumed for both machinery

consumption and staff’s personal use. Among the production chain, only the Dough

mixer machine requires the use of water. With the usage of the machine, we assume

each batch of the mixer can blend 50 kilograms of flour with a maximum mixing time

of 6 minutes, in total requiring 0.015 cubic meters of water including the portion for

staff’s personal use. Consequently, we calculate that the water overhead for

production is 0.09 cubic meters of water per hour. From there, we can determine the daily water cost. IStrawB Partnership Company 17 Gro Pl uan p ni

0 n2g and Budgetting Report for 05/2024 MASTER BUDGETING Fixed Manufacturing Overhead

Regarding the production overhead expense for production, the part consists of 2

types of expenses, which are variable and fixed.

Considering the fixed expenses, we include the insurance-deducted wages of a

supervisor and a security guard, which are 13,425,000 VND and 8,950,000 VND

respectively. Furthermore, renting would also be considered as a fixed expense, with

the cost of 20,000,000 VND for each month. Another factor for fixed manufacturing

overhead expense is depreciation for Right of Use, which is computed monthly at the

amount of 17,361,111 VND. Lastly, the Direct Labour expense listed as fixed production

overhead is also counted. The specific amount for each month is extracted from the

Direct Labor sheet since the amount only accounts for 3 months.

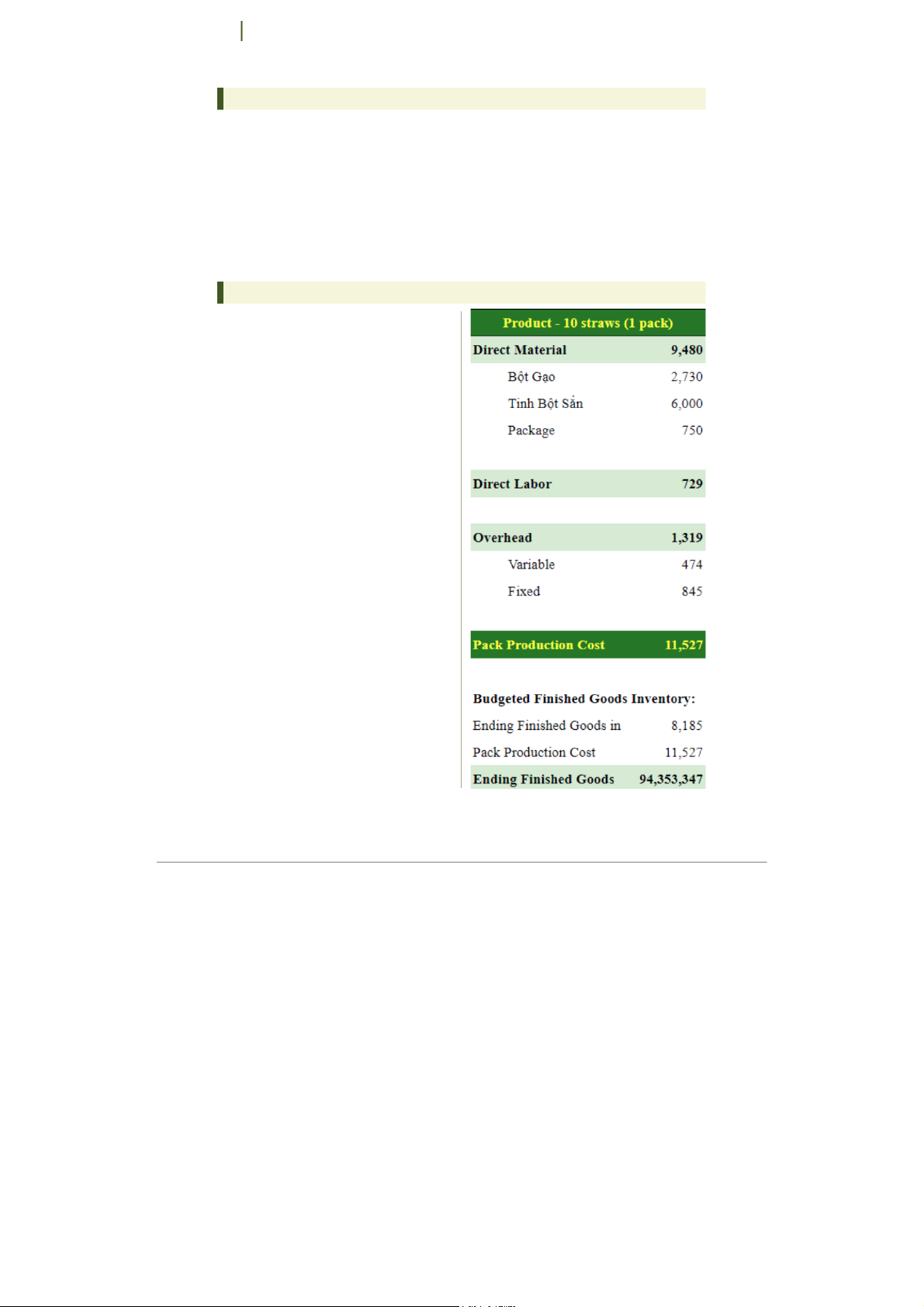

Ending Finished Goods Inventory

With each pack (including 10 rice straws)

produced, IStrawB needs a total of 9,480

VND for direct materials. Particularly, rice

flour, tapioca starch, and packages cost us 2,730; 6,000; and 750 VND

respectively. At the same time, IStrawB

also compensates our laborers for their

effort to work hard for many days, and

this amount that markup the product cost by 729 VND for each pack.

Regarding the manufacturing overhead

cost, the combination of fixed overhead

(845 VND) and variable overhead (474 VND) constitutes the entire

manufacturing overhead cost of 1,319

VND for each pack produced. Hence, the

final production cost for each pack was budgeted at 11,527 VND.

Additionally, the finished goods ending

inventory was reported to be 8,185

packs; therefore, the total amount of

ending inventory of finished goods listed

in the balance sheet is 94,353,347 VND (8,135 packs x 11,527 VND)