Preview text:

Chapter 1

1/ Direct cost can be easily traced to specificed cost

2/ Indirect cost cannot be esily traced to specificed cost

3/ Manufacturing cost include direct materials and direct labor, and manufacturing overhead

- Direct material: material uesd in the final product

-Direct labor: includes labor costs easily traceable to finished products

( lương của công nhân tham gia vào sản xuất)

- Manufcturing overhead: ( là các chi phí không trực tiếp liên quan đến việc sản xuất sản phẩm

nhưng cần thiết cho quá trình sản xuất.) Prime cost= DM + DL Conversion cost= DL + ManuOver 4/ Nonmanufacturing cost

- Selling cost is a costs incurred to secure customer orders

and get the finished product to the customer.

VD: advertising, shipping, sales travel, sales commissions, sales salaries

-Administrative costs is all costs associated with the general management of an organization

5/ Product cost: sẽ được ghi nhận là tài sản trong bảng cân đối kế toán cho đến khi sản phẩm đó được bán.

Ðiều này có nghia là nếu sản phẩm chưa được bán, chi phí liên quan đến sản phẩm đó sẽ được tính vào tồn kho

(product costs include direct materials, direct labor, and manufacturing overhead.)

6/ Period cost include all selling costs and administrative costs.

7/ Variable cost proportional to production ( tăng theo tỉ lệ thuận)

8/ Fixed cost remains constant regardless of production. Unlike variable costs, fixed costs are not

affected by changes in activity.

- Committed : long term, cannot be significntly reduced in the short term

-Discretionary: may be altered in the short term by current managireial decisions 9/ Mixed cost are also known as semivariable costs. Y = a + bX In this equation, Y = The total mixed cost

a = The total fixed cost (the vertical intercept of the line)

b = The variable cost per unit of activity (the slope of the line) X = The level of activity

>Product cost = DM + DL + ManuO

>Period cost = Selling + Administrative >Prime cost= DM + DL

>Conversion cost= DL + ManuOver

>Variable manufacturing cost = DM + DL + Var manuo

>Total FC= Fmanufacturing + Fselling + Fadministrative

10/ Opportunity cost is the potential benefit given up when one alternative is selected over another.

11/ Sunk costs have already been incurred and cannot be changed now or in the future.

>COGS= Beginning+ Purchase- Ending

> Total Direct Manufacturing Cost=DM mới + DL mới

> Total Indirect Manufacturing Cost=Variable Overhead mới +Fixed Overhead cũ

>Những bài liên quan Manufacturing Overhead = 45% Conversion Costs Chap 2

1/Measuring DM cost: A bill of materials is a document that lists the

quantity of each type of direct material needed to complete a unit of product.

2/Job cost sheet records the materials,

labor, and manufacturing overhead costs charged to that job

3/ Measuring DL cost: A time ticket provides

an hour-by-hour summary of the employee’s activities throughout the day

( indirect labor cost donnot get directed poseted on Job cost sheet)

4/ Computing Predetermined Overhead Rates

( manufacturing overhead also needs to be

recorded on the job cost sheet) - ManuO is an indirect cost

-ManuO are variable overhead costs because they tỉ lệ thuận to changes in the level of production

-The average cost per unit varies from one period to the next

>POHR=Estimated tt manu for period/ Estimated tt unit Y = a + bX Where,

Y = The estimated total manufacturing overhead cost

a = The estimated total fixed manufacturing overhead cost

b = The estimated variable manufacturing overhead cost

per unit of the allocation base

X = The estimated total amount of the allocation base 5/ Applying ManuO

-is computed before the period begins and is used to apply overhead cost to jobs throughout the period

-the costs would be direct costs, not overhead -

>Overhead applied to a particular job = Predetermined overhead rate × Actual

direct labor-hours worked on the job

>Total EstiO=FixedO+(Variable Overhead Rate×Estimated MH)

>POHR=Estimated Machine-HoursTota/Estimated Overhead

>Total Overhead=Variable Overhead+Fixed Overhead Chap 3

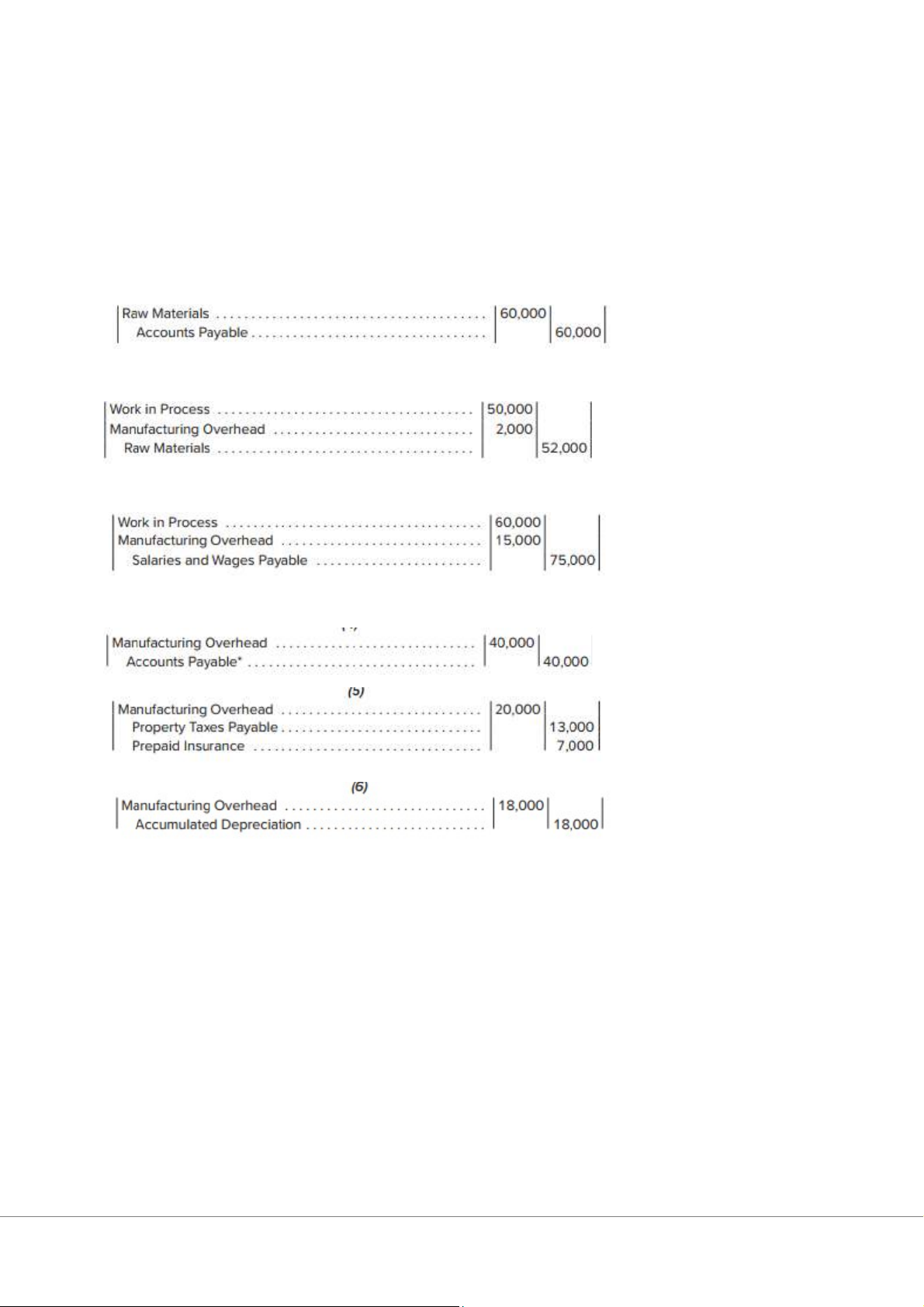

1/ The purchase and issue of materials -

-Issue of direct and indirect materials 2/ Labor cost - 3/ ManuO costs

4/Applying Manufacturing Overhead

-The Concept of a Clearing Account: the Manufacturing Overhead account operates as a clearing

account. Actual manufacturing overhead costs are debited to the account as incurred throughout the year.

5/Nonmanufacturing costs

-should not go into the Manufacturing Overhead account. 6/ Schedule of COG manu

>Raw in production= Beginning+Purchase-Ending

>Total manu cost added to produc= DM+ DL+ ManuO in process

>COG manu= Beginning + Total manu cost added to produc- Ending 7/ Schedule of COGS

>Unadjust COGS= Beginning+ COG manu- Ending > >

> Vì Credit> Debit nên Overapplied overhead.

8/ Fundamental Accounting Equations

>Ending retain=Beginning+ Net income –Dividend Chap 4

1/ Similarities and Differences Between Job-Order Costing and Process Costing - Similarities

Both systems have the same purposes—to assign material, labor, and manufacturing

overhead costs to products for computing unit product costs

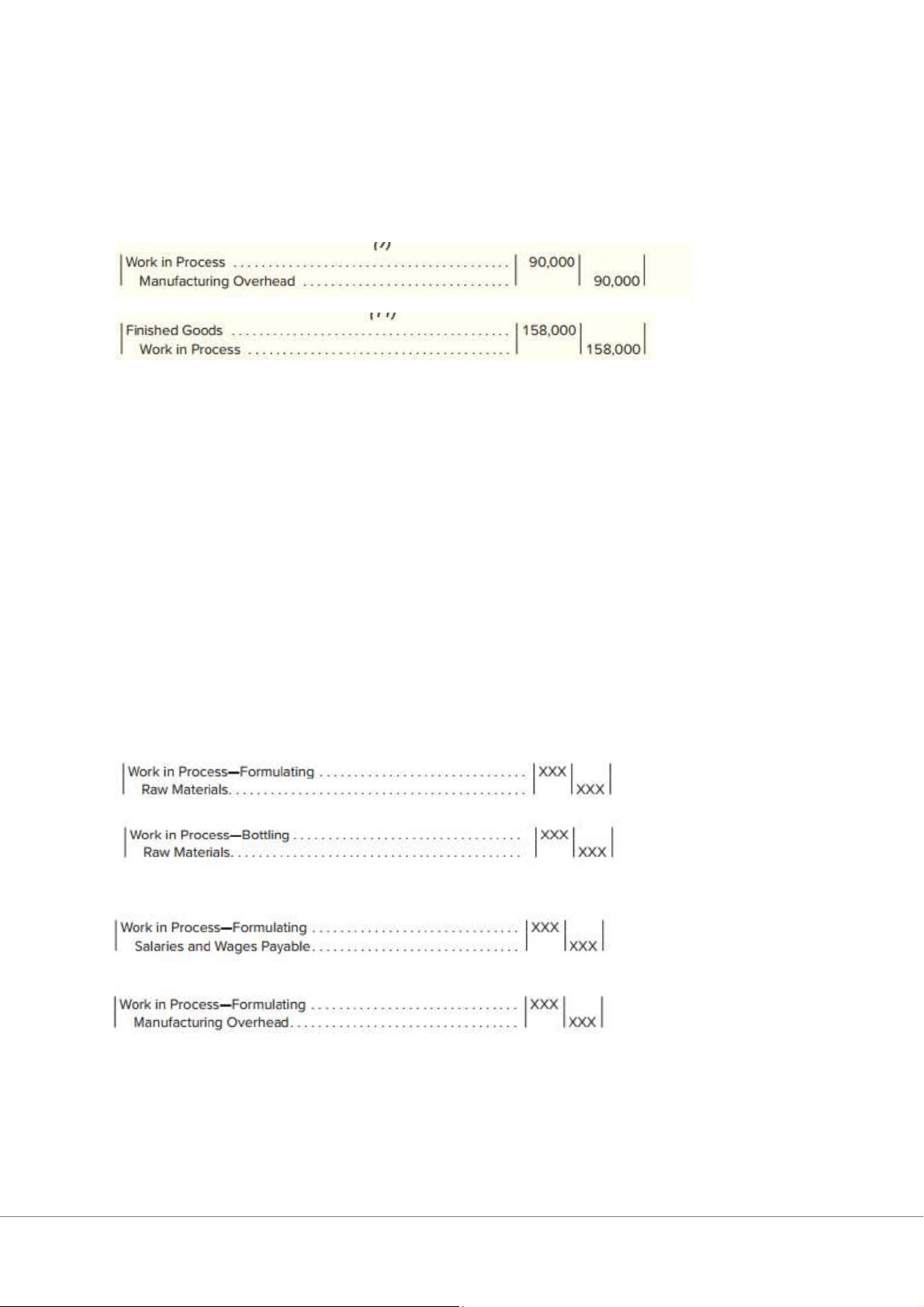

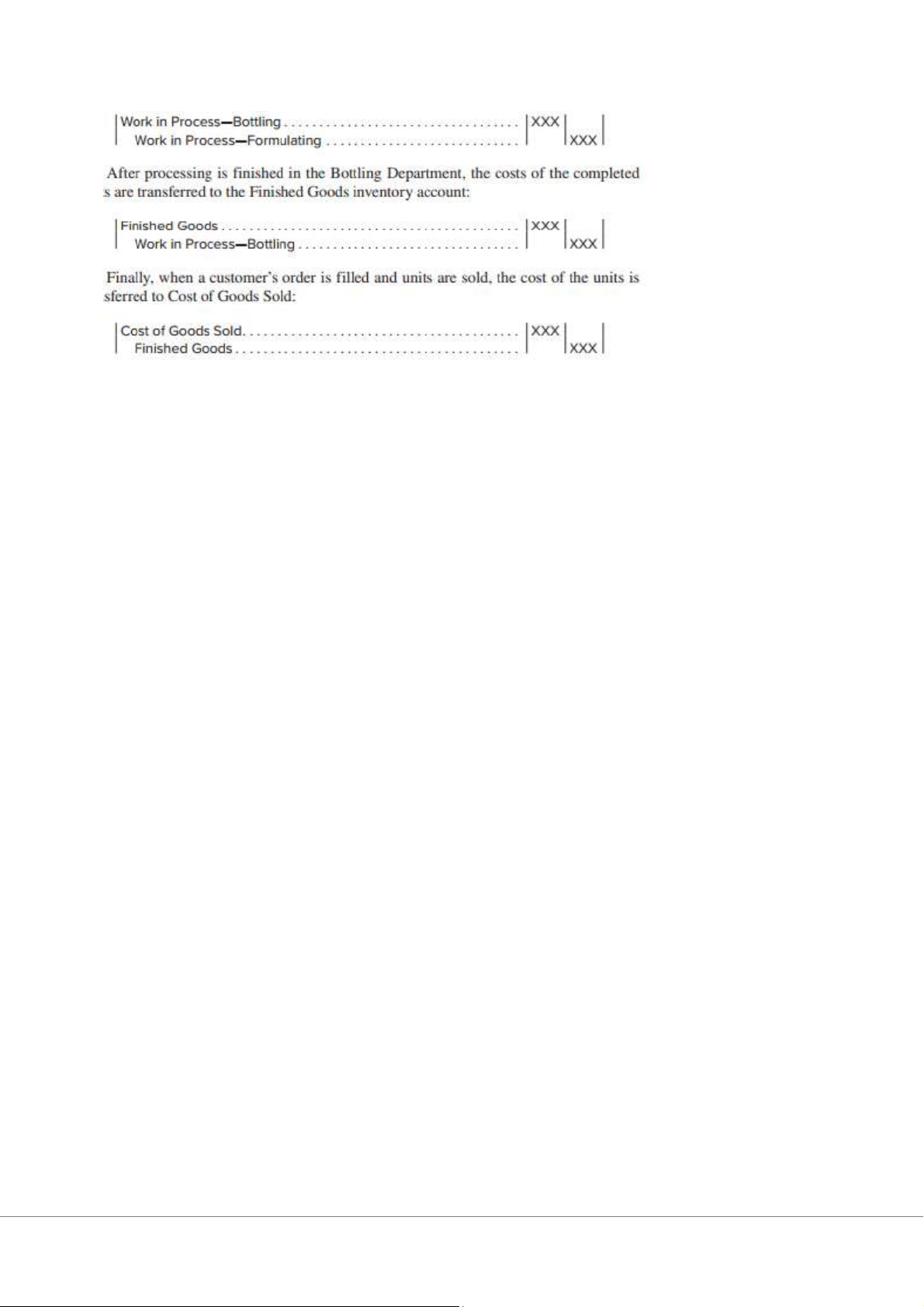

- Include ManuO, Raw material, WIPS,FG 2/Processing department

- is an organizational unit where work is performed on a product and where

materials, labor, or overhead costs are added to the product. 3/ Material cost - - 4/Labor cost 5/Overhead cost 6/Completing the cost flow 7/Key concept

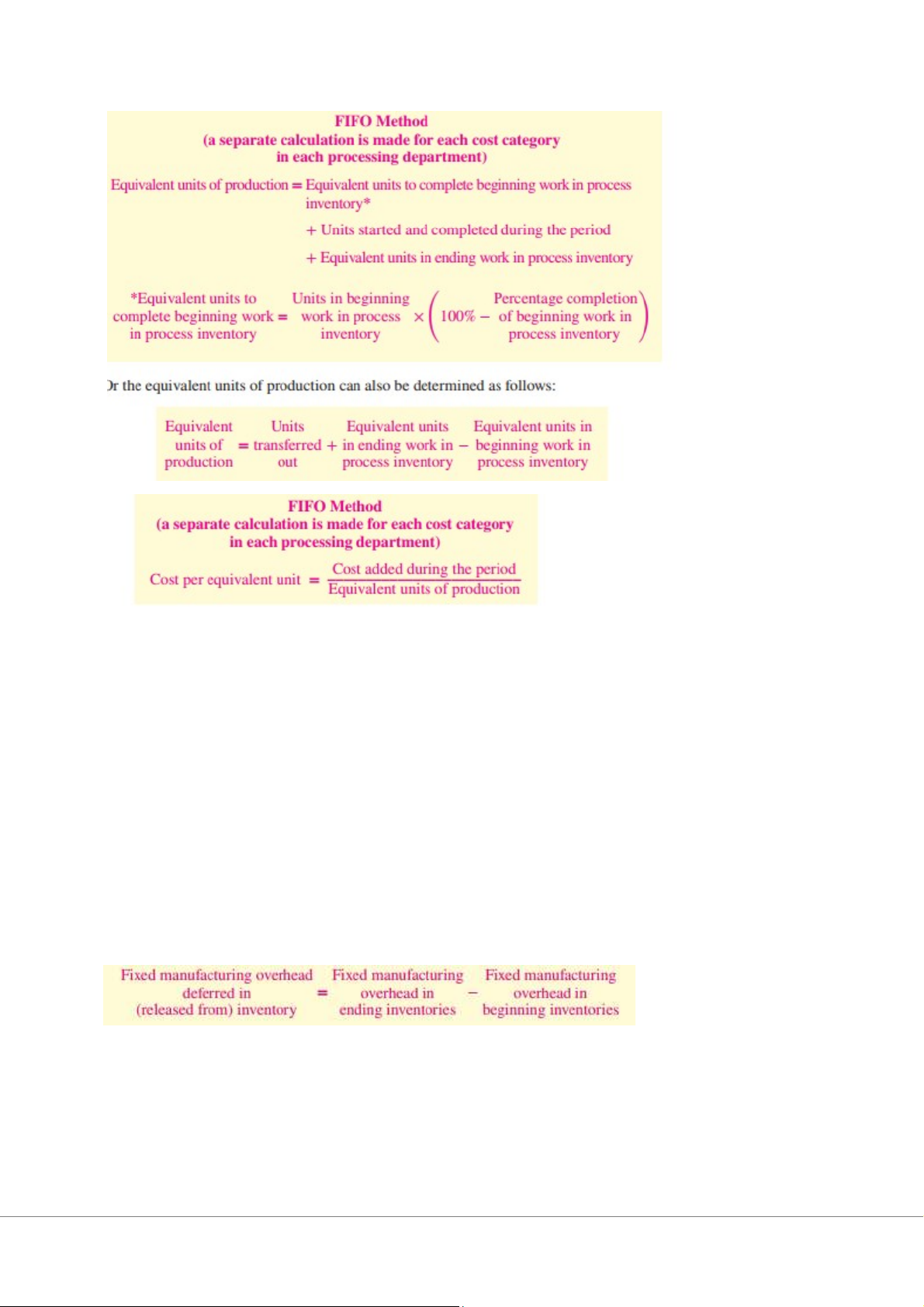

C1: . The weighted-average method and FIFO method C2: Conversion cost

C3: equivalent number of fully completed units using the following formula

> Equi units = Number of partially completed units × Percentage completion

> Equi units of production =Units transferred to the next department or to finished goods + Equi units in

ending work in process inventory

>Unit beginning+ Unit started and tranffer= Unit ending+ Unit completed

>Cost per equi= (cost of beginning+ cost added)/ equi unit of produc FIFO Method

>Costs Added=Cost of Units Transferred Out+Ending Work in Process Inventory−Beginning Work in Proc ess Inventory

> Total Cost to be Accounted For=Beginning Work in Process Inventory+Costs Added

> Total Equivalent Units for Conversion= Completed Units+ Ending WIP

> Equivalent Units (DM)=Units Completed+ Ending WIP Units

> Conversion Cost (Transferred Out)=Units Transferred Out×Cost per Equivalent Unit Chap 6

1/ Variable costing: include DM, DL, and the variable portion of manufacturing overhead.

2/ Absorption costing: include DM, DL, and both variable and fixed manufacturing overhead.

>Unit Product Cost=Variable Manufacturing Cost+Fixed Manufacturing Overhead

- net operating income under variable and absorption costing will equal only when production and sales are equal.

- Under variable costing, all variable production costs are treated as product costs.

- Under absorption costing, all manufacturing costs—both variable and fixed—are treated as product costs

- product costs under both absorption costing and variable costing is DM

- Variable costing net operating income usually closer net cash flow of period than absorption 3/ Break even analysis

>Total period cost= (Unit sold x variable selling expense) +Fix selling expense+ Fix manuO > Unit product cost: Absorption Variable DM,DL, variable manuO DM,DL, variable manuO Fix manufac / Unit product >Absorption net income: Sale revenue (1)

COGS= Unit sold x unit product cost (2) Gross= (1)-(2)

Selling and ad expenses= ( unit sold x variable selling expenses) + Fixselling expense (3) Net income= [(1)-(2)] –(3) >Variable net income: Sale revenue (1)

COGS= Unit sold x unit product cost (2) Gross= (1)-(2)

Total fix cost= Fix manuO per + Fix selling expenses (3) Net income= [(1)-(2)] –(3)

>Dollar value ending inventory= Ending unit x unit product cost